H&R Block is an online tax preparation service that helps you file your own tax returns either online or with software that you download to your computer. You can also file with a tax professional in an office or virtually. Its features include W-2 import, refund transfer, multiple guarantees, a tax calculator, and a tax preparation checklist. You can file simple federal and state returns for free or choose from its paid packages with prices that start at $35 per federal return, plus $37 per state.

Pros

- Five federal e-files included with desktop software

- Free in-person audit support

- Access to tax professionals with all paid online plans

- Choice of desktop or online software

Cons

- Desktop software requires installation

- No live tax pros with the desktop software

- Free Tax Pro assistance doesn't include a full review

- User interface isn’t as easy as other programs

- Best for taxpayers that want desktop software: With its desktop software, you can prepare as many returns as you like and e-file five of them for no additional cost.

- Individuals and businesses that need a tax professional: H&R Block offers an assisted service, where a tax professional will file for you. Free in-person audit support is also available.

- Expats seeking tax services: H&R Block offers both do-it-yourself (DIY) and assisted tax services to US citizens and green card holders who are required to file their US expat taxes every year. Its online software is designed to identify tax benefits specifically for expats.

- QuickBooks Self-Employed users: If you use QuickBooks Self-Employed to manage your books, you can purchase TurboTax as a bundle and transfer your business income and expenses automatically.

- Freelancers looking for free software to file an individual return with Schedule C: If you only need to file an individual return with Schedule C, FreeTaxUSA is a good option. Individual state returns are only $14.99 per state.

- Businesses that require unlimited one-on-one tax assistance: TaxAct Xpert Help connects you with certified public accountants (CPAs) or other tax experts who can help you navigate your tax situation and answer your questions. There’s no limit to the number of times that you can speak with tax experts during your filing experience.

If you’re looking for other options, check out our article on the best small business tax software. We looked at a variety of solutions and narrowed our recommendations down based on the price of preparing the typical bundle of returns required by most business owners.

H&R Block Alternatives

Self-Employed Returns | Corporate & Partnerships Returns | Live Assistance | Full Service Preparation | |

|---|---|---|---|---|

$85 plus $37 per state | $99 Desktop Only | ✓ | ✓ | |

$64.99 plus $44.99 per state | Starting at $139.99 plus $54.99 per state | ✓ | N/A | |

| $129 plus $59 per state | Desktop Only $190 plus $55 per state | Self-employed only | Self-employed only |

| Free federal plus $14.99 per state | N/A | N/A | N/A |

H&R Block Deciding Factors

Intended Users | Small businesses wanting online software with access to help from a tax professional for free |

Business Income Tax Returns Supported | Schedule C (online & desktop) Form 1120, 1120S, and 1065 (desktop only) |

Communication | Phone, live chat, and in-person |

Federal Online Preparation & Filing | $0 to $85 |

State Online Preparation & Filing | $0 to $37 |

Tax Advice From a Pro | Included in paid online plans |

Return Review by a Pro | $55 to $95 for online plans only |

Free Trial of Online Plans | Start for free - pay when you file |

Federal Desktop Software | $35 to $99 |

State Desktop Software | One state included in most plans, $39.95 for additional states |

State Filing Fee | $19.95 |

Free Trial of Desktop Software | None |

Mobile App | ✓ |

H&R Block Pricing

H&R Block’s online software includes a free edition for simple returns as well as three paid packages with prices that range from $35 to $85 per federal return, plus $37 per state. If you need the help of a tax pro, its Online Assist version is now included with every paid online subscription. If you prefer desktop software, you can choose from four tiers with prices ranging from $35 to $99 for unlimited returns, although you may have to pay extra for e-filing state returns and more than five federal returns.

