A personal holding company (PHC) is closely held A closely-held corporation has very few members. Often, these members have a familial relationship, although this is not required to meet the definition. C corporation (C-corp), where at least 60% of its income is from passive investments like stocks, bonds, and rental activities. A company may be classified as a PHC when cash generated from the sale of business assets is not distributed to shareholders in an attempt to avoid the shareholder dividend tax.

In my experience, with retained cash, the C-corp invests the money, which results in passive investment income that must be paid to the shareholder as dividends to avoid the 20% PHC tax. There are two tests used to determine whether or not your business qualifies as a PHC; and if it does, a few things can be done to minimize the tax impact.

Personal holding company tests

To be classified as a PHC for tax purposes, a corporation must meet certain criteria laid out by the IRS. Both tests must be met for the PHC classification to apply.

1. Ownership test is met if, during the last half of the tax year, five or fewer people own more than 50% of the value of the corporation’s stock. For the purposes of the test, what the IRS considers to be an “individual” takes many shapes and forms.

Let’s look at which types of entities qualify as an individual:

- An employer-provided qualified pension, profit-sharing, or stock bonus plan

- Supplemental Unemployment Benefit Trust

- A private foundation that is funded by a single source

- A part of a trust permanently set aside or exclusively used in a charitable trust

2. Passive income test can be met if at least 60% of the PHC’s income is derived from investment income.

Application of the personal holding company tests

The majority of PHCs are invested in relatively simple investments, and their PHC income consists of dividends and interest. However, other more complicated investments generate PHC income, like rental property.

Patrick owns 100% of a corporation named Patrick Products, Inc., which used to manufacture and sell widgets. It sold all of its operating assets in the prior year and invested the proceeds in stocks and bonds rather than making a taxable dividend distribution to Patrick.

After the sale, its only source of revenue is the interest and dividend income it receives from its investments. The corporation does not engage in any active business operations, so its income is derived exclusively from passive income.

Since the PHC has fewer than five shareholders (in this case, one) and over 60% of the corporation’s income is derived from passive income, Patrick Products, Inc. is a PHC since it meets both the ownership and the passive income tests.

Personal holding company tax

In addition to the 21% corporate income tax, a PHC’s undistributed personal holding company income (UPHCI) is subject to a tax of 20% for each tax year. Passive income sources — such as dividends, interest, rent, royalties, and annuities — are used to calculate the UPHCI.

The PHC tax is designed to discourage individuals with high marginal tax rates from shielding their income from taxation and encourage the PHC to distribute its earnings to shareholders.

