Small Business Administration (SBA) Form 1368 must be filled out when you apply for an SBA disaster loan. Examples of disaster loans include the Economic Injury Disaster Loan (EIDL) and the Military Reservist Economic Injury Disaster Loan (MREIDL).

SBA Form 1368 allows small business owners to provide details about the economic impact of a disaster on their business. It requires you to disclose monthly sales figures, an economic forecast, and any additional information not captured in the forecast. The last section provides an important opportunity to provide details and context.

To download the latest version of SBA Form 1368, click the prompt in the download widget below or download it directly from the SBA government website.

How to Fill Out SBA 1368

SBA Form 1368 requires you to fill out monthly sales figures and a projected profit and loss statement. It also offers you an opportunity to explain the figures you selected. This additional part of the application is valuable because it can increase your chances of getting funding and can put the business into context. However, it must still be accurate.

To complete SBA Form 1368, complete the three sections listed below. You should consult your financial adviser when completing this form to ensure accuracy.

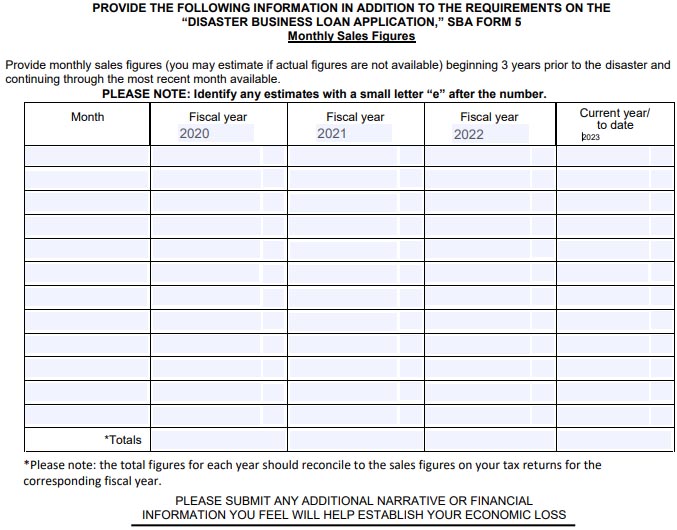

Section 1: Monthly Sales Figures

The SBA requires that you provide the last three available years of your business’ sales history. You must enter monthly sales figures for each of the three years on the form.

First section of SBA Form 1368

Filling out sales figures can take some time, but it’s an important step in establishing the impact of a disaster on the bottom line of your business. As you go through this process, take notes on specific details or anomalies, as these details will be important later when filling out the third section of the form.

Some details worth noting include:

- Unusually high or low sales in a given month

- Months with no sales

- Steady decline or increase over the past three years

- Anything else that looks unusual

Unlike many other types of SBA loans, the SBA offers SBA disaster loans directly.

One major difference between SBA loans and bank loans is that unlike your local banker, the person reviewing your SBA loan does not have knowledge of the past performance of your business over the years. Temporary spikes or dips in business performance should be noted to provide the full context of your application and sales figures. This will help your chances of qualifying for funding.

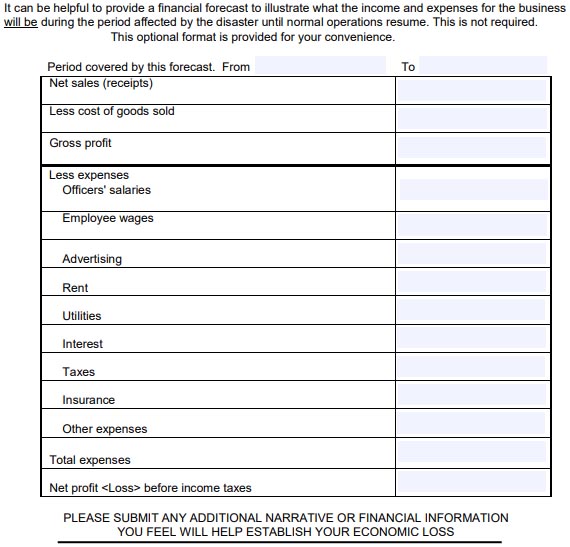

Section 2: Disaster Financial Forecast

The SBA also offers you an opportunity to forecast the economic impact of the disaster on your business. You are not required to use the SBA’s provided template to outline your forecast; however, if you are completing the application on your own, we recommend that you use it.

Sections 2 and 3 of SBA Form 1368

First, you’ll need to provide an estimate of the period of time until the business will be able to resume normal operations. Once you determine that, proceed to the following:

- Net sales: When projecting net sales, consider the first few weeks since the disaster and how that went.

- Less cost of goods sold: This has likely remained stable, but sometimes the cost of goods may have risen, which is important to note here.

- Gross profit: Subtract your cost of goods sold from net sales to get the gross profit.

Then you’ll need to account for expenses, including:

- Officers’ salaries: These are salaries paid to the business owners and other executives.

- Employee wages: This includes hourly wages, tips, commissions, and other forms of compensation paid to employees.

- Fixed and variable costs: This is the sum of advertising, rent, utilities, interest, taxes, insurance, and other expenses. Ensure these expenses have realistic and accurate projections that can be supported if needed.

Finally, you’ll arrive at two calculations:

- Total expenses: Get the sum of salaries and all other costs listed above and combine them for a total expense.

- Net profit/loss before income taxes: The difference between the gross profit and total expenses should be the net profit or loss.

Stop at this stage and ensure the projections are correct and the costs are easy to understand for someone only looking at the numbers. Ensure the difference between the projected net profit and the sales figures in the first section makes sense and creates a rational case for needing economic relief. Note anything unusual that will need to be explained in the next section.

Section 3: Additional Information

This section provides the space to explain the details of your past sales figures and your projections. The notes you’ve been taking throughout this process all belong here. If you need to explain your economic struggles in more detail and the suspected reason for these issues, this is the time to do it.

Use this opportunity to provide context to the numbers contained in the projections for this SBA loan application. Doing this will help the person reviewing your application understand why you chose certain estimates. These explanations can increase the chances of getting approved for funding with an SBA disaster loan.

For additional guidance, see our guide on how to get a small business loan.

Frequently Asked Questions (FAQs)

There were two types of EIDL funding during the COVID-19 pandemic. EIDL Advance funds are like grants and do not have to be repaid. However, EIDL loans are not forgivable and must be repaid.

The SBA can request administrative wage garnishment (AWG), or the process of requiring an employer to pay a portion of your disposable pay to satisfy a non-tax debt to the United States. SBA debtors can request a hearing to either dispute the existence or amount of debt or the terms of the repayment schedule.

In general, you can sell your business if there is an EIDL loan against it as long as the proceeds from the sale will pay the loan off in full. In most cases, you won’t be able to transfer the business with a lien against it. Be sure to consult your legal and financial advisers before considering a sale with a pending EIDL loan.

Bottom Line

SBA Form 1368 is required for an EIDL and MREIDL application. When completing it, you must provide monthly sales figures and projected profit-and-loss information. It also allows you to provide context and explanations for your decisions throughout the process, which can increase your chances of getting approved. Be sure to have your financial adviser review the form before submitting it to ensure it is complete and accurate.