The best accounts payable software must have strong general accounts payable (A/P) features like vendor tracking, purchase order (PO) tracking, and vendor payments tracking. Good A/P automation should also reduce data entry, streamline the A/P process, and provide options for managers to review and approve bills before payment.

Based on these requirements, here are the seven best accounts payable systems that can help your business process and manage payables easily:

- BILL: Best overall A/P software with outstanding features at a low price

- Melio: Best free standalone A/P platform

- Ramp: Best for issuing cards and managing expenses

- QuickBooks Bill Pay: Best for QuickBooks Online integration

- Wave: Best free accounting software with A/P features

- Centime: Best for comprehensive cash forecasting and analysis

- Quadient Accounts Payable by Beanworks: Best for A/P automation

Best Accounts Payable Systems Compared

Software | Monthly Price | Free Trial | Highlights | Drawbacks |

|---|---|---|---|---|

| Starts at $45 per user | 30 days |

|

|

| Free | ✕ |

|

|

| Free | ✕ |

|

|

| $60 to $200 | 30 days |

|

|

| Free or $16 | ✕ |

|

|

| Starts at $149 per month | ✕ |

|

|

| Contact Sales | ✕ |

|

|

BILL: Best Overall A/P Software

Pros

- Affordable plans

- Includes A/R and invoicing

- Can auto-capture feature receipts from email or document uploads

- Can pay bills using automated clearing house (ACH), credit card, check, or international wire transfer

Cons

- Has additional transaction fees for payment services like ACH processing, check mailing, credit or debit card processing

- Is not a substitute for accounting software

- Is not ideal for businesses with few clients

- Requires the Team or Corporate plan for QuickBooks or Xero integration.

