Form 6252 is used to report income from the disposition of property sold under the installment method. In the course of a sale, when one or more payments are made after the close of the tax year, the installment method applies.

Key Takeaways:

- For each payment period, the seller can defer a portion of the tax on a sale where there is a gain.

- Form 6252 is not completed when there is a loss.

- Related party installment sales are generally not allowed, but when an exception applies, Part III of Form 6252 is completed.

What Sales Are Reported on Form 6252?

Generally, when property is sold, a seller would recognize a gain or loss in the same year. However, under the installment method, the gain is allocated over each of the payment periods set forth in the installment agreement. Learn more about installment sales.

Since gain is allocated to multiple payment periods, the related tax is also dispersed over multiple periods, resulting in a significant perk for the selling party. Buyers also benefit from the liquidity obtained by spreading out cash expenditures over time.

Losses are ineligible for installment sale treatment and are not reported on Form 6252. In addition, the following kinds of property are ineligible for installment sale treatment:

- Property sold by those who routinely sell the kind of item being considered for installment sale treatment

- Inventory

- Stock sold on properly accredited securities exchange

What Is Needed to Complete Form 6252?

- Contract price

- Basis

- Amount of depreciation recapture The IRS requires that depreciation taken over the life of certain depreciable items be taxed at the time of sale at ordinary income rates. This process is called depreciation recapture. ; note that depreciation recapture is ineligible for installment sale treatment

- Principal received during the year on the installment contract

Example of Completed Form 6252

Pay It In Parts, LLC sold property to Paul Pennysaver for $250,000 in 2023. Paul paid for the property in six installments plus 10% interest, starting in September 2023.

- Pay It In Parts, LLC basis: $100,000

- Gross profit: $150,000 ($250,000 − $100,000)

- Gross profit ratio: 60% ($150,000 ÷ $250,000)

Pay It In Parts, LLC recognized income in the amount of 60% of each principal portion of each payment received.

Before Form 6252 can be completed, Pay It In Parts, LLC must create an amortization schedule to separate each payment into interest income (reported on Schedule B) and principal received (reported on Form 6252).

Month | Payment | Interest | Principal | Outstanding Loan Balance | Gain/Gross Profit | Return of Capital |

|---|---|---|---|---|---|---|

Sept 2023 | $42,890 | $2,080 | $40,810 | $209,190 | $24,486 | $16,324 |

Oct 2023 | $42,890 | $1,740 | $41,150 | $168,040 | $24,690 | $16,460 |

Nov 2023 | $42,890 | $1,400 | $41,490 | $126,550 | $24,894 | $16,596 |

Dec 2023 | $42,890 | $1,050 | $41,840 | $84,710 | $25,104 | $16,736 |

Total 2023 | $174,668 | $6,270 | $165,290 | $84,710 | $99,174 | $66,116 |

Jan 2024 | $42,890 | $710 | $42,180 | $42,530 | $25,308 | $16,872 |

Feb 2024 | $42,880 | $350 | $42,530 | -0- | $25,518 | $17,012 |

Total 2024 | $87,334 | $1,060 | $84,710 | -0- | $50,826 | $33,884 |

In 2023, Pay It In Parts, LLC recognized $6,270 in interest income and $99,174 in gain. $66,116 of the cash received was not subject to tax, as it is considered an ROI.

On the 2024 tax return, Pay It In Parts, LLC will recognize $1,060 in interest income and $50,826 in gain. $33,884 of the $87,334 cash received will be treated as a nontaxable ROI.

The following 2023 information reported on Form 6252 was based on the following fact summary:

