The best commercial real estate databases offer deal-predictive intelligence, robust lead filtering, and niche tools and services to help you grow your business. Real estate professionals dealing with commercial properties can use this data to learn about the market and generate client and listing leads. I evaluated and narrowed down the six best commercial real estate databases based on pricing, quality of data sources, research features, customer reviews, and functionality.

- Best for predictive analytics: Reonomy

- Best for data aggregator and marketing options: CRE Collaborative

- Best for property ownership details: ProspectNow

- Best for commercial real estate investing and transactions: Real Capital Analytics

- Best for free tools: Commercial Investment Multiple Listing Service (CIMLS)

- Best for in-depth reporting tools: CoStar

Best Commercial Real Estate Databases at a Glance

Database | Starting Monthly Price | Free Trial | Occupant/Tenant Data | Customer Relationship Management (CRM) Integration |

|---|---|---|---|---|

$49 | ✓ 7 days | ✓ | ✓ | |

$14.99 per user | ✕ | ✕ | ✓ | |

$119 per user | ✓ 3 days | ✓ | ✓ | |

| $99 | ✓ | ✓ | ✕ |

Free plan | ✕ | ✕ | ✕ | |

$466 | ✕ | ✓ | ✓ | |

What Is a Commercial Real Estate Database?

Commercial real estate (CRE) data encompasses information and statistics related to properties utilized for business purposes, such as office buildings, retail spaces, and industrial facilities. Data includes details about property characteristics, market trends, rental rates, occupancy rates, sales transactions, and other relevant information. These details are crucial for investors, developers, brokers, and other professionals in the commercial real estate industry to make informed decisions and evaluate the value and potential of properties.

Reonomy: Best for Predictive Analytics

What We Like

- Artificial intelligence (AI) tools accurately predict deals

- 200+ search filters

- Easy-to-use interface

What's Missing

- No mobile app

- Customer service is not available 24/7

- Costs can add up for teams

Reonomy Monthly Pricing

Pricing

- Free trial: 7 days

- Individual accounts: $49 per month

- Team and enterprise packages: Customized

Reonomy is a commercial property database that provides information about a property’s mortgage, lender, tenants and occupants, and contact details. It also integrates with client relationship management (CRM) software and uses artificial intelligence (AI) and machine learning to determine the likelihood of deals throughout entire markets. Reonomy receives data from exclusive partners, including more than 3,100 local county assessors, census data, secretary of state, title companies, and geospatial providers. However, it could improve by offering a mobile app and 24/7 customer support.

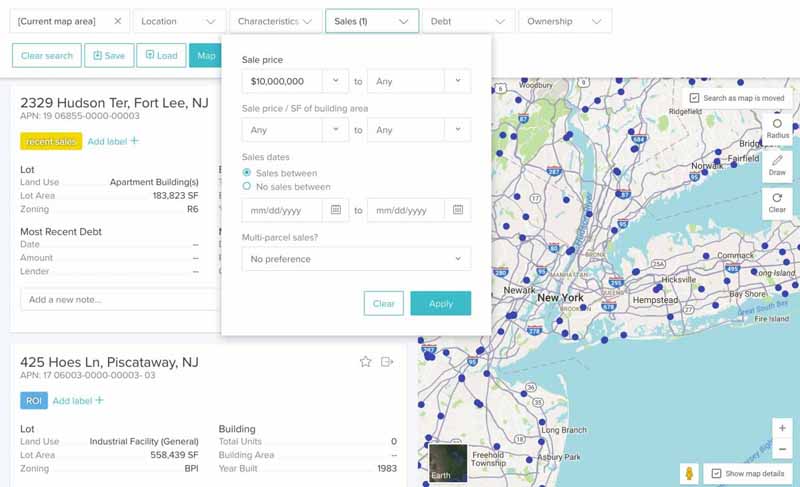

Reonomy property search filters (Source: Reonomy)

- Detailed search filters: Search properties and owners by important filters like origination date, loan amount, and owner portfolio

- Custom data feeds: Receive customized data and reports to stay up-to-date on commercial transactions in your local market

- Outreach tools: Ownership details and contact information help you contact potential leads efficiently

- Customer support: Available via phone, email, and live chat during business hours

Reonomy is a leading commercial real estate data company that offers advanced tools and technology to its users. The platform has an impressive customer review rating of 4.3 out of 5, with most users expressing satisfaction with the user-friendly interface and ease of finding property details.