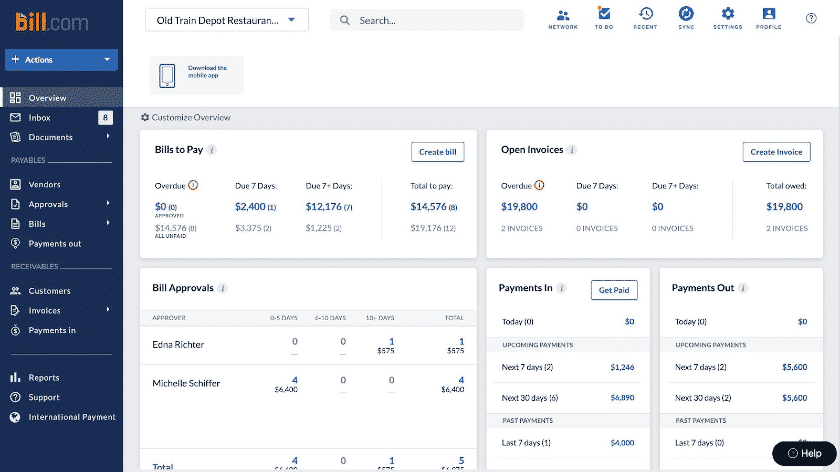

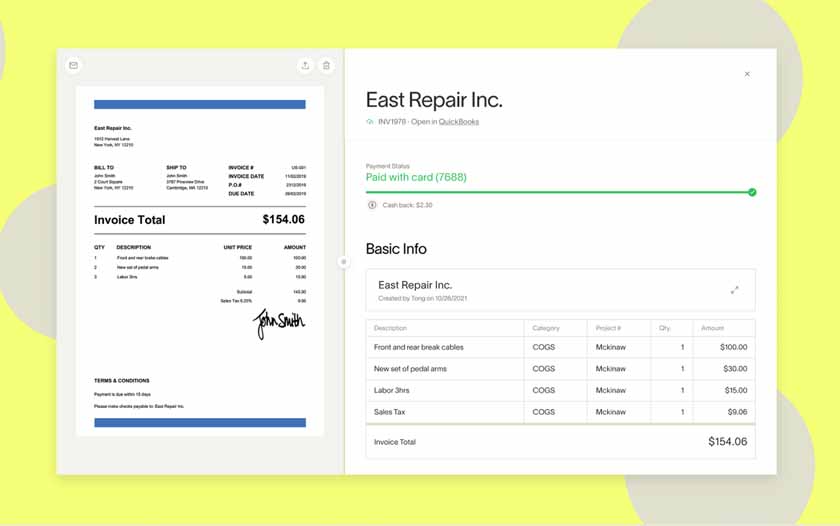

BILL offers solutions to two vital business processes. You can get either invoicing (A/R) or billing (A/P) under separate plans or get both for a single price. You may also sign up for a 30-day free trial.

A/P or A/R

- Essentials: $45 per user, per month

- Team: $55 per user, per month

A/P and A/R

- Corporate: $79 per user, per month

- Enterprise: Custom pricing

BILL is our best overall pick because of its comprehensive features in managing bills. We like the status tracking feature, which helps businesses stay on top of all bills. If your vendor also uses BILL, sending bills and requesting payments will be a breeze. However, the process for sending bills to non-BILL users is easy as well. The solution integrates with QuickBooks and Xero, making it easy for users to implement in their small business accounting software.

Aside from that, BILL scores the highest in special A/P features. Our evaluation reveals that BILL can offer great value to customers through its premium features, like faster and easier payments for vendors and suppliers within BILL. However, its ease of use score is only above average because of limited customer support options (live chat and help center only) and the need for accounting software integration.

Our recommended alternative would be QuickBooks Online because it’s accounting software with integrated A/P features and better customer support, which includes phone support.

Melio: Best Free Standalone A/P Platform

Pros

- Has no subscription fee

- Is available for unlimited number of users

- Has no sign-up or account needed to pay vendors

Cons

- Has no audit trails feature

- Doesn’t have an Android mobile app

- Has no phone support

Melio charges $0 for using the platform, but you have to pay transaction fees.

- Free ACH bank transfers

- $1.50 check mailing fee

- 2.9% fee for credit and debit card transfers

- 1% fee for same-day bank transfers

- $20 fee for expedited check delivery and international US dollars (USD) transfers

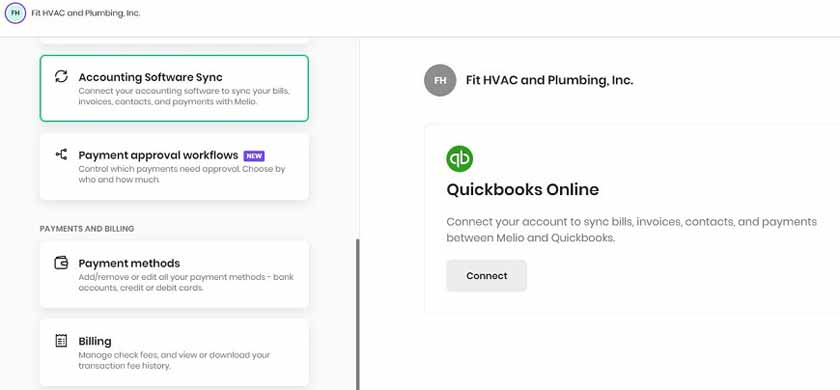

Melio offers the essential features we’re looking for and, therefore, meets our minimum expectations, making it our best standalone A/P platform. It has no platform fees, making it a flexible solution for small businesses. You only pay for successful transactions, which is helpful if your business only performs occasional transactions with vendors and customers.

Our evaluations of general and special A/P features reveal that Melio has all the essential functions, with a sprinkle of advanced features like custom workflows and optical character recognition (OCR). Overall, the provider is above average and doesn’t have a significant weakness worth mentioning.

We recommend BILL for advanced features like its vast network of BILL users that enables you to pay vendors faster as long as they’re using BILL. Moreover, Wave is another free alternative if you want to combine A/P and general accounting.

