The Financial Crimes Enforcement Network (FinCEN) is a bureau that operates within the US Department of the Treasury (USDT) under the Secretary for Terrorism and Financial Intelligence. FinCEN safeguards and monitors the flow of money within the US and internationally. It collects and analyzes transactions from financial institutions and shares all criminal findings with law enforcement and government agencies to stop criminal activity, money laundering, and terrorist funding.

It protects business accounts in the following ways:

FinCEN’s history and mission

FinCEN was officially formed on April 25, 1990, to support many different levels of authority — such as local, state, federal, and international partners. It was created to provide a multi-source intelligence and analytical network to investigate and prosecute criminals committing financial crimes within the US and crossing international borders.

It combined forces with banking acts — such as The Bank Secrecy Act (BSA) and The USA Patriot ACT — to establish one central crime-fighting network. It focuses on different types of financial crimes, such as

- Corruption and kleptocracy Kleptocracy is a government with corrupt leaders who misuse their power to expropriate the wealth of the people and the land they govern through embezzlement and misappropriation of funds.

- Cybercrime

- International and domestic terrorist financing

- Fraud

- Transnational organized crime

- Drug trafficking

FinCEN’s mission is to safeguard the financial system from illicit use, combat money laundering and its related crimes (including terrorism), and promote national security through the strategic use of financial authorities and the collection, analysis, and dissemination of financial intelligence.

FinCEN reporting requirements

Financial institutions are required to keep up with transactions that meet certain criteria or are suspicious in some way.

Financial institutions reporting to FinCEN

- Bank and financial holding companies

- Casinos and card clubs

- Money Services Businesses (MSBs)

- Brokers or dealers in securities

- Mutual funds

- Insurance companies

- Futures commission merchants and introducing brokers in commodities

- Residential mortgage lenders and originators

Required reports

- Currency Transaction Report (CTR) is filed for cash deposits in excess of $10,000 in a single day.

- Suspicious Activity Report (SAR) is used to report to FinCEN if there is any customer visiting a branch who acts in a suspicious way or has an account that appears to be funding illegal activities. Other reasons for reporting include using a fake ID, appearing to evade regulations, structuring transactions to avoid thresholds, and engaging in high risk business activities.

- Monetary Instrument Report is a record of transactions involving large amounts of cash or other forms of funds such as money orders, cashiers checks, or travelers checks. This log can be used to detect trends common in money laundering schemes.

- Designation of Exempt Persons (DOEP) is used for businesses that are exempt from reporting large cash deposits if it has been determined this is normal business activity for them. A good example would be a large store that serves hundreds of customers daily, such as a grocery or big box store. It is normal for this type of business to collect large amounts of cash, so it may qualify for exemption for filing reports if deposits exceeding $10,000 are made.

Reports filed by account holders

- Foreign Bank and Financial Accounts Report (FBAR) is filed by US citizens to declare any accounts held at financial institutions overseas. It is used by law enforcement and government agencies to detect and identify activities and trends carried out by real people who are using foreign bank accounts to circumvent US laws and regulations.

- Beneficial Ownership Information (BOI) is used to declare the real people who have at least 25% interest in a company located in the US. It is filed at the inception of a business and is only refiled if changes are made, the business is sold, or if the business is closed.

When criminal activity is detected

When financial institutions follow the FinCEN reporting requirements, it is easier to spot criminal activity. If a report is filed by a financial institution and a crime is uncovered, FinCEN acts immediately.

With financial crimes, the passage of time generally results in more victims and higher monetary losses. Depending on the nature of the crime, FinCEN analyzes the facts and informs the appropriate authorities so that action can be taken quickly.

FinCEN’s functions and responsibilities

The main functions of FinCEN include

- Monitoring suspicious activity and transactions meeting certain thresholds

- Collecting and analyzing data.

- Sharing pertinent information with law enforcement, financial intelligence, and regulatory agencies.

- Enforcing banking acts and regulations to prevent and detect money laundering.

