If you or your lender hire a loan packager, referral agent, broker, accountant, attorney or consultant to help prepare or secure a Small Business Administration (SBA) loan, you are required to fill out SBA Form 159.

This is a form that is used far less frequently than other SBA forms. Less than 40% of SBA loan applications annually require this form, which allows you to report any fees paid in the transaction for the origination of SBA financing.

There are two versions of this form depending on the type of SBA loan. You can download them from our widget below the bullet points or directly from the SBA website by clicking the links in the bulleted section:

Explore your SBA lending solutions now with Grasshopper Bank |

|

When SBA Form 159 Is Required

If you hire an agent to help you prepare an application for an SBA loan, you must fill out SBA Form 159. If multiple agents were hired, a separate form must be submitted for each one.

Due to the complexity and time it takes to complete an SBA loan application, some borrowers, or lenders, hire a professional to help. This often falls into one of two categories:

- You paid an agent: You pay compensation to an agent or to the lender for help with your loan application.

- Your lender is paying a referral fee: Lenders may occasionally pay referral fees to agents who have brought your loan to them. Also, the lender may pay a third party to handle the administrative portion of the lending process. Your lender should disclose this information to you upfront.

To determine if you need to fill out SBA Form 159, you must first decide whether you have paid someone who meets the SBA’s legal definition of an agent.

Defining an Agent

According to the SBA, loan packagers, referral agents, brokers, accountants, attorneys, consultants, and “any other party that receives compensation from representing an applicant or lender in connection with an SBA loan” may all qualify as agents.

However, many services performed by those individuals as part of the loan application process are exempt from SBA Form 159. Some examples include:

- Your accountant prepares financial statements required in the normal course of business and not related to the loan application.

- A state-certified or state-licensed appraiser employed by the lender appraises collateral in connection with the SBA loan.

- You work with a lender service provider operating under an SBA-approved lender service provider agreement. This includes SCORE, the Small Business Development Centers, and others.

- An individual performs a business valuation, with no additional services performed in connection with the loan application.

- An environmental professional is employed by the lender to conduct an environmental assessment of the collateral in connection with the SBA loan.

- A real estate agent receives a commission in connection with the sale of real estate.

- You work with an attorney in connection with an SBA loan closing.

How to Fill Out SBA 159

You must fill out one Form 159 for each agent used. There are two different versions of Form 159: one that covers both 7(a) and 504 loans, and one for SBA disaster loans.

SBA Form 159 for SBA 7(a) and 504 Loans

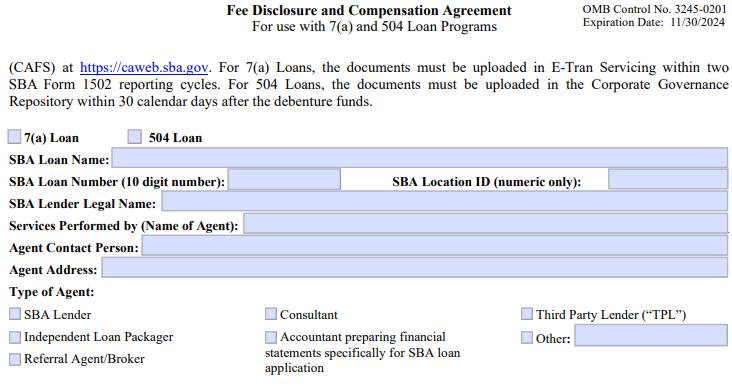

First, on page two, identify whether you have applied for an SBA 7(a) loan or a 504 loan. If the loan application is under your personal name, use that. If the loan application is under the name of a partnership, corporation, or LLC, use this name as it appears on your SBA loan application and tax forms. You will then include your SBA loan number.

SBA Form 159 for SBA 7(a) and 504 Loans, identifying page

Your SBA lender will provide their legal business name and FIRS, which is their identification number for the SBA. Then, you list the corporate name of the agent that assisted you, the individual agent’s name, and the agent’s address. The type of agent then needs to be marked.

