Product and period costs are the two major classifications of costs that have different accounting treatments. Product costs are related to the cost of purchasing inventory for sale or performing a service. Meanwhile, period costs are costs that are not related to production but are essential to the business as a whole. It’s important to distinguish between product vs period costs because the former must be deducted when a good or service is sold, whereas the latter is deducted in the period it is incurred.

Product Costs | Period Costs | |

|---|---|---|

Definition | Expenses attributable to the purchase or production of goods or performance of services. Anything related to your small business’s main products or services is considered a product cost. | Costs related to business functions that aren’t directly related to the production or performance of services. These costs are essential to the business even though they don’t directly contribute to the business’s main products. |

As to Their Components | Direct materials, direct labor, and overhead | Selling, general, and administrative expenses |

As to Their Degree of Traceability | Direct cost and easily traceable | Indirect cost and not traceable easily |

As to Their Recognition as Expense | Upon sale to customers | During the period in which they were incurred |

As to Their Accounting Treatment | Inventory and cost of goods sold (COGS) | Expense as incurred |

As to Their Behavior With Respect to Activity Levels | Mostly variable | Mostly fixed |

As to Where They Are Reported | Balance sheet until inventory is sold, and then income statement | Income statement |

How To Distinguish Product Costs From Period Costs in a Small Business Setup

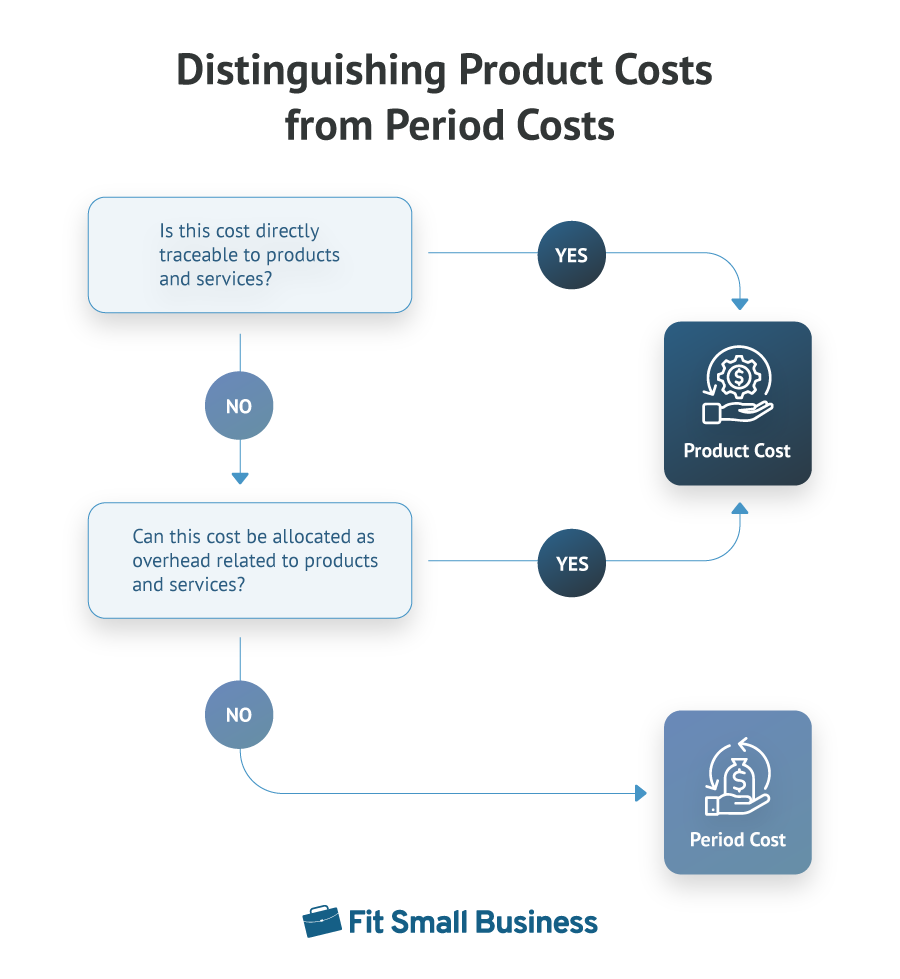

To distinguish between product vs period costs, you need to perform two tests: traceability and allocability. The traceability test segregates easily traceable costs such as materials and labor. If a certain cost item isn’t traceable, you need to test it for allocability. Allocation is the most practical way to account for non-traceable costs, but these costs must be directly related to products and services before they are allocated. If they’re not directly related, they are period costs.

Below is a simple flowchart we designed that summarizes how to distinguish period costs vs product costs.

