In accounting, liabilities are debts your business owes to other people and businesses. Examples of liabilities include bank loans, IOUs, promissory notes, salaries of employees, and taxes. Liabilities are on the right side of the balance sheet, and these accounts have a normal credit balance. It means that crediting liability accounts increases their balances while debiting them decreases their balances.

KEY TAKEAWAYS:

- Liabilities are unavoidable and essential in business operations if managed properly. They aren’t inherently bad for business as long as utilized properly.

- Liabilities can be current or long-term, depending on the maturity date of these liabilities.

- Some liabilities arise only when a certain condition has been met. These liabilities are called contingent liabilities. As long as the condition hasn’t been met, you’re still not liable for such contingent liability.

How Liabilities Work

Liabilities exist because there are obligations between two parties. In this case, your business has an obligation to do something for or to give something to another person or entity. For example, businesses have the obligation to pay their employees just compensation. Hence, businesses are liable to pay salaries and wages to their employees after the employees have performed their duties.

Moreover, the government requires businesses to pay taxes as mandated by the law. After earning income, taxes owed to the government are liabilities since paying taxes is an obligation. Overall, liabilities will almost always require future payments depending on the agreement between you and the other party involved.

Our article about accounting basics discusses in detail the concepts you need to understand small business accounting.

How To Find Liabilities in the Balance Sheet

Balance sheet presentations differ, but the concept remains the same. Some businesses prefer the account-form balance sheet, wherein assets are presented on the left side while liabilities and equity are presented on the right (see highlighted part).

ABC COMPANY Balance Sheet December 31, 2022 | |||

|---|---|---|---|

ASSETS | LIABILITIES | ||

Cash in bank | $5,000 | Accounts payable | $1,000 |

Accounts receivable | $1,000 | Salaries payable | $5,000 |

Fixed Assets | $7,000 | Taxes payable | $2,000 |

Inventory | $2,000 | Total Liabilities | $8,000 |

EQUITY | |||

Capital | $5,000 | ||

Retained earnings | $2,000 | ||

Total Equity | $7,000 | ||

TOTAL ASSETS | $15,000 | TOTAL LIABILITIES & EQUITY | $15,000 |

Example of Account Form Balance Sheet

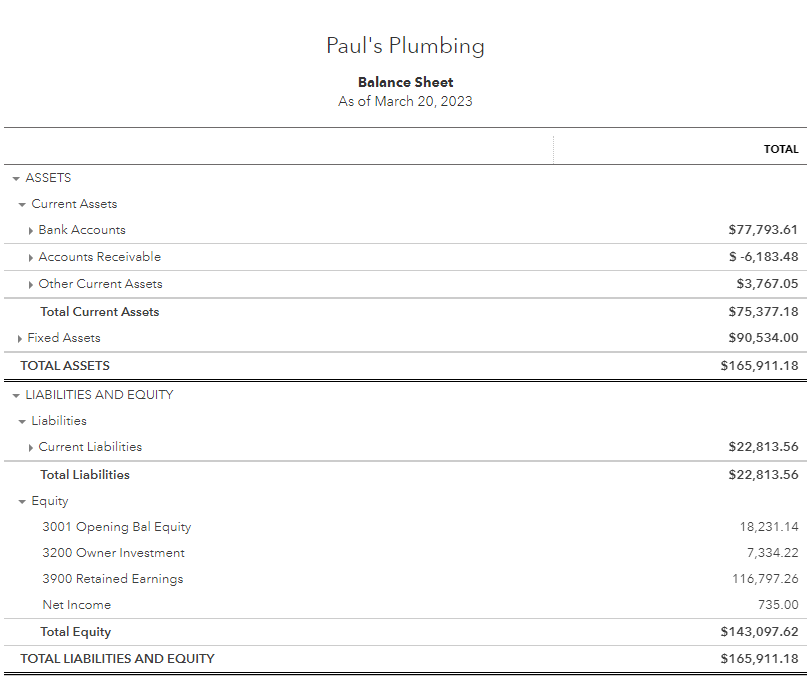

Other balance sheets are presented using the report-form method, which is the most common method of balance sheet presentation. You can find liabilities right after the assets section.

Sample of a Report Form Balance from QuickBooks Online

Why Are Liabilities Important to Small Business?

Liabilities aren’t inherently bad for businesses. Some owners are afraid of liabilities because they always associate them with debt. While all debts are liabilities, not all liabilities are debts:

- Stimulates business expansion and growth: Loans can be used for purchasing equipment and vehicles for business operations or inventory to sell to customers. Obtaining loans and mortgages can help your business purchase real property or high-value assets without burning a lot of cash. Although debt has interest, it’s a necessary tradeoff for accessing additional funds that can help double or triple your business’ future income.