- Interest Income: $6,270

- Gain: $99,174

- Cash: $174,668

- Amount of $100,000 basis returned in 2023: $66,116

- Depreciation taken prior to sale: $20,000

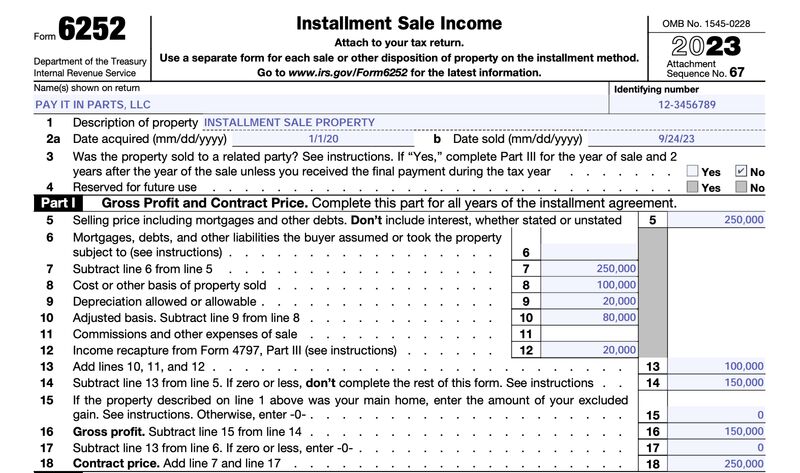

Form 6252, Part I for 2023

Lines 1-3 of Form 6252 should be completed with identifying information about the taxpayer and basic information about the sale.

Form 6252, Part I, completed with sample data

Part I, lines 5-18, should be completed with additional details related specifically to the installment sale:

- Line 5: The selling price for the property sold by Pay It In Parts, LLC was entered on this line.

- Line 6: This line was left blank since the property sold was not subject to any outstanding debt.

- Line7: Line 5 was carried down to line 7 since there were no liabilities to report on line 6.

- Line8: The original price of the property was shown here, before depreciation.

- Line 9: The depreciation through date of sale was entered on this line.

- Line 10: This line was used to show the adjusted basis for the property (purchase price less depreciation).

- Line 11: Pay It In Parts, LLC had no commissions or expenses of sale to report.

- Line 12: Since depreciation recapture is ineligible for installment sale, it is treated as taxable income on Form 4797 and thus reduced taxable gain on Form 6252.

- Line 13: Lines 10 through 12 are combined on this line. This is the adjusted basis of the property sold, plus an adjustment for depreciation recapture income reported on Form 4797.

- Line 14: Line 13 is subtracted from line 5. This is the total gain on the installment sale. This is the gain that will be recognized over multiple years as the contract price is collected.

- Line 15: This line was left blank since the property sold was not a principal residence.

- Line 16: Gross profit is calculated on line 16.

- Line 17: Line 13 is subtracted from line 6.

- Line 18: The contract price is figured by adding lines 7 and 17.

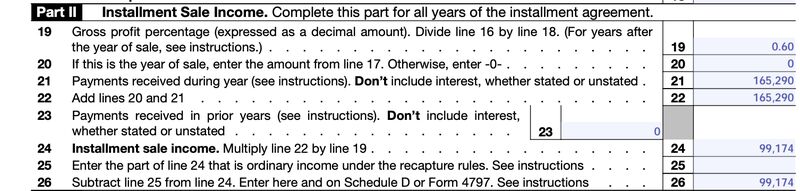

Form 6252, Part II for 2023

Part II is where the gain recognized for the year is reported.

Form 6252, Part II – Year 1 (2023), filled out with sample data

Lines 19-26 are input as follows:

- Line 19: The 60% gross profit percentage is calculated by dividing line 16 by line 18.

- Line 20: Even though this is the year of sale, the computations still result in zero input on this line since the property sold was not subject to liabilities.

- Line 21: The $165,290 sum of monthly payments was entered here.

- Line 22: Lines 20 and 21 were summed on this line.

- Line 23: This line was left blank since there were no prior year payments.

- Line 24: Based on the gross profit percentage calculated above, the amount of gain recognized for 2023 was $99,174.

- Lines 25 and 26: These finalize the computations for reporting the gain which would then be transferred to Form 4797 for property used in a trade or business or Schedule D.