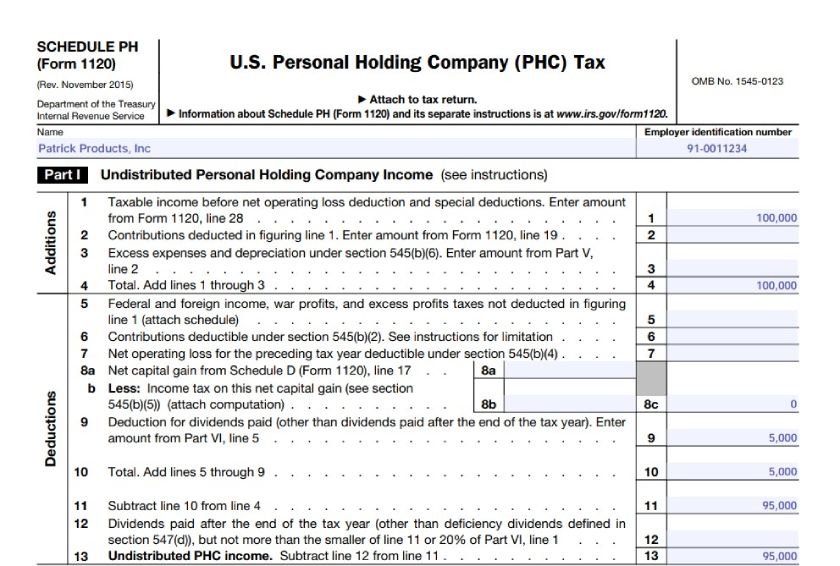

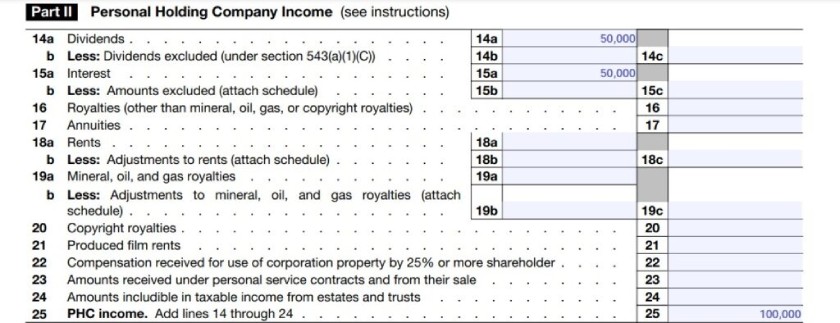

Considering the same facts as in my sample above, in 2025, Patrick Products, Inc. earned $50,000 in dividends and $50,000 in interest income. Of the total earnings of $100,000, the PHC made a single distribution of $5,000 during the year and held the remaining $95,000. Since the company did not distribute all of its PHC Income, it will be subject to the PHC tax.

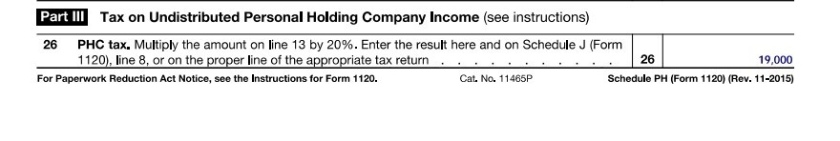

Given this set of facts, the PHC tax is calculated as follows:

$95,000 (undistributed earnings) × 20% (tax) = $19,000

This PHC tax is in addition to any corporate income tax Patrick Products, Inc. must pay. It can be avoided by distributing an additional $95,000 to Patrick.

Patrick will compute this tax on Schedule PH, which I discuss below.

Personal holding company filing requirements

A PHC must file IRS’s Schedule PH, US Personal Holding Company (PHC) Tax, and attach it to IRS Form 1120, US Corporation Income Tax Return.

Additionally, if the PHC thinks it will owe $500 or more in taxes when it files its return, then it must pay estimated taxes in quarterly installments using IRS Form 1120-W, Estimated Tax for Corporations.

The estimated tax payments should be made on

- the 15th day of the fourth, sixth, ninth, and twelfth months of the corporation’s tax year; or

- April 15, June 15, September 15, and December 15 for calendar year corporations ending on December 31

Let’s look at Patrick Products, Inc.’s Schedule PH, where the calculation of Patrick’s PHC tax would be reported.

In Part I, Patrick Products, Inc. figured the total amount of its undistributed income, which was $95,000 ($100,000 − $5,000).

Sample Schedule PH Part I

In Part II, Patrick Products, Inc. figured the total amount of PHC Income, which is $100,000.

Sample Schedule PH Part II

Patrick Products, Inc. calculated its PHC tax using Part III. For 2025, the PHC tax is $19,000 ($95,000 × 20%).

Sample Schedule PH Part III

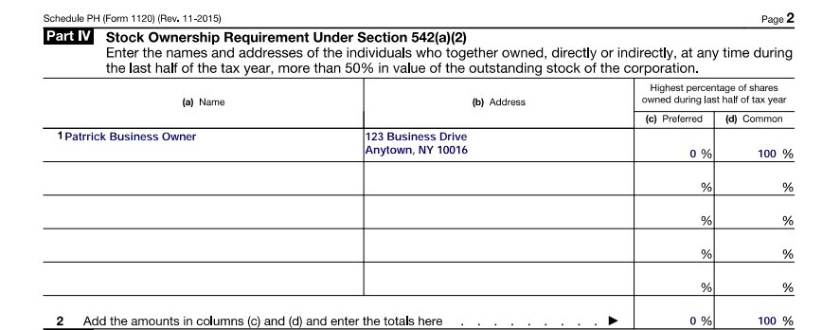

In Part IV, Patrick listed himself as the 100% owner of Patrick Products, Inc.’s common stock.

