All domestic C corporations (C-corps) must file IRS Form 1120, U.S. Corporation Income Tax Return, every year they are in business, even if they don’t have any taxable income. The financial information in Form 1120 is pretty straightforward—as long as you have your balance sheet and profit and loss statement prepared.

The more difficult part of completing this form is all the detailed questions you’re asked. We will walk you through how to fill out Form 1120 to help you fill out the financial information using sample financial statements. We will also provide tips on the detailed questions and suggestions for where to find more information for filling out Form 1120.

To make changes to an already-filed Form 1120, you must file an amended tax return using Form 1120X. We’ll help you complete that return in How to Amend a Corporate Tax Return.

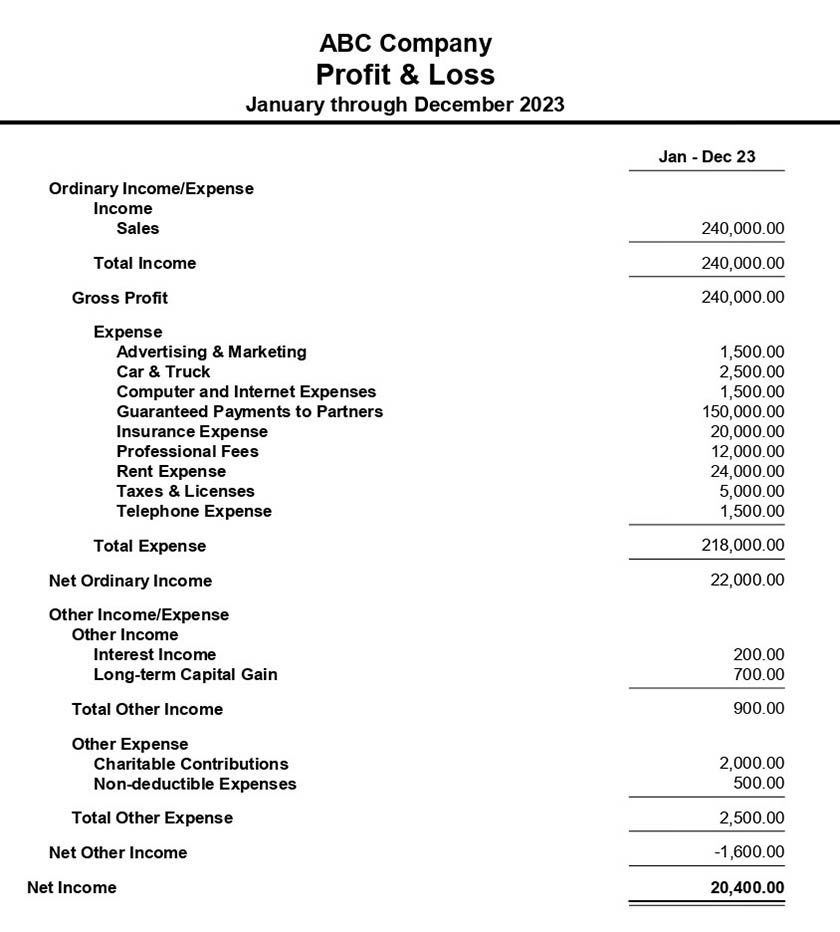

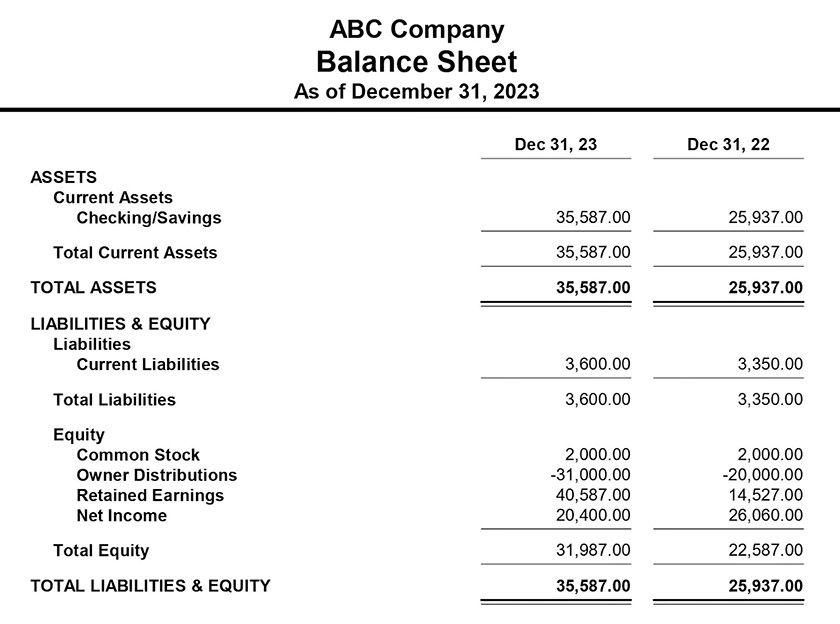

We’ve made a sample profit and loss (P&L) statement and balance sheet, which you can see below, to help you better understand how to fill out Form 1120. You might also want to keep the IRS’s Form 1120 instructions close by as we fill out the form to help you with your corporation’s tax return.

