Microfinancing is the process in which small loans are issued to individuals or companies that may not qualify for traditional means of financing. Loans can range from as low as $50 to as much as around $50,000 and are typically designed to help underserved communities and businesses, such as startups or companies, that don’t have access to lending services.

While the loans used in microfinance may be smaller than those in conventional lending, microfinancing as a whole plays a large role in stimulating the worldwide economy. If you’re considering this type of loan for yourself or are interested in getting an idea of the impact it has, here are some microfinance statistics to be aware of.

General Microfinance Statistics

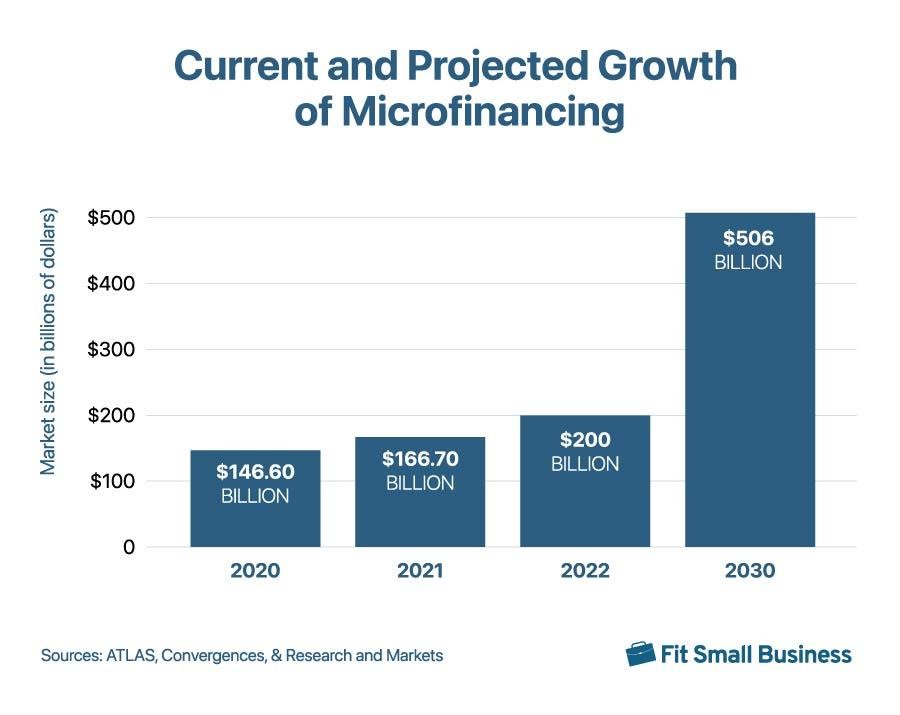

1. As of 2022, the microfinance market was valued at over $182 billion

Individual loans made in microfinancing may be small, but they play a large role in the global economy. In total, information summarized by Convergences (based on data sourced from ATLAS) revealed that the total market size of microfinancing was valued at $182.7 billion in 2022.

This represented a year-over-year growth of 13.7%, up from 9.6% in the prior year. The market value also represents around 173 million borrowers who took advantage of microfinancing, a year-over-year increase of 5%

2. Microfinancing is projected to reach nearly $500 billion by 2030

Microfinancing has historically consisted of a large number of loans issued to borrowers worldwide, and that trend is expected to continue growing. According to a report from Research and Markets, the global microfinancing market is projected to reach a size of close to $500 billion by 2030. This represents an expected average annual growth rate of approximately 12% and is an indicator that individual investors and lending institutions recognize the benefits of continuing to offer this type of product.

3. More than $82 million in SBA microloans were issued in 2022

The Small Business Administration (SBA) offers a microloan program for businesses needing up to $50,000 in funding. These loans can be used for a wide range of business purposes, including working capital, inventory, equipment, and other business expenses. The average SBA microloan is about $13,000, and the SBA issued $82.6 million for its 2022 fiscal year. Of the loans that were issued 5,055 went to small businesses, and 76% of the number of loans went to underserved communities.

4. The average microloan is under $2,000

According to a recently completed survey, few microloans ever exceed $2,000, although this varies by region and lender type. For instance, private microfinance lenders report an average loan of $1,943. Meanwhile, loans made in Sub-Saharan Africa, East Asia, and the Pacific reported an average loan size closer to $1,000.

