Knowing how to find investment properties for sale requires a multifaceted approach, using various strategies and resources. These can include exploring online real estate platforms (like Zillow and Realtor.com), attending local auctions, networking at events, and tapping into the expertise of seasoned real estate agents. We’ve compiled a list of the most effective ways to find rental properties to buy so you can get started on your investment journey today.

1. Online Real Estate Platforms

Online sites like Zillow, Redfin, LoopNet, and Realtor.com are great tools for learning how to find investment properties for sale. They’re user-friendly and provide comprehensive data, but the properties are often listed at or above total market value, so thorough due diligence is crucial. Still, you can find some great investment opportunities. Even if you don’t buy a property from an online real estate platform, you can use the data to research and learn about the markets in which you want to invest.

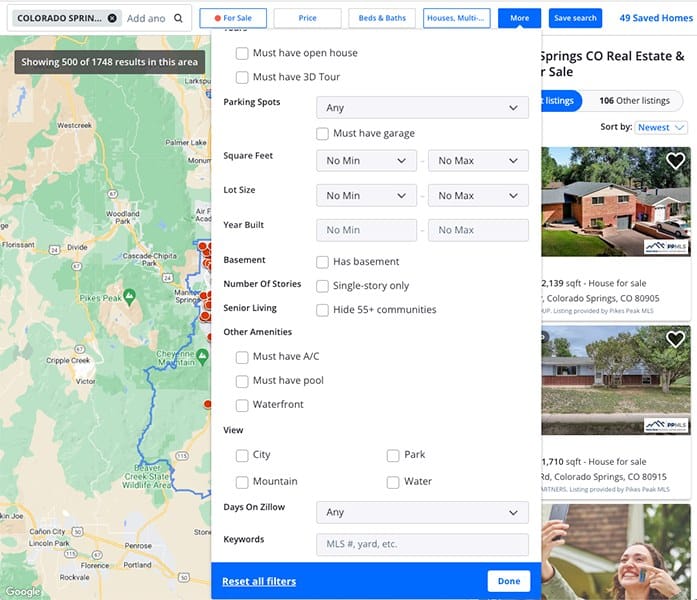

Zillow search filters (Source: Zillow)

With 36 million monthly visits, Zillow is the most popular online real estate listing site for residential properties. It’s an ideal resource for finding investment properties and evaluating prices of current and recently sold listings. It also has preforeclosure and foreclosure listings. Input your criteria, save searches, and get notified when new properties with your search terms are published. You can also list your rental vacancies and properties for sale.

2. Real Estate Agents

Selecting the right real estate agent is pivotal when looking for investment properties. They should possess knowledge of essential investment property metrics, including capitalization rate, cash-on-cash return, net operating income, and gross rent multiplier. Your chosen agent should also be proficient in identifying and providing crucial due diligence materials, such as rent rolls, security deposit records, expense lists, repair history, lead remediation certificates, and building codes.

Real estate agents, realtors, and brokers have access to the most recent properties listed in the multiple listing service (MLS) at their fingertips. They also have connections and may know of properties soon to be available. Ask your network for referrals to agents, attend agents’ open houses, or do an online search to begin the process of finding a great real estate agent.

3. Commercial Real Estate Databases

When considering how to find investment properties for sale, commercial real estate databases like LoopNet, CoStar, and CREXi can be invaluable resources. These platforms list properties for sale or lease. Define your criteria, including property type, location, size, and budget, and use advanced search filters to narrow your options. Regularly monitor new listings and set up alerts for customized updates. Conduct thorough due diligence on potential properties before making investment decisions.

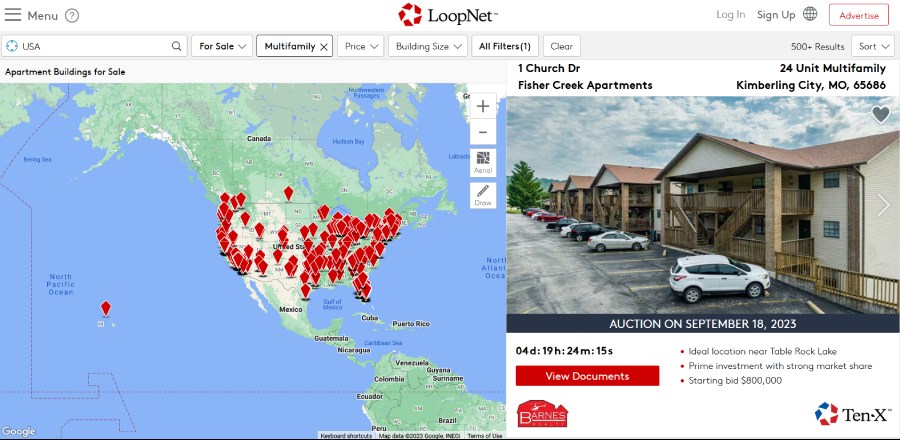

United States multifamily property search (Source: LoopNet)

