Employers can get a tax credit called the Work Opportunity Tax Credit (WOTC) of up to $2,400 per employee if they hire people who have been out of work for a long time. For this credit, a person is considered to have long-term unemployment if they have been out of work for at least 27 consecutive weeks and have received unemployment benefits for some or all of that period.

Here are the steps to claiming your tax credit, along with an example to illustrate each step.

Step 1: Qualified Long-term Unemployed Worker Completes IRS Questionnaire Before Interview

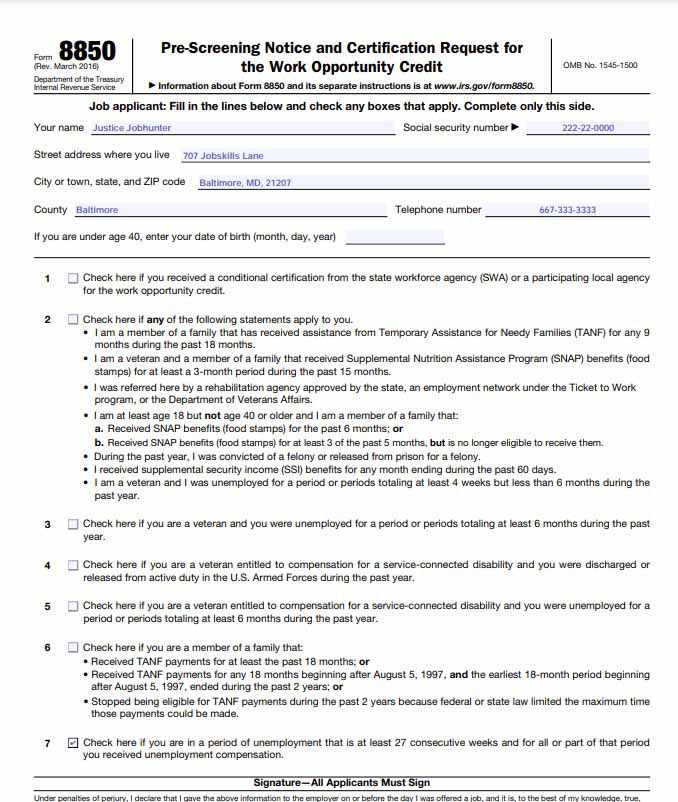

To qualify for this credit, your business must prescreen the potential candidate. To fulfill this requirement, the candidate must fill out IRS Form 8850.

Candidates who have faced long-term unemployment will check the box next to Question 7, indicating they are in a period of unemployment that is at least 27 consecutive weeks, and for all or part of that period, they received unemployment compensation.

On this same form, your business will complete the information section on Page 2 and fill in the date that the job applicant gave you information about being a member of the targeted group.

After being unemployed for 28 months, Justice Jobhunter finally came across what seemed like the ideal remote position for her: graphic designer for Online Rock Stars Corp, an S-corp in Baltimore, Maryland.

A day later, recruiter Rachel Roberts called to ask if she would fill out an application and Form 8850. Because Form 8850 requires a wet signature, the application and form must be delivered to the office. Excited about her newfound luck, Justice immediately completed the forms and dropped them off to Rachel.

Filled out sample of IRS Form 8850 Page 1

Step 2: Interview & Make Your Hiring Decision

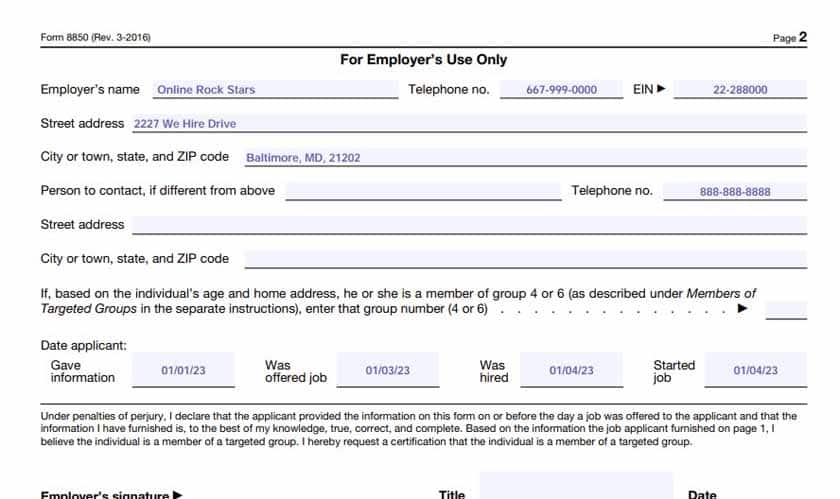

Your next step is interviewing the candidate and making a hiring decision. If the candidate is qualified for the job and you’re ready to make an offer, you’ll need to fill out the rest of Form 8850.

On Page 2, you need to fill in

- The date you interviewed the job applicant

- The date you hired the applicant

- Their start date

It is vital that the date the applicant provided their information on Form 8850 is before the date the applicant was offered a job.

