Interim financial statements provide a snapshot of your business’s financial position and performance over a period shorter than a full fiscal year, typically on a quarterly or semi-annual basis.

What Are Interim Financial Statements? Purpose & Examples

This article is part of a larger series on Bookkeeping.

Interim financial statements are composed of the income statement, balance sheet, and cash flow statement. Think of a visit to your doctor for a routine checkup, wherein they’ll often run blood tests to see if everything looks good. These tests give a snapshot of your health at that moment, helping catch any potential issues early.

It works the same way for a business. Generating interim financial reports throughout the year allows you to check on your business’s financial health before problems get out of hand. While waiting for the annual report is an option, some issues may go unnoticed, and then it may be too late to fix them.

Interim reporting requirements for small businesses

Small businesses aren’t legally required to prepare interim financial statements — unless you operate in regulated industries like banking, healthcare, insurance, or utilities. But before you dismiss them as unnecessary extra work, hear me out. Just because the law doesn’t mandate them doesn’t mean they aren’t valuable.

Interim reports give you a real-time financial checkup, helping you

Instead of flying blind until tax season or year-end, you’ll have the data you need to stay in control of your finances — all without waiting for an accountant to hand you a report months later.

Purpose of interim financial statements

I get why interim financial reporting might seem unnecessary. But to show you its value, let’s walk through a few fictional scenarios where businesses used interim reports to spot problems early and find solutions.

Spotting cash flow problems

The strong sales in Q2 should have led to a growing cash balance, so the numbers aren’t adding up. Since revenue alone doesn’t tell the full story, preparing an interim cash flow statement for the past three months is the best way to track where the money went.

Without this report, identifying the root cause is a guessing game. Have expenses quietly increased? Is inventory loss from shoplifting or breakage forcing more frequent restocking? Speculation won’t solve the problem, but an interim cash flow statement will reveal exactly where the cash is going, allowing the owner to take action before the situation worsens.

Identifying problems with profitability and costing

There are plenty of reasons why a restaurant might struggle to turn a profit despite a surge in sales. If I had to guess, overhead costs could be a major factor. Restaurants don’t just sell food; they sell an experience, from ambiance to service quality, and those elements come with significant expenses. But at the end of the day, my guess is no better than the restaurant owner’s.

An interim income statement provides a clear snapshot of what happened over the past few months. Without it, finding the issue is just a guessing game.

- Did ingredient costs eat into margins?

- Did excessive food waste drive up expenses?

- Did third-party delivery fees cut too deep into profits?

- Are menu prices so low that it’s unhealthy for the business?

These are the kinds of questions an interim income statement can answer, giving the owner real data to work with instead of relying on speculation.

Planning for tax liabilities

Scenario: A copywriting agency avoids ongoing accounting fees by hiring an accountant only once a year before tax season, paying just $2,000 for tax-ready financial statements. The owner is satisfied with the cost savings, believing it’s enough to stay on top of finances.

After a year of strong growth and returning clients, the agency invests its available cash in new equipment and software to expand operations. However, when tax season arrives, the owner is blindsided by a huge tax bill without reserves to cover it.

This case is a classic example of why interim reports matter. Had the owner known about the estimated tax bill, they could have adjusted their business’s spending on new equipment and software to maintain a cash cushion.

Interim reports offer valuable insights into both current and future financial obligations, helping businesses make informed decisions before it’s too late. They serve as a financial checkpoint, ensuring that major investments, tax planning, and cash flow management align with the company’s overall stability.

Deciding on new business opportunities

Though the reasons for the acquisition are good, the owner is unsure if they can afford it. This is where interim reports come in. Before engaging with the acquiree, the owner must look first at their company’s interim balance sheet to assess its cash, other assets, liabilities, and equity.

Say the owner’s strategy is to pay the company $2 million in cash, $3 million in convertible preferred stock, and $5 million in bonds. Hence, the interim balance sheet will show if the business

- Has enough cash to cover for the purchase price, if not to be paid in whole

- Can issue additional stock (for corporations) as a form of payment

- Is liquid enough to incur more liabilities (i.e., for bond issuance) while maintaining a healthy debt-to-assets and debt-to-equity ratio

Real-life examples of interim financial statements

To get an accurate depiction of what an interim financial statement looks like, I’ll show Starbucks Corporation’s latest 10-Q report.