5. Most microfinancing providers offer additional services

60 Decibels conducted a survey of over 114 institutions globally and found that 71% provided additional non-financial services at no extra charge. Some examples of these additional services include education and training to help borrowers better manage their business finances.

When taking into consideration other financial services provided, approximately 32% only offered loan products, with the rest providing insurance, savings, and other deposit or banking services.

Microfinance Demographics Statistics

6. Women make up the majority of microfinance loans

Microloans are typically designed to reach underserved communities, minorities, and those who are unable to get conventional means of funding. As one example, women-owned businesses often fall into one of these categories, as a recent post by the U.S. Census revealed that only around 22% of businesses were owned by women.

Microfinance data reveals that it has been a success in this regard, as a survey from 60 Decibels revealed that two-thirds of microloans were issued to women in 2023.

7. 1.4 billion people worldwide do not have access to banking services

According to the World Bank, 1.4 billion adults worldwide do not use formal banking services. That represents a large opportunity for microfinance lenders to provide assistance in the form of not only microloans but also checking and savings accounts to help improve one’s ability to respond to a financial emergency and foster a higher rate of financial inclusion. These individuals who do not have banking services are typically those living in rural areas, underdeveloped, or otherwise underserved communities.

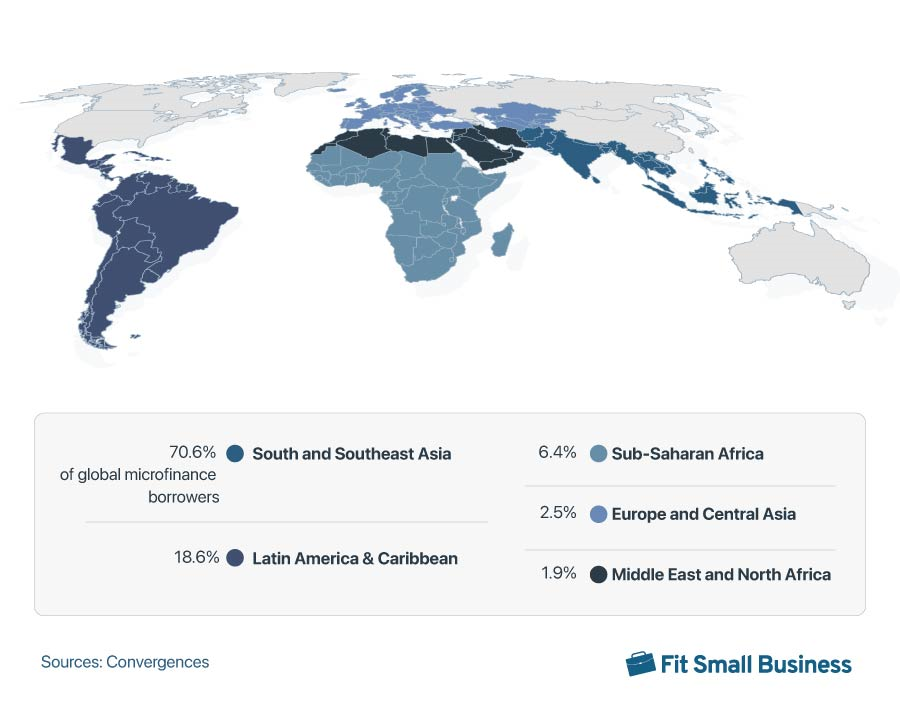

8. Asia represents the most popular location for microfinancing

Geographically, South and Southeast Asia have the highest concentration of microfinance borrowers. Compared to the global market, it has 70.6% of borrowers based on 2022 year-end data from Convergences. Other regions with a large number of microfinance borrowers include Latin America, the Caribbean, Sub-Saharan Africa, Europe and Central Asia, and the Middle East and North Africa.

Asia is also the most popular location for microfinancing when total funds issued is taken into account. Asia represents 37% of the worldwide microfinancing amount, followed by Latin America, Africa, Europe, and the North African regions.

9. Funding amounts for microloans has a global median of 39% of a country’s Gross National Income

According to Convergences, microloans represent a median of 39% of Gross National Income when all countries are taken into consideration. This figure is the smallest in the South and Southeast Asia region at 21.1%, which shows that most microloans made in this region are much smaller on average when compared to the rest of the world.