LoopNet is a commercial real estate database with listings for sale, lease, and auctions. It includes many property types: office space, retail, industrial, multifamily, restaurants, and shopping centers. LoopNet is one of the few investment property search databases with online auctions, making it easy to evaluate property information and strike a deal in a few days. If you’re considering buying or leasing commercial real estate, LoopNet is hands down the best way to find investment properties.

4. Leverage Networking

Another way to learn how to find investment properties is by leveraging your networking abilities. By actively engaging with various real estate-related networks, you can discover valuable opportunities that might not be available through conventional channels. Join local real estate investment groups, attend meetups, and participate in industry events to connect with fellow investors, agents, and professionals who often share valuable insights and off-market deals.

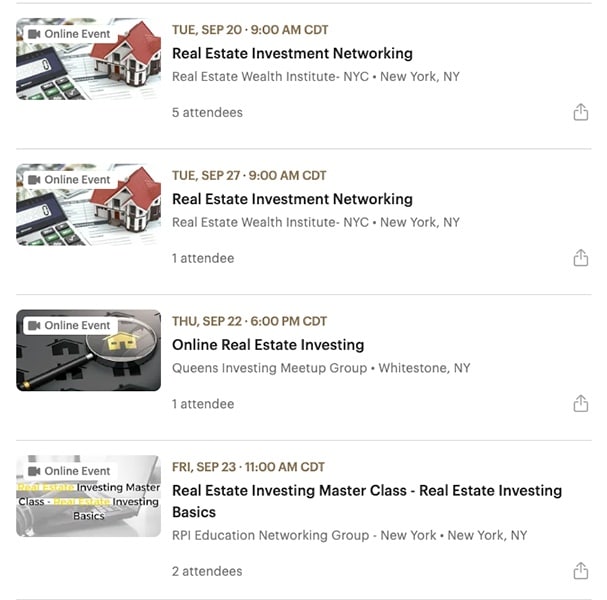

Real estate investing events (Source: Meetup.com)

Online forums, social media groups, and real estate-focused websites offer avenues to expand your network. Cultivate relationships with real estate agents specializing in investment properties, as they can access inside information and exclusive listings. Furthermore, legal and financial professionals, local business owners, property managers, and even your existing contacts can provide leads and introductions to potential sellers or off-market opportunities. By nurturing these connections, you increase your chances of discovering opportunities that align with your goals.

5. Real Estate Investment Groups

In addition to your professional network, you’ll need to learn how to find real estate investors who can guide you on your journey. If you’re new to real estate investing, you can leverage real estate investment groups and organizations to access a wealth of knowledge and resources within the industry. These groups often provide networking opportunities, connecting investors with like-minded individuals, mentors, and potential partners. Additionally, they offer educational events, market insights, and access to off-market deals, enhancing an investor’s ability to make informed and profitable real estate investment decisions.

The National Real Estate Investors Association (NREIA) homepage (Source: NREIA)

Joining business and investing groups like these can simplify building a network. They comprise other professionals with goals like yours and experience you can learn from. Plus, many groups host pressure-free online and in-person meetings or teach valuable information for free.

Here are some renowned real estate investor groups:

- The National Association of Independent Landlords

- National Real Estate Investors Association (NREIA)

- National Real Estate Investment Club (NREIC)

- Business Networking International (BNI)

6. Tap Into Your Sphere of Influence

As your real estate investing business expands, employ diverse strategies to consistently discover lucrative properties. Leveraging your sphere of influence (SOI) is an ongoing approach while concurrently generating leads through alternative methods. Friends, family, acquaintances, and professionals in related fields, such as mortgage brokers, attorneys, inspectors, or property managers, serve as valuable sources of information and connections. Increasing awareness of your real estate investor status expands your network and prompts more people to offer potential properties or referrals.