Ramp: Best for Issuing Cards & Managing Expenses

Pros

- Has no subscription or platform fee

- Issues virtual cards and tracks expenses

- Offers multiple payment methods for bills

Cons

- Limited customer support (support email and help center only)

- Only accepts registered companies

- Doesn’t offer corporate credit cards

Ramp is free to use for expense management, card issuance, and bill payments.

Ramp is primarily an expense management software. But with Ramp Bill Pay, you can also get bill management features to manage vendor payments. We chose Ramp because it covers two major business areas, expenses and payables. Since these two areas overlap, Ramp can help review and approve business expenses and route reimbursable expenses as payables.

Ramp scored high in special A/P features because it processes bills and workflows in batches. It also has no monthly fee, making it a cost-effective pick for large companies. However, Ramp’s major limitation is that it doesn’t accept unregistered businesses and freelancers. We recommend choosing Melio instead since they accept sole proprietors and freelancers.

QuickBooks Bill Pay: Best for QuickBooks Online Integration

Pros

- Schedules and makes payments within QuickBooks through Bill Pay

- Can pay bills with a credit card, even if the vendor doesn’t accept credit cards

- Automatically records Bills paid by check or direct deposits

- Make partial bill payment

Cons

- Limited customer support (support email and help center only)

- Only accepts registered companies

- Doesn’t offer corporate credit cards

QuickBooks Online has four different plans to choose from and a free 30-day trial. However, A/P features are not present in the most basic plan, Simple Start. Below are the QuickBooks Online plans with billing features:

- Essentials: $60 per month for up to three users

- Plus: $90 per month for up to five users

- Advanced: $200 per month for up to 25 users

In addition, Bill Pay for QuickBooks Online integrates with the tiers above, so you can pay, track, and manage bills right inside the platform:

- Basic: $0 per month with five free ACH payments per month

- Premium: $15 per month with 40 free ACH payments per month

- Elite: $90 per month with unlimited ACH payments

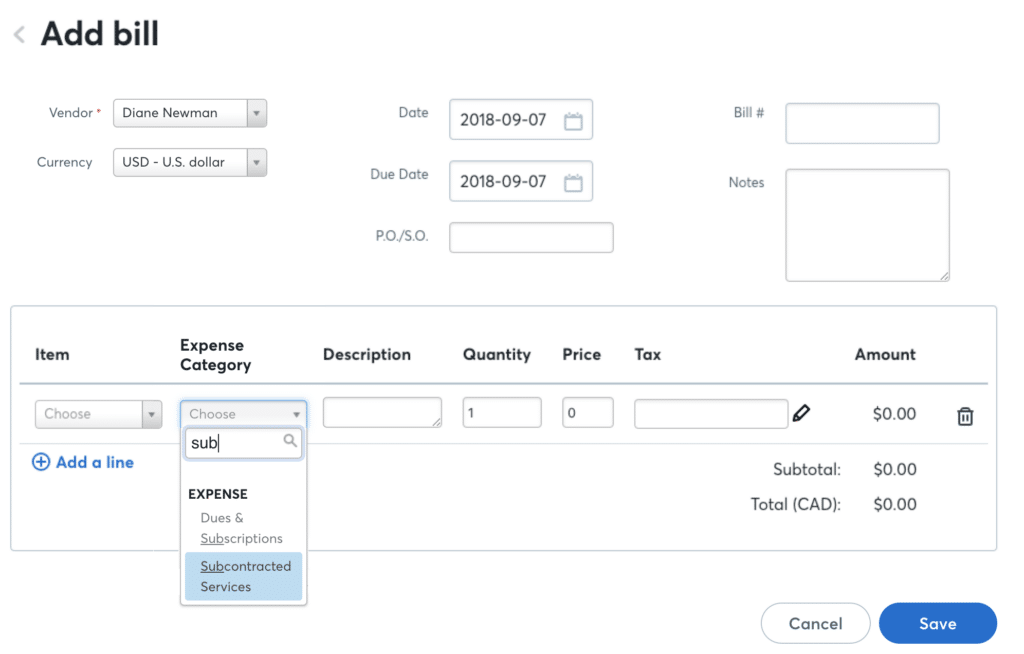

QuickBooks Online is an ideal fit for small businesses looking for a two-in-one solution for accounting and A/P tracking. QuickBooks Online alone can track and account for payables, but you’ll have to send payments outside the app. If you add QuickBooks Bill Pay, you can send payments directly within QuickBooks, making bill payments easier and faster.

