I’ll walk you through how to reconcile petty cash, which starts with computing the petty cash on hand and all the receipts in the lockbox. The custodian may uncover discrepancies, and they must deal with them accordingly. At the end of the reconciliation process, the custodian must request a petty cash replenishment to restore the amount of petty cash on hand for future expenses.

Step 1: Compute the Value of Receipts, Bills & Coins in the Lockbox

The first step in petty cash reconciliation is checking the petty cash lockbox. If your company uses the petty cash correctly, the lockbox should only contain the following items:

- Bills and coins

- Receipts from petty transactions

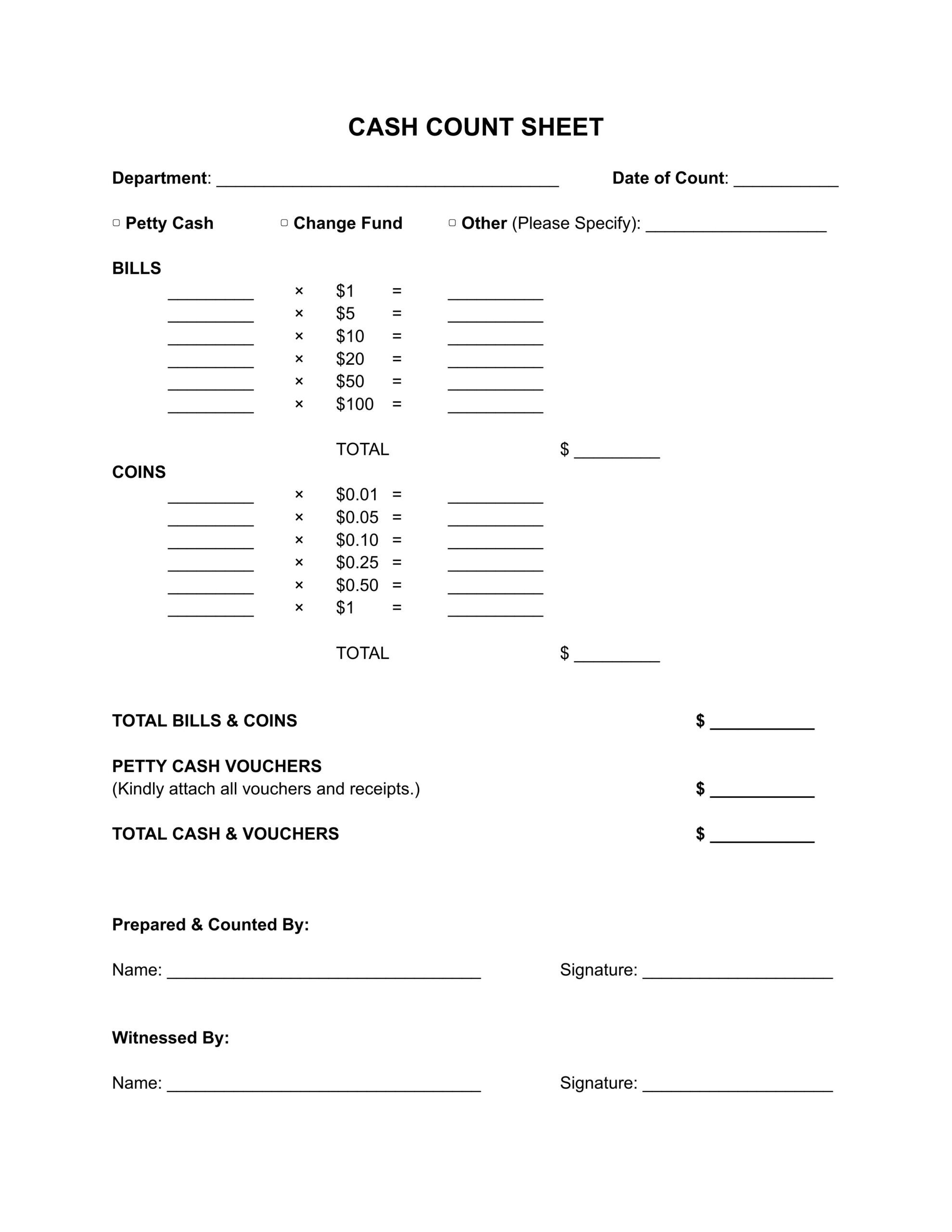

To document the counting of the petty cash lockbox, you need to have a petty cash count sheet similar to the template below, which you can download for free.