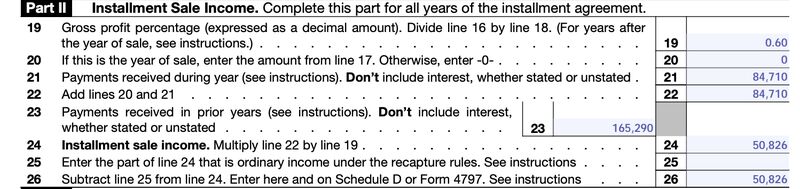

Form 6252, Part II for 2024

While Part I is only completed in the year of sale, Part II will need to be completed for each year subsequent to the sale until the entire contract price is collected. During the years that follow the year of sale, Part I can be left blank. For 2024, Pay It In Parts, LLC will need to complete Part II to report the $84,710 in principal collected in 2024:

The following 2024 information was reported on Form 6252:

- Interest Income: $1,060

- Gain: $50,826

- Cash: $87,334

- Amount of $100,000 basis returned in 2023: $33,884

- Depreciation taken prior to sale: $20,000

Form 6252, Part II – Year 2 (2024), completed with sample data

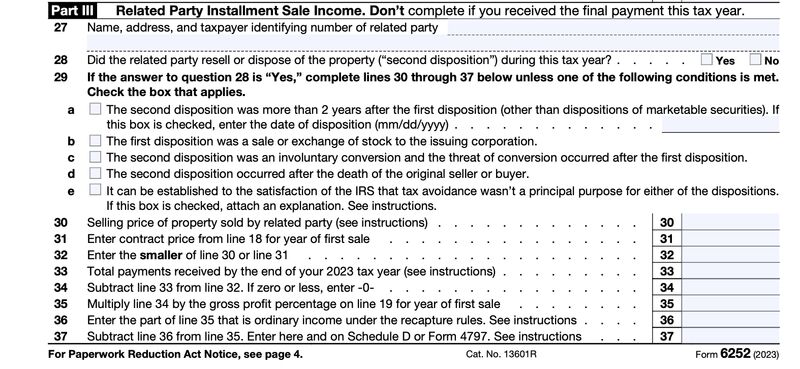

Form 6252, Part III

Part III is the final section of Form 6252. For Pay It In Parts, LLC, this section is not applicable, since Paul Pennysaver is not related in any way to the seller.

However, Part III should be completed in other scenarios if there is an installment sale between two parties for which there is a permissible exception. The IRS notes that related parties include your spouse, child, grandchild, parent, brother, or sister and a related corporation, S Corporation, partnership, estate, or trust.

General Rule on Installment Sales with Related Parties

The IRS looks skeptically upon installment sales to related parties since there is a high likelihood of abuse of the tax deferral benefit. As a general rule, when there is a sale to a related party, all payments are treated as though they were received in the year of sale, which eliminates the tax deferral benefit.

However, the IRS has noted that related party sales may be permitted if the seller can prove the purpose is not tax avoidance. The seller must also affirm in Part III of Form 6252 that the related party buyer did not turn around and resell the property in the current tax year.

Form 6252, Part III – Related Party Installment Sale Income

Who Should File Form 6252?

Form 6252 should be filed by taxpayers who make a sale subject to the installment sale method in both the year of the sale and all subsequent years until the entire sales price is collected.

Unless the transaction is specifically excepted from installment sale treatment, any sale where one or more payments are received after the close of the tax year constitutes an installment sale and is eligible for installment sale treatment.

In addition to form 6252, there may also be another form that you need to file to report the sale. If the property sold was a trade or business property, you will need to complete Form 4797. If the property sold was non-trade or business property, you’ll need to complete Schedule D for the sale.

How to Submit Form 6252?

Form 6252 is submitted along with the tax return for the taxpayer making the installment sale. For instance, if the seller is an individual, Form 6252 will be submitted as part of their Form 1040 individual tax return for the year of sale and each subsequent year until the sales price is collected.

Frequently Asked Questions (FAQs)

With an installment sale, sellers don’t have to recognize income all at once. Instead, they can split the income and the related tax across more than one tax period.

Interest income received from installment sales should be reported as ordinary income on the seller’s tax return in the same way that any other interest would be reported. Interest income is excluded from Form 6252.

No. The installment method is automatic when a taxpayer qualifies and must be calculated and reported on Form 6252.

Bottom Line

Form 6252 is used to report sales executed under an installment agreement. There are specific kinds of transactions that are ineligible for installment sale treatment. However, for transactions that the IRS has not specifically excepted from installment sale treatment, sellers can benefit from tax deferral and buyers can better control cash flow.