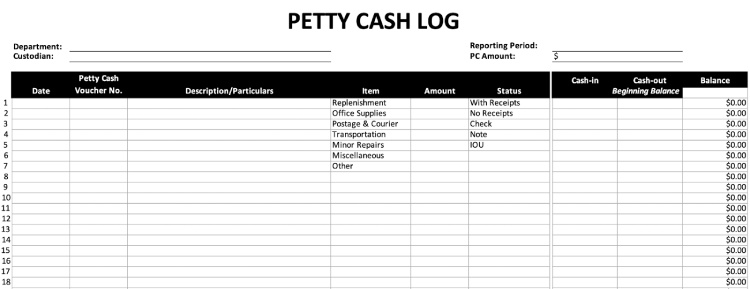

A petty cash log (also called a petty cash register) is the official record of all petty cash transactions. The petty cash custodian is in charge of maintaining the petty cash log for all petty cash transactions that were taken out of the fund. We have prepared a free downloadable petty cash log template that you can use for your small business.

Our petty cash log template is easy and simple to use. You can print it and use it as the official record for petty expenses—or you may just edit it directly in Excel.

Here are some reminders about using our template:

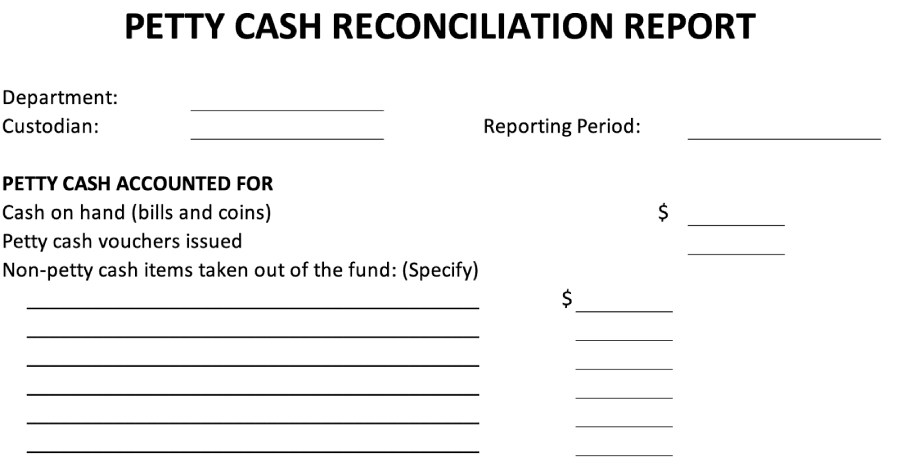

- Don’t forget to fill out the fields on top of the log sheet. If you’re the custodian, enter your department and name. The reporting period is the range in which you can use the petty cash fund. It can be good for one to several weeks or one month, or until you use up the petty cash fund.

The PC Amount corresponds to the allowed fund, not the current balance. If the company allowed a petty cash of $1,000, that’s the only amount that you should put there.