However, some users have raised concerns about functionality gaps, such as search filters that need fixing or incorrect contact information on properties. If you’re looking for an alternative commercial real estate ownership database, consider CoStar. CoStar is known for its highly accurate data and in-depth analytics.

CRE Collaborative: Best for Data Aggregating & Marketing

What We Like

- Single dashboard for all commercial real estate data

- Concierge service for setup

- Social media tools and integrations

What's Missing

- No transaction history

- Lacks data details and technologies

- No mobile app

CRE Collaborative Monthly Pricing

- Starter plan: $14.99 per user

- Premium: $59.99 per user

- Enterprise: Contact CRE Collaborative for a quote

CRE Collaborative is a comprehensive commercial property database that offers real estate data, professional networks, and technology services. It acts as a CRE data aggregator to ensure you have accurate information. You can then use the data in your marketing efforts when servicing commercial clients and connecting with other professionals. It also offers services such as marketing and technology advisors, property searches, and the ability to post and advertise properties. However, it lacks crucial data such as transaction history, mortgage and lender, and occupant/tenant data.

Visual map of how CREC works (Source: CREC)

- Free review for professionals: Receive a no-obligation review of your company technology and data

- All-in-one tools: Facilitates branding, social media marketing, networking with professionals, and finding and analyzing properties

- Additional partnerships: With the premium membership, you receive access to QuantumListing, Zip Analyser, and Landchecks. This extends your data and your ability to manage it by providing data-mapping systems and information on zoning, environment, and foreclosures

- Customer support: Available by phone or email, and includes a detailed frequently asked questions (FAQs) section with tutorials for new and existing users

Unfortunately, very few third-party online CRE Collaborative customer reviews are available. However, the existing reviews are highly positive, giving the platform a customer review rating of 5 out of 5. Users love the efficiency of having a single platform to organize all data and promote properties. If you’re looking for a platform with more property details and market data, Real Capital Analytics provides the most in-depth analytics and reporting.

ProspectNow: Best for Property Ownership Details

What We Like

- Predictive analytics identify potential deals

- Detailed owner contact information

- Includes sales comps and multiple listing service (MLS) data

What's Missing

- No mobile app

- No live chat and 24/7 customer support

- Not as many types of property details as in other platforms

ProspectNow Monthly Pricing

- Free trial: 3 days

- Residential: $119 per user

- Commercial: Custom-priced

ProspectNow is a platform that helps agents and investors find ownership information for residential and commercial properties. It provides accurate and detailed ownership information for single-family, multi-family homes, apartments, industrial, and other commercial properties. With accurate and detailed ownership data, it’s easier to connect with owners and generate new leads. Also, it uses AI and predictive analytics to identify properties most likely to sell in the next 12 months. However, it could improve its services by providing a mobile app, live chat support, and 24/7 customer service.

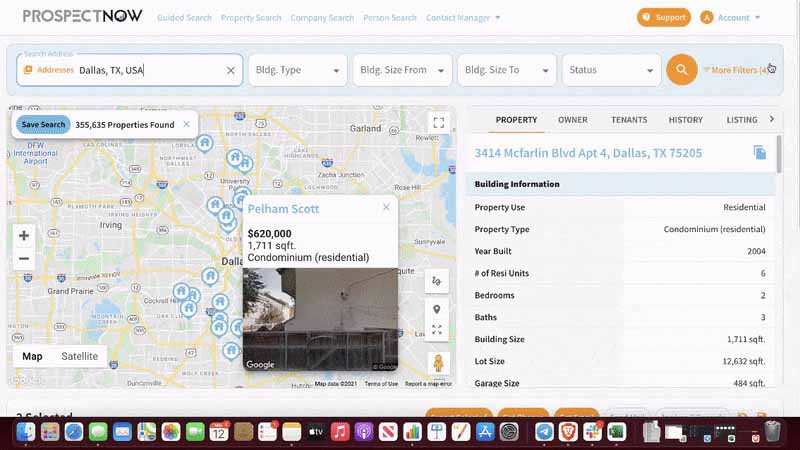

ProspectNow interface (Source: ProspectNow)