Rachel liked Justice’s application, so she called her for an interview. After the interview, Rachel decided to hire Justice right away. She offered Justice the job, which paid $75,000 and would begin the next day. Justice was happy that her unemployment was over, so she accepted the job immediately. After receiving Justice’s acceptance, Rachel completed the rest of Form 8850.

Completed sample of IRS Form 8850 Page 2

Step 3: Apply for Certification

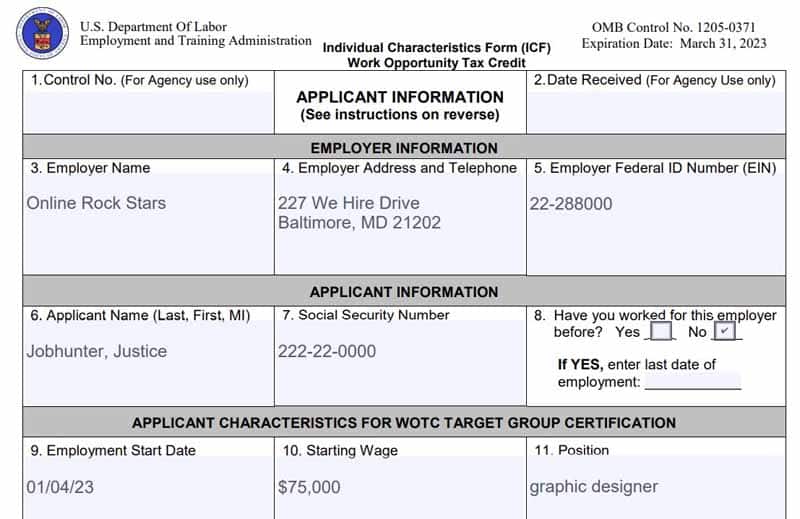

You should apply for WOTC certification through your state’s workforce agency within 28 days of hiring a new worker. You’ll need to submit IRS Form 8850 along with ETA Form 9061, the Individual Characteristics Form (ICF) for the Work Opportunity Tax Credit. The Form 9061 can be completed and signed by either the applicant or employer.

You’ll also need to gather supporting documentation from your new employee. You can submit any of the following documents:

- Unemployment insurance wage records

- Unemployment insurance claims records

- ETA Form 9175, Long-Term Unemployment Recipient Self-Attestation Form

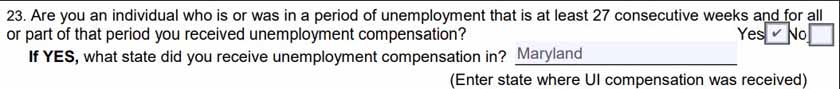

Individuals who face long-term unemployment should complete Form 9061 by checking the “yes” box next to Question 23, indicating that they are an individual who is or was in a period of unemployment for at least 27 consecutive weeks, and for all or part of that period they received unemployment compensation.

After you have completed Form 9061 and attached the required information, you’ll need to mail it to your state workforce agency. In each state, the agencies go by different names but they usually offer programs for unemployment training, job, career, and business services as well as programs for veteran reemployment.

If you don’t know where your state’s workforce office is, the United States Department of Labor has a list of all WOTC State Coordinators. You can contact them and ask where you should send your application.

After Justice started her new job, Rachel decided it was time to apply for certification. She completed Form 9061, Individual Characteristics Form (ICF), Work Opportunity Tax Credit, and also gathered Justice’s supporting documents.

Example of a filled-out IRS Form 9061

Since Justice was out of work for more than 27 weeks before being hired, the box next to question 23 on Form 9601 will be checked

Sample of Form 9061’s Question 23 filled in

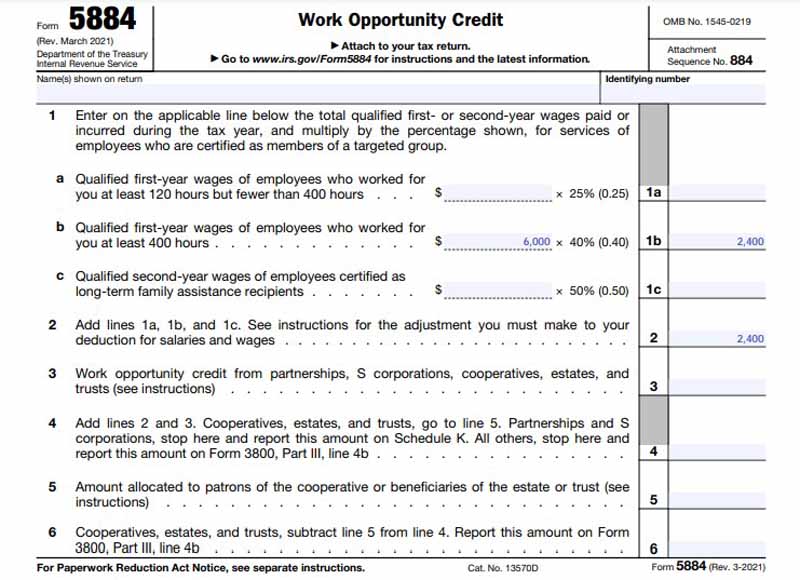

Step 4: Calculate the Credit for Hiring a Long-term Unemployed Person

Once you’re certified, you’re ready to calculate your credit using IRS Form 5884 and claim it as part of the general business credit reported on IRS Form 3800.