Informational Fields in the Petty Cash Log

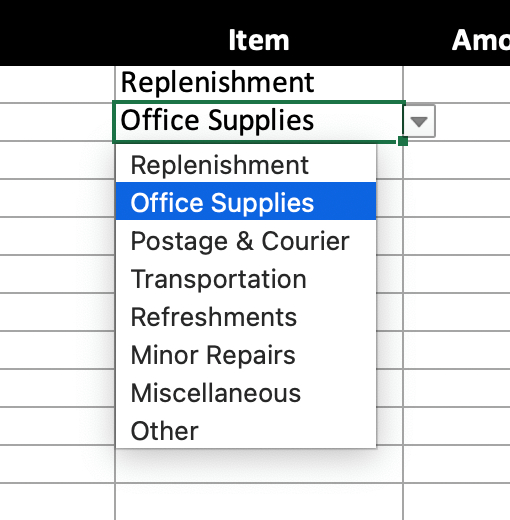

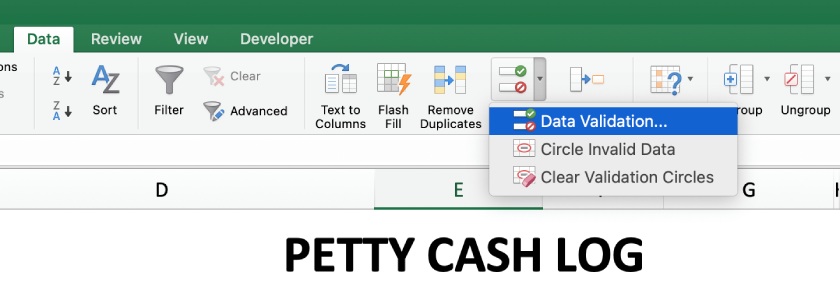

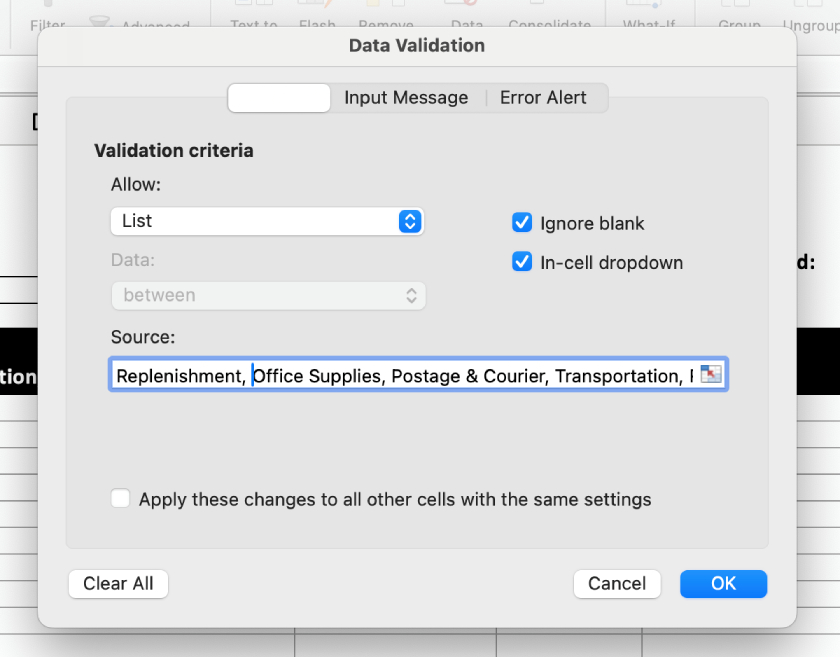

- Customize the petty cash items list as you see fit. We’ve included a default list of petty cash items in the dropdown menu. If you want to add or remove items, go to Data Validation to modify the list.

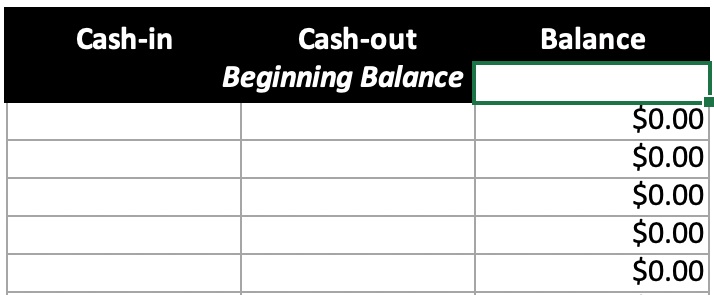

- Add the beginning balance of petty cash to the log. The beginning balance should be the actual cash on hand in your sheet. If you run out of space in the petty cash log, the beginning balance should be the carryforward balance from the previous sheet.

Cash-in, Cash-out, and Balance in a Petty Cash Log

Important Items in the Petty Cash Log

A petty cash log must report all transactions charged to the petty cash fund. It is an essential document in petty cash accounting and helps the petty cash custodian track all petty expenses and reconcile all petty cash transactions before asking for replenishment.

We have provided a template above, but here’s the simplified version of the log.

PETTY CASH LOG | |||||||

|---|---|---|---|---|---|---|---|

Department: ________________________ | Custodian: ________________ | ||||||

Date | Voucher No. | Description | Item | Amount | Cash-in | Cash-out | Balance |

Here are the important items that should be included in a petty cash log.

- Date: The date in the petty cash log must be the date when the petty cash was disbursed.