- Residential and commercial property data: Over 42 million commercial real estate properties

- Return on investment (ROI) calculator: The ROI calculator shows how much money ProspectNow can generate in your business

- Property and financial details: Includes information on property use, purchase date and price, assessed value, and loan provider

- Task management tools: Track appointments and tasks, and add notes to properties and owners within the platform

- Customer support: Available by phone, email, and live chat

With a limited number of ratings, ProspectNow has a good customer review rating of 4.3 out of 5. Customers note the platform’s interface is easy to use and presents all the essential information on one screen, making task completion more efficient. They also stated that it is a great, affordable option compared to other commercial property owner databases, like CoStar.

However, some customer reviews indicate they don’t love the credit system that limits the number of monthly searches and said the pipeline to track leads is difficult to manage. For a commercial real estate database that easily integrates with other CRMs, try Reonomy.

Real Capital Analytics: Best for CRE Investing & Transactions

What We Like

- Mobile app

- Free trial

- Provides comprehensive property and market data

What's Missing

- Plan pricing is quite expensive

- No CRM integration

- No live chat support

Real Capital Analytics Monthly Pricing

- Basic: $99

- Pro: $199

- Enterprise: Custom pricing

Real Capital Analytics is a CRE database that provides investors with critical market insights about key players, transactions, and investors, such as current deals, past transactions, and market trends. With Real Capital Analytics, users can explore market transactions and delve deeper into the individual investors involved in these deals. The platform provides users information about property owners, property attributes, and debt terms. However, it could improve by offering CRM integration and live chat support.

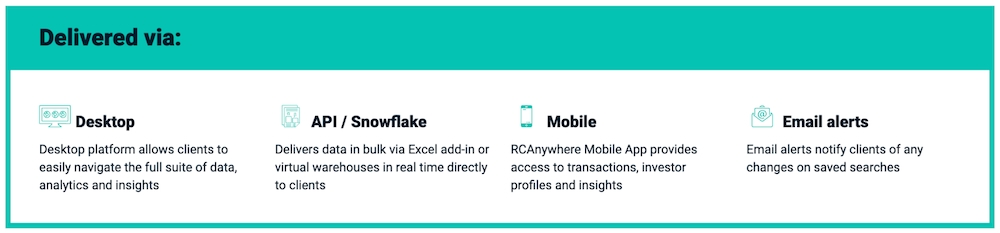

Delivery options (Source: Real Capital Analytics)

- Delivery: Choose whether to deliver and access all the data on a desktop, snowflake, mobile, or in email alerts.

- Market analysis: Create real-time custom market reports detailing pricing, volumes, and yields.

- Transactions: The platform boasts an extensive $42 trillion of capital markets transactions. This includes sales, financings, refinancings, construction, and mortgage debt, giving you a comprehensive market view.

- Mortgage Debt Intelligence (MDI): A linked, searchable database of properties, loans, and their borrowers and lenders. It helps you understand the risk associated with an owner’s or lender’s complete commercial real estate exposure.

- Registered Properties module: This allows you to explore the complete inventory of commercial properties—50MM+ assets included in the United States and 5MM+ leaseholds available in the United Kingdom.

Real Capital Analytics obtained a 3.4 out of 5 customer rating for its comprehensive data and resources. It also has a mobile application that allows users to access their accounts anytime and anywhere. Another feature that users love is its free trial, enabling interested users to test and experience the tool before committing.

Unfortunately, some users are dissatisfied with its user interface, saying that it needs to be updated and that they must update it since it makes it difficult for them to use and operate the tool. Plus, Real Capital Analytics doesn’t offer a built-in CRM and live chat support, unlike CRE Collaborative.