Sample profit & loss statement

Sample balance sheet

Step 1: Collect the Required Information

Whether you decide to use a tax professional, use tax software, or complete this form by hand, you’ll need your corporation’s financial information and documentation to complete Form 1120. Much of this information can be found on your prior-year tax return:

- Details about your corporation: This includes the name of the business, the date of incorporation, the date of the election to be treated as a corporation, your employer identification number (EIN), and your mailing address.

If the corporation has not received its EIN by the time the return is due, enter “Applied For” and the date the corporation applied in the space for the EIN. If you need help acquiring one, read our guide on how to get an EIN.

-

- Tax year: You need to know if you’re filing on a calendar year or fiscal year—like June 30. This must match your prior-year return unless you ask the IRS permission to change it.

- Business activity: A description of the business activity of the C-corp, the main product or service you offer, and the business activity code that reflects your industry. You can find a complete list of the business activity codes on page 28 of the IRS’s instructions for Form 1120.

- Accounting method: Most C-corps may use either the cash or accrual method of accounting, although large corporations may be required to use accrual. You must use the same accounting method as the prior year—unless the IRS permits you to change.

Need a bookkeeping solution for your small business? Get on top of your financials today with Merritt Bookkeeping |

|

- P&L statement: This financial report—also called an income statement—is a summary of the corporation’s income and expenses for the year.

- Balance sheet report: A balance sheet is a financial statement that summarizes all assets, liabilities, and owner’s equity as of the end of the tax year.

- Fixed asset purchases report: Print the general ledger (GL) for each of your fixed asset accounts, which should show all the purchases and sales of fixed assets during the year. Fixed assets are things like machinery, vehicles, buildings, and improvements to buildings. This information is necessary when figuring out how much the C-corp can deduct for MACRS depreciation, bonus depreciation, and section 179 expense this year.

- Payroll expense report: You should also print out a report showing compensation paid to the officers of the C-corp. This detail is necessary because compensation for officers is reported on a separate line item from salaries and wages paid to other employees.

- Capital accounts: Create a detailed list of all transactions that affect the capital accounts of the shareholders, such as capital contributions, distributions, dividends, and buyouts.

- Loans: Create a complete record of every financial transaction involving shareholder loans and repayments, including any interest paid or received.

- Forms 1099: If your corporation paid an independent contractor or freelancer during the year, you may need to report the payment on your Form 1120. Our guide on Form 1099 reporting can help you figure out if you’re required to issue any 1099s.

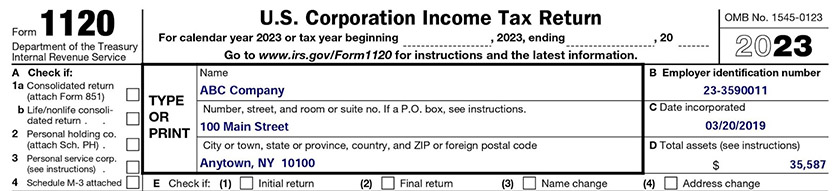

Step 2: Complete the General Information Section

You may wish to download IRS Form 1120 from the IRS website to follow along with this guide.

IRS Form 1120 General Information

- Initial return: If this is your corporation’s first tax return, write the date it was formed where it says “tax year beginning” at the top of Form 1120. You should also mark the box for initial return in item E. (1). This date should match your corporation’s date of incorporation in item C.

- Item B: Enter your corporation’s EIN assigned by the IRS in this section or “Applied For” if you’ve applied but haven’t yet received your number.

- Item D: Enter the total assets of your corporation as shown on your balance sheet. This must match the ending total assets shown on Schedule L of Form 1120 discussed later. Our sample company has $35,587 in total assets at the end of the year according to our balance sheet provided above.

Step 3: Fill Out Income & Deductions Section

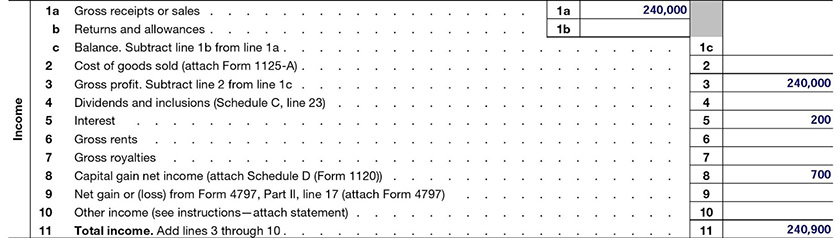

You must list your corporation’s income and deductions on the first page of Form 1120. We have completed Lines 1a through 37 using the example P&L statement of our fictitious C-corp above.

- Line 1: Gross receipts from the sale of your goods or services

- Line 2: Your cost of goods sold is reported on line 2 and must match the cost of goods sold calculation done on Form 1125-A, which is not illustrated in this article.

- Line 4: C-corps treat dividend income differently than other taxpayers, as we’ll discuss when completing Schedule C. After you calculate the includible dividends on Schedule C, place that income on line 4.

- Lines 5–7: Income from interest, rent, and royalties must be separated from the income reported on Line 1 and reported on lines 5, 6, and 7.