In our evaluation, we assumed that QuickBooks Bill Pay is integrated with QuickBooks Online. Pricing took a hit since Bill Pay charges additional monthly fees for higher plans, which may discourage businesses on a budget. However, QuickBooks Online has a perfect score in general A/P features because it is accounting software, and Bill Pay complements QuickBooks Online’s A/P features. It has all the features essential for bill tracking plus the general ledger. Its ease of use score is commendable because it has multiple support channels.

Overall, QuickBooks Online is a good pick for A/P management since it’s accounting software, but we recommend BILL or Melio for dedicated A/P software. However, existing QuickBooks Online users who are dissatisfied with the A/P features can integrate the platform with BILL for better A/P management.

Wave: Best Free Accounting System With A/P Features

Pros

- Is user-friendly for recording bills

- Has an affordable paid plan for unlimited users

- Is easy to set up

- Has optical character recognition in receipt scanning in the paid plan

Cons

- Free plan limited to one user

- Is not a good fit for large businesses, especially those with inventory

- Limits receipt scanning in the paid plan

- Can’t track classes or locations

Wave has a free and paid plan. The free plan has all the essential features but is limited to one user and doesn’t allow you to connect to a bank account—although you can import bank statements manually.

- Starter: Free for 1 user

- Pro: $16 per month for unlimited users

Wave is a good pick for small businesses with few bills to track. Freelancers can use it to record recurring billings from frequent vendors like mobile data plans, software subscriptions, and internet service plans.

Wave scored fairly in general A/P features, knowing that it’s free accounting software, and it’s expected that it will not score well in special A/P features since these features are premium. We only recommend Wave if you’re a freelancer with very few vendors to account for in the books. Melio is a more powerful alternative if you prefer A/P-focused features.

Because of Wave’s simplicity in A/P tracking, we can’t recommend this software to established small businesses. Instead, choose QuickBooks Online for a more complete accounting solution and inventory features.