In a cash count sheet, you’ll have to specify the following information:

- Date of the count: More often than not, petty cash counts are performed when there is a need for replenishment and the petty cash on hand is running low. Hence, the expectation is that the count date must be near the date of the petty cash replenishment request.

- Department: Some companies grant petty cash accounts to different departments. If that’s the case in your company, mention the department in the cash count sheet to avoid confusion.

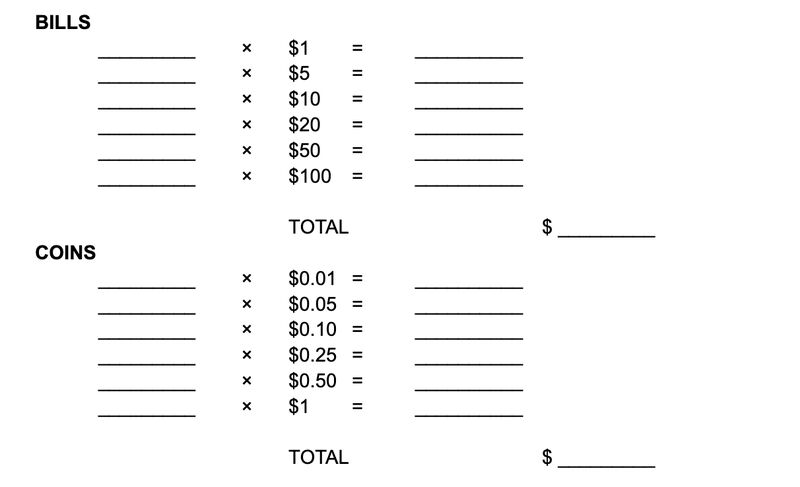

- Bills and coins computation: Stating the amount of cash in the petty cash box is not enough. You must break down that amount per bill and coin denomination. In our sample template (see image below), you’ll see that it asks for the quantity of each currency denomination.

Computing Bills and Coins per Currency Denomination

- Amount of vouchers and receipts: When you reimburse petty expenses or allow certain transactions to be charged in petty cash, you need to collect the receipts and issue a petty cash voucher. You must attach all vouchers and receipts to the cash count sheet.

- Preparer and witness: When performing a cash count, it’s best practice to have a witness present. The witness will act as a third-party individual who can attest to the accuracy of the cash count at the moment it is counted.

Step 2: Determine the Value That Should Be in the Lockbox

The amount in the petty cash lockbox should equal the petty cash allowance granted to the department. For instance, you may set a petty cash allowance of $500. Assuming proper internal controls are in place over petty cash, the total lockbox dollar value must equal $500, regardless of whether it’s in bills, coins, or receipts.

