In accounting, a “source document” refers to any document that substantiates and evidences a transaction. It’s important to retain and organize these documents to research problems or questions that arise concerning transactions. You also might need to provide these to the IRS if it audits you or questions anything related to your tax return.

The type of source document you should retain varies with the type of transaction you need to substantiate. Just as there are different source documents for personal finances and business, there are specific source documents for accounting. These documents prove not only that a transaction took place but also that a business rendered goods or services. They can be classified as either internal or external source documents.

INTERNAL | EXTERNAL |

|---|---|

Internal source documents are created and used within your business. They’re often used to make decisions about different aspects of your business, such as assisting with forecasting, setting pricing, and maintaining accurate financial records. | This document originates from an outside company and enables you to prove that your business completed a transaction with another business. They’re useful when preparing your taxes and substantiating transactions if questioned by the IRS. |

1. Sales Workflow Source Documents

Sales workflow documents include sales orders, packing slips, invoices, sales receipts, and bank deposit slips. They’re all crucial documents for creating a paper trail for your company’s transactions.

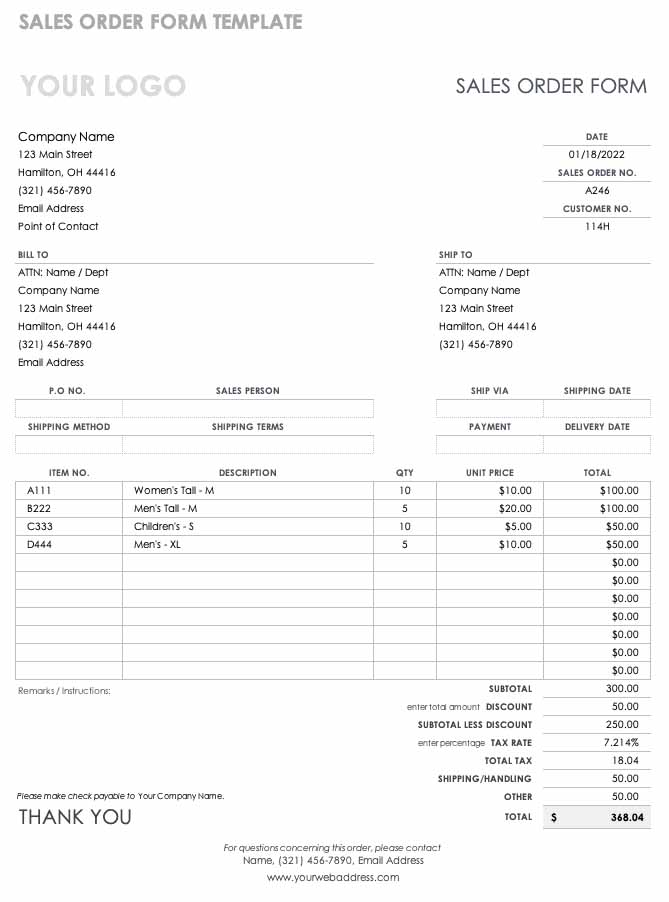

Most commonly used by manufacturers, retailers, wholesalers, or suppliers, a sales order is a document prepared by the seller and issued to a customer that confirms the sale of goods or services involved in a given transaction. It contains details about the sale, including the quantity and price of any goods or services exchanged, delivery date, delivery address, and payment method.

This internal document generated by the vendor allows companies to keep track of the orders they fulfill. Recording sales orders is an important part of the sales process as it documents the reduction of inventory or materials available for future sales.

Sample Sales Order (smartsheet.com)