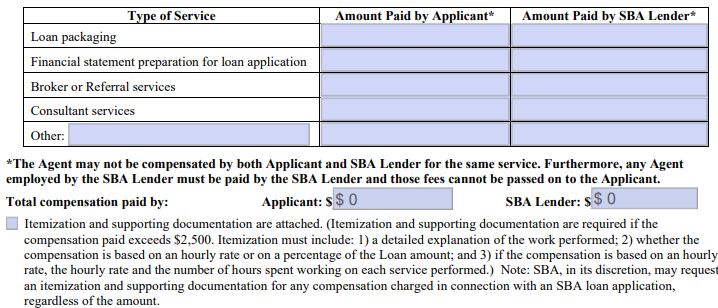

SBA Form 159 for SBA 7(a) and 504 Loans, calculations page

In the table in the image above, the fees paid by both the applicant and the SBA lender for various services are broken down. If the amount paid totals over $2,500, itemization and supporting documentation of the fees are required.

The itemization needs to include details on the work performed, along with an hourly rate and the number of hours spent on each activity. Even if the amount does not exceed $2,500, the SBA may request this documentation from you.

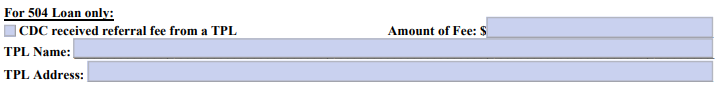

Special Section for SBA 504 Loans Only

With 504 loans, the CDC may act as a referral agent to a third-party lender (TPL). If this is the case, ensure that the CDC discloses any fees it received from the TPL.

The applicant, the agent, and the SBA lender must all sign this form.

SBA Form 159 section for SBA 504 loans

SBA Form 159D for Disaster Loans

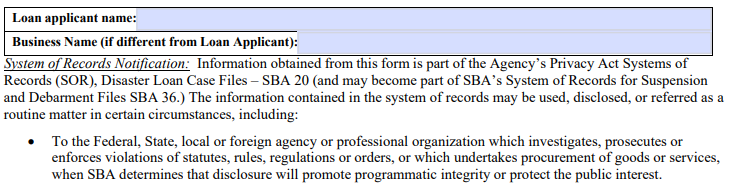

SBA Form 159D is used for both personal disaster home loans and business disaster loans. This form has less information to fill out and also has different requirements than the form for 7(a) and 504 loans. First, the only personal or business information needed from the applicant is the loan applicant’s name and the business name.

SBA Form 159D for Disaster Loans, identifying page

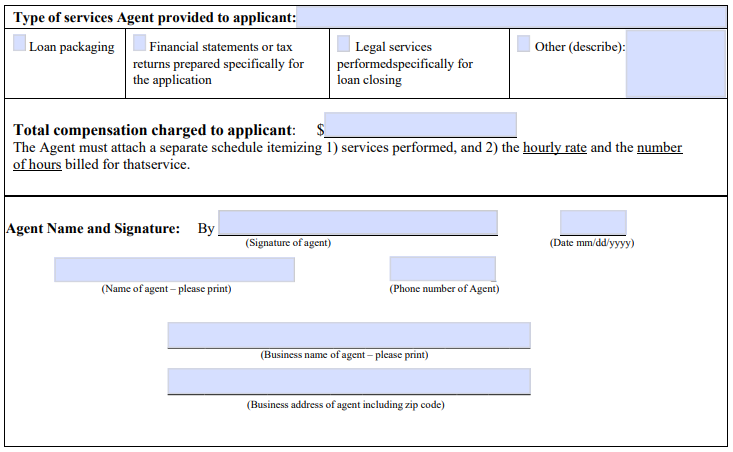

Second, the information required on Form 159D regarding compensating an agent involves checking any appropriate boxes and listing the total compensation amount. Like SBA Form 159, the SBA requires itemization of all services that exceed $2,500 on disaster business loans. Since this form is also used with home loans, in those situations, the itemization requirement is $500.

Only the applicant and the agent would be required to sign SBA Form 159D.

SBA Form 159D for disaster loans, calculations page

Frequently Asked Questions (FAQs)

A separate form must be filled out for each agent. Once this is done, the SBA lender and application both must sign and date each form.

The two-masters rule states that you and your SBA lender are not both allowed to pay the same agent for the same services. The SBA allows you to pay a fee to the same agent if you can prove you are paying for two distinctly different purposes.

If you are unable to agree upon a payment plan to repay the loan, the SBA can ask the Department of the Treasury to garnish your wages, tax refunds, or retirement funds to repay the loan.

Bottom Line

Overall, SBA Form 159 is one of the simplest forms to fill out, but it’s only used by less than half of all SBA loan applicants. If any third parties are getting paid in the loan transaction, or have already been paid, then you may need to fill out the form.

Before applying for any business loan, be sure to read our guide on how to get a small business loan. It will allow you to be prepared for the application process and potentially answer questions you might have about a possible loan.