A trial balance is an internal accounting tool used to verify the accuracy of the bookkeeping system. It’s not a financial statement; it’s a list of all general ledger accounts with their respective debit or credit balances at a specific point in time.

The fundamental principle behind a trial balance is that the total debits must equal the total credits, ensuring that the accounting equation (Assets = Liabilities + Equity) remains balanced. Before preparing financial statements, a business will look at its trial balance to ensure that its accounting system is in balance.

Trial Balance Example

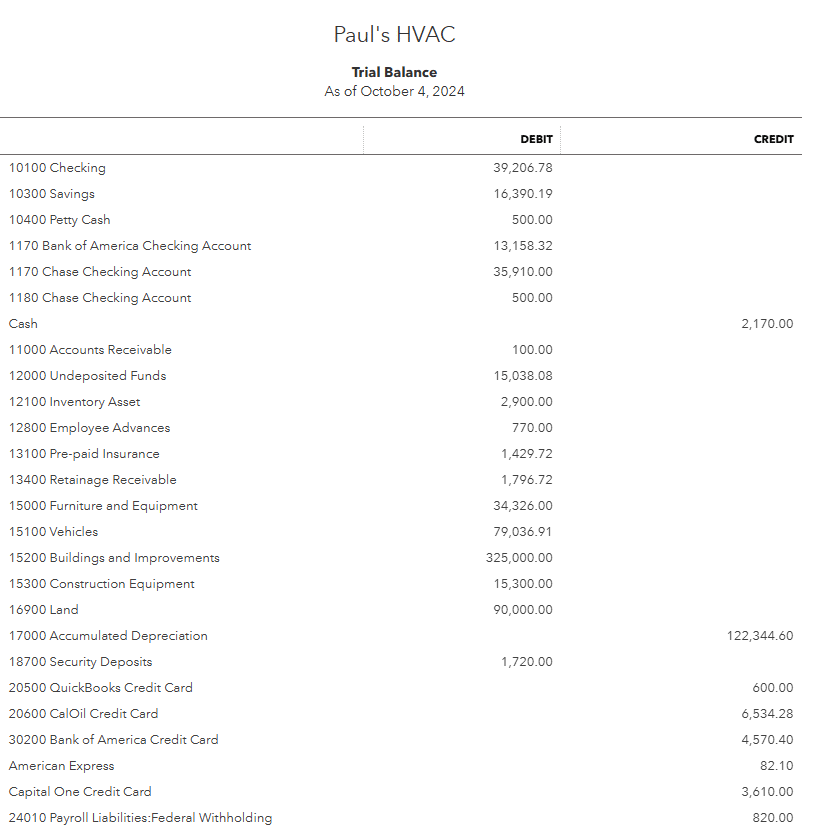

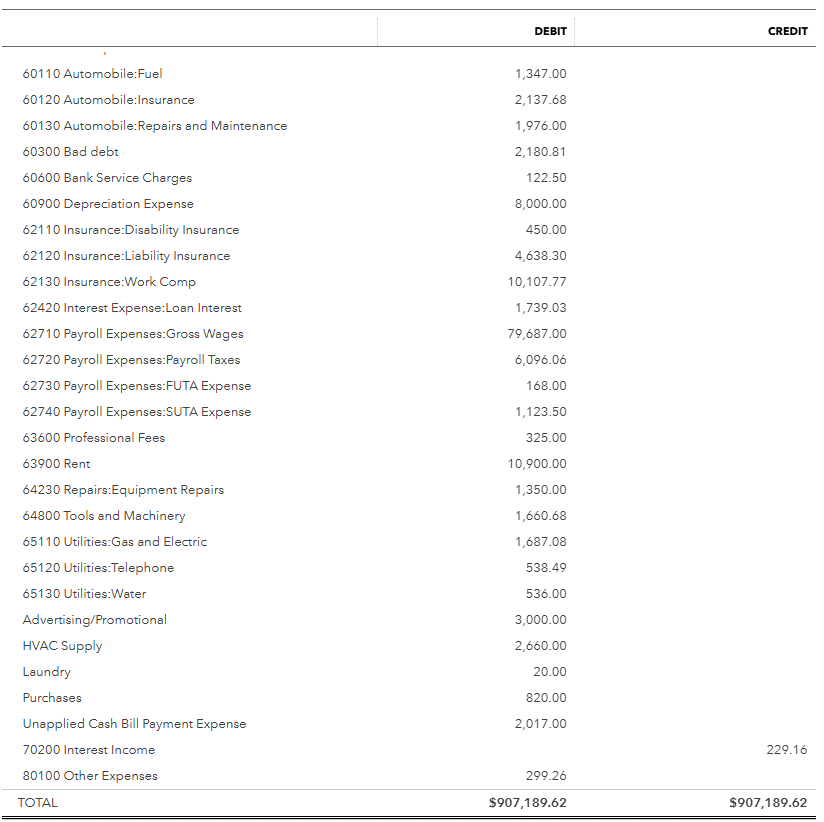

In the trial balance example below, you’ll see that Paul’s HVAC has prepared a trial balance for the year-to-date, which in this case is January through October 4, 2024. This trial balance contains the key components as described above, including the different accounts with their assigned account numbers and debit or credit balances for each. This report was created in QuickBooks Online, but most small business accounting software offers this feature.

Sample trial balance with ending balances

Ideally, the totals for the debit and credit columns will be equal, which indicates that the accounting system is in balance. In the second image, you’ll see that Paul’s HVAC has prepared an accurate trial balance.

Key Components of a Trial Balance

While the format may vary slightly, a trial balance will include the following components:

- Account name and description: This clearly identifies each account included in the trial balance and is separated by assets, liabilities, equity, income, and expenses. Examples are Cash, Accounts Receivable, Inventory, Accounts Payable, Sales Revenue, and Rent Expense.

- Account number: Some businesses may assign an account number, which is a unique numerical identifier. This helps with organization, especially in larger businesses with many accounts. It often follows a chart of accounts system for accuracy.

- Debit column: This is the left-hand side of the trial balance, and it lists the balances of all accounts that normally have a debit balance. These accounts include assets (what the company owns), expenses (costs incurred to generate revenue), and dividends (distributions to shareholders).

- Credit column: This is the right-hand side of the trial balance, and it lists the balances of all accounts that normally have a credit balance. These accounts include liabilities (what the company owes to others), equity (the owner’s stake in the company), and revenues (income generated from business activities).

- Totals: At the bottom of the trial balance, the total of all debit balances is calculated. Similarly, the total of all credit balances is calculated. These two totals must be equal for the trial balance to be considered balanced.