Decision Chart for Distinguishing Product and Period Costs

Is this cost directly traceable to products and services?

When costs are traceable to products and services, they are undeniably product costs. Being traceable means that you won’t have a hard time determining the physical quantity and its cost equivalent.

For example, a bakery can determine accurately that it will need 12 pounds of butter to create a large batch of cookies. Moreover, it also knows that a pound of butter costs $4 from its supplier. We can say that the cost of butter is traceable to the cookies (final product) because it’s not hard to measure the physical quantity of butter needed for a batch and the cost of purchasing it.

To expound, let’s assume that the bakery hires two professional bakers. The bakery pays $20 an hour for each baker for a 40-hour work week. We can determine easily the hours worked of each baker by looking at their daily attendance. Hence, the hourly wages of each baker is also directly traceable to the production of cookies in the bakery.

In summary, traceable product costs can be classified as:

- Direct materials (DM): These are materials used to produce a good or perform a service, such as 12 pounds of butter

- Direct labor (DL): These are time spent by employees in the production area or those that deal with clients, such as hourly wages of professional bakers.

DM and DL behave variably and proportionately to activity levels. It means that DM and DL increase as production increases, and they decrease if production decreases as well.

To understand the concept of traceability further, see our comparison of direct vs indirect costs, which discusses the nature of the costs and provides some examples.

Can this cost be allocated as overhead related to products and services?

If the cost didn’t pass the traceability test, it is an overhead cost. Allocation is the only way to account for overhead since we can’t pinpoint its direct relationship to products and services. Overhead can be product or period cost, depending on its source.

Allocable to Products & Services

To illustrate, let’s use our bakery example again. The bakery uses baking appliances to bake cookies and other pastries. Let’s assume that the bakery’s electric bill is $1,000. Now, ask yourself: What portion of $1,000 can we trace conveniently to the production of cookies alone? Do you think it’s convenient for the bakery to track the number of kilowatt-hours (kWh) used by all electric appliances to cook a batch of cookies?

If your answer is no, then you’re correct. It’s inefficient to trace electric cost to the final product. Hence, we just allocate them by dividing $1,000 with the total number of units (cookies and all other products) produced during the month. The electricity is still a product cost, but it’s allocated evenly across all products and recognized as an expense when those products are sold.

Allocable but nontraceable costs to products and services—like our electricity example above—are called manufacturing overhead (MOH). We still include MOH as part of product costs even if we can’t trace them directly. Most MOH are fixed but they can also be mixed or semivariable.

For example, most of the electricity for the bakery is probably fixed to power, such things as lights and heating, ventilation, and air conditioning (HVAC). However, part of the electricity might be variable, such as to power the ovens for each batch of cookies. Regardless, the electricity can be allocated to products monthly by dividing the monthly expense by the number of units produced.

Not Allocable to Products & Services

If the cost isn’t traceable and allocable to products and services, this cost is a period cost. Period costs are essential to business operations but don’t directly affect the final products. To continue our bakery example, let’s say we’re hiring an external bookkeeper to do the books. We pay the bookkeeper an average of $400 monthly.

Can we determine how much of the $400 is related to the cookies? Did the bookkeeper help in making cookies? Can we say for sure that the bookkeeper was able to cook at least one batch of cookies? As silly as it may sound, that’s the best illustration of why the bookkeeper’s fee is a period cost.

Period costs are hard to pinpoint to the business’s main products, but they are incurred nonetheless because they’re essential. Examples of period costs include rent and utilities of admin offices, finance charges, marketing and advertising, commissions, and bookkeeping fees.

The concept of product vs period costs is a subset of cost accounting. Read our article about managerial accounting to learn more about how it can help your business manage costs.

Accounting Treatment of Product and Period Cost

Because of the different nature of product and period costs, they receive different accounting treatments. Product costs form part of inventory and the balance sheet, making them inventoriable cost. They only affect the income statement when inventory is sold, and the cost of inventory becomes COGS. Moreover, period costs are expenses in the income statement of the period in which they were incurred.

Let’s discuss the accounting treatment of product costs and period costs in greater detail.

Frequently Asked Questions (FAQs)

Accurate measurement of product and period costs helps you report the correct amount of expense in the income statement and assets in the balance sheet. Failing to distinguish between product vs period costs could result in an overstatement or understatement of assets and net income.

Product costs are reported as expenses when sold. Upon sale, they become part of COGS in the income statement.

Bottom Line

The difference between period costs vs product costs lies in traceability and allocability to the business’ main products and services. Easily traceable costs are product costs, but some product costs require allocation since they can’t be traced. Otherwise, costs that can’t be traced or allocated to products and services are classified as period costs or costs that are attributed to the period in which they were incurred.