CIMLS: Best for Free Property Search Tools

What We Like

- Free to access

- Search commercial properties across the country

- Search for commercial real estate professionals

What's Missing

- Limited property owner data

- Limited market data

- Lacks built-in CRM

CIMLS Monthly Pricing

- Basic plan: Free

- Gold membership: $20

CIMLS is a free commercial real estate database that allows users to search for commercial properties for sale or lease and sales comps based on a specific property. It also allows investors, tenants, and owners to search for a real estate professional to work with. CIMLS is a great platform to add listings and be discovered by potential tenants and clients in your area. It offers extensive search features such as city, property type, keywords, price range, and square footage. However, it could improve its services by offering CRM integration and more comprehensive property and market data.

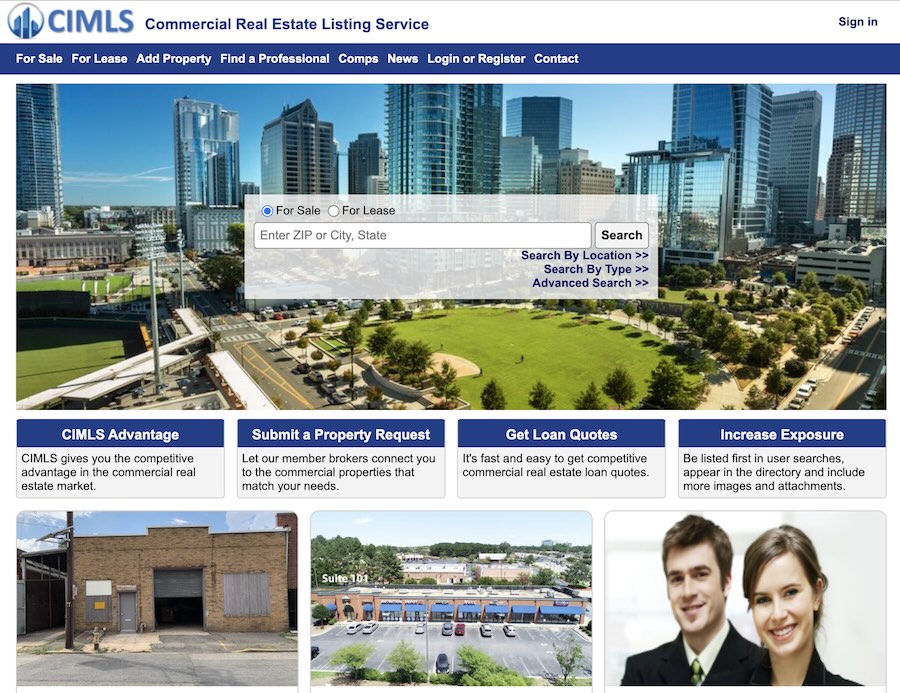

CIMLS online website (Source: CIMLS)

- Easy-to-use interface: Simple database with clear menus for property searches, locations, professionals, and comps

- Extensive search features: Use search filters to find properties, professionals, and comps easily

- Free property listings: Easy and free to post a commercial real estate property with an account

- Customer support: Available during business hours by phone and email

There are no reliable online reviews for CIMLS, but the platform is simple and easy to use, and customer service is efficient and helpful. Since the platform is free, signing up is risk-free, and you can browse properties and professionals before adding any of your own information. However, property data and analytics are extremely limited compared to other commercial lease databases, like ProspectNow and Reonomy. Consider supplementing CIMLS with another commercial real estate data source.

CoStar: Best for In-depth Reporting Tools

What We Like

- Products customized for different types of commercial real estate professionals

- Advisory services

- Easy-to-use platform

What's Missing

- Most expensive database

- No free plan or trial

- No live chat support and 24/7 customer service

CoStar Monthly Pricing

- CoStar membership starts at $466 and varies based on your level of access

CoStar is a commercial real estate information and analytics provider that offers different tools for an array of different audiences. Its tools make it easy to build financial models, generate customized reports, and search in-depth data worldwide. CoStar provides some of the most detailed and accurate information, along with easy-to-digest analytics and reports. It offers aerial and map overlays, forecasts generated by local commercial experts, and graphs of market and submarket trends. The system could be improved by providing a free trial.