Microfinance Customer Statistics

10. Microfinance payments generally are affordable for clients

Being that microfinancing generally focuses on underserved communities, some may believe that the possibility increases for predatory lending practices to occur, such as charging prohibitively expensive rates or hidden fees. In general, however, this does not appear to be the case. Response to surveys showed that only 1 in 4 borrowers reported loan payments as being a burden, with 91% having never experienced an unexpected fee. Additionally, 88% of borrowers reported being able to make loan payments from their regular business income or wages.

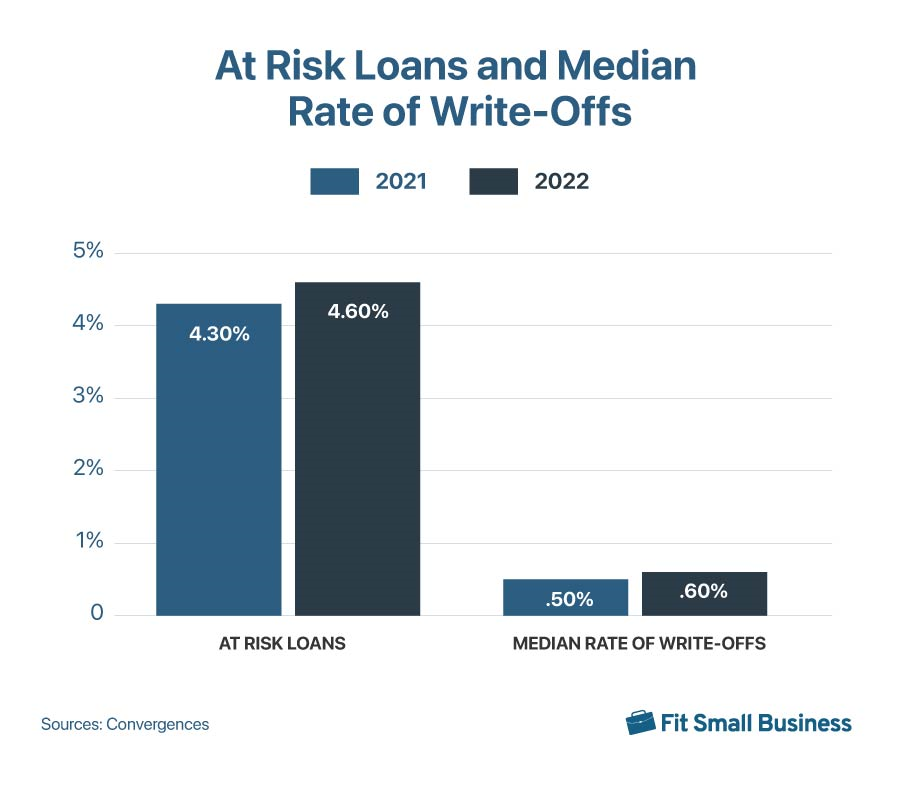

11. Microloans have a high repayment rate

Some banks and lending institutions may consider microloans as having a greater risk of default, which may partially be because these loans typically target underserved communities and those that do not qualify for conventional loans. However, information gathered from ATLAS and Convergences showed that the amount of write-offs of microloans has historically been low.

The median rate of write-offs was 0.6% in 2022, with 4.6% of loans considered at risk of loss as a result of no payments being made in the past 30 days. Compared to 2021, the median rate of write-offs was 0.5%, with 4.3% of loans considered at risk of loss.

12. Nearly half of microloan customers are relatively new

60 Decibels completed a survey of over 32,000 microfinance borrowers worldwide, and found that on average, 53% of them had been with their lender for less than a year. These newer borrowers represented a greater portion in Asia with 56% of them having been with their provider for under a year. Africa represented the region with the smallest portion at 48%.

13. About two-thirds of microloan customers borrowed funds as a group

Microloans can be made to individuals or to a group, with each member of that group assuming responsibility for repayments. Group loans are often made in the event of larger loan amounts or when financing costs are high. This can also occur if there are no other microfinance lenders available in the area.

Approximately 33% of microloans were issued to group borrowers, an indication that in most areas, competition amongst lenders is high or the costs to get funding are reasonable. This may also not come as too much of a surprise, considering the fact that microloans are typically smaller in size and should not often require borrowing as a group as a way to strengthen the loan application.