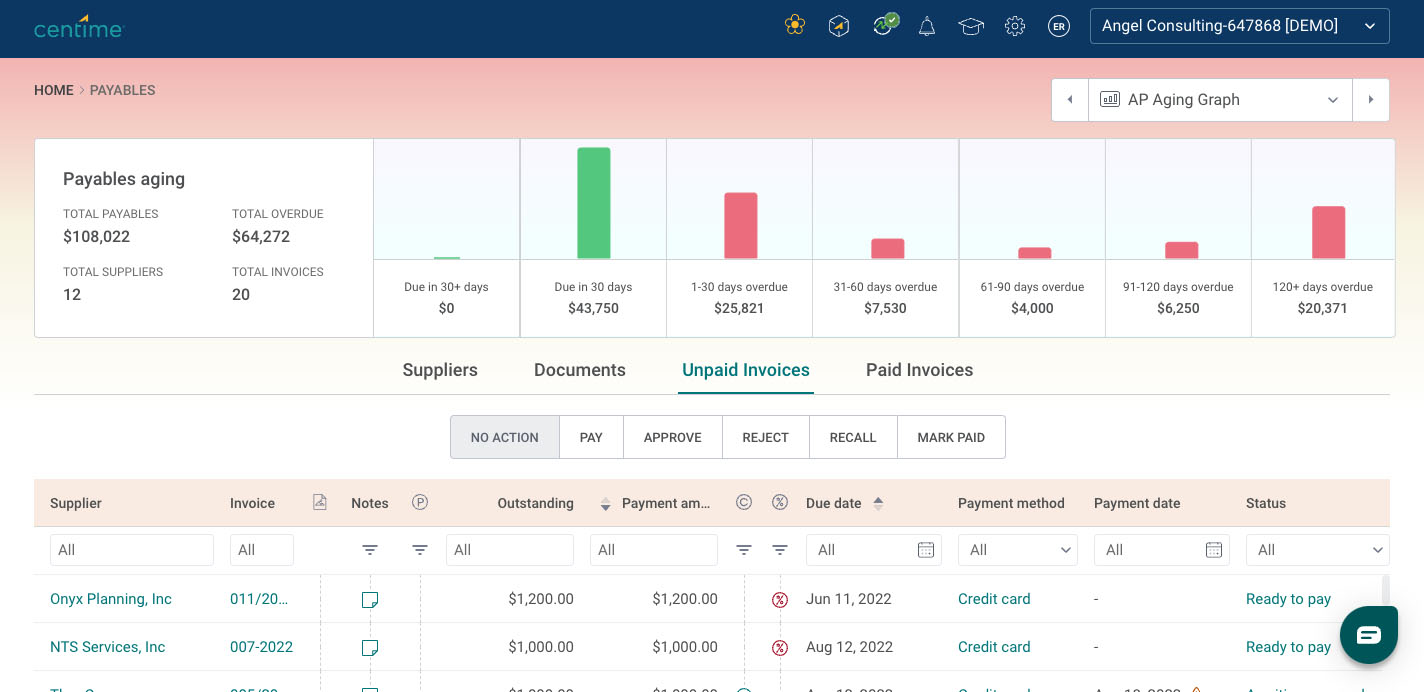

Centime: Best for Comprehensive Cash Forecasting & Analysis

Pros

- Has cash flow impact tracking for payables and receivables

- Forecasts cash flow

- Has KPI and financial metrics dashboard, such as cash runway and burn rate

- Integrates with QuickBooks

Cons

- Has no detailed pricing information

- Doesn’t offer free trial to use with actual company data

Base plans start at $149 per month. Users who need a comprehensive set of features can request a custom quote.

Centime incorporates A/P management in cash management and business banking software. Users can process vendor invoices, route approvals, make payments, and track performance. It has modules for accounts receivables, cash flow forecasting, and KPI metric tracking. Therefore, we recommend it if you want A/P features integrated with cash flow tracking and forecasting.

Although Centime can do more than just manage A/P, it does offer decent A/P features. It scores well in general and special A/P features—but not as excellent as BILL or Ramp due to missing features like purchase order (PO) management. I don’t recommend Centime purely for its A/P features because it’s a bit expensive compared to other options for A/P management. However, we like how it combines A/P and A/R management to maximize and forecast cash flow.

So if you want to get the most from your limited working capital, it is the ideal choice for A/R and A/P. Its KPIs, financial metrics, and cash management features utilize your A/R and A/P activity to generate highly accurate information.

Quadient Accounts Payable by Beanworks: Best for A/P Automation

Pros

- Auto-captures bills from email

- Has bill coding feature including multicurrency bills

- Integrates with QuickBooks, Sage, and Xero

- Includes bill approvals and routing

- Has an audit trail

- Sets and manages spending limits

Cons

- Has no transparent pricing

- Takes two hours before imported invoices from QuickBooks appear, according to some users

- Is not a substitute for accounting software

Quadient Accounts Payable offers varied plans based on the users’ needs, and Beansprout is recommended for starters. Users can also choose plans for Purchase Orders, Invoices, Payments, and Expenses. There is no pricing information on its website, so we recommend contacting sales for pricing information.