For new hires that qualify based on long periods of unemployment, you’ll enter the amount of qualified wages on line 1(a) or 1(b) of Form 5884 and calculate the amount of allowable credit on line 2.

Let’s take a look at those lines:

- 1(a) Enter qualified first-year wages of employees who worked for you at least 120 hours but fewer than 400 hours and multiply this amount by 25% (0.25)

- 1(b) Enter qualified first-year wages of employees who worked for you at least 400 hours and multiply this amount by 40% (0.40)

As you can see from the calculations above, you can claim more credit the more hours your employee works during the tax year.

Tip:

You can claim a credit for the first 12 months of employment, which usually is spread over two tax years. For example, if you hire a qualified person on September 1, 2022, you’ll claim a credit on three months of wages in 2022 and a credit on nine months of wages in 2023.

Rachel will now calculate the credit using IRS Form 5884. When hiring individuals who have faced long-term unemployment, $6,000 in qualified wages will be used to calculate the credit.

Calculating the WOTC for 2023 on IRS Form 5884

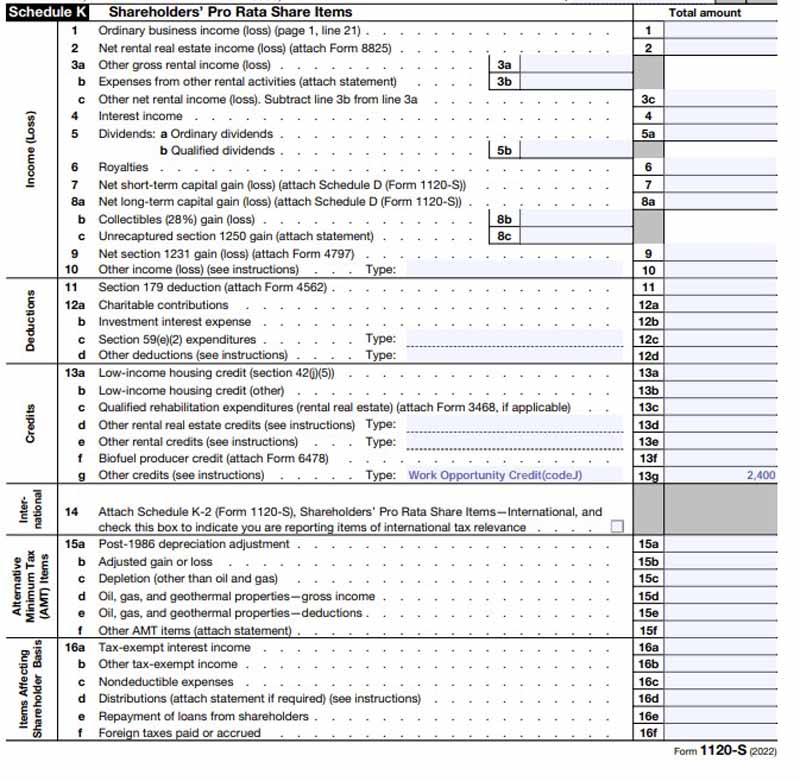

Step 5: Report the Tax Credit on Your Tax Return

The credit then flows to various forms, depending on your entity classification:

Entity Type | Where to Report |

|---|---|

Sole Proprietor | IRS Form 1040 or 1040 SR, Schedule 3, line 6a |

C Corporation (C-corp) | IRS Form 1120, Schedule J, Part I, line 5c |

S Corporation (S-corp) | IRS Form 1120-S, Schedule K, line 13g |

Partnership | IRS Form 1065, Schedule K, line 15f |

Since Online Rock Stars Corp. is organized as an S-corp, the credit will be reported on IRS Form 1120-S, Schedule K, line 13g.

WOTC being carried to IRS Form 1120- S, Schedule K, line 13g

Frequently Asked Questions (FAQs)

Where can I find more information about hiring individuals who have faced long-term unemployment?

If you want to connect with talent who have been out of the workforce for a while, you can partner with a return-to-work program like iRelaunch or Path Forward.

Can I submit the application electronically?

No, all the forms must be submitted by mail and require you and the applicant to sign with a wet signature.

Can I claim the credit for more than one person?

Yes, if you hire more than one individual who has faced long-term unemployment or is a member of any other targeted group (felons or veterans, for example), you may claim the credit for each applicant.

Bottom Line

If you are looking for new candidates, don’t forget to give your applicants Form 8850 along with their applications. Hiring an individual who has faced long-term unemployment will not only give you access to a potentially loyal employee but qualify you for a tax credit.