Online Preparation & Filing

Pricing & Features | Free Online | Deluxe | Premium | Self-Employed |

|---|---|---|---|---|

Federal Filing ($/Return) | $0 | $35 | $65 | $85 |

State Filing ($/State) | $0 | $37 | $37 | $37 |

Tax Pro Assist Included | N/A | ✓ | ✓ | ✓ |

Tax Pro Review | $55 | $65 | $95 | $95 |

Earned Income Tax Credit (EITC) | ✓ | ✓ | ✓ | ✓ |

Retirement Income | ✓ | ✓ | ✓ | ✓ |

W-2 Wages | ✓ | ✓ | ✓ | ✓ |

Live Phone or Chat Support | N/A | ✓ | ✓ | ✓ |

Schedule A Itemized Deductions | N/A | ✓ | ✓ | ✓ |

Schedule D Capital Gains & Losses | N/A | N/A | ✓ | ✓ |

Schedule E Rental Income | N/A | N/A | ✓ | ✓ |

Schedule C Business Income | N/A | N/A | N/A | ✓ |

The free plan is best for renters, students, and W-2 employees. It includes W-2 photo capture and easy import, and it supports Form 1095 (A and B), 1098 (E and T), and 1099 (B, DIV, INT, and R). While you have access to the software’s help center, you don’t get live customer support.

This plan is for you if you have mortgage interest, real estate taxes, or health savings account (HSA) contributions. It gives you access to all the features of the free option, plus access to live phone or chat support, and its unique DeductionPro tool, which helps you optimize charitable donations.

If you’ve sold stocks, bonds, or other investments that must be reported on Schedule D, you’ll need this edition. In addition to all of the features in Deluxe, Premium also helps you claim rental income and deductions on Schedule E and import expenses from your favorite expense tracking applications, such as Stride.

Get this plan if you own a business that reports on Schedule C. It includes everything in Premium, plus the ability to claim all small business expenses, including asset depreciation. If you’re an Uber driver, this plan also allows you to import your tax information directly from Uber.

Each paid online package includes an Online Assist version with live tax pro support, which gives you unlimited access to live tax experts with share-screen and on-demand chat or video. You can file your returns at an office or virtually.

For an additional cost, a tax pro will review your entire return before it is filed.

Desktop Software

Pricing & Features | Basic | Deluxe + State | Premium | Premium & Business |

|---|---|---|---|---|

Federal Program Including Federal E-Filing Fees for Five returns | $25 | $59 | $85 | $99 |

State Program | $39.95 | One state included - $39.95 for additional states | ||

State e-Filing Fee | $19.95 | $19.95 | $19.95 | $19.95 |

Have Children | ✓ | ✓ | ✓ | ✓ |

Wages (Form W-2) | ✓ | ✓ | ✓ | ✓ |

Itemized Deductions (Schedule A) | N/A | ✓ | ✓ | ✓ |

Rental Property (Schedule E) | N/A | N/A | ✓ | ✓ |

Self-Employed (Schedule C) | N/A | N/A | ✓ | ✓ |

Business Returns (Forms 1120, 1120S, and 1065) | N/A | N/A | N/A | ✓ |

If you’re an employee or a parent who needs simple federal filing, then Basic is for you. It includes features like drag-and-drop importing of prior-year returns, photo uploads, and free in-person audit support. No state returns are included with the Basic program, so if you need a state return you’re better purchasing the Deluxe program which includes your first state return for free.

This product, which includes everything in Basic, is the best fit if you’re an investor or a homeowner wanting to maximize tax deductions, such as your charitable donations and home mortgage interest, and report investment income.

If you’re a self-employed individual, a freelancer, an independent contractor, or a rental property owner, Premium has the tools you need to manage your taxes. Get it if you have income reported on Form 1099-MISC or Form 1099-NEC.

H&R Block New Features for 2024

New for 2024, H&R Block includes AI Tax Assist with all paid online subscriptions. Their AI engine is available 24 hours a day and allows you to ask unlimited questions.

H&R Block Features

H&R Block offers some advanced features that are helpful for tackling difficult tax situations, depending on the version and package you choose. For instance, it offers W-2 photo capture, multiple guarantees, and easy input from other tax programs. We have some of H&R Block’s main features detailed below.

H&R Block will refund any fees incurred to file a return that includes an error on its part, and it’ll refund you for any interest or penalties up to a maximum of $10,000. It’ll also explain any notices received from the IRS.

If you discover an error in the H&R Block tax preparation software that entitles you to a larger refund (or smaller liability), you’ll receive a refund of the fees paid to prepare the return and you may also use H&R Block software to amend your return for free. To qualify, your refund claim must be made within the calendar year in which it was prepared. The larger refund or smaller tax liability must not be due to incomplete, inaccurate, or inconsistent information supplied by you.