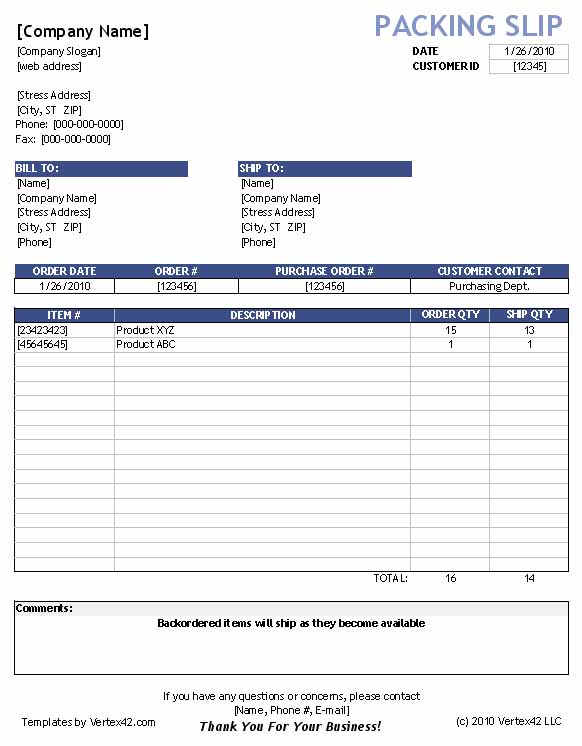

A packing slip is an internal document that includes a complete list of items included in a package. It often includes such information as stock keeping unit (SKU) numbers, weights, dimensions, and the number of units that are used by shipping departments to determine what inventory needs to be sent out to complete an order accurately. If you’re shipping a product to a customer, saving the packing slip enables you to prove that the purchase took place and was fulfilled.

Sample Packing Slip (vertex42.com)

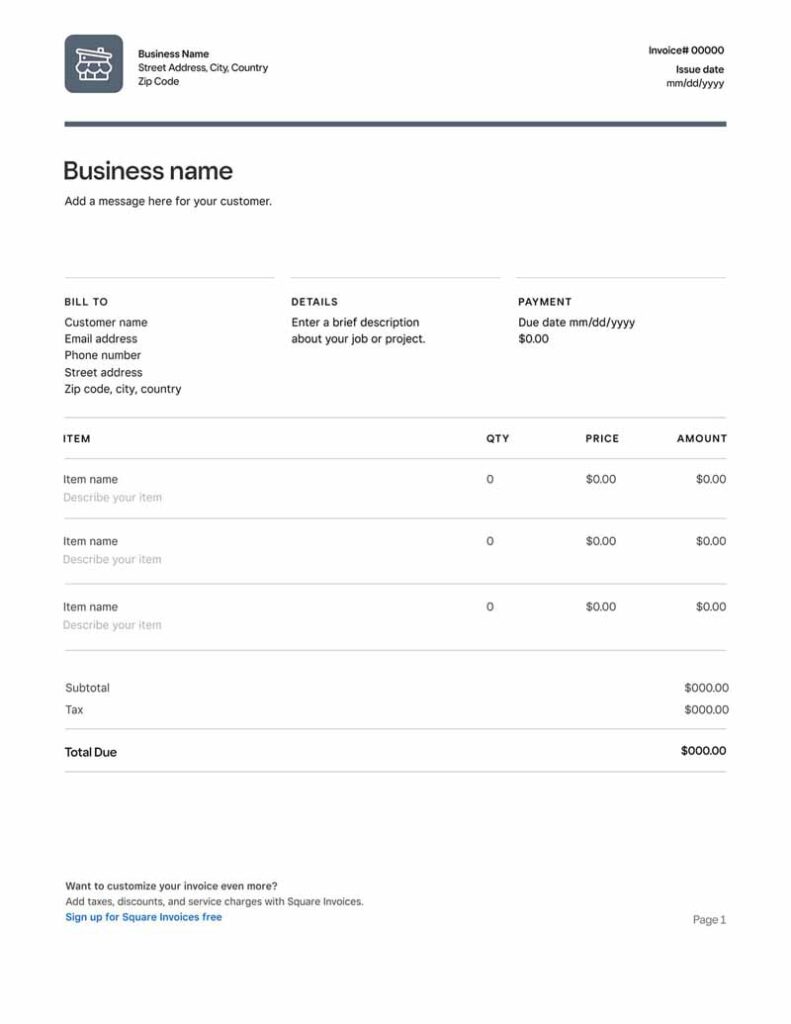

An invoice is a bill that’s drawn for customers after purchasing goods or receiving services by the business. It’s an internal document sent to the customer after the item has shipped and helps to maintain cash flow and streamlines the accounting process. As shown in the sample below, a typical invoice includes the seller and buyer details, date, invoice number, payment due date and payment terms, a description of the service or product, and amount charged.

