The steps shown here will walk you through how to complete Form 5884. These steps address how to obtain the form, complete calculations, report pass-through credit, and file the completed form. To further assist, we’ve provided an example of a filled-out form, prepared in accordance with the IRS’s Form 5884 instructions.

Key Takeaways:

- Form 5884 is used to claim the credit for hiring individuals who are members of specific targeted classes and is filed with your business tax return.

- Qualified wages for purposes of calculating the credit are generally limited to $6,000 per worker. Specific target groups may have qualifying wages up to $24,000.

- Shareholders and partners can report any WOTC shown on Schedule K-1 directly on Form 3800 and are not required to complete Form 5884.

Step 1: Obtain the Form

IRS Form 5884 may be available in your business tax software. As several forms are in the 5884 series, you’ll want to ensure that for the general WOTC, you use the IRS Form 5884 with no suffix.

Step 2: Complete Line 1 Subsections

Line 1 is divided into subsections a through c. Lines 1a to 1c are used to compute the allocable credit for the wages earned and hours worked.

- Line 1a: Qualified Employee Wage Analysis: 120-399 hours

As noted in the Form 5884 instructions, line 1a is for “qualified first-year wages of employees who worked for you at least 120 hours but fewer than 400 hours.”

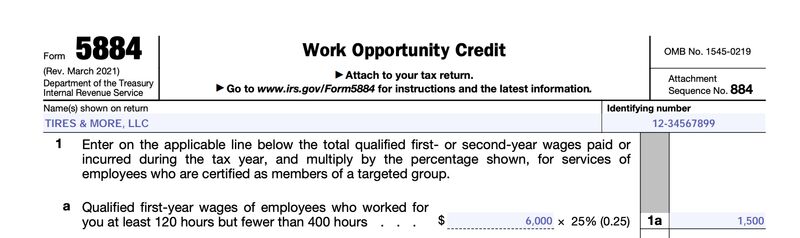

To help you complete the form, we’ll provide an example.

- In 2023, you hired Joe to work at your mechanic shop. Joe is a qualified ex-felon to whom you paid $20,000 in 2023. For more information on calculating the credit for Joe, read How to Claim the Tax Credit for Hiring Felons.

- In 2022, Ted was hired and was paid $8,000 for 2023. Ted’s immediate family received Temporary Assistance For Needy Families (TANF) during the past 19 months. To complete the form for Joe and Ted, follow the instructions below.

Let’s say that Joe’s wages of $20,000 were for 200 hours worked in 2023. Since the maximum amount of wages for Joe’s targeted class (qualified ex-felon) is $6,000, $6,000 would be multiplied by 25% for a $1,500 calculated credit on line 1a.

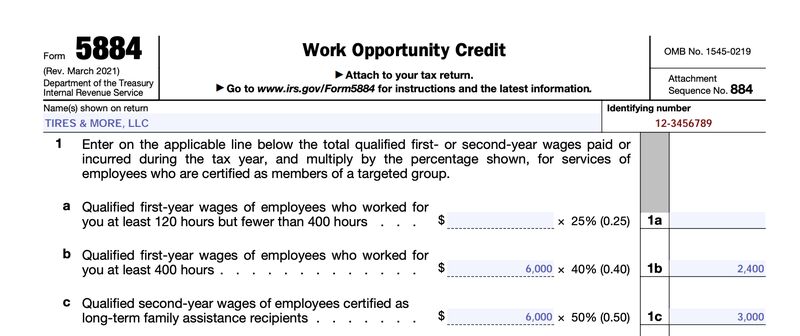

IRS Form 5884’s Line 1a

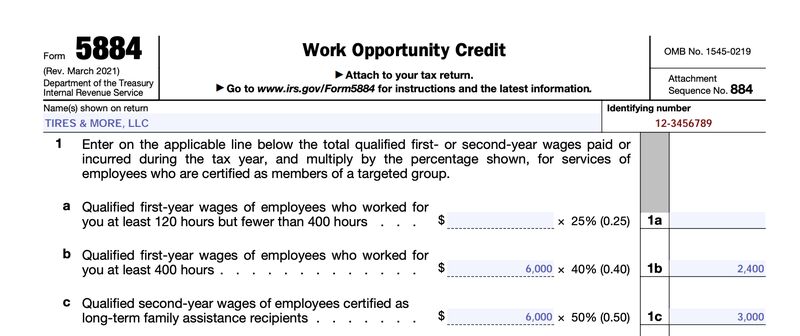

- Line 1b: Qualified Employee Wage Analysis: 400-plus hours

Line 1b is for “qualified first-year wages of employees who worked for you at least 400 hours.”

Let’s assume that Joe worked 800 hours for the $20,000 that you paid him in 2023. Again, since $6,000 is the maximum amount for Joe’s targeted class, $6,000 would be multiplied by 40% for a $2,400 credit (shown in the image below).