- Line 8: If you have any capital gains or losses, you need to complete Schedule D and then report the net capital gain on this line. The most common sources of capital gains and losses are the sale of investment property and capital gain distributions from mutual funds.

- Line 9: You need to complete Form 4797 to calculate any gain or loss if you sold business assets during the year like buildings or equipment. You’ll report all or a portion of the gain from Form 4797 on this line.

Form 1120, Page 1, Lines 1–11

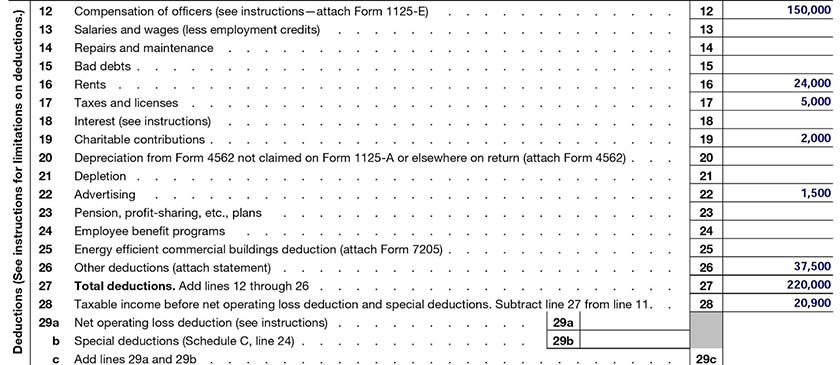

Report the deductions shown on your Profit and Loss statements in this section. Most of the lines are straightforward, but here are some helpful tips.

- Line 12: Report any compensation paid to officers on line 12 and then attach Form 1125-E to provide additional details. Be sure to remove any officer compensation from total wages and salaries reported on Line 13.

- Line 13: All salaries and wages paid during the year—except for those paid to officers—are reported on Line 13.

- Line 19: Charitable contributions must be made to qualified charities and are generally limited to 10% of taxable income. See the instructions for line 19 if you think your deduction might be limited.

- Line 20: Depreciation reported on Line 20 comes from Form 4562 and includes the deductions for depreciation, bonus depreciation, and section 179 expense.

- Line 25: The energy efficiency commercial buildings deduction is new for 2023. Owners of commercial buildings that qualify as energy efficient can claim this special deduction. See the IRS’s instructions for Form 7205 for more information.

- Line 26: Report your deductible meals along with any other expenses not reported elsewhere.

Form 1120, Page 1, Lines 12–29

In general, a corporation can only deduct 50% of the amount that would otherwise be allowed for meals paid for or incurred as part of its trade or business. For more on this topic, see our in-depth guide on the meals and entertainment deduction.

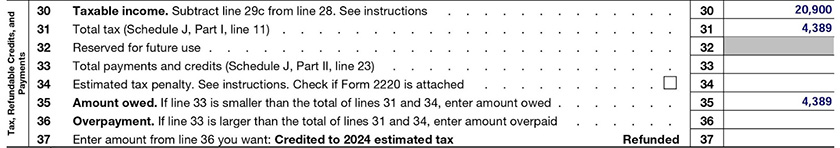

- Lines 31 & 33: Report the total tax and total payments and credits calculated on Schedule J, discussed later in this article.

- Line 34: If you owe tax with your return, you may also owe an underpayment penalty. The underpayment penalty is interest owed to the IRS for not paying your tax liability timely throughout the year. Learn how to calculate your penalty on Form 2220.

- Line 37: If you have an overpayment of tax, you can choose to apply your overpayment to your 2024 tax liability. This is usually a good idea if you plan on making estimated tax payments next year.

Step 4: Complete Schedule C—Dividends, Inclusions & Special Deductions

Schedule C is used to report dividends, interest, and any other income from corporations in which your corporation has an ownership interest. If your corporation doesn’t own stock in other corporations, you can skip this section. In our example, ABC Company did not get any dividends, so the fields on this form will be left blank.

It’s pretty rare for small businesses to have subsidiary corporations that pay dividends. However, if you do, then be sure to complete this section and report your dividends received deduction on page 1, line 29b.

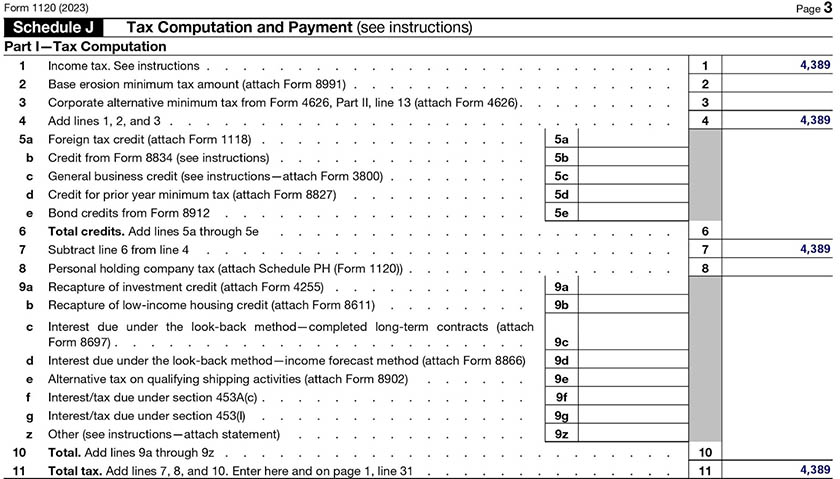

Step 5: Complete Schedule J—Part I & Part II

Schedule J, Part I, Tax Computation and Payment

Part of Schedule J is used to calculate all the taxes owed by your C-corp. If you have positive income on line 30 of page 1, then you should show tax on line 1 of this form. The other taxes and credits shown in Schedule J, Part I are less common.