Statistics on the Impact of Microfinancing

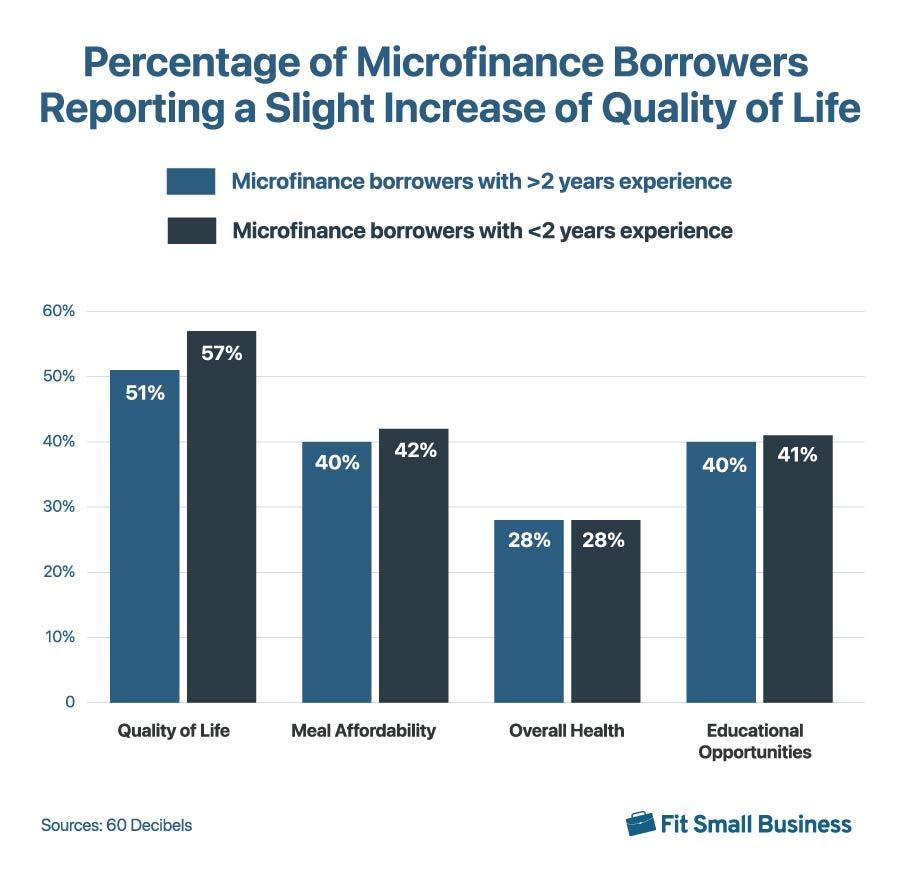

14. Most borrowers report an improvement in quality of life

Borrowers who have received assistance from a microloan generally report an increase in the quality of their lives. This is based on survey responses from over 32,000 participants, with other life impacts including things like health, access to education, home improvements, and confidence in managing finances.

As much as 57% of borrowers reported an overall increase in the quality of their lives, and 54% reporting a greater ability to weather a financial emergency.

15. The expanded access to microloans has improved the financial status of most borrowers

Microfinance provides loans to individuals and businesses that otherwise might not be able to get funding. This assistance can help the business grow and generate additional sales. The additional revenue that’s generated plays a large role in strengthening the financial position of the business and the business owner, all of which is supported by data from 60 Decibel’s microfinance survey, where as much as 90% of respondents reported an improved ability to manage finances, and 79% reported an increase in the balance of their savings.

16. Microfinance helps promote economic growth through the creation of jobs

Similar to 60 Decibels, BNP Paribas completed its own survey of microfinance institutions based solely on entities and organizations it supported in 2022. It found that over 1.2 million jobs were created as a result of microfinance based on 21 lenders in 13 countries.

It should come as no surprise that microfinance, one of several methods to fund your startup, helps support economies by the creation of jobs as the funding itself can help businesses continually grow, something that often leads to the need for additional resources and employees to scale.

Bottom Line

Microfinancing plays a large role in the global economy, with loans ranging from as low as $50 to as much as $50,000. These loans often go to underserved communities. If you’re considering getting microfinancing for your business, the statistics we’ve listed above can give you an idea of what you can expect as a borrower. Check out our microloan guide for more details on what they are and where you can get funding.