- Line 1c: Qualified Second-year Wages for Long-term Family Assistance Recipients

Line 1c is for “qualified second-year wages of employees certified as long-term family assistance recipients.”

The credit for Ted’s wages is limited to $6,000 and would be calculated on line 1c at 50%, shown below with the qualified portion of Joe’s wages for 800 hours of work.

IRS Form 5884’s Lines 1a through 1c

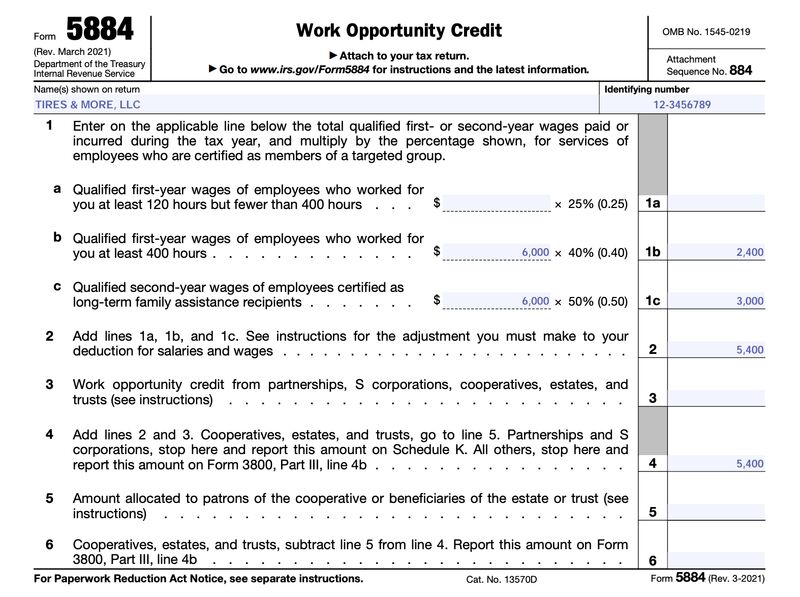

Step 3: Report Line 1 Calculations on Line 2

Add up lines 1a through 1c, and enter the total on line 2. The line 2 amount below represents the calculated amount Tires & More, LLC, will take as a credit. The salaries and wages deduction on the business return will need to be reduced by this amount on line 2.

IRS Form 5884’s Line 2 showing the sum of Lines 1a through 1c

Step 4: Report the Credit from Pass-through Entities on Line 3

If a WOTC is calculated on a pass-through entity and reported to the taxpayer on Schedule K-1, that credit should be entered on line 3. For purposes of this input, a pass-through entity includes partnerships, S Corporations (S-corps), cooperatives, estates, and trusts. Tires & More, LLC, is not invested in any pass-through businesses that are eligible for a WOTC, so this line has been left blank.

Step 5: Sum Calculated and Pass-through Credit on Line 4

On line 4, combine the credit calculated on line 2 with any credit shown on line 3 from pass-through entities. Tires & More, LLC, will only include the credit amounts from Ted and Joe’s qualified wages on line 2 since there is no pass-through credit to include.

The line 2 amount is carried down to line 4. This is the last line on the form that needs to be completed for all entities except cooperatives, estates, and trusts.

- Partnerships and S-corps should enter the line 4 number on Schedule K and then distribute the credit to its owners on each Schedule K-1.

- Any other entity should take the line 4 number and carry it to Form 3800, Part III, line 4b.

Preparers calculating the credit for cooperatives, estates, and trusts should consult the form instructions for information on completing lines 5 and 6.

A completed IRS Form 5884

Step 6: File the Completed Form

Since information from Form 5884 carries to Form 3800, both forms will need to be filed with the IRS as part of the full business return package.

- How to file: Form 5884 should be included with the income tax return and preferably remitted to the IRS electronically using tax software. For our recommendations, see our roundup of the best professional tax software.

- When to file: Form 5884 should be filed on the due date of the timely filed income tax return, with extensions. For small business calendar year entities, the due dates are as follows:

- Form 1120S: March 15

- Form 1120: April 15

- Form 1065: March 15

- Form 1040/Schedule C/Single-member LLCs: April 15

Each income tax filing can be extended up to six months, with a timely filed extension. Form 5884 is due with the timely filed income tax return.

Frequently Asked Questions (FAQs)

You can find your state workforce agency by contacting your local Department of Labor or reviewing its website.

You should contact and request worker certification from the state workforce agency for the state in which the employee will be working.

Employers can partner with the Department of Labor’s American Job Center[1] to connect with targeted groups.

Bottom Line

You should now know how to complete Form 5884, which is used to claim the WOTC for wages paid in the first and second year of a qualified worker’s employment. With some limited exceptions, the maximum amount of wages on which the credit can be calculated is $6,000 per employee.