Sample Invoice (squareup.com)

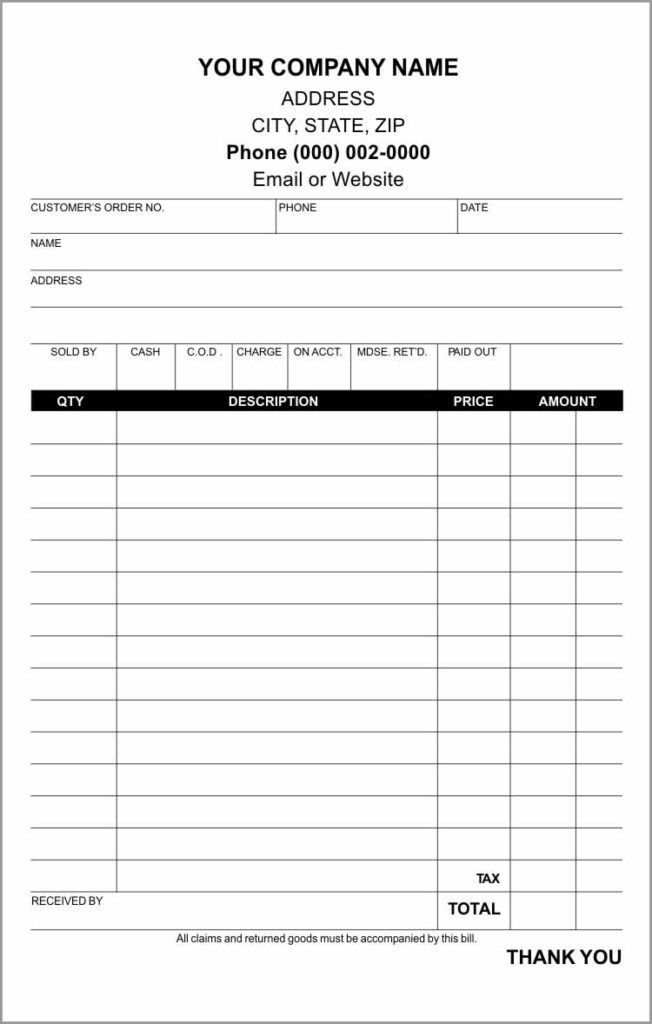

A sales receipt, a document that records a sale, can come in many forms. In its most basic form, it acknowledges that a seller has been paid for goods or services. The receipt is always issued by the seller and given to the buyer. It’s provided only after the goods have been transferred or services have been rendered and the client has paid in full. Sales receipts are internal documents for sellers and external documents for buyers.

Sample Sales Receipt (lighthouseprinting.com)

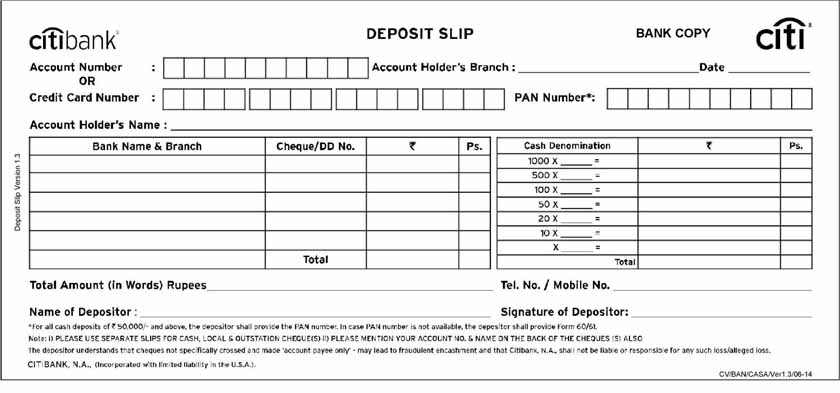

When you make a deposit of cash or checks at the bank, you’ll receive a slip to prove it. This slip, which is always an external document, breaks down the total amount being deposited and shows the amounts of checks and cash. Save these for your records to verify your income.

Sample Bank Deposit Slip (templatelab.com)

Tip:

Good bookkeeping software will generate these source documents for you as you progress through the sales process. See our guide of the best small business accounting software to find one that’s right for your business.