While we don’t present any detailed calculations of these less-common items, read on to learn the basics of each line and whether it might apply to you.

IRS Form 1120 Schedule J Part I & Part II—Tax Computation

- Line 1: This line is your regular federal income tax and is calculated as 21% of your taxable income shown on line 30 of page 1. Federal income tax for ABC Company is $20,900 times 21%, or $4,389.

Special Taxes for Very Large Corporations: Lines 2 & 3

- Line 2: The base erosion minimum tax is only applicable if the C-corp had at least $500 million of gross receipts in any of the prior three years.

- Line 3: Only corporations with an average of $1 billion in financial statement income over the prior three years are subject to the corporate alternative minimum tax.

Tax Credits: Line 5

- Line 5a: You might be eligible for a foreign tax credit if you paid any income tax to a foreign government. The most common instance of this for small businesses is when you receive foreign investment income through a mutual fund. These mutual funds often must pay tax to foreign governments for which the investors can claim a credit.

- Line 5b: Complete Form 8834 if you have an electric vehicle credit carryover for vehicles placed in service before 2007. Credit for electric vehicles placed in service in 2023 are reported on Form 8936 and are part of the general business credit reported Line 5c.

- Line 5c: Many small businesses qualify for one or more of the general business credits reported on Form 3800.

- Line 5d: This line is only applicable if you’ve paid alternative minimum tax in the prior year.

- Line 5e: If you own any tax credit bonds, claim your tax credit on Form 8912 and then report it here. Learn more about tax credit bonds through IRS Form 8912.

Other Taxes: Lines 8 & 9

- Line 8: If at least 60% of your income is from passive investments like stocks, bonds, and rental activities, then your corporation might be a personal holding company (PHC) and subject to a special PHC tax if you failed to pay enough in dividends.

- Line 9: Line 9 reports a myriad of very rare taxes. See the instructions for Form 1120 if you’ve:

- Claimed an investment credit or low-income housing credit in a prior year

- Reported long-term contracts using the percentage complete method

- Reported depreciation of property under the income forecast method

- Operated a United States flag vessel of more than 6,000 tons for shipping activities

- Deferred tax on installment obligations

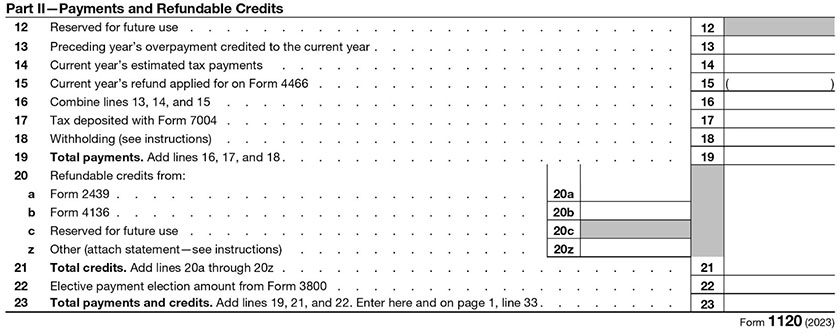

Schedule J, Part II: Payments and Refundable Credits

Part II of Schedule J is used to report payments or refundable credits. The most common item to report is any estimated tax payments you made during the year, which go on line 14.

IRS Form 1120 Schedule J Part II—Payments and Refundable Credits

- Line 13: Report on this line any portion of your 2022 refund that was applied toward your 2023 estimated tax. You can find this amount on line 37 of your 2022 Form 1120.

- Line 14: Enter any estimated tax payments made during 2023 or January 2024 applied to the 2023 tax year.

- Line 15: Although rarely done, if you requested a quick refund of your 2023 estimated tax payments on Form 4466 because they far exceeded your expected liability, enter the refunded amount here.

- Line 17: If you’ve extended this 2023 Form 1120, enter any payment of tax you made with the extension. This will be shown on line 8 of the Form 7004 filed to receive the extension.

- Line 18: While rare for corporations, enter any federal income tax withheld on income received.

- Line 20a: If you received a Form 2439 for undistributed long-term capital gains (rare), then enter any tax paid as shown in box 2.

- Line 20b: Report any credit for federal taxes paid on fuel from Form 4136. The most common source of this credit comes from using fuel that includes federal taxes for nonhighway use. For instance, farmers or landscapers who purchase their fuel from a typical gas station can claim a credit if the fuel is used in off-road tractors or lawn equipment.

Step 6: Complete Schedule K—Other Information

All corporations must fill out Schedule K, and understanding the complex questions on this schedule is one of the hardest parts of self-preparing your Form 1120. Fortunately, most small businesses will answer no to most of the questions. We’ll help you identify which questions might apply to your corporation.

