Using a 401(k) to start a business is possible if you’re looking for financing outside of a business loan. While 401(k) accounts are primarily used for retirement savings, they can also be used for business purposes in the form of a rollover for business startups (ROBS), a 401(k) loan, or a regular 401(k) withdrawal.

Depending on your circumstances, the best 401(k) business financing option can vary. Each has nuances that can affect your total costs, the speed at which you receive access to funds, and your eligibility. The option you select may also have tax implications, so you may want to consider speaking with an accountant to ensure you won’t have an unexpected bill when you file your taxes.

Key Takeaways:

- 401(k) business financing can allow you access to funding with minimal to no debt obligations.

- A 401(k) can provide funds for business purposes and can be associated with a variety of costs, regulations, and specific qualification criteria.

- Using a 401(k) to buy a business can help finance an acquisition, or you can use it to fund an existing business to be used for a variety of business purposes.

Using a Rollover for Business Startups (ROBS)

How a ROBS Works

A ROBS allows you to access funds from your retirement accounts without penalty or tax implications. That said, there are various tax rules and regulations that business owners must adhere to.

When using a ROBS, it works by first transferring the funds in your personal retirement account to your company’s retirement plan. That plan is then designated as an entity that will purchase stock in the business, providing you with access to the money. It’s similar to an individual purchasing stock in a publicly owned company, as that action is what provides additional funds that the company can use.

Due to the complexity of this type of transaction and the consequences of improperly conducting a ROBS, it’s highly recommended that you use an experienced ROBS provider like Guidant Financial. It is an expert in ROBS transactions and provides one of the industry’s best audit protection and legal support services in the event any issue arises.

Pros & Cons

| PROS | CONS |

|---|---|

| Provides tax- and penalty-free access to retirement funds | Complex transaction that can be difficult to understand |

| Easier qualification requirements than traditional business loans | Typically takes several weeks before funds can be accessed |

| No monthly payments required as it is not a loan | Ongoing maintenance is required to remain compliant |

| Funds can be used for any business purpose | Most ROBS providers charge one-time and recurring fees to maintain the plan |

Who Should Consider a ROBS

For those considering a ROBS, determine whether or not you have the resources to be considered eligible. You can also consider speaking with a ROBS provider to gain additional insight, as many of these companies offer free consultations. They can educate you about the process and help you determine if this type of rollover might be a good fit for your circumstances. If you think a ROBS might work for you, consider the following criteria.:

- Your business is, or will be, structured as a C Corporation (C-corp): One of the core requirements of a ROBS is that your business must be a C-corp. This is to allow the company to have shareholders and the subsequent purchase of stock that will allow you access to the funds.

- You have a large retirement account balance: With most ROBS providers, you’ll need a minimum balance of $50,000 to be eligible. This is largely done to ensure you are not charged excessive fees in relation to the amount being rolled over.

- You don’t want monthly loan payments: Since a ROBS is not a loan, you won’t have to make monthly payments. This can help from a cash flow perspective and also save you on interest charges.

- You are comfortable risking your retirement account balance: If your business fails, you also risk losing the retirement funds used in the rollover.

- You’re unable to qualify for a business loan: Most business loans have requirements for things like credit score, time in business, and revenue. A ROBS has no such criteria, which is why we also identified it as one of the best ways to fund a startup.

Summary of Typical Rates, Terms & Qualifications

Typical Rates & Terms | |

|---|---|

Interest Rate | None |

Repayment Term | None |

Initial Setup Fee | $0 to $5,000 |

Ongoing Maintenance Fee | $0 to $150 monthly |

Funding Speed | 2 to 4 weeks |

Typical Qualifications | |

Minimum Balance to Qualify | $50,000, but may be flexible |

Required Credit Score | None |

Required Time in Business | None |

Required Business Revenue | None |

How to Get a ROBS

As a ROBS can be a complex transaction to maneuver, we highly recommend working with an experienced ROBS provider. In addition to Guidant Financial, you can also consider our other recommendations for the best ROBS companies.

Generally, a ROBS transaction can be simplified into the following six steps.

- Step 1: Establish a C-corp.

- Step 2: Create a retirement plan within the C-corp.

- Step 3: Choose a custodian for the retirement plan (check out our picks for the best 401(k) companies).

- Step 4: Rollover funds from personal retirement accounts to the C-corps retirement plan.

- Step 5: Have the C-corp’s retirement plan purchase stock in the company.

- Step 6: Utilize available funds for business purposes.

If you’re looking for additional details for each stage, you can reference our ROBS guide.

Using a 401(k) Loan

How a 401(k) Loan Works

A 401(k) loan allows you to borrow against the balance in your 401(k) retirement account. IRS rules typically limit the amount you can borrow to either 50% of your vested balance or $50,000, whichever is less.

Repayments are typically made quarterly and are expected to be paid in full within five years from loan origination. Although 401(k) loans carry an interest rate, that interest is repaid to your retirement account.