2. Purchases or Expense Workflow Source Documents

The purchase and expense workflow includes source documents, such as purchase orders (POs) and vendor invoices, which are essential for tracking your company’s expenses:

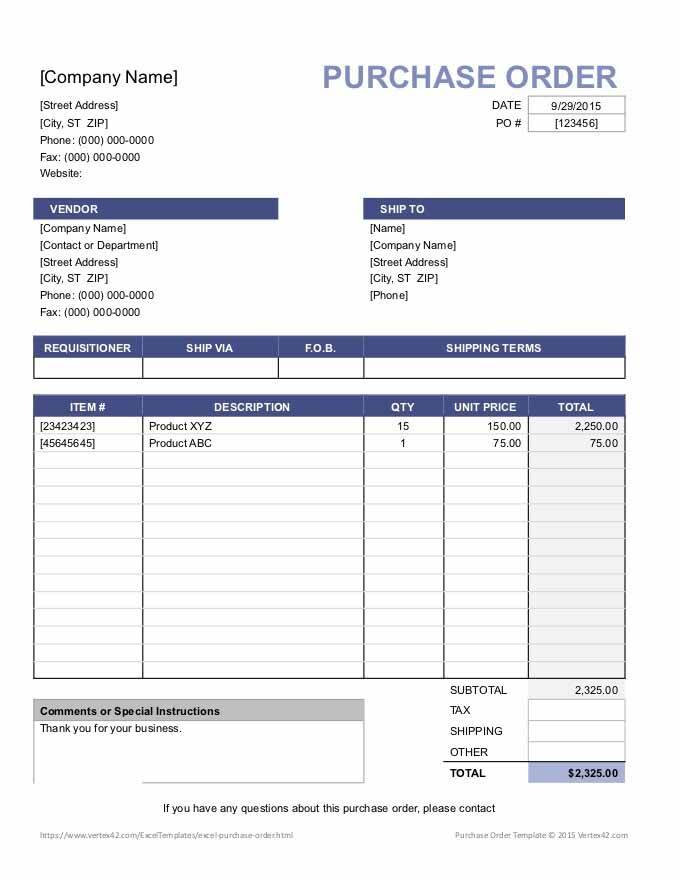

If your business regularly purchases inventory to be sold, then you’ll process POs. These internal documents detail the dates and amounts of your purchase so that you can manage your expenses. Sometimes, the supplier will issue this document to you, or you can create it yourself. After the PO is approved, the vendor will begin the order fulfillment process and return an invoice.

Sample Purchase Order (gonitro.com)

Vendor invoices are requests for payment for products or services. They may represent a bill for ongoing services or can be based on purchase orders for specific items and services. Keeping a copy of each vendor invoice ensures that you have a record of your expenses and can also keep track of upcoming due dates.

An invoice is a vendor invoice if it bears the name of the vendor, not your business’ name. It contains more or less the same information as your business’ invoice documents.

3. General Accounting Workflow Documents

There are a few general accounting source documents that are important to retain for your records. These include your bank and credit card account statements, copies of your cleared checks, a petty cash log, and receipts.