- Petty Cash Voucher Number: Using a petty cash voucher can provide proper documentation and control over petty cash. However, it’s optional. You can use the petty cash log and record all transactions as you disburse the cash.

- Description: The description must briefly explain the purpose of the disbursement.

- Item: The petty cash item is the allowed expense in a petty cash fund. The common petty cash items are as follows:

- Office supplies

- Postage and courier charges

- Transportation

- Minor repairs

- Miscellaneous

- Amount: The amount should correspond to the actual amount disbursed.

- Cash-in and Cash-out: These columns show the replenishment (cash-in) and disbursements (cash-out).

- Balance: The balance is the current balance of the petty cash fund. It must match the actual cash on hand.

Petty Cash Reconciliation Report

Another useful template that must come with the petty cash log is the petty cash reconciliation report. When it’s time to request petty cash replenishment, the custodian must first reconcile the petty cash on hand and determine if all petty cash items are accounted for at the end of the reporting period.

The petty cash reconciliation report contains two major areas: petty cash accounted for and petty cash accountabilities.

Petty Cash Accounted For

Ideally, the petty cash accounted for must only include the sum of petty cash on hand (bills and coins) plus all the receipts given to the custodian. However, there are items that are sometimes taken out of the petty cash fund for convenience. We call them non-petty cash items.

PETTY CASH ACCOUNTED FOR | |||

|---|---|---|---|

Cash on hand (bills and coins) | $ | ||

Petty cash vouchers issued | $ | ||

Non-petty cash items taken out of the fund: (Specify) | |||

_______________________________________ | $ | ||

_______________________________________ | $ | ||

_______________________________________ | $ ____________ | ||

TOTAL | $ | ||

Non-petty cash items are items taken out of the petty cash fund that should not be charged to the fund. Suppose you need to cash a check at the bank, but it’s already 5 PM, so the bank’s closed. Since you need cash badly, you go to the petty cash custodian and ask them to cash the check using petty cash money.

Converting the check into cash is not a petty cash item, but cash was still taken out of the petty cash fund. Hence, that must be part of the non-petty cash items in the reconciliation report.

Examples of non-petty cash items are:

- Employee loans or IOUs

- Employee cash advances

- Checks converted to cash

- Money that doesn’t belong to the fund but was found in the petty cash box

Petty Cash Accountabilities

In an ideal world, the petty cash accountability should only be the petty cash fund amount. However, the custodian sometimes puts money in the petty cash box that should not be placed there.

Suppose the whole company decided to chip in for the farewell party of a colleague who’s about to retire. You might suggest keeping the money in the petty cash box for safekeeping.

PETTY CASH ACCOUNTABILITIES | |||

|---|---|---|---|

Petty cash fund allocation | $ | ||

Non-petty cash item mixed with the fund: (Specify) | |||

_______________________________________ | $ | ||

_______________________________________ | $ | ||

_______________________________________ | $ ____________ | ||

TOTAL | $ | ||

If the custodian is disorganized, it’s possible that the contributions will be mixed with the petty cash fund. In that case, you must include the contributions in the petty cash accountabilities because they have already been commingled with the petty cash fund. However, if the contributions are intact (i.e., sealed in an envelope), it’s fine not to include it as an accountability.

Cash Short or Over

The petty cash accounted for, and petty cash accountabilities should match. If it doesn’t match, there can be either missing money or unrecorded petty cash transactions.

The custodian must be held accountable to the petty cash fund. That’s why if there are shortages or overages, the custodian must explain why there’s a difference.

- If the petty cash accounted for is less than the petty cash accountabilities, there is a shortage.

- If the petty cash accounted for is more than the petty cash accountabilities, there is an overage.

Frequently Asked Questions (FAQs)

You can create a petty cash log in Excel or a columnar notebook. Our free petty cash template is a good starting point if this is your first time using a petty cash log.

For petty cash recording, you need to log at least the nature of the transaction, reference numbers, date, and amount. It’s up to you if you want to log other information like the name of the payee or memo entries about the petty cash transaction.

Bottom Line

Knowing what a petty cash log is can help businesses track all petty expenses properly. It is the official document that serves as proof that payment was made for small expenses. Another useful document would be the petty cash reconciliation report. This report summarizes all petty cash transactions and ensures that petty cash is accounted for and petty cash accountabilities are reconciled.