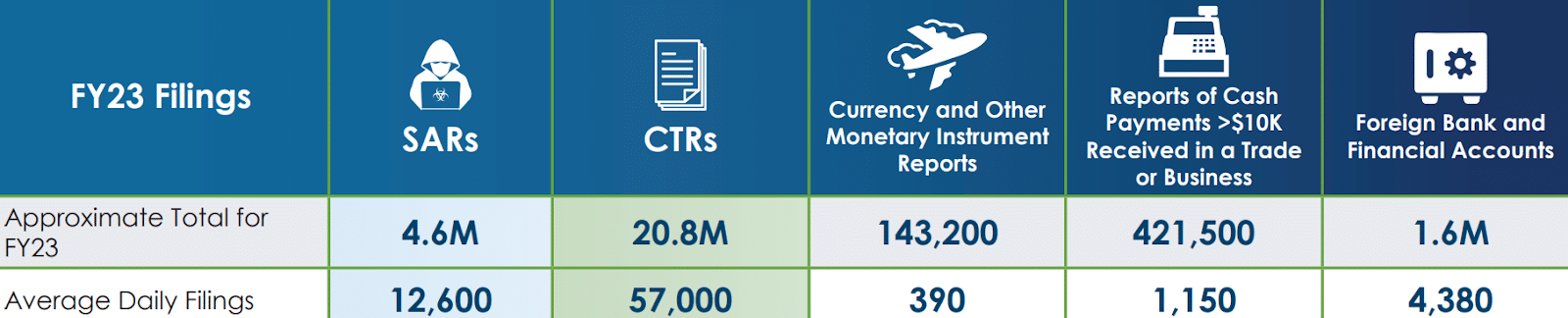

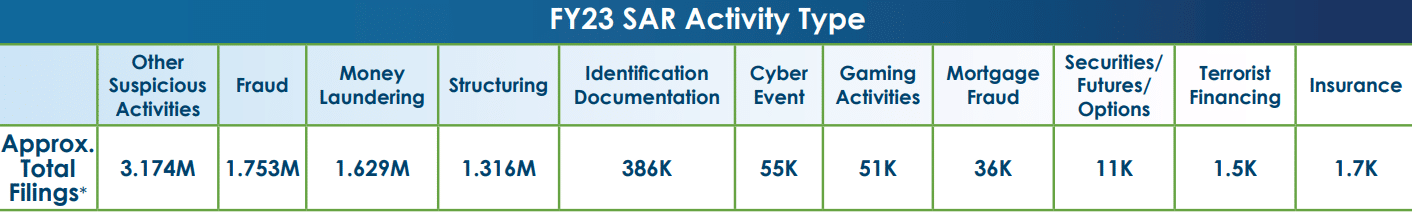

The images below show the high volume of transactions and reports FinCEN is responsible for each day; these are submitted from financial institutions following the FinCEN reporting requirements, as detailed above. As you can see, there is a large quantity of information that FinCEN has to sort and investigate, as it receives a daily average of 75,000 reports.

FinCEN and Artificial Intelligence (AI)

Given the constant flow of funds in and out of countless financial institutions and accounts, FinCEN has implemented AI. It assists with data collection and flags transactions that happen in specific patterns and that show characteristics of criminal trends.

A good example of a pattern is a business that generally never deposits large quantities of cash and suddenly deposits cash daily. Another pattern could be if the deposits were just under the threshold for reporting. Not only are those unusual activities for this customer, but they also show signs that the depositor is trying to avoid reporting.

Frequently asked questions (FAQs)

FinCEN is a division that operates within the USDT. It is part of the terrorism and financial crimes sector that monitors transactions and helps to prevent financial crimes, money laundering, and terrorist funding. It identifies dirty money and stops its movement through the system to prevent it from funding illegal activities.

Any registered company that does business in the US must register with FinCEN by submitting a Beneficial Ownership Information (BOI) filing when the company is created, is registered, or has a change in ownership. This includes corporations, LLCs, partnerships, foreign businesses working within the US, and money services businesses. The registration will show the beneficial owners, including the percentage of ownership, voting rights, and controlling members.

No. FinCEN is a bureau of the USDT that regulates financial crimes and the financing of terrorist activity, whereas the IRS is a government agency that collects taxes on earned income and helps taxpayers determine their tax liability. While both may uncover financial discrepancies, the IRS is mainly concerned with the tax liability related to the situation, while FinCEN is more focused on criminal activity.

Bottom line

FinCEN is a special division of the USDT that offers protection to citizens of the US along with many other countries. It has measures in place to monitor the movement of funds, ensuring dirty money is not filtered into the system and used to commit financial crimes or fund terrorist activity. If suspicious activity is uncovered, financial institutions can provide the necessary documentation to assist law enforcement and government agencies to stop criminals in their tracks.