Step 3: Create a Petty Cash Reconciliation Report

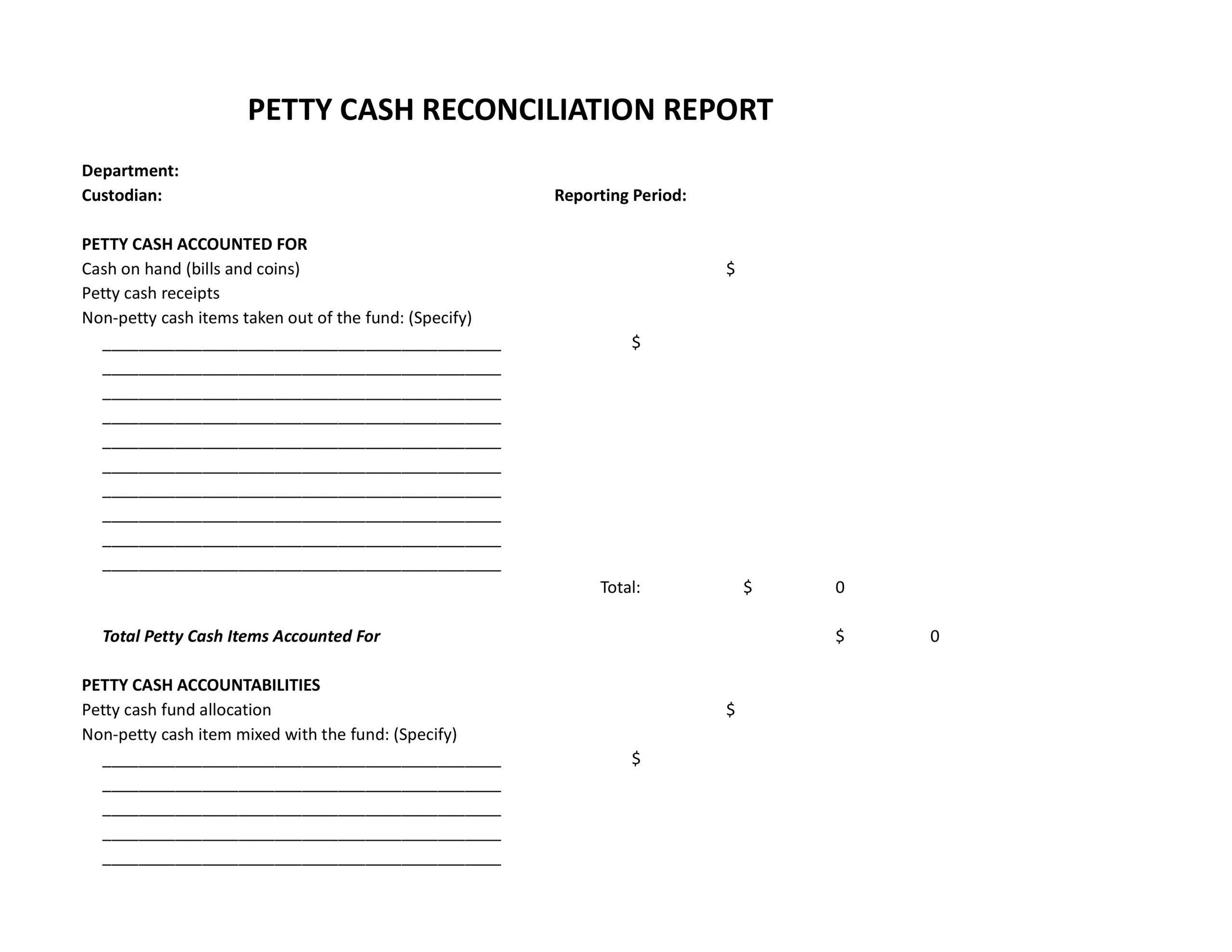

A petty cash reconciliation sheet summarizes all transactions that affected the petty cash fund. This will be your main working paper in reconciling all the differences in the petty cash fund. You may download the template that we created below.

This report shows two sections:

- Petty cash accounted for represents the actual cash on hand, petty cash vouchers, and other non-petty cash items taken out of the petty cash fund (e.g., IOUs and checks).

- Petty cash accountabilities represent the “should-be” amount of petty cash. This is the amount we expect to see in the petty cash lockbox.

Non-petty Cash Items Taken Out of the Fund

When internal controls are not in place or properly enforced, it’s easy to abuse petty cash for different purposes. Hence, you might find items that should be taken out of the petty cash fund, such as the following:

- IOUs: An IOU (short for “I owe you”) is an informal agreement between the petty cash custodian and an employee for a borrowed amount.

- Checks: Say you received a paycheck but the banks are already closed and you badly need the money. Some employees tender the check to the petty cash custodian in exchange for cash. If this happens, you’ll see checks in the petty cash lockbox that should be deposited to the bank.

- Communal fund: Sometimes, employees contribute to an office party or out-of-town excursion. These contributions are called communal funds. This money should not be found in the petty cash lockbox, but some businesses do it for “safety” purposes. If it is necessary to include communal funds in the lockbox for safety, place them in an envelope to keep them separate from petty cash.

- Personal receipts: A petty cash custodian should never add unreimbursed personal receipts to the petty cash lockbox. However, it’s still possible to see personal receipts, especially if the custodian is unorganized in managing the petty cash.

- Vendor invoices with large amounts: Petty cash should only be used for petty expenses. The business must set a threshold for petty expenses (e.g., $50 and below). Paying vendor invoices with large amounts using petty cash violates the policy, bypasses the proper authorizations, and prevents the proper accounting of the invoice.