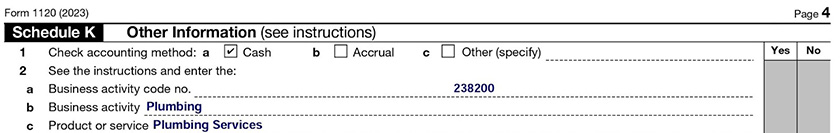

- Line 1: Select your overall method of accounting as either cash, accrual, or other—which is generally a hybrid of cash or accrual. Your accounting method has to be the same as last year unless you request the IRS to change it on Form 3115.

- Line 2: Enter your business activity, product or service, and business activity code. The business activity code will generally be the same as last year, but you can verify the code to use by referring to the IRS’s Form 1120 instructions.

Form 1120, Schedule K, Lines 1 & 2

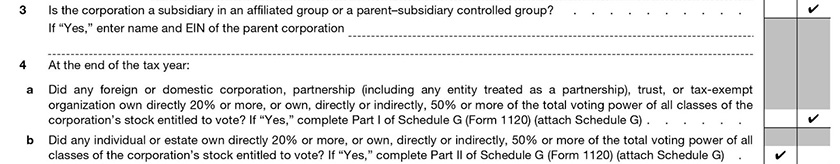

Lines 3 and 4 deal with the owners of this corporation.

- Line 3: If the corporation is owned 80% or more by another corporation but chooses to file a separate return instead of being included in a consolidated return, then mark yes and enter the name of the corporation with 80% or more ownership.

- Line 4: This line asks if anyone owns 20% or more of the corporation. If so, attach Schedule G and answer yes to either line 4a or 4b depending on the type of owner:

- Answer yes to Line 4a if the 20% owner is a corporation, partnership, trust, or tax-exempt entity and then attach Schedule G.

- Answer yes to Line 4b if the 20% owner is an individual or estate.

Most small businesses will answer yes to Line 4b.

Form 1120, Schedule K, Lines 3 & 4

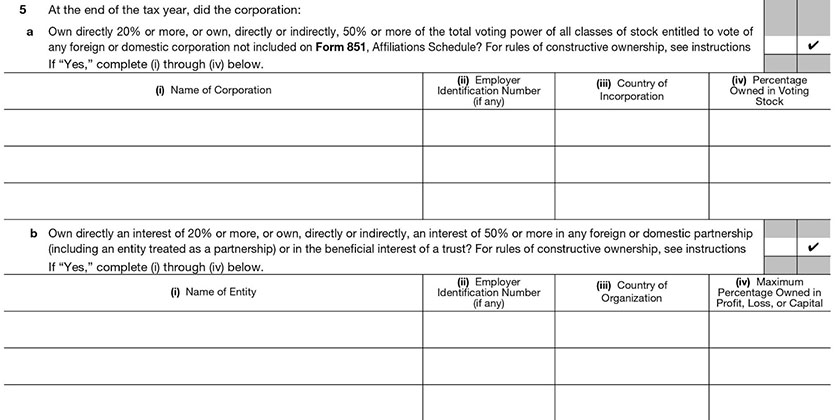

Line 5 gathers information about any entities for which this corporation owns directly 20% or more, or indirectly through related parties 50% or more.

- Line 5a: Answer yes and provide a list of any corporations owned.

- Line 5b: Answer yes and provide a list of any partnerships owned or trusts with a beneficial interest.

Form 1120, Schedule K, Line 5

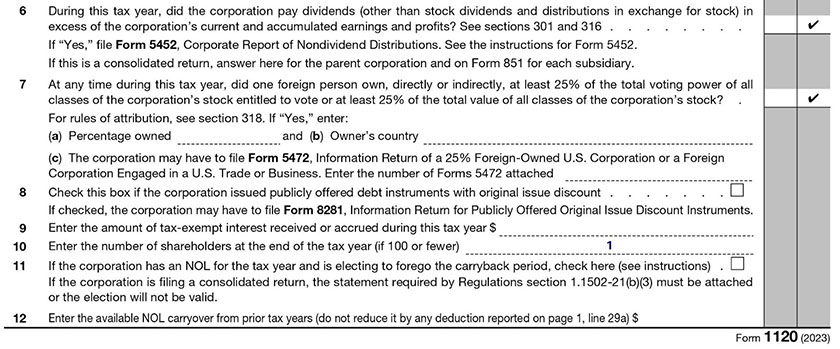

- Line 6: Answer yes if you paid shareholder distributions in excess of earnings and profits, which are similar to retained earnings but calculated with some tax adjustments. These excess distributions are generally treated as capital distributions instead of dividend income to the shareholder. This is pretty rare.

- Line 7: If the corporation was owned 25% or more by a foreign person, then answer yes and provide the percentage owned and owner’s country.

- Line 8: Check this box if the corporation issued public debt with an original issue discount (OID), which is pretty rare for a small business.

- Line 9: Enter any tax-exempt interest that was received. This is usually interest received on municipal bonds. Note that interest received on most federal bonds and treasury notes are not tax-exempt and must be reported as taxable on page 1.