You’ll receive 20% off the following year’s tax preparation if H&R Block fails to provide any of the following four benefits: upfront transparent pricing, free audit assistance, transparent process, and free mid-year care check-in. These benefits are available whether you are an assisted client or do your own taxes using the DIY online or software tax preparation products. This guarantee is only available at select locations.

In case of an IRS audit, H&R Block offers free audit support to help you understand the process and how to respond to it. If you need a qualified H&R Block enrolled agent―a federally authorized tax practitioner―to represent you before the IRS, you’ll need to purchase its Peace of Mind Extended Service Plan add-on.

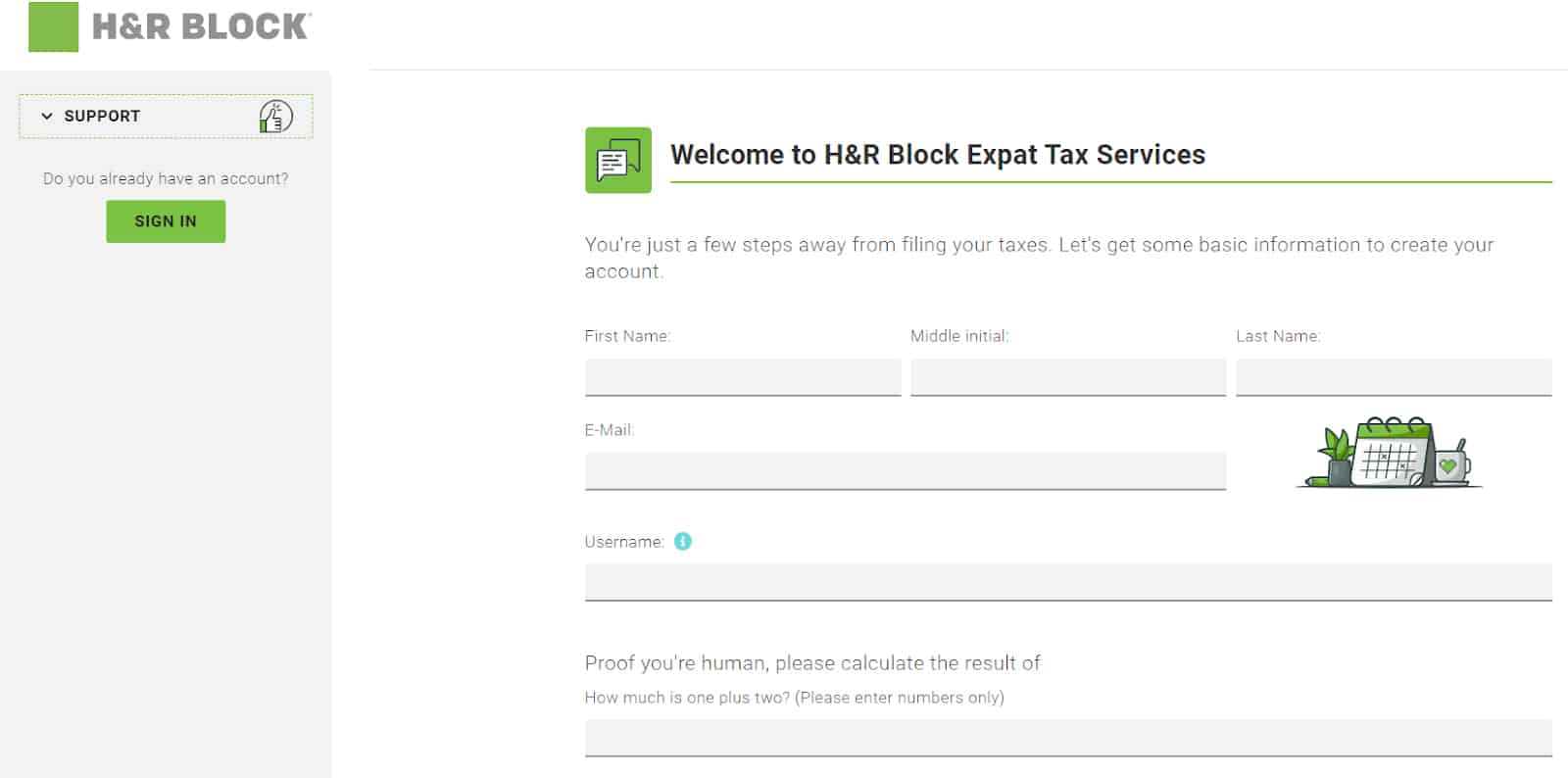

If you’re an American expat, H&R Block’s international tax experts will work with you to file your expat taxes. You also have the option of filing them yourself. H&R Block’s software is designed to identify tax benefits for expats, ensuring that you take advantage of every credit and deduction.

H&R Block Expat Tax Services (Source: H&R Block)

The DIY online option starts at $99 for simpler returns covering employment income, but more complex expat situations like self-employment income and investment income, such as stock options, can use the software for an additional cost. The fee to have an advisor prepare your taxes starts at $199. Both the online tax prep and tax guidance have a 100% Accuracy Guarantee, ensuring that your tax return will be prepared correctly.