Step 4: Address Discrepancies

Ideally, the petty cash accounted for must have the same balance as the petty cash accountabilities. However, improperly managing the petty cash fund can lead to discrepancies. When those arise, it’s important to find the root cause. Missing receipts are often the cause of discrepancies, which is why maintaining a petty cash log can help reduce discrepancies.

- Petty cash accounted for > Petty cash accountabilities: There is an overage, which occurs when either the:

- Counted bills and coins exceed the amount that should be after the count. Non-petty cash money—like communal funds—may be mixed with the petty cash fund. Best practice dictates that non-petty cash money should not be kept in the lockbox.

- Receipts exceed the should-be amount of receipts. Unreimbursed receipts may be mixed with petty cash receipts.

- Petty cash accounted for < Petty cash accountabilities: There is a shortage, which occurs when either the:

- Counted bills and coins fall short of the should-be amount after the count. There could be multiple possibilities for this discrepancy. However, don’t immediately assume that the custodian uses the money for personal use—unless there’s evidence to the accusation.

- Some receipts are missing. It’s possible that some employees may have failed to return the receipts to the custodian, or the receipt may have been misplaced or lost. It’s best to check the petty cash log to verify if a disbursement was recorded for the missing receipt.

Let’s assume the following information:

- Petty cash allocation: $500

- Bills and coins: $387.20

- Petty cash receipts: $112.80

Here’s a simplified petty cash reconciliation computation using the information provided above:

Petty Cash Accounted For: | |

| $387.20 |

| $112.80 |

TOTAL | $500.00 |

Petty Cash Accountabilities: | |

| $500.00 |

Overage (Shortage) | $0 |

Assume the following:

- Petty cash allocation: $500

- Bills and coins: $357.20

- Petty cash receipts: $112.80

Using that information, here’s a simplified petty cash reconciliation computation:

Petty Cash Accounted For: | |

| $357.20 |

| $112.80 |

TOTAL | $470.00 |

Petty Cash Accountabilities: | |

| $500.00 |

Overage (Shortage) | $(30.00) |

The most likely cause of this shortage is someone received a $30 reimbursement and failed to provide a receipt. Check the petty cash log to see if you can find a $30 transaction and then verify the receipt is included in the petty cash box. Another possibility is that someone stole $30 from the fund.

Let’s take the following information:

- Petty cash allocation: $500

- Bills and coins: $387.20

- Petty cash receipts: $131.80

Here’s a simplified petty cash reconciliation computation given the aforementioned information:

Petty Cash Accounted For: | |

| $387.20 |

| $131.80 |

TOTAL | $519.00 |

Petty Cash Accountabilities: | |

| $500.00 |

Overage (Shortage) | $19.00 |

The most likely scenario for this overage is that the petty cash box includes a receipt that was never reimbursed. Match the receipts in the box to the petty cash log to find the unreimbursed receipt. Another possible cause is someone added $19 of communal funds to the lockbox for safekeeping.

When there are petty cash discrepancies, investigating the discrepancy is necessary. If the discrepancy can’t be resolved, the best course of action would be to forgive the petty cash custodian for failing to manage the fund properly. However, disciplinary action must be taken if the custodian continues to have overages and shortages.

Step 5: Top Up the Petty Cash

Assuming all discrepancies have been resolved, the final step of the reconciliation process would be topping up or replenishing the fund. The replenishment equals the amount of receipts in the reconciliation. When the replenishment is made, the receipts should be removed from the box and used as support for the cash distribution.

For instance, say that the petty cash on hand is $350 and receipts are $150 for a total petty cash allocation of $500. The maximum top-up amount should be $150. Additional cash of $150 should be placed in the box and $150 of receipts removed.

Frequently Asked Questions (FAQs)

First, compute the petty cash on hand and all the receipts. Second, the accountability or the amount of petty cash allocated should be determined. The petty cash on hand and all receipts should equal the petty cash accountability. Otherwise, there is a discrepancy.

If the petty cash does not balance, the best action is always to investigate the discrepancy. Many errors can be found by comparing the receipts in the box to the petty cash log. However, penalizing the custodian should not be the first course of action. You should first review if there are missing receipts or money in the lockbox.

Bottom Line

Reconciling the petty cash fund is a necessary process to ensure the proper accounting of all expenses, no matter how small they are. We hope our guide on how to reconcile petty cash helped you understand how petty cash reconciliation works and how you can use this process to enhance petty cash practices in your business.