- Line 10: Enter the number of shareholders at the end of the year if less than 100. Most small businesses will have to enter a number here.

- Line 11: If you are reporting a loss for the year, check this box if you want to carry the loss forward to future years rather than carry it back to previous years. If your loss is a significant amount, you should consult a tax pro before making this election.

- Line 12: If you have a loss being carried forward from prior years, enter the amount here. You should also enter the amount of the NOL being used to offset current-year income on page 1, line 29a.

Form 1120, Schedule K, Lines 6 – 12

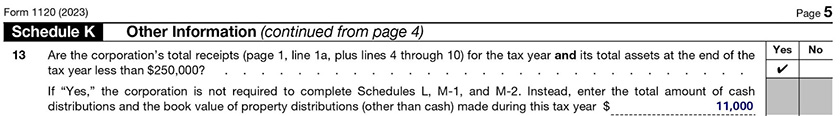

Answer yes to line 13 if the corporation had less than $250,000 in gross receipts (page 1, line 1a) and less than $250,000 in total assets at the end of 2023. If yes, then also disclose the amount of distributions made on the line provided.

Small corporations answering yes to line 13 are not required to complete Schedules L, M-1, or M-2.

Form 1120, Schedule K, Line 13

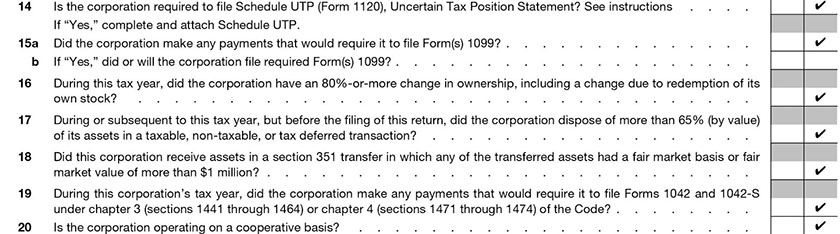

- Line 14: Mark yes if you’re claiming an uncertain tax position in this tax return. An uncertain tax position is one that you are not confident will be allowed if reviewed by the IRS. I’d recommend consulting a tax pro if you think this might apply to you.

- Line 15: Answer yes if the corporation made payments during the year that were required to be reported on Form 1099. If you answered yes to line a, be sure to file the form as required and also mark yes to line b. Many small businesses will answer yes to this question because of payments made to contractors that must be reported on Form 1099-NEC. Learn more through our guide to 1099 reporting.

- Line 16: Answer yes if the corporation had an 80% change in ownership during the year, which is rare.

- Line 17: If you disposed of more than 65% of your assets during the year answer yes to line 17.

- Line 18: A section 351 transfer is when a corporation receives assets from a new or current shareholder in exchange for issuing that shareholder stock. It is most common when an existing business is transferred into a corporation. Mark yes to this line if you received property worth $1 million or more in exchange for stock. We have a guide on the Section 351 exchange if you want to learn more.

- Line 19: If you made payments to foreign persons that represent US source income to that person, you must file Form 1042 or Form 1042-S and mark yes to this question.

- Line 20: If the corporation is being operated as a CO-OP, mark yes to line 20. This is rare for a small business.

Form 1120, Schedule K, Lines 14-20

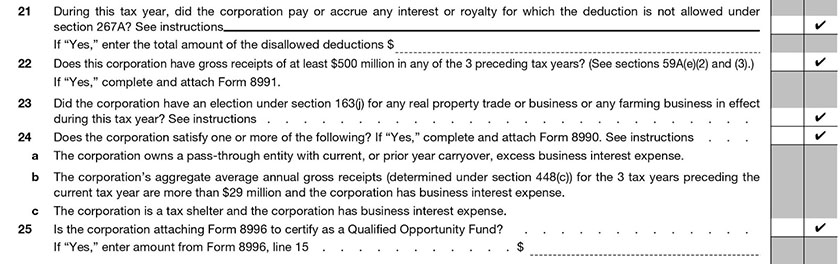

- Line 21: If you made interest payments to related parties during the year, you might be unable to deduct the interest—unless the related party reports the interest as taxable income. If your related party interest is nondeductible, then answer yes and provide the amount in the space provided.

Related parties include a corporation and a shareholder, but the interest is deductible by the corporation as long as the shareholder reports it as interest income.

- Line 22: Only mark yes if you have gross receipts of at least $500 million in any of the prior three years.

- Line 23: The section 163(j) election is not applicable to corporations with average annual gross receipts of less than $29 million over the prior 3 years, so small businesses can answer no to this question.

- Line 24: This line determines if a corporation is subject to the limitation on interest expense. Most small businesses with average annual gross receipts of less than $29 million over the prior three years can answer no to this question.

- Line 25: Answer yes if you are applying for certification as a Qualified Opportunity Fund, which is rare for small businesses.

Form 1120, Schedule K, Lines 21 – 25

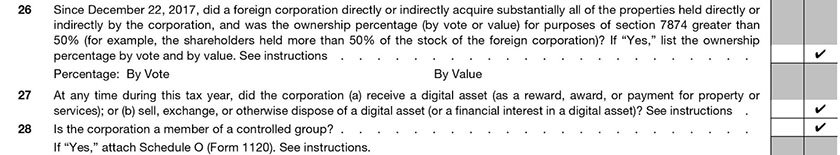

- Line 26: This line is asking if you’ve moved your company’s assets offshore by selling substantially all the assets to a related foreign corporation. This is rare for a small business, but if you think it might apply, then definitely seek the help of a tax pro.