Additionally, since 401(k) loans are typically tied to an employer, you’ll be required to repay the loan on an accelerated timeline if you separate from the company. If that happens, you’ll have until the due date of your next federal tax return to pay off the loan.

Pros & Cons

| PROS | CONS |

|---|---|

| Less complicated than a ROBS | Could face large tax and early withdrawal penalties if money isn’t repaid |

| Interest repaid is increased contributions to your retirement account | Hurts cash flow because you have loan payments to account for |

| Business isn’t restricted to a C-corp; can be organized in any manner | Only an option with 401(k); cannot take out a loan against an individual retirement account (IRA) |

Who Should Consider a 401(k) Loan

For business owners looking to utilize a 401(k) loan, there are a few instances in which it may be best applicable. This may include that:

- You have a sufficiently large balance in your 401(k): Since 401(k) loans are limited to the lesser of 50% of your vested balance or $50,000, you’ll want to ensure that it will be enough to satisfy your funding needs.

- You don’t anticipate separating from your employer in the short term: Since you’d have to repay the loan on an accelerated timeline if you separated from your employer, we recommend this as an option only if you don’t foresee any short-term changes in employment.

- You have the ability to repay the loan quickly if needed: Since you’d have a shorter period to pay off the loan if you separated from your employer, it’s a good idea to also have other means to complete a full payoff just as a backup plan.

- You don’t qualify for a business loan: A 401(k) loan rarely has requirements for things like credit scores or income, which makes it a good option to consider if you’re unable to get a business loan.

Summary of Typical Rates, Terms & Qualifications

Typical Rates & Terms | |

|---|---|

Interest Rate | Prime plus 1% to 2% |

Loan Amount | 50% of vested 401(k) balance or $50,000, whichever is less |

Repayment Term | 5 years |

Funding Speed | 1 to 3 weeks |

Typical Qualifications | |

Required Credit Score | None |

Required Time in Business | None |

Required Business Revenue | None |

How to Get a 401(k) Loan

Getting a 401(k) loan is typically facilitated by your plan’s administrator, so there are nuances in applicable financing steps. In general, however, you’ll need to go through the following:

- Step 1: Contact your plan’s administrator with your loan request.

- Step 2: Review terms and complete the required paperwork with the details of your funding request.

- Step 3: Verify receipt of funds.

- Step 4: Verify regular payments through payroll deductions or other methods as allowed by your plan administrator.

Using a 401(k) Withdrawal

How a 401(k) Withdrawal Works

By using a 401(k) withdrawal, you can access the vested portion of your 401(k) account balance. However, it’s important to keep in mind that this option is typically associated with hefty penalties, fees, and taxes.

401(k) accounts are designed for retirement, so the IRS assesses an additional income tax of 10% on withdrawals made prior to the age of 59.5. Since the funds you withdraw may also be taxed as regular income, your plan administrator could also be required to withhold 20% for federal taxes.

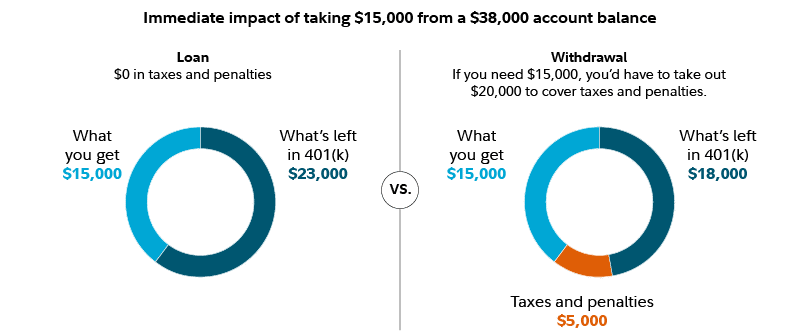

To illustrate the impact that penalties and taxes could have on a 401(k) loan versus an early withdrawal, Fidelity provides an example of how an individual would need to take out nearly $23,000 just to net $15,000 in funds. See the graphic below.

Although the precise amounts can vary depending on your unique circumstances, the key takeaway is that the amount of taxes and penalties can quickly lower the amount of the final check you receive.

Pros & Cons

| PROS | CONS |

|---|---|

| Can potentially get a larger sum of money without having to repay a loan | Can face substantial tax liabilities and penalties for early withdrawal |

| No restrictions on how your business is organized | Could place you in a higher tax bracket, causing a larger tax burden |

| Funds could be used for both personal and business expenses | May be risking your future ability to retire if the business fails and retirement funds are lost |

Who Should Consider a 401(k) Withdrawal

A 401(k) withdrawal should be considered as a last resort unless you’ve reached retirement age and can escape the heavy amount of taxes and penalties involved with cashing out the account early. With that being said, it might be a good option if any of the following apply to you:

- You have an urgent need for funds and cannot get financing elsewhere: If you need funds quickly to cover an emergency but cannot get approved for a loan, a 401(k) withdrawal can be an option as it does not have any credit or income requirements.