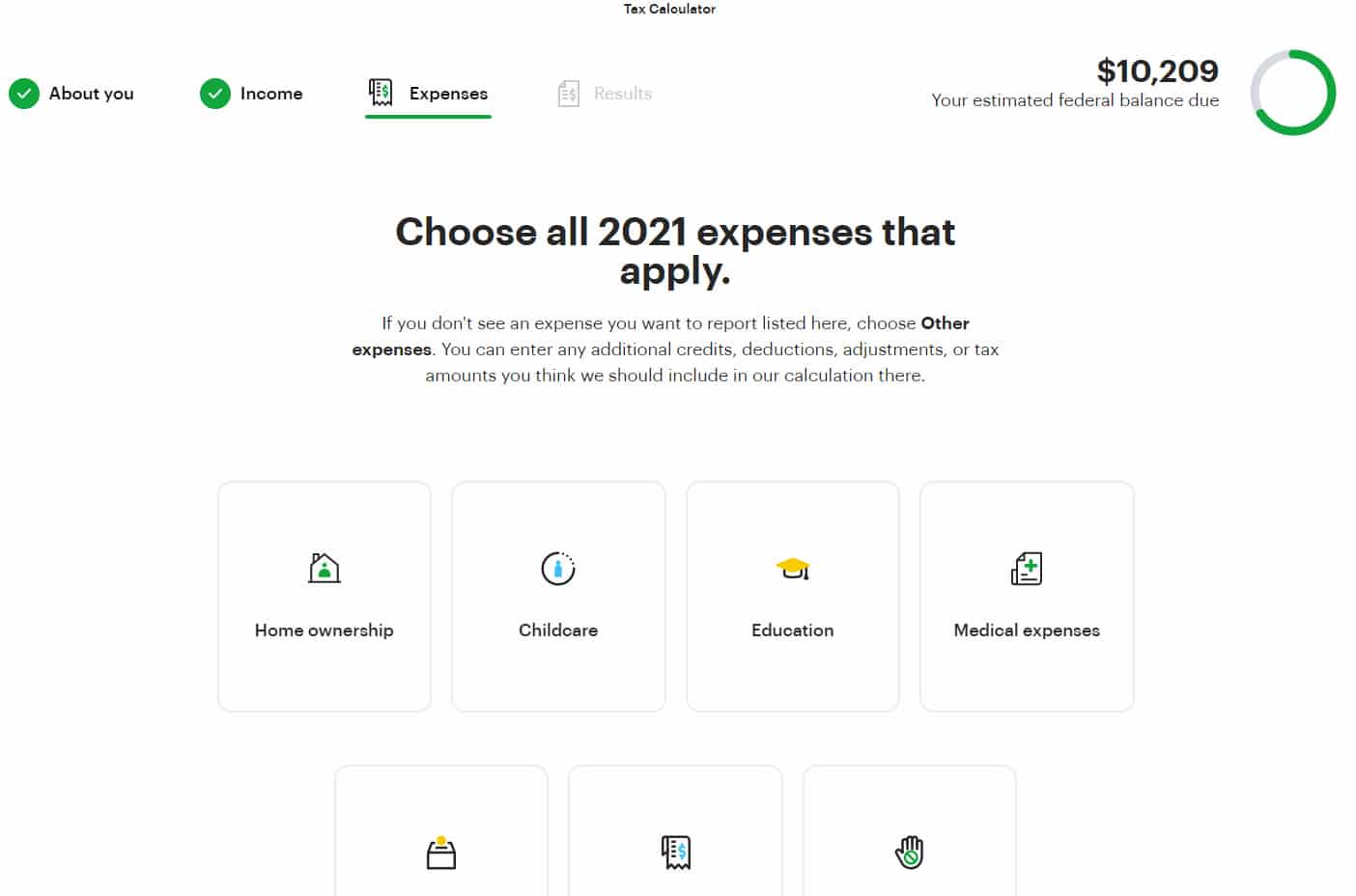

The free tax calculator helps you learn about your current tax situation and plan ahead. Answer a few questions about your life, income, and expenses, and the calculator will estimate your filing status and taxable income based on those factors. This is useful information to determine whether you’ll end up owing taxes or may be entitled to a refund.

H&R Block Tax Calculator (Source: H&R Block)

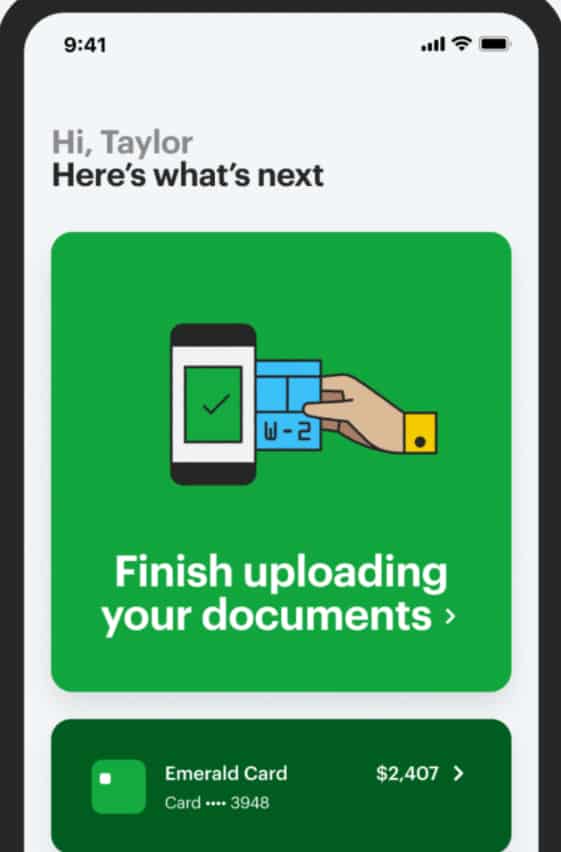

Available on Google Play and App Store, H&R Block’s mobile application, called MyBlock, lets you prep and file your returns anytime and anywhere. You can access and manage your Emerald card, credit score, and Tax Identity Shield membership. Take a picture of your W-2 and then use MyBlock to import it to your account. This is much easier than entering all your W-2 information manually. You can also get support from a tax pro through on-demand chat or video.

H&R Block’s MyBlock mobile app (Source: H&R Block)

If your business needs year-round help with bookkeeping and payroll, H&R Block has Block Advisors who can assist you. Options include a DIY Starter service that starts at $39 per month and full-service bookkeeping that starts at $175 per month. Both plans include access to virtual and in-person help.

For payroll services, the Self-Employed version starts at $59 per month and allows you to pay yourself. Meanwhile, one or more employees start at $79 per month plus $10 per employee per pay run.

H&R Block’s Tax Identity Shield helps to protect you from identity theft, and if you do become a tax fraud victim, it offers assistance from a specially trained agent to help recover your refund as quickly as possible. Included are a dark web identity watch, credit report access and identity monitoring, and tax return notifications.

