Our guide will walk you through how to fill out Form 8824. These instructions detail the supporting documents needed to prepare the form and list line-by-line instructions. A completed form is also provided for further clarity on Form 8824 instructions.

Key Takeaways:

- Form 8824 is used to report the exchange of like-kind business or investment property.

- Special reporting is required for like-kind exchanges involving related parties and multiple assets exchanged simultaneously.

- Gain must be recognized in the current year when cash or non-like-kind exchange property is received or liabilities are relieved in the exchange.

- Form 8824 is filed with your tax return.

Step 1: Gather Supporting Information

Here is a general summary of the information needed to complete Form 8824:

- Relinquished property details (description, adjusted basis, FMV, etc.)

- Replacement property details (description, FMV, etc.)

- Date of property exchange

- Date new property was identified

- Date new property was received

- Date old property was obtained

- Details of cash included by either party as part of the exchange

- Debts or obligations taken on by either party as part of the exchange

Step 2: Get the Form

Professional tax prep software will likely have Form 8824 ready for you to populate with your information. However, you can also find a copy of Form 8824 on the IRS website.

Step 3: Complete Part I—Information on the Like-kind Exchange

Part I consists of seven lines. Above Part I, the taxpayer’s name and SSN or EIN should be entered.

To further assist with form completion, our Form 8824 instructions are accompanied by this sample scenario:

Ingrid Investor owns investment real estate at 123 Elm Street.

- FMV of Elm Street property: $200,000

- Adjusted basis of Elm Street property: $110,000

Ingrid exchanges the Elm Street property for another piece of real estate at 456 Pine Avenue.

- FMV of Pine Avenue property: $150,000

- Outstanding mortgage balance on Elm Street property at the exchange: $20,000

The original owner of the Pine Avenue property agrees to assume Elm Street’s mortgage and give Ingrid $10,000 as part of the exchange agreement.

INGRID INVESTOR’S GAIN CALCULATION | |

|---|---|

FMV of Pine Avenue Property | $150,000 |

Cash to Ingrid From Other Party | $10,000 |

Elm Street Mortgage Assumed by Other Party | $20,000 |

Total to Ingrid | $180,000 |

Adjusted Basis of Elm Street Property | ($110,000) |

Realized Gain | $70,000 |

Recognized Gain | $30,000 |

Deferred Gain | $40,000 |

Generally, the gain on an exchange is tax-deferred, but in this case, since Ingrid was released from $20,000 in mortgage liabilities and received $10,000 in cash, she will recognize the gain for the sum of those two amounts ($10,000 + $20,000). The other $40,000 of realized gain will be deferred by reducing her basis in the Pine Avenue property.

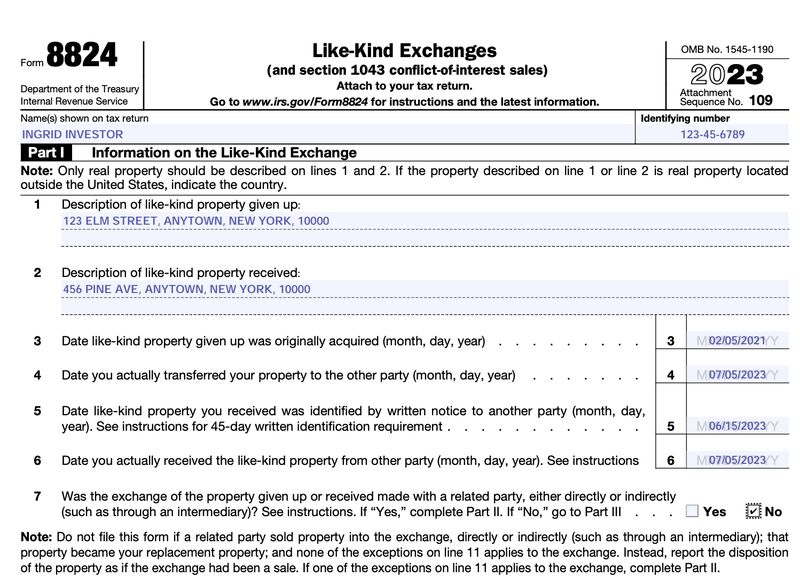

Given the data from the example, Ingrid’s Form 8824, Part I, will be presented as follows:

An example of a completed Form 8824, Part I

- Line 1: Description of the like-kind property given up. Enter a description of the property being surrendered. Real estate may be described by listing an address. Foreign real estate should include the country where the property is located.