I have encountered additional columns on trial balances, which include the unadjusted balance, or the initial balance before any adjustments. You might also see an adjustments column, which reflects the value of any adjusting entries made.

Purposes and Benefits of a Trial Balance

A trial balance acts as a checkpoint in the accounting process, ensuring the integrity of your data and providing a solid base for financial reporting and analysis. It’s an indispensable tool for maintaining accurate and reliable financial records.

Here are some of the purposes, as well as benefits, of a trial balance:

Detects and Prevents Errors

The core purpose of a trial balance is to ensure that the total debits equal the total credits. If they don’t match, it immediately signals an error in the accounting system, prompting investigation. By catching errors early on in the accounting cycle, you prevent them from carrying over and affecting the accuracy of financial statements. While not foolproof, a trial balance can help detect errors like incorrect entries, missing transactions, or transposition of numbers.

Is a Foundation for Financial Statements

The trial balance provides the necessary data to prepare the major financial statements, including:

- Balance sheet: Assets, liabilities, and equity balances are taken directly from the trial balance.

- Income statement: Revenue and expense balances are used to calculate net income or loss.

- Statement of cash flows: The trial balance helps in analyzing changes in account balances over time, which is crucial for the cash flow statement.

Provides a Simplified Financial Overview

The trial balance offers a concise summary of all account balances at a specific point in time, giving a quick overview of your company’s financial position. By comparing trial balances from different periods, you can track changes in account balances and identify trends, which is useful for management decision-making.

Provides an Audit Trail

The trial balance also serves as an audit trail, allowing auditors to trace transactions back to their original source documents. It ensures that debits equal credits and helps identify discrepancies such as unusual changes in account balances or accounting mistakes. It also confirms that entries match real business activities, targets high-risk areas for focused testing, and aligns adjustments for accurate statements.

Aids in Improved Decision Making

Accurate financial information, backed up by a balanced trial balance, leads to more informed business decisions. In addition, analyzing trial balance data helps you assess your company’s financial performance, identify areas for improvement, and make strategic adjustments.