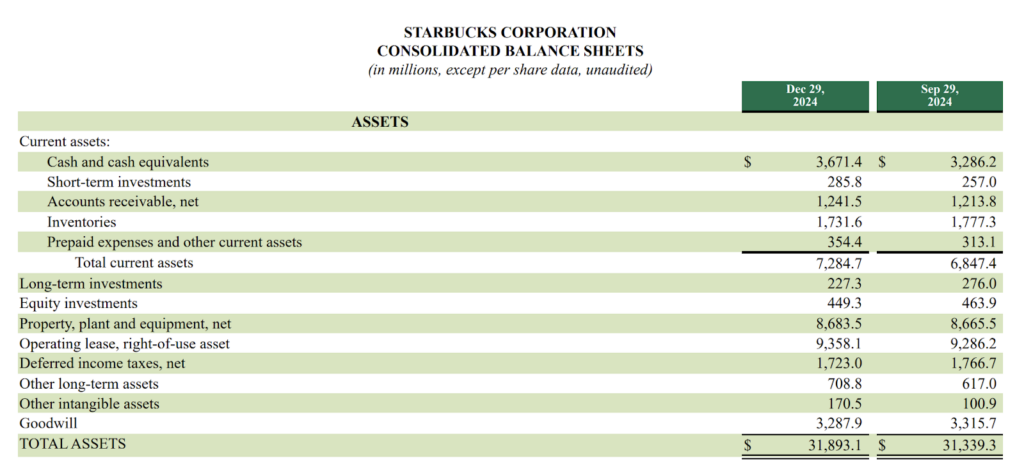

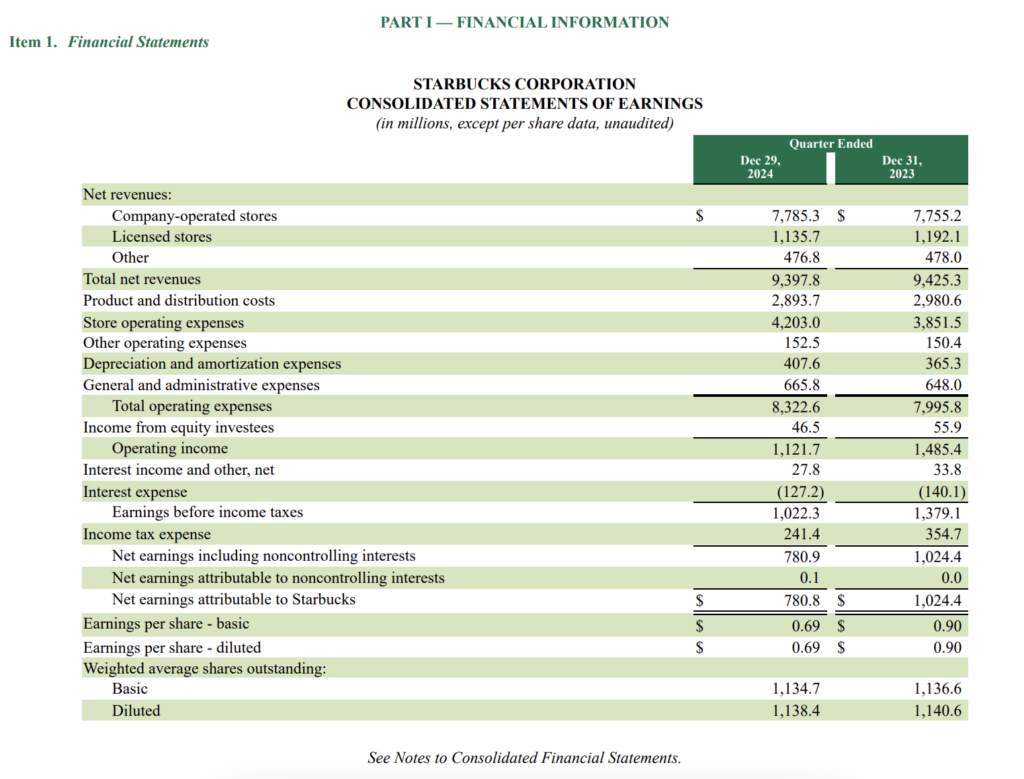

Below is Starbucks’ interim income statement, labeled “Consolidated Statements of Earnings.” While the name may differ, it’s essentially the same as an income statement, and the contents remain unchanged.

Starbucks Corporation’s interim income statement (Source: Starbucks)

The income statement compares Starbucks’ interim results for the quarters ending Dec. 29, 2024, and Dec. 31, 2023. As an investor, the first thing I’d notice is the increase in operating expenses and the decrease in earnings before tax.

There’s also a possible red flag — store operating expenses jumped from $3,851.5 million to $4,203.0 million, a 9% increase. Without a corresponding revenue boost, this spike raises questions. A smart investor would want to dig deeper. What is driving the higher costs, and is it a temporary issue or a long-term concern? What business decision contributed to this?