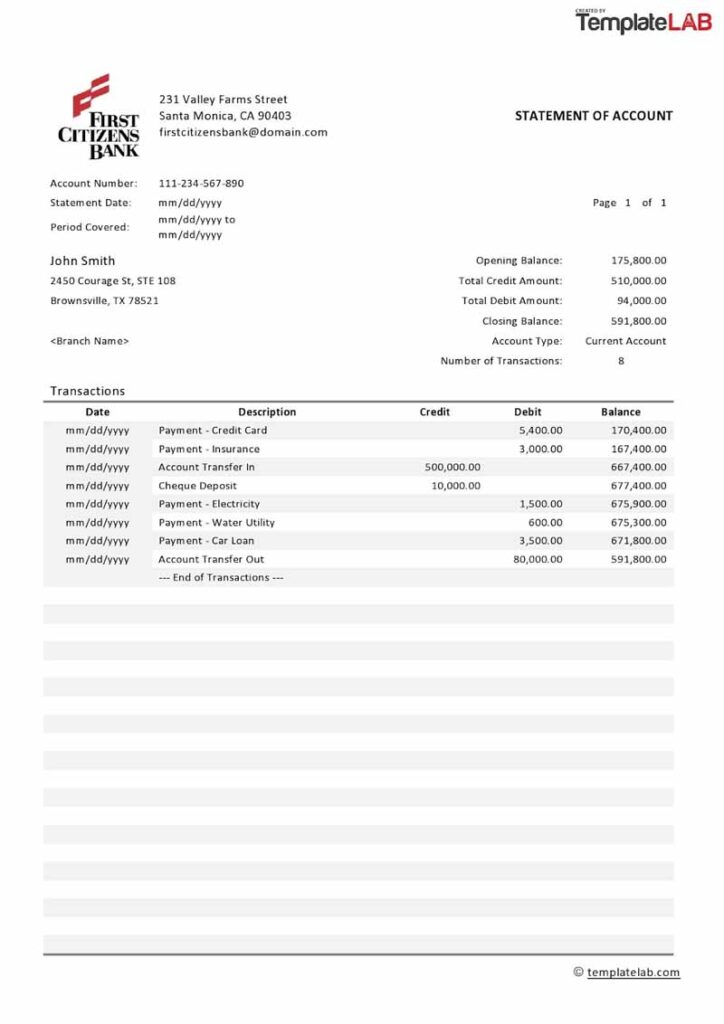

Your bank account statement is an essential document because it helps you compare the bank’s records with your own. By reconciling your account statement each month, you’ll be able to identify and resolve any discrepancies and ensure that your accounting is accurate.

Sample Checking Account Statement (templatelab.com)

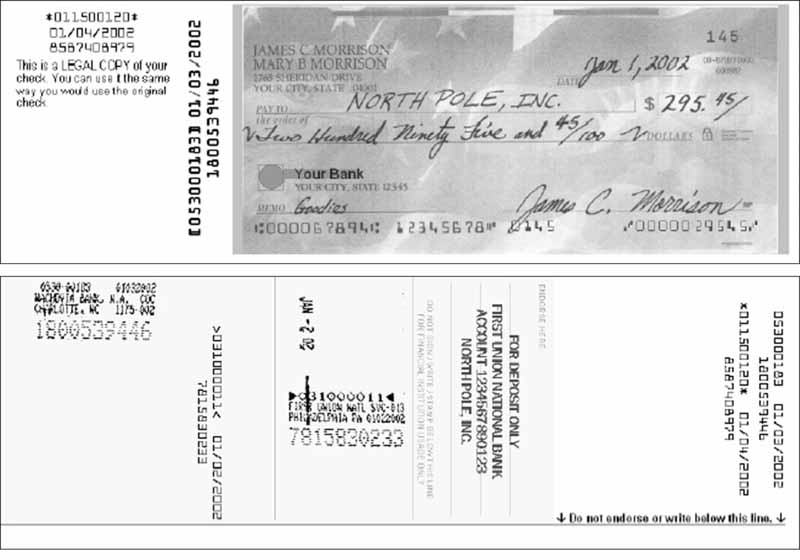

Checks should always include the name of the payee, date, amount paid, and an authorized signature. Retaining copies of your cleared checks ensures that you have proof that a transaction took place, in case there’s ever a question. You can also match these checks with your account statement each month.

Sample of Cleared Check (nbcnews.com)

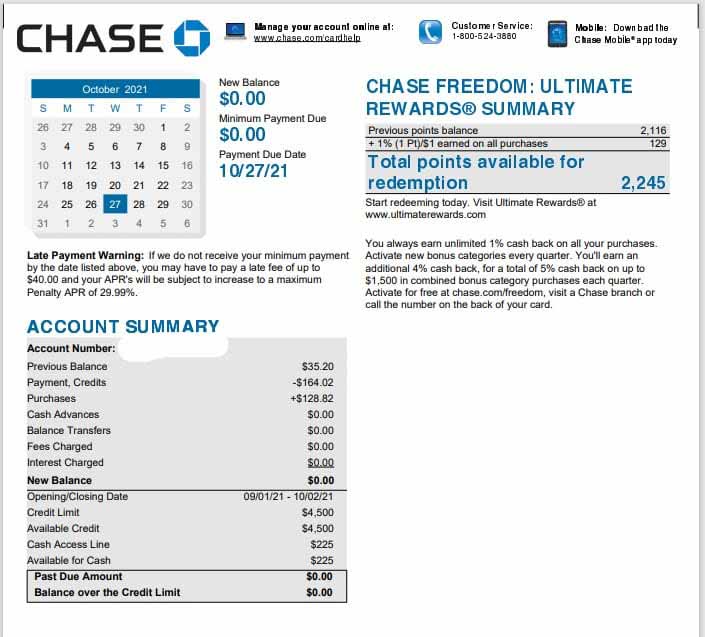

A credit card statement is a summary of how you used your credit card during a billing period. The summary includes your payments, credits, purchases, cash advances, balance transfers, fees, interest charges, and amounts past due.