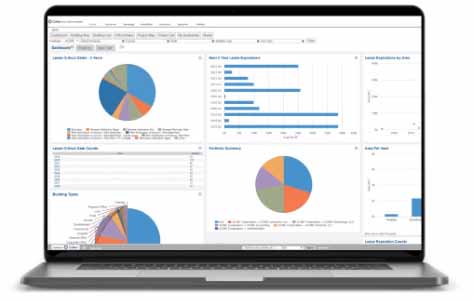

Real estate manager website (Source: CoStar)

- Variety of products: Solutions for commercial properties, comps, tenants, risk analysis, analytics, news, and advanced reporting

- Real Estate Manager: Combination of market data, analytics, and management software for real estate teams

- Reporting and analytics: Extensive reporting tools for leasing, construction, loan and financials, and real estate market data

- Advisory services: Consulting to help you communicate with investors, allocate resources, analyze locations, and get support during deals

CoStar has a positive customer review rating of 4.4 out of 5, but some reviews are mixed. Users note it’s an easy-to-use platform that makes generating and understanding in-depth data easy. They also note that customer service is highly responsive, helpful, and friendly. However, some reviewers have had trouble with sporadic inaccurate data and can’t justify the cost of the software. For a similar, more affordable database, try ProspectNow.

How We Evaluated the Best Commercial Real Estate Databases

Investing in real estate requires detailed information about properties and finances to make profitable choices. Therefore, we meticulously evaluated each platform based on the core features necessary for the widest range of professionals, like detailed property data, ease of use, CRM integration, and customer reviews. This thorough evaluation process ensures that the platform we recommend is the best fit for your needs.

After all of our research, Reonomy emerged as the best commercial property database because of its advanced technology, predictive analytics, data accuracy, and easy-to-use interface. Plus, with over 50 million commercial properties in the database, Reonomy gives you the maximum amount of data with high accuracy. All professionals looking for the best way to prospect real estate leads will undeniably find value in this platform.

These are the criteria we used to establish the best commercial real estate data sources:

25% of Overall Score

To accurately evaluate the price of each database, we took both cost and value into consideration. We searched for commercial real estate data sources with free trials, free plans, and extensive tools that offer a good ROI for users.

20% of Overall Score

General features include components essential in commercial real estate research, such as property details (asset type, location, building size, and zoning), transaction history, mortgage and lender data, occupant and tenant data, customized reporting, ownership data, and contact information.

15% of Overall Score

Users should be able to understand the functionality of the database (with some or little technical support) and have access to a CRM to track contacts and data, either built-in or through integrations. In addition, we researched platforms available on a mobile app.

15% of Overall Score

Based on customer feedback for each platform, with particular attention given to reviews of the product and popularity of the provider, and to certify the data and customer care provided meet user expectations.

15% of Overall Score

Expertise in the field and firsthand experience with the providers allow us to evaluate the standout features, value for the money, and ease of use for each of these real estate data sources.

10% of Overall Score

We looked into the convenience and attainability of customer service for technical and customer support.

Frequently Asked Questions (FAQs)

The CoStar Group owns various real estate brands, including LoopNet, Showcase, Ten-X, Apartments.com, Apartment Finder, and Homesnap, making it the largest and most well-known commercial real estate database. However, Reonomy is another wide-reaching platform with extensive data and tools for investors.

Data is vital in commercial real estate, and the most common types of data include property, transaction, financial, ownership, and demographic data. Property data includes the asset type, location, size, and zoning. Transaction and ownership data include information about the loan, lender, owner, and tenant. Finally, demographic data refers to information about the local market, including household age, income, ownership rates, and migration.

Commercial real estate can include various property types, so the evaluation process will vary. In every case, however, analyzing commercial properties should consist of an evaluation of:

- Comparable properties

- Type of investment

- Acquisition expenses

- Property cash flow

- Local real estate market and economics

- Demographics

With this information, real estate professionals can make wiser decisions. Without gathering the necessary data, you risk the success of your investments.

Bottom Line

Commercial real estate professionals have diverse needs for commercial real estate data providers. The providers must provide accurate and current property and market data. Analytical tools such as data visualization and predictive modeling are crucial to helping professionals interpret data and gain insights into market trends and potential investments. These CRE data providers help professionals make informed decisions and stay ahead of the competition.