So, put yourself in the shoes of the Starbucks CEO. Given the increase in store operating costs without revenue boost, how would you address this? This is why interim reporting is necessary; it gives you the opportunity to act on issues that might be a bigger problem in the future.

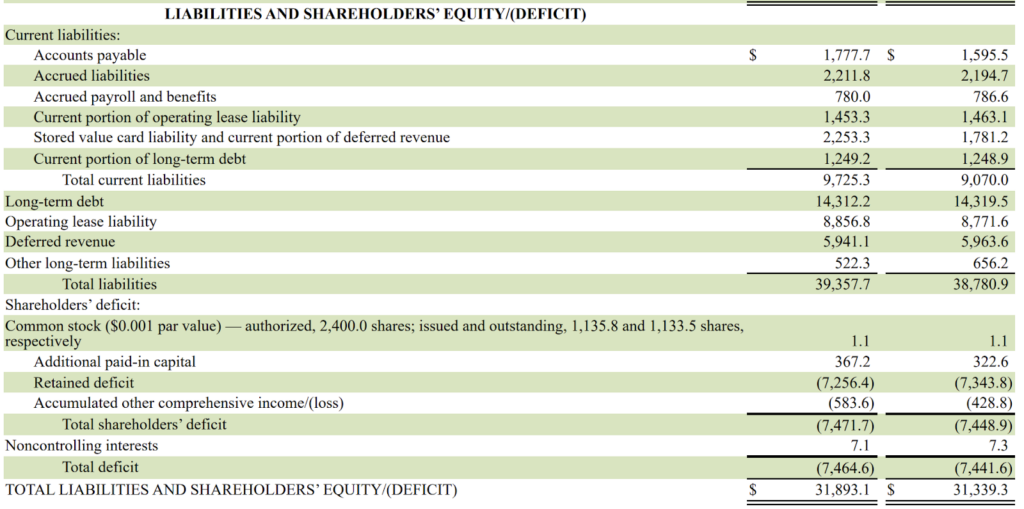

Now, let me show you the interim balance sheet, which I separated into two groups: assets in the first tab, and liabilities and equity in the second. This time, Starbucks is comparing the beginning and ending balances.