- Supports business operations: Salaries and wages are liabilities arising from employment. Without employees, it’s almost impossible to run a business. Hence, liabilities from salaries and wages are normal in the conduct of business.

- Represents capital funded by creditors: In finance, capital can be sourced through equity and debt. Knowing how much capital is funded through debt can help you understand the capital structure of your business and position your business in a favorable image.

How To Classify Liabilities

A liability can be classified as current or long-term:

- Current: Due in less than 12 months or within the normal operating cycle, whichever is shorter; but for simplicity in a small business setting, we can set the period for current liabilities as due in less than one year

- Long-term: Expected to be settled for a period of more than 12 months; some long-term liabilities also require the application of the time value of money (computation of compounding interest), such as leases, pensions, and notes

Contingent Liabilities

A contingency is an existing condition or situation that’s uncertain as to whether it’ll happen or not. An example is the possibility of paying damages as a result of an unfavorable court case. The condition is whether the entity will receive a favorable court judgment while the uncertainty pertains to the amount of damages to be paid if the entity receives an unfavorable court judgment.

US GAAP requires some businesses to disclose or report contingent liabilities. Small businesses that aren’t required to comply with the US GAAP may opt not to consider contingencies in financial reporting.

Most contingent liabilities are uncommon for small businesses, but here are some that you might encounter.

- Loss contingencies: These are probable and measurable losses that you’ll have to pay in the future because of a past event. An example of a loss contingency would be the estimated cost of product recalls due to defects.

- Litigations, claims, and assessments: These are contingent liabilities arising from pending or threatened litigation or possible claims and assessments.

- Warranty liability: This liability arises from assurance-type warranties, where the seller promises to make good on a deficiency or poor quality of a product. Assurance-type warranties come with the product. For example, refrigerator manufacturers often give 10-year service warranties for factory defects and minor repairs.

- Unearned warranty revenue: This liability arises from service-type warranties where the seller sells a separate warranty contract. An example of this warranty would be AppleCare for Apple Products. By buying AppleCare, you can get an extended warranty after the standard warranty expires. Apple must initially report the amount received as “unearned” and then gradually recognize it as revenue when the service has been performed or the contract expires.

- Premium liability: A premium liability arises from promotional programs to entice customers to buy your products in exchange for a premium. A famous example of a premium would be the annual Starbucks planner. If customers can collect a certain number of stars for every beverage ordered, they can get the planner for free. Since it’s impossible to ascertain the actual number of redemptions, the U.S. GAAP requires Starbucks to use estimates and record a contingent liability.

- Environmental liabilities: This liability arises from noncompliance with environmental safety regulations of the US Environmental Protection Agency (EPA).

Recognizing liabilities in the balance sheet can be tricky and a confusing bookkeeping responsibility. However, if you know the characteristics of a liability, you can categorize a transaction as one.

- It’s a present obligation that will be settled in the future using cash, goods, or services. For example, you have a bank loan that needs to be repaid after two years. Today, you have a present obligation to repay the loan but the actual payment will be in two years’ time.

- It’s an unavoidable obligation. Liabilities often arise from contractual and legal obligations. In a contract, you agree to give or to do something for another person. If you don’t fulfill your obligations, the other person can sue or ask for damages. Take note that paying taxes is a legal obligation, which is unavoidable.

- It’s a result of a past event. Past events give rise to a liability. Examples are transactions to purchase goods or services on credit.

Frequently Asked Questions (FAQs)

No, liabilities and expenses are different account types. However, an expense can create a liability if the expense is not immediately paid. For instance, when you receive a utility bill, you must record the utility expense. You also must record a utility liability for the amount you owe until you actually pay it. But not all liabilities are expenses—liabilities like bank loans and mortgages can finance asset purchases, which are not business expenses.

Interest is often the cost of liabilities. When you borrow funds, you’ll have to pay interest to the creditor. However, other liabilities such as accounts payable often don’t have interest charges since these are due in less than six months. In very specific contract liabilities, failure to pay on the installment date will produce penalties, and such penalties can also be considered a cost of having liabilities.

Bottom Line

A liability is a major component of the accounting equation. In a small business, these usually are simple because they only pertain to basic things, like A/P, loans, salaries, and taxes. However, as your business grows and needs to comply with the US GAAP, there are other types that you must consider for accounting purposes.

Understanding what liabilities are in accounting, as well as the most common examples of each type, can help you track and identify them in your balance sheet.