- Line 27: If the corporation received or disposed of digital assets—most commonly cryptocurrency—during the year, then mark yes. Paying expenses with digital assets qualifies as disposing of them.

- Line 28: If this corporation is a member of a controlled group, answer yes and complete Schedule O where you’ll need to show how certain tax benefits will be split among members of the group. Controlled groups include both brother-sister corporations and parent-subsidiary corporations.

If the owners of this corporation also own another corporation, the corporations are a brother-sister-controlled group. This is the most common form of a controlled group for small businesses.

Form 1120, Schedule K, Lines 26 – 28

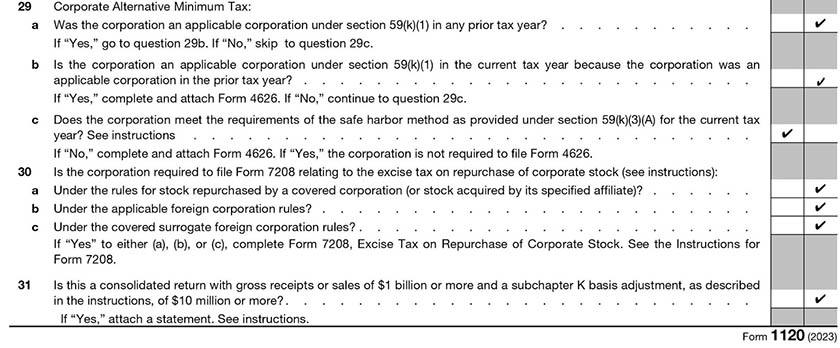

- Line 29: This line determines if the Corporate Alternative Minimum Tax applies to this corporation; if you’re a small business, then it does not. Answer no to all the questions for line 29 unless you’ve ever had a three-year period with adjusted financial statement income of over $1 billion.

- Line 30: Answer no unless you are a publicly traded company and repurchased shares during the year.

- Line 31: Answer no if the corporation’s gross receipts for the year are less than $1 billion.

Form 1120, Schedule K, Lines 29–31

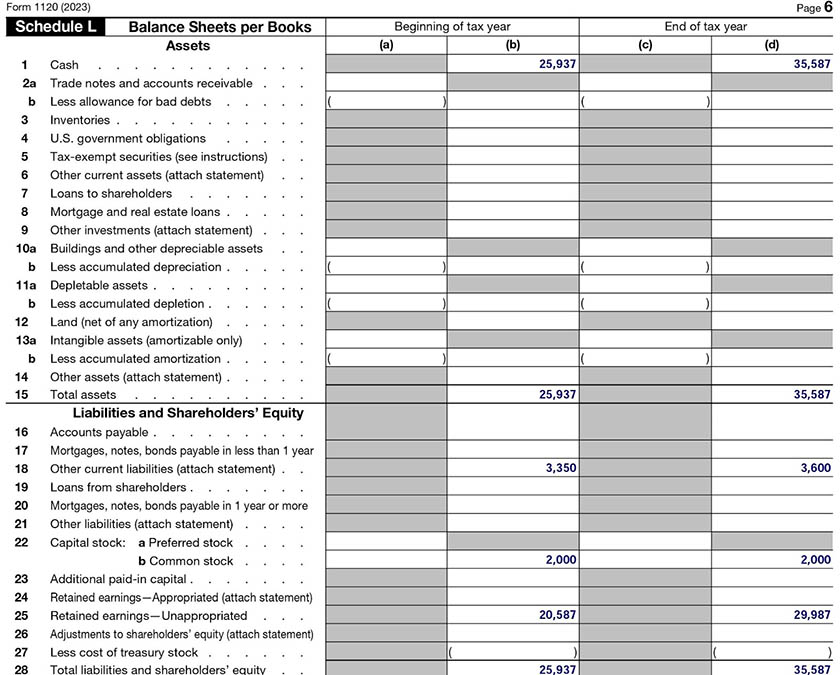

Step 7: Complete Schedule L—Balance Sheets per Books

This section is optional for corporations that answer yes to Schedule K, line 13, but we recommend completing it anyway as it demonstrates to the IRS that your books are in good order. The information for Schedule L comes directly from your balance sheet, so it’s pretty straightforward to complete.

Here is the Schedule L based on ABC Company’s balance sheet presented at the top of the article:

Form 1120 Schedule L Balance Sheet

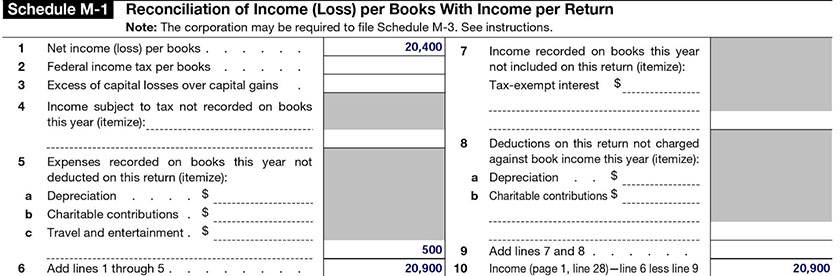

Step 8: Complete Schedule M-1—Reconciliation of Income (Loss) per Books With Income per Return

As with Schedule L, Schedule M-1 is not required if you answered yes to Schedule K, Line 13. While it can be a bit confusing to complete, we recommend at least giving it a try before leaving it blank. Schedule M-1 shows all the differences between the net income on your profit and loss statement and taxable income reported on page 1 of this 1120.