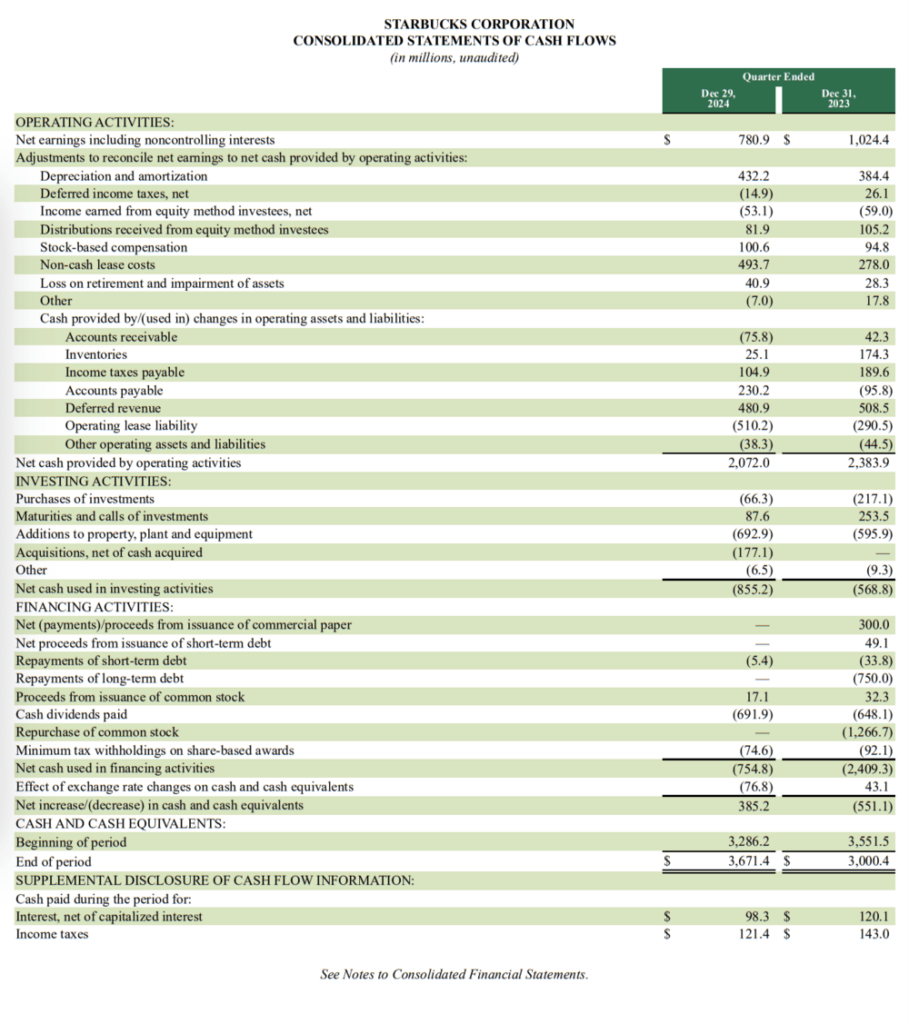

Now, let’s look at the interim cash flow statement. At first glance, Starbucks’ cash flow is healthy despite having a shareholders’ deficit. That’s why, earlier, I said that seeing a deficit isn’t immediately a red flag because Starbucks is still generating a good amount of cash.

Starbucks Corporation’s interim cash flow statement (Source: Starbucks)

Compared with Q4 of 2023, Starbucks has more cash and cash equivalents in Q4 of 2024. If I were the CEO of Starbucks, I’d use the interim cash flow statement to look at transactions that produce cash inflows and outflows.

In my opinion, one thing that’s not helpful in the cash flow statement above is the presentation of operating activities. It uses the indirect method, which can be difficult to read if you’re not well-versed in accounting.

Interim reporting recommendations for small businesses

If you are not required to publish interim financial statements but prefer to do so in the interest of transparency with your stakeholders, here are some of my tips.

✅ Set a reporting cadence.

When you commit to interim reporting, stakeholders need to know when you’ll release them. The typical cadence is quarterly, wherein you’ll update stakeholders of what has happened during the quarter and how the quarter’s results contribute to the annual goals.

A semi-annual cadence is also perfectly acceptable. However, it’ll just be one interim report in the middle of the year, with the next one already being the annual report.

I prefer a quarterly cadence because it captures seasonal trends effectively. For example, it allows you to explain to stakeholders why Q4 figures might appear underwhelming, attributing them to typical seasonal shifts in buying behavior during the holiday season rather than a decline in business performance.

✅ Give meaningful analysis to data.

If insights are unclear, they can leave the reader more confused than informed. The key question to ask is: What information do they need to know? In a small business environment, the primary focus should always be on profitability and cash flow, as these directly impact the company’s ability to stay afloat and grow.

Rather than overwhelming stakeholders with excessive data, focus on key financial indicators that tell a clear story. By honing in on these critical insights, small business owners can use interim reports not just as compliance tools but also as strategic roadmaps for smarter decision-making.

✅ Keep reports simple yet informative.

A financial report doesn’t need to be overloaded with numbers to be effective. The goal is to keep it concise yet insightful, focusing on key financial statements (i.e., income statement, balance sheet, and cash flow statement) while highlighting essential trends.

Use plain language to explain shifts in revenue, expenses, or cash flow, and include comparative figures to make trends easier to spot. Avoid unnecessary complexity; instead, ensure the report clearly answers the most important question: What does this mean for the business, and what actions should be taken?

Interim vs annual reports

An interim report only runs for a period of less than one year (e.g., quarterly, semi-annually), whereas an annual report spans one whole year.

Annual reports or Form 10-K are usually published several months after year-end, particularly within

- 60 days after year-end for large filers

- 75 days after year-end for accelerated filers

- 90 days after year-end for non-accelerated filers

Private companies (i.e., those that the SEC doesn’t require to submit Form 10-K) have no deadline. Rather, it is management who will decide whether or not to publish an annual report.

Interim reports or Form 10-Q are published particularly within

- 40 days after quarter-end for large filers

- 40 days after quarter-end for accelerated filers

- 45 days after quarter-end for non-accelerated filers

Private companies are also not required to release interim reports unless it is a management decision to do so.

Frequently asked questions (FAQs)

An interim financial statement can be a quarterly balance sheet, cash flow statement, or income statement, providing a financial snapshot for a period shorter than a full fiscal year.

Publicly traded companies in the US must file interim financial statements (Form 10-Q) with the SEC, while private businesses and nonprofits may prepare them for lenders, investors, or internal financial tracking. Small businesses are not legally required to prepare them but benefit from them for better cash flow management and decision-making.

An interim report covers financial performance for a shorter period (e.g., monthly or quarterly), while a final report (annual financial statements) summarizes a full fiscal year and is often audited for tax or regulatory purposes. Interim reports help track progress and spot financial issues early, while final reports provide a complete, end-of-year financial summary.

Bottom line

Interim financial statements can help you keep track of your business’s financial health. They’re more than just reports that some companies do for SEC compliance — they’re a real-time financial checkpoint that helps you manage cash flow, spot trends, and make informed decisions before small issues turn into bigger problems.