It’ll also show your new balance, available credit, and the last day of the billing period. It’s important to reconcile your credit card statement to ensure that you haven’t missed any fraudulent charges, and it can serve as evidence that a particular purchase was made.

Sample credit card statement

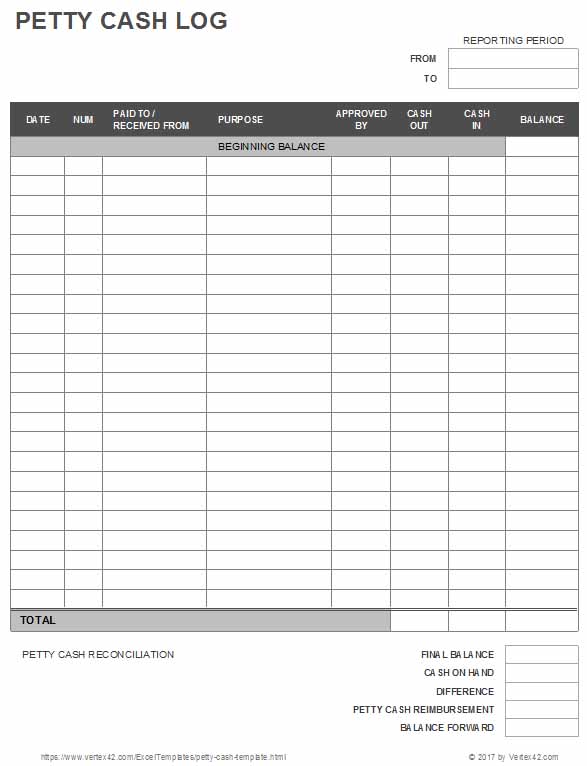

A petty cash log is where you record petty cash expenditures and is part of a manual record-keeping system. There are two primary types of entries in a petty cash log—a debit to record cash and a credit to reflect a cash withdrawal from the petty cash fund. These credits can be for such transactions as payment for office supplies, meals, or stamps.

Sample Petty Cash Log (vertex42.com)