Sample Schedule PH Part IV

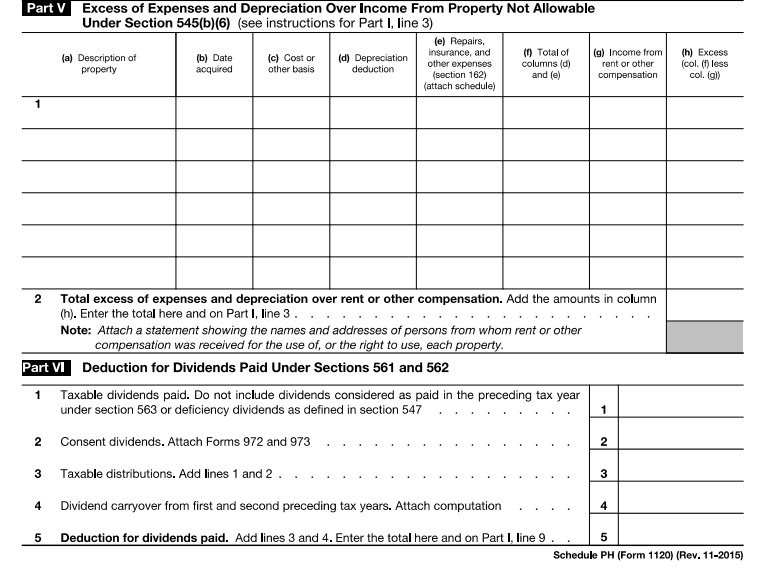

Parts V and VI of Schedule PH do not apply to Patrick, so these sections are left blank.

Sample Schedule PH Parts V & VI

How to avoid the personal holding company tax

There are two main ways to avoid the PHC tax.

1. Shed some cash. Here are ways that can be done:

- Make distributions to the shareholder during the year.

- Make distributions to the shareholder within 2.5 months after year-end and attach an election under Sec. 563(b). These are referred to as throwback distributions and are limited to 20% of the amount of distributions made during the year.

- Give charitable contributions.

- Invest in tax-exempt bonds, which are excluded from taxable income.

2. Avoid being classified as a PHC in the first place. If at least 41% of the corporation’s income is generated from operations, the 60% passive income test will not be met. However, in practice, it may not make the most sense to reinstate operations just to save tax if the business assets were disposed of for a practical and necessary reason.

Reasons to have a personal holding company

Despite the tax consequences, there are compelling reasons to maintain a PHC.

1. Consolidated business lines without consolidated liability: You can keep important assets separate from entities holding business operations.

1. Streamlined management: Using a single holding company to facilitate multiple subsidiaries can simplify operations through the allocation of shared resources.

2. Potential tax savings with consolidated filings: If a holding company owns 80% or more of the voting power and stock value of affiliated companies, a consolidated return may be an option. Consolidated filing allows for capital gains and losses between the related companies to offset each other, resulting in the potential for reduced tax.

Frequently asked questions (FAQs)

A PHC must check Item A, box 2, of Form 1120, and then attach Schedule PH to the corporation’s tax return.

No, corporations cannot claim a deduction for paying the PHC tax.

In general, the purpose of a PHC is to manage or hold other companies.

The penalty for failing to distribute PHC income is a 20% annual tax on the UPHCI.

Bottom line

If you’re selling the operating assets of your business, consider the tax consequences of retaining the proceeds in your corporation, which will likely create a PHC. Hefty taxes are imposed on any undistributed income, so you’ll need to track PHC income constantly and ensure that you make adequate distributions to avoid the PHC tax. Remember that there may be practical reasons to hold on to your PHC, so all factors should be carefully considered in the strategic process.