Limitations of a Trial Balance

While a trial balance is a valuable tool for checking the accuracy of your accounting records, it’s important to be aware of its limitations. To overcome these, I suggest conducting thorough reviews of the trial balance, looking beyond just the balancing of debits and credits. Perform regular bank reconciliations and other account reconciliations, and implement strong internal controls to prevent and detect errors. Use your professional judgment and accounting knowledge to analyze the trial balance and identify potential issues.

Following are some key limitations of a trial balance:

Doesn’t Detect All or Specific Errors

A balanced trial balance doesn’t guarantee error-free records. Some errors can still exist even if the total debits equals the total credits. For example, if you incorrectly record $100 as a debit to Office Supplies instead of Rent Expense, the trial balance will still balance, but your expense accounts will be misstated.

Here are some common errors that a trial balance might miss:

- Omission: A transaction is completely left out of the accounting records

- Commission: A transaction is recorded twice

- Compensating errors: Two or more errors offset each other, masking the individual mistakes

- Incorrect classification: A transaction is recorded in the wrong account, as in the example above

- Original entry errors: The initial recording of a transaction is incorrect, but the error is carried through to the ledger

Doesn’t Reveal Underlying Issues

A trial balance primarily focuses on the mathematical accuracy of the records. It doesn’t reveal qualitative issues like inadequate documentation or internal control weaknesses. It simply shows the account balances—it doesn’t explain the reasons behind those balances or any unusual fluctuations.

Is Limited in Scope

A trial balance provides a snapshot of the accounts at a particular date—it doesn’t show the flow of transactions over time. It is primarily an internal tool for accountants and bookkeepers and isn’t typically shared with external stakeholders.

Types of Trial Balances

There are three main types of trial balances: the unadjusted trial balance, the adjusted trial balance, and the post-closing trial balance. Each serves a specific purpose within the accounting cycle, and by understanding the distinctions among them, you can gain a clearer picture of how they contribute to the overall accounting process.

Unadjusted Trial Balance | Adjusted Trial Balance | Post-closing Trial Balance | |

|---|---|---|---|

Purpose |

|

|

|

Timing |

|

|

|

Source |

|

|

|

How to Prepare a Trial Balance

If you’re not using accounting software to generate your trial balance, you can follow this process to prepare a trial balance:

- Step 1: Gather your information. Your primary source is your company’s general ledger. This is where all the financial transactions are recorded in individual accounts. You’ll also need your chart of accounts, which is a list of all account names and numbers used by your company. Then, determine the specific accounting period for which you are preparing the trial balance (e.g., month-end, quarter-end, or year-end).

- Step 2: List the accounts. Typically, accounts are listed in the following order: assets, liabilities, equity, revenues, and expenses. For each account, include the account number from your chart of accounts and the account name/description.

- Step 3: Determine account balances. For each account in the general ledger, calculate the ending balance. This is the difference between the total debits and total credits for that account. Identify whether the ending balance is a debit or a credit.

- Step 4: Create the trial balance. Set up a table with the following columns: account number, account name, debit, and credit. Record the balances by entering the ending balance for each account in the appropriate debit or credit column.

- Step 5: Calculate the totals. Add all the debit balances and then add all the credit balances. Ensure that the total debit balance equals the total credit balance. If they don’t match, you need to investigate and correct any errors.

Frequently Asked Questions (FAQs)

A balance sheet is a formal financial statement that provides a snapshot of a company’s financial position at a specific point in time. It shows what the company owns (assets), what it owes (liabilities), and the owner’s stake (equity). A trial balance, on the other hand, is primarily an internal tool used to verify the mathematical accuracy of the accounting records by ensuring that the total debits equals total credits.

The three types of trial balances are unadjusted trial balance, adjusted trial balance, and post-closing trial balance. The main difference lies in the timing and the inclusion of adjusting and closing entries. See our table above for more detail about each.

Common errors detected by a trial balance include the transposition of numbers, or accidentally reversing digits when recording an amount; recording a debit or credit in the wrong account; and forgetting to include an account balance in the trial balance. Additional ones include making errors when calculating the account balances or totaling the debit and credit columns, and recording only one side of a transaction.

No, a trial balance isn’t a formal financial statement like the balance sheet or income statement. It’s an internal tool used to verify the accuracy of your accounting records before preparing financial statements.

Bottom Line

The trial balance, while seemingly a simple list of accounts and balances, plays a vital role in the accounting process. It acts as a checkpoint, ensuring the fundamental accounting equation is balanced and paving the way for accurate financial reporting. By diligently preparing and reviewing trial balances, your business can maintain financial integrity, detect errors early on, and make informed decisions based on reliable financial information.