- Line 2: Description of the like-kind property received. Enter a description of the property received in the exchange. As with the property given up, real estate can be shown here by listing the property’s physical address.

- Line 3: Date like-kind property given up was originally acquired. The date entered here may be the date of purchase or receipt by inheritance or gift. For Ingrid, the date entered here was the date she purchased the property she exchanged.

- Line 4: Date you transferred your property. The date entered on this line should be the date you sold your property.

- Line 5: Date like-kind property received was identified. Gain deferral rules require that a replacement property be identified within 45 days of giving up the original property. The date you enter here will show compliance with that rule.

- Line 6: Date you received the like-kind property from the other party. Enter the date that you took possession of the replacement property identified in line 5.

- Line 7: Identify if this exchange involved a related party. Check yes or no, as applicable.

Step 4: Complete Part II—Related Party Exchange Information (if applicable)

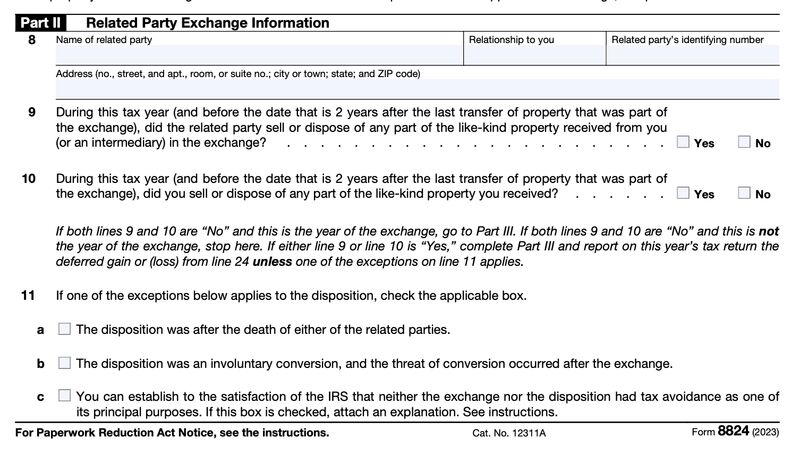

Part II of Form 8824 will need to be completed for two years following an exchange with a related party. Related parties include spouses, siblings, children, parents, and grandparents, as well as any related businesses, trusts, or estates. There are additional restrictions to gain deferral for related party exchanges.

In our sample scenario, Ingrid’s exchange was not with a related party, so line 7 was marked as “no,” and Part II was left blank.

Form 8824, Part II

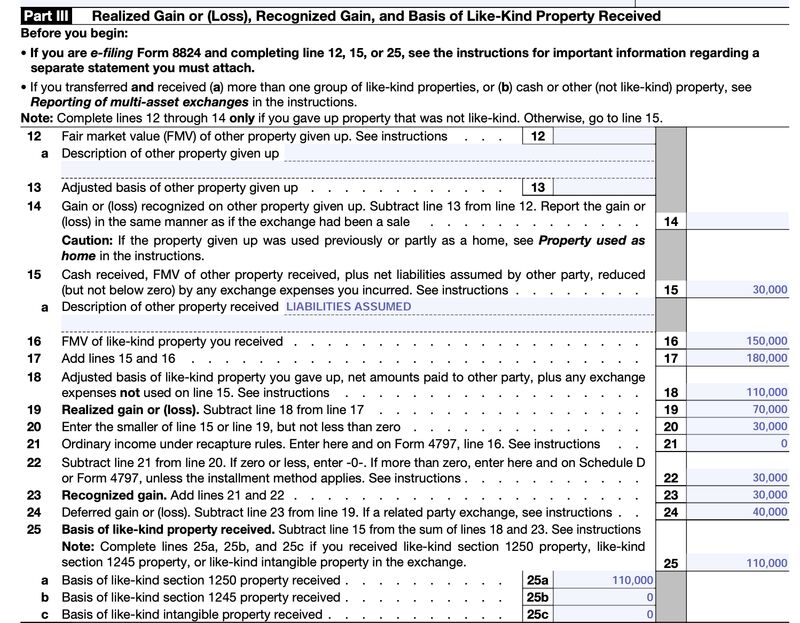

Step 5: Complete Part III—Realized/Recognized Gain or Loss

This is the section where the deferred gain and any gain that has to be recognized in the current year are calculated.

Form 8824, Part III, complete with sample data

- Lines 12–14: Other Property Given Up. These lines should be completed if, as part of the exchange, you gave up property that was not like-kind. The only property that Ingrid relinquished was the like-kind property, so lines 12–14 were left blank. If you give up non-like-kind property where its FMV is greater than your basis, you’ll need to recognize a gain on line 14.