To complete Schedule M-1 you’ll need to go line-by-line down page 1 of income and deductions and find any instances in which the amount reported there differs from the amount reported on your profit and loss statement. For ABC Company, the only difference is $500 of meals expense shown on the profit and loss statement, which is nondeductible and therefore not shown on page 1.

Form 1120, Schedule M-1, Reconciliation of income

- Line 1: The net income shown on line 1 must match the net income shown on your profit and loss statement.

- Line 2: Federal income tax expense is not deductible on page 1, so if there is any federal income tax expense shown on your profit and loss statement, it must be entered on line 2.

- Line 3: If your profit and loss statement shows capital losses in excess of capital gains, that excess must be entered here as capital losses in excess of capital gains cannot be deducted on page 1.

- Line 4: If there is any income on page 1 that is not on your profit and loss statement, enter on line 4. This is most often a timing difference where income is being recognized for tax this year but recognized for book purposes in a different year.

- Line 5: Any expenses on your profit and loss statement that exceed the amount deducted on page 1 must be reported here. For example, if tax depreciation shown on page 1 exceeds the depreciation expense on your profit and loss statement, enter the excess on line 5a. Any nondeductible expenses like entertainment or penalties can be listed below line c.

- Line 7: Any income shown on your profit and loss statement this year but isn’t shown on page 1 must be entered here. As with line 4, this is usually a timing difference between when income is recognized on the tax return versus when it’s recognized on the books.

- Line 8: Any deductions on page 1 that are greater than the expense shown on the profit and loss statement are entered on line 8.

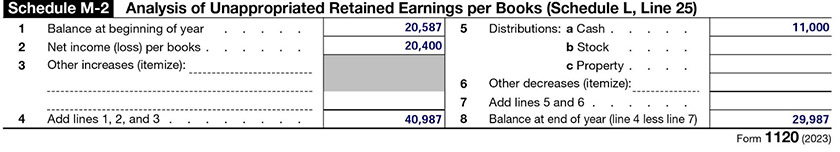

Step 9: Complete Schedule M-2—Analysis of Unappropriated Retained Earnings per Books

As with Schedules L and M-1, Schedule M-2 isn’t required if you answer yes to line 13 of Schedule K. However, this schedule is the final bit of proof you can provide to the IRS that your books are in order and your tax return balances as discussed next.

Form 1120, Schedule M-2, Analysis of Retained Earnings

For your tax return to balance, the following must hold true:

- Line 1 must agree to Schedule L, line 25, column a

- Line 2 must agree to Schedule M-1, line 1

- Line 8 must agree to Schedule L, line 25, column d

How To Assemble Form 1120

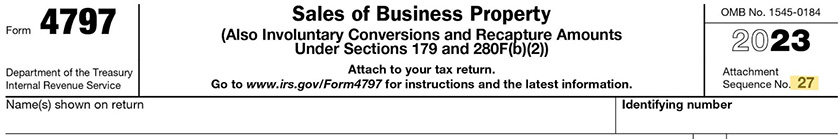

You’ll likely have additional forms and schedules that need to be attached to your Form 1120. If you’re filing on paper, you need to arrange the forms according to the Attachment Sequence No. As an example, we’ve highlighted this number for Form 4797:

IRS Form 4797 Header with Attachment Sequence Number

If you have any supporting statements or attachments, then they will be at the very end of the return, behind all schedules and forms. Ensure they are labeled with which schedule or form they support and then place them in the same order as the schedules and forms. Also, include the name and EIN of the corporation on each attachment.

Frequently Asked Questions (FAQs)

If you have already filed Form 1120 and need to make changes, you will need to use Form 1120-X, Amended U.S. Corporation Income Tax Return, to correct a previously filed Form 1120.

A corporation that fails to pay the tax when it is due may be fined 1/2 of 1% of the unpaid tax for each month or part of a month that the tax is not paid, up to a maximum penalty of 25% of the unpaid tax. If you fail to file, the penalty is 5% of the unpaid taxes for each month or part of a month that the tax return is late, not to exceed 25% of your unpaid taxes.

A C-corp that has dissolved generally must file by the 15th day of the fourth month after the date it dissolved. Additionally, if this is the corporation’s final Form 1120 return, you should check the “Final return” box in the return in item E.

Bottom Line

The income, gains, losses, deductions, and credits of a corporation, as well as the amount of income tax that must be paid, must all be reported and calculated by the U.S. Corporation Income Tax Return using Form 1120. You can start your return by downloading IRS Form 1120 and filling it out by hand, or you can do it all electronically to have it complete in time for the filing date.