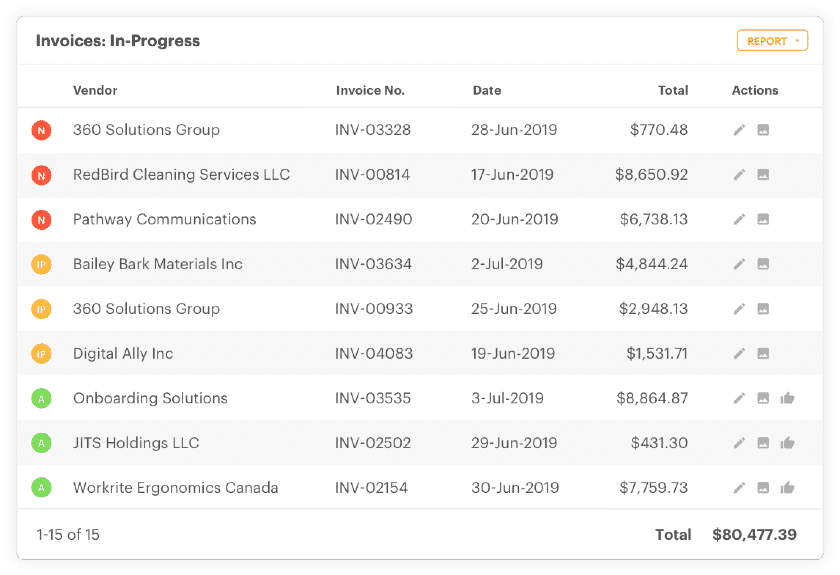

We chose Quadient Accounts Payable for users wanting more control over the A/P process. It can perform a three-way match of purchase orders, invoices, and receiving reports to reduce time for manual matching. It also has controls and workflows to ensure that every transaction complies with company policy.

Quadient AP is a competent pick for A/P management, as shown in its high score in special A/P features. Its best feature is automation since it gives users more options to speed up bill processing. However, Quadient AP took a hit in pricing because the cost information is not readily available on the website, making a price quote another step.

It is best for Xero integration because Xero users can utilize all of Quadient AP’s automation features, such as three-way matching and enhanced controls.

How We Evaluated Best Accounts Payable Software

We employed specific criteria to evaluate the best accounts payable software. We considered pricing, general features, specific features, and ease of use. We assigned an equal percentage for each criterion and different weights for subcriteria.

25% of Overall Score

In assessing the pricing, we considered the transparency, affordability, and flexibility of pricing plans. We also gave more credit to the software providers that can accommodate more users.

25% of Overall Score

When considering basic A/P functionality, we looked at features, such as creating vendors, tracking vendor transactions, viewing outstanding bills, recording vendor credits, and other minor A/P features.

25% of Overall Score

In evaluating special A/P features, we focused more on A/P automation. We heavily considered the ability of the software to reduce data entry time, workflow approvals, and batch processing. We also included the following:

25% of Overall Score

Most accounting solutions include A/P features but don’t necessarily provide the functionality to handle more complex processes, such as batch payments. Depending on the size and needs of your business, the A/P features included in reputable bookkeeping software may be enough to do the job. Otherwise, automation software is helpful for processing a large volume of bills and simplifying complex A/P activities.

When deciding, you have to consider qualitative and quantitative factors in A/P automation. It’s a decision of whether to insource, such as hire A/P professionals, or outsource, such as when getting an A/P automation service. As far as the quantitative aspect, consider the relevant costs of insourcing, such as salaries of A/P professionals, and relevant outsourcing expenses, like the monthly cost of the A/P automation software.

Frequently Asked Questions (FAQs)

Automating A/P starts with shifting from manual to automated A/P processing. You should get A/P software that’s either included in your bookkeeping system or a separate tool that integrates with your accounting platform. The solution must include features that reduce data entry and speed up bill processing.

A/P software manages, automates, and records A/P transactions in an efficient manner. These systems should reduce data entry time, streamline processing and review, and facilitate a channel to make payments to vendors.

An A/P automation tool often uses advanced technology like artificial intelligence (AI) to reduce manual work. A/P automation features include automatic classification of transactions, optical character recognition, and workflow rules.

Bottom Line

Accounts payable software helps you track which bills are due and when they’re due, which is a key component of managing your business successfully. Some A/P solutions take it a step further by automating the process, allowing for more complex features like approval workflows and global payments. The right fit for your business is the software that suits both your current needs and is also scalable for the future.