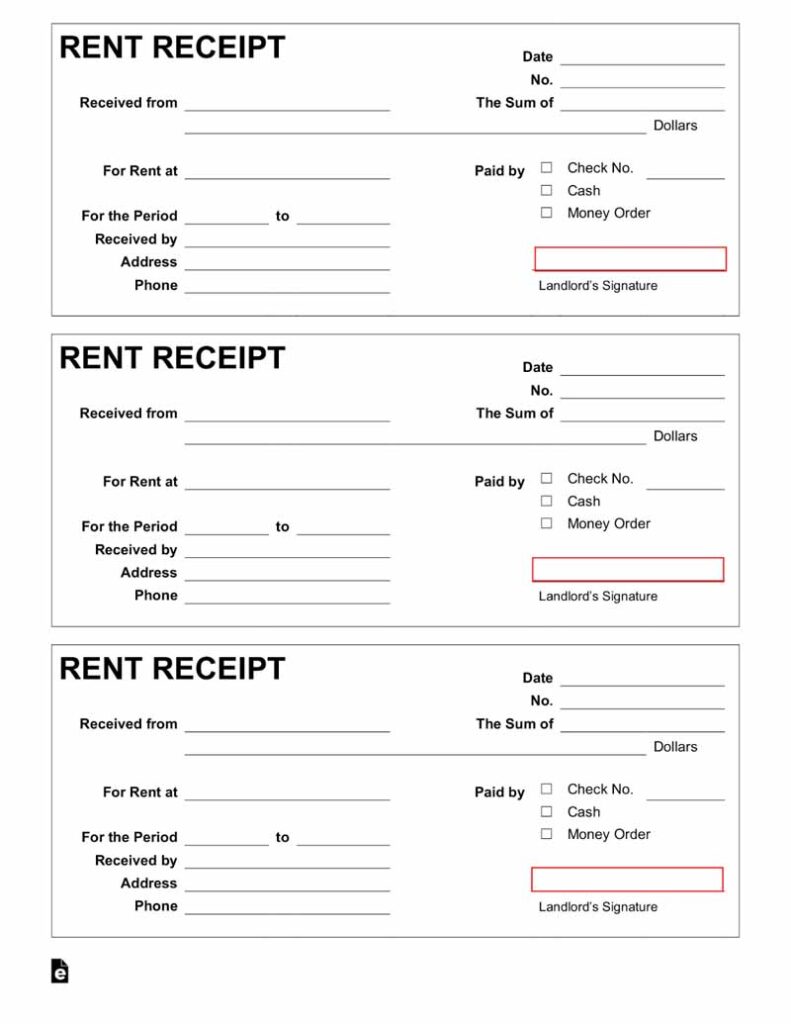

Once the customer pays the bill, the seller issues a receipt that details the order and payment terms. This source document is proof that the seller fulfilled the order and the client paid the balance. Receipts should be matched to checking and credit card statements and the petty cash log.

Sample Rent Receipt (eforms.com)

4. Payroll Workflow Source Documents

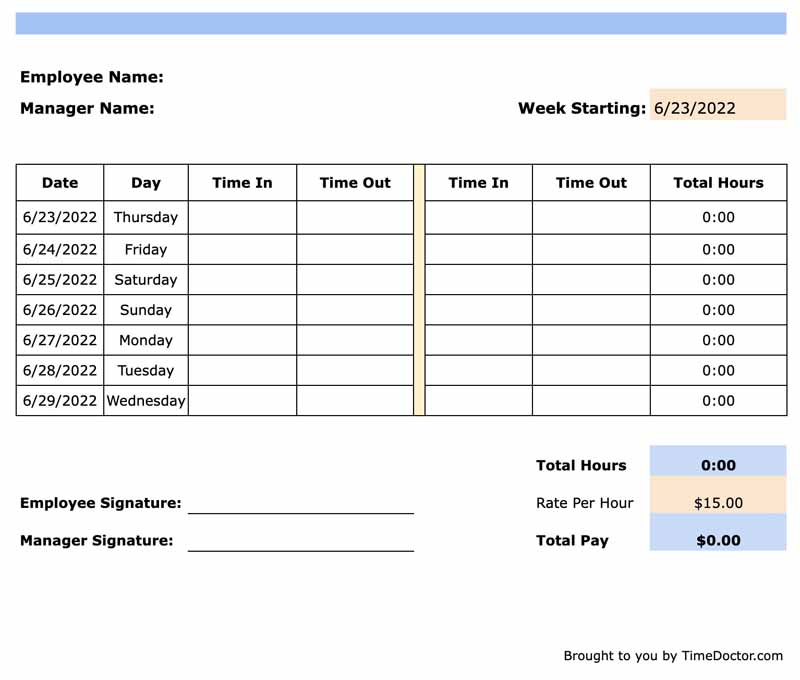

If your business has employees, maintain copies of their timesheets and expense reports as a backup in case there’s ever a question about the accuracy of a transaction. Often, businesses will bill their clients for time or expenses that were incurred by their employees. These documents serve as proof and can be attached to invoices that are sent to the client.

A timesheet is a data table that an employer can use to track the time that a particular employee has worked during a certain period. Businesses use timesheets to record time spent on tasks, clients, or projects. There are different methods to record timesheets, such as paper, spreadsheet software, and online time tracking software.

Sample Employee Timesheet (timedoctor.com)