- Line 15: Cash Received. Liabilities relieved and cash received are noted on this line. Ingrid received $10,000 of cash and was relieved of a $20,000 mortgage. The sum of $30,000 was input on line 15.

- Line 16: FMV of like-kind property received. Ingrid received property with an FMV of $150,000, as shown on line 16.

- Line 17: Total Received. Add lines 15 and 16 to arrive at the total value of what you received in the exchange.

- Line 18: Adjusted Basis. The adjusted basis is entered here, which will be subtracted from the total received to arrive at the realized gain.

- Line 19: Calculate Realized Gain. Line 18 is subtracted from line 17. This is the tentative gain to be deferred.

- Line 20: Summary Calculation. Enter the smaller of line 15 or 19, as instructed.

- Line 21: Ordinary Income Recapture. Certain transactions may result in ordinary income recapture, which would be reported here on line 21. Amounts input here would be recognized in the current year.

- Line 22: Additional Calculation for Recognized Gain. Subtract line 21 from line 20, as instructed.

- Line 23: Recognized Gain. This is the gain that will be taxable on the current year tax return. Ingrid’s recognized gain is $30,000, consisting of the cash received and liabilities relieved.

- Line 24: Deferred Gain or Loss. The gain calculated here is the amount of gain that is able to be deferred through the use of a like-kind exchange in place of an outright sale. Ingrid’s deferred gain is $40,000.

- Line 25: Calculation of Basis in Replacement Property. This is where the basis of the new replacement property is calculated. This is important information to have for when the property is ultimately disposed of or rolled into a subsequent like-kind exchange.

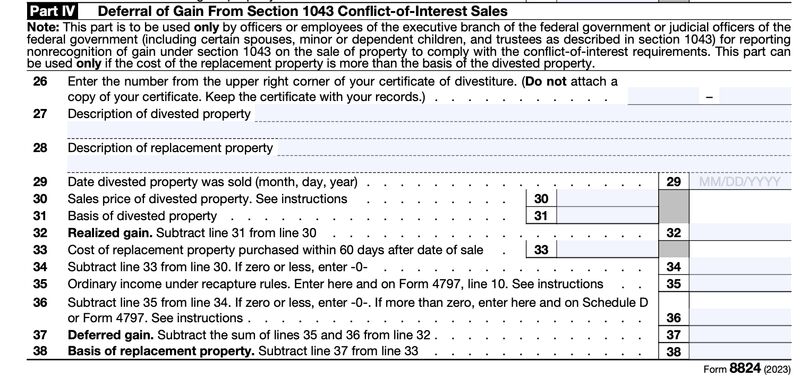

Step 6: Disregard Part IV for Traditional Like-kind Exchanges

This section is uniquely for federal employees to report transactions where there may be a conflict of interest. This section generally does not apply to reporting for traditional like-kind exchanges. This section was left blank for Ingrid.

Part IV of Form 8824

Step 7: File the Completed Form

Form 8884 will need to be included with your timely filed tax return, including extensions. Special reporting is required for like-kind exchanges involving property that was at one point used personally.

When multiple assets are part of the exchange, a single Form 8824 should be filed, and a summary statement should be attached for each piece of property. The summary statement should include the following:

- All of the details requested on Form 8824 for each exchange

- Taxpayer name and EIN or SSN at the top of each page of the statement

On Form 8824, enter the taxpayer’s name and EIN or SSN.

- Put “Summary” on line 1.

- Include the sum of all recognized gain from each exchange on line 23.

- Include the aggregate basis for all of the like-kind assets in the transaction on line 25.

Frequently Asked Questions (FAQs)

Form 8824 should be completed by any taxpayer participating in a like-kind exchange.

Line 15 is calculated by adding the FMV of any non-like-kind property or cash received by the taxpayer completing the form. In addition to property and cash, line 15 includes the amount of the taxpayer’s liability assumed as part of the exchange less the amount of any liability assumed by the taxpayer.

If Form 8824 is not filed for a taxpayer participating in a like-kind exchange, the IRS could disregard the transaction, and the taxpayer could not only lose the tax deferral, but also be subject to penalties.

Bottom Line

Form 8884 is required for taxpayers participating in a like-kind exchange. A like-kind exchange allows for gain on the transfer of property to be deferred, but if cash or non-like-kind property is received or liabilities relieved, some gain may still need to be recognized in the current year. When more than one piece of property is part of the like-kind exchange transaction, one Form 8824 should be filed, and an individual statement should be attached for each property.