- You have reached retirement age: If you’ve already reached the age of retirement, you can avoid the penalties associated with an early withdrawal. However, be aware that the funds you get may still be taxed as ordinary income.

- You qualify for an exception to be exempt from penalties: The IRS has a list of exceptions to the 10% additional tax that will exempt you from paying an early withdrawal penalty. However, no exemptions are listed for utilizing funds for starting up a business, covering regular business expenses, or acquiring another company.

Summary of Typical Rates, Terms & Qualifications

Typical Rates & Terms | |

|---|---|

Interest Rate | None |

Funding Amount | Your current vested 401(k) balance |

Penalties and Fees | 10% penalty may apply prior to age 59.5, in addition to federal and state income tax |

Repayment Term | None |

Funding Speed | 1 to 2 weeks |

Typical Qualifications | |

Required Credit Score | None |

Required Time in Business | None |

Required Business Revenue | None |

How to Complete a 401(k) Withdrawal

Depending on your employer and/or the retirement plan’s administrator, the steps involved with a 401(k) withdrawal may differ. However, generally, the process is as follows:

- Step 1: Contact your employer or the plan’s administrator with your request.

- Step 2: Review any disclosures you’re provided and complete your plan’s paperwork for a withdrawal request.

- Step 3: Verify receipt of funds.

Risks to Consider with 401(k) Business Funding

Using a 401(k) to finance your business comes with a few risks for you to keep in mind before you pursue this option. These include:

- Losing your retirement savings: If you mismanage your business finances, you could potentially lose your retirement savings in the event you can’t recoup your financial losses. This is a big risk from a personal finance perspective, as you could impact your future financial stability by investing your retirement funds into your business.

- Penalties and fees: Depending on the financing type and administrator, there may be hefty penalties or fees associated with financing your business with a 401(k). Be sure to read the fine print before entering into any agreements.

- Compliance with IRS regulations: There are certain rules and regulations to be mindful of to ensure you’re in compliance with the IRS. It’s worth consulting a professional who may be able to help you navigate through the financing process.

Alternatives to 401(k) Business Funding

Whether you are ineligible or funds from a 401(k) don’t meet your business needs, there are alternatives that you can consider to secure other forms of financing. If you decide to pursue a traditional business loan, we recommend reading our guide on how to get a small business loan, as it contains tips on improving your approval odds and getting funded more quickly.

Here are some other options to consider:

- Personal loan: In some cases, you can get up to $100,000 or more in funding on a personal loan. Qualification requirements typically focus more on your personal credit and finances rather than those of your business. Check out our picks of the best personal loans for business funding.

- Home equity loan (HELOAN) or home equity line of credit (HELOC): These are good options if you have good personal credit, finances, and sufficient equity in your home. Funds can be used for nearly any business purpose, and you can check out our separate guides on getting a HELOAN to finance your business and using a HELOC to fund your business to learn more about how to get this type of financing.

- Friends and family: A big benefit of asking friends and family for funding is that you can bypass many of the typical requirements associated with getting a loan from a bank. With that being said, there are still tax regulations to follow, and it can run the risk of straining relationships if the business venture does not succeed. To learn more, read our guide on raising money from friends and family to fund your business.

- Angel investors: Angel investors are suitable for early-stage businesses seeking capital without taking on debt. These investors offer seed money in exchange for equity in your company, which can make it a great option for businesses with limited credit history and financial resources. To learn more, read our guide on how to raise angel funding for your business.

Frequently Asked Questions (FAQs)

Generally, you can choose from one of three main options. If you have at least $50,000 in your retirement accounts, you can do a rollover for business startups (ROBS). Your second option is to borrow funds and get a 401(k) loan. Finally, you can choose to cash out the balance of your 401(k), although this is an option that often carries hefty penalties and tax implications.

IRS regulations generally allow you to get up to 50% of your vested balance or $50,000, whichever is less. If you need more funding than that, you’ll need to cash out your 401(k) or consider alternative methods of financing.

By using your 401k to buy a business, there can be significant penalties and fees involved. In addition to having to pay income tax, individuals who have not yet reached retirement age may be subject to an additional 10% early withdrawal penalty.

Bottom Line

If you’re looking to utilize a 401(k) to start or buy a business, it’s important to understand your options and their associated risks. You’ll need to consider if it’s worth risking your retirement savings balance and compare your financing options accordingly.

If you’re considering 401(k) business financing, we recommend speaking with a company like Guidant Financial. It is a specialist in 401(k) business financing and offers different types of funding options such as SBA loans, franchise financing, unsecured loans, and equipment leasing. You can set up a free consultation session to discuss your needs and see if it can offer a suitable form of funding for you.