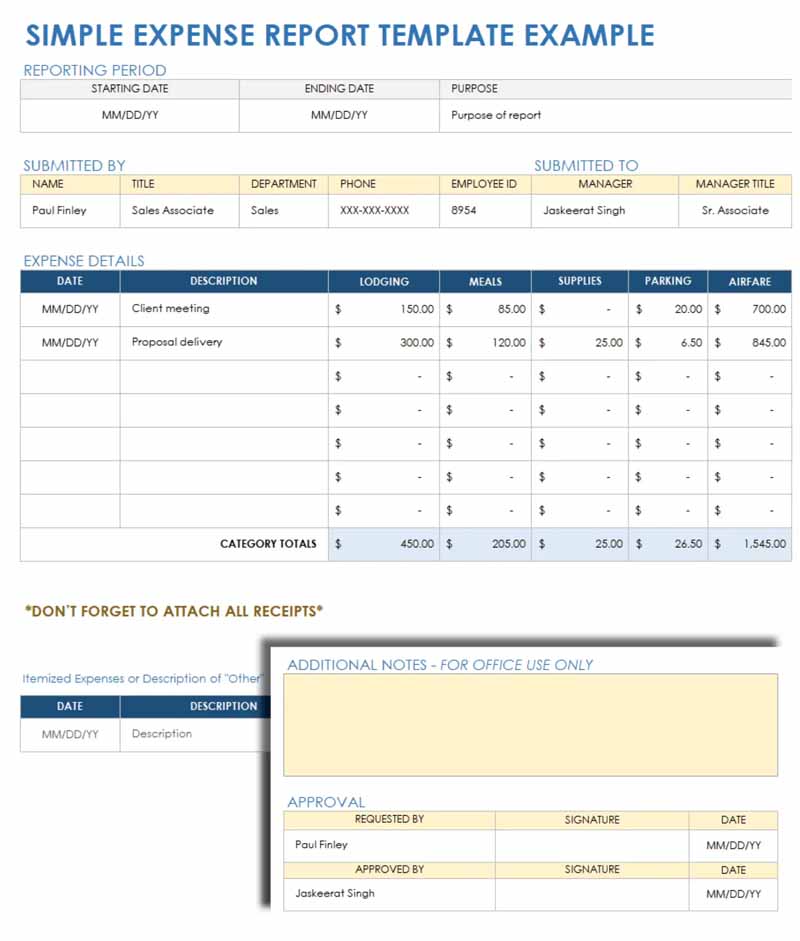

If you reimburse your employees’ expenses, retain any applicable receipts for your records. In addition, to avoid treating the payments to your employees as income, the employee should document the date and purpose of the expense, and the employer must reimburse the exact amount.

Sample Employee Expense Report (smartsheet.com)

Why Source Documents in Accounting Are Important

When properly organized and maintained, source documents will provide you with a paper trail for all of your transactions and serve as records in case of an audit or a need to prove business compliance. Retaining all source documents allows you to ensure that your books are up to date. All source documents should be stored, either physically or electronically, for future reference.

If your business is audited, your source documents serve as valuable evidence for the income and expenses that you’re claiming. As such, it’s important that you save your receipts and deposit slips.

It’s essential that the auditor has access to a clear paper trail of all transactions to confirm the accuracy of bank and credit card balances. This enhances transparency and ensures that the audit will run more smoothly.

In considering all the elements that are essential for business compliance, the successful management of source documents is at the top of the list. You should document your compliance with internal requirements closely with company records. You might need them if you decide to sell your business or if legal action is taken against your business.

Source documents can be helpful to ensure that your accounting data is accurate. They also provide for more efficient bank reconciliation. Ideally, you’ll avoid entering transactions directly from a bank statement and instead enter them from a source document.

Having source documents readily available will make the reconciliation process easier and more accurate. It’ll also help to gather clean data that can be translated into business insights.

How To Use Source Documents

There are a few things to consider when using source documents, which include how they’re stored, the formats that are acceptable, and how long the documents should be retained.

It’s important to record any information that’s generated through source documents in either your company’s journal, accounting software, or financial books. After the document has been recorded, it should be organized in a file so that it can be retrieved at any time. Ideally, you’ll also keep a record of internal control procedures that specifies who in your company can access and authorize payments, orders, and other transactions.

In most cases, photocopies of source documents are acceptable legally, which means source documents can be stored electronically and the originals destroyed. The IRS has accepted photocopies of receipts since 1997—as long as they’re legible and contain all of the information present in the original.

Many businesses and government agencies also use the IRS standard of complete, legible, and accurate reproductions of original documents. However, other institutions may add to these general requirements.

Generally, source documents should be kept as long as they serve a useful purpose or until all legal and regulatory requirements are met. Businesses often base how long they keep files on the length of the statute of limitations for breach of contract or fiduciary duty, and professional liability claims.

You should always keep receipts, bank statements, invoices, payroll records, and any other documentary evidence that supports an item of income, deduction, or credit shown on your tax return for at least six years.

Frequently Asked Questions (FAQs)

No, a journal entry is the official way of recording transactions in the books. All journal entries are based on source documents that serve as evidence of transactions.

Yes, as source documents are evidence of transactions. You’ll need them to substantiate your accounting records. Aside from that, you’ll need source documents to present during an IRS audit.

Bottom Line

A source document is an original document, such as an invoice or a canceled check, which contains essential details that will either support or substantiate a transaction. It doesn’t have to be a paper document, as electronic records are acceptable. Depending on the nature of your business, the types of source documents that you need to retain will vary.