Pay your tax filing fees directly from your refund. H&R Block charges $39 for a federal refund transfer with the state refund transfer included. If you wish to receive your remaining refund by check after making payments from your refund transfer account, you’ll need to pay an additional fee of $25.

If you don’t sign up for Refund Transfer, you can receive your refund as a direct deposit or paper check free of charge. Of course, you’ll have to pay for your software from another source prior to filing. You can also elect to have your refund on a prepaid Mastercard, the H&R Block Emerald Card.

H&R Block Customer Service & Ease of Use

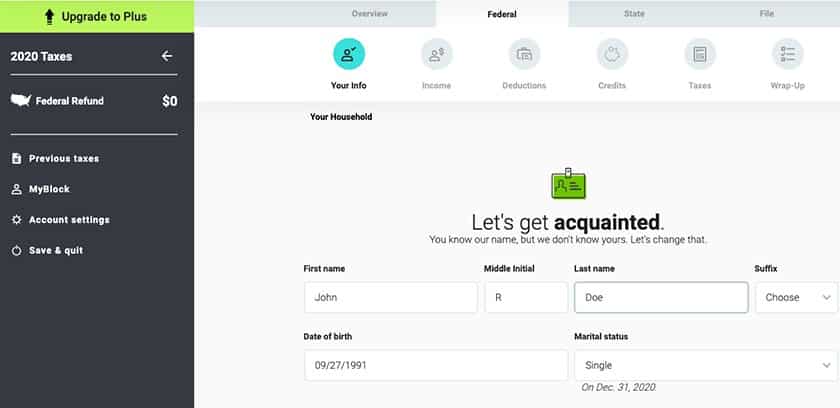

While H&R Block’s user interface isn’t as simple as some other online programs like TaxSlayer, it’s still seamless and easy to navigate. Every page includes clear instructions for the next steps, and you can skip some pages and go back to complete them later. To get started, you need to answer a series of questions about your life, income, deductions, and other information:

H&R Block’s interview process (Source: H&R Block)

Once you log in, you can view the status of your refund and check your past tax history. You can also instantly access the calculator to estimate your tax refund:

H&R Block’s tax history page (Source: H&R Block)

There’s an in-software help center including extensive online customer support, including a database of frequently asked questions (FAQs), blogs, and communities of experts. If you need unlimited live chat support and the ability to call and talk to a person, you’ll need to purchase a paid version. Finally, you can visit an H&R Block agent in any of its 12,000 offices.

H&R Block User Reviews

H&R Block received shockingly low user reviews from Consumer Affairs of only 2.1 out of 5 stars. However, scores were much better from the other sites we looked at including Influenster where they scores 4.1 out of 5 based on over 21,000 reviews. Users appreciate the different options for every budget and the ability to work with a tax professional if needed. Reviewers also praised its ease of use and the data verification features that ensure accuracy. Its biggest drawbacks are the fact that you have to pay for state filing. Other users didn’t like that the desktop software doesn’t come with live tax help.

H&R Block earned the following average scores on popular review sites:

- Consumer Affairs: 2.1 out of 5 based on more than 2,847 reviews

- Capterra: 4.3 out of 5 based on more than 58 reviews

- Influenster: 4.1 out of 5 based on more than 21,000 reviews

FAQs

Does H&R Block offer quarterly payment assistance?

Yes, H&R Block’s tax experts will assist with filing your quarterly taxes through their quarterly tax payment service.

Does H&R Block provide audit support?

Yes, H&R Block will review, research, and respond on behalf of your business to any IRS letter or notice in case of an audit.

How much does H&R Block cost?

H&R Block offers two options for filing your returns—online or desktop software. The online solution includes a free edition for simple returns and three paid packages with prices that range from $35 to $85 per federal return, plus $37 per state. With the desktop program, there are four tiers with prices ranging from $25 to $899 for unlimited returns, although you may have to pay extra for e-filing more than five returns.

Bottom Line

H&R Block is a solid choice for individuals and self-employed taxpayers wanting to save on their federal and state tax returns. Its free edition is a bit more expanded than most other programs, and its online versions come with multiple guarantees that will help you reduce your tax liabilities and increase your refund. It also gives you the option to talk to a live tax pro online, plus you can visit an agent at a desk in its brick-and-mortar office.