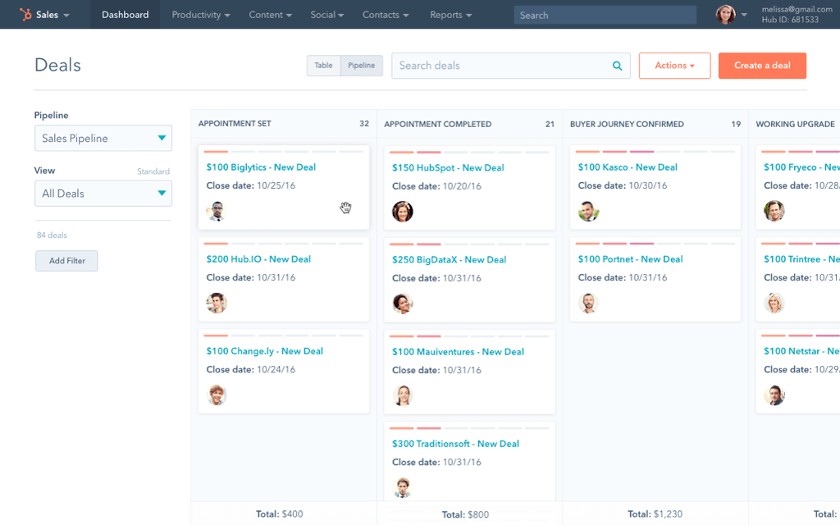

A visual view of the pipeline (Source: HubSpot)

The best way to maintain communications with many people is by using real estate customer relationship management (CRM) software like HubSpot. The HubSpot CRM is free to use but also provides multiple packages and a la carte options as your business grows. It lets you keep all your contacts in one place, keep notes on communications, and stay updated on potential and current deals. Sign up for HubSpot CRM for free today, or read our review page to learn more.

7. Turnkey Real Estate Companies

Turnkey real estate is a fully renovated investment property in move-in condition. Most of these opportunities come with tenants in place and a property manager to handle the day-to-day operations. Search reputable websites or contact local agents specializing in turnkey properties to find turnkey real estate for sale. These professionals can help you identify fully renovated and ready-to-rent properties that require minimal effort on your part to start generating rental income.

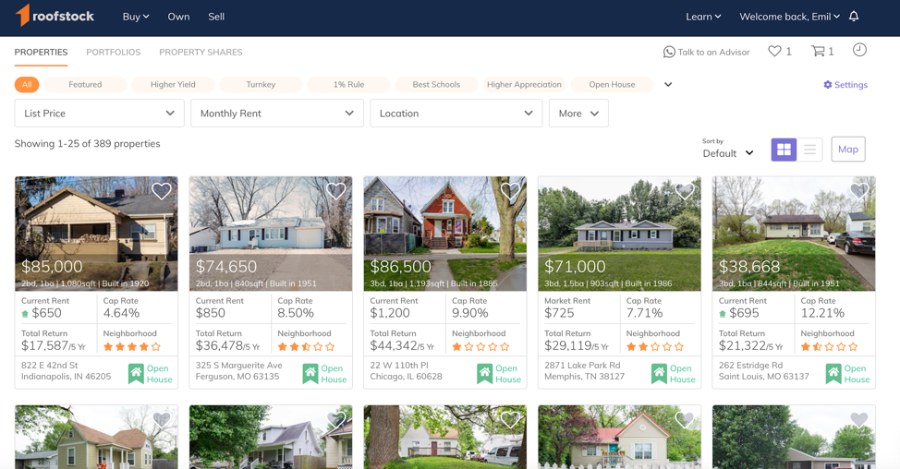

Turnkey property listings on Roofstock (Source: Roofstock)

One such company is Roofstock, a leading platform for turnkey real estate, offering fully renovated rental properties across the U.S. Its user-friendly platform provides detailed property data, tenant history, and inspection reports to aid in informed investment decisions. Roofstock also offers property management services, simplifying the process for investors seeking hands-off real estate opportunities. Check out our Roofstock review to see if it meets your specific needs.

8. Property Management Companies

Property management companies often have extensive local market knowledge, allowing them to identify potential investment properties in desirable areas. They may know about properties that will soon be available among the ones the company manages. They also can help assess properties for their investment potential, considering factors like rental income, property condition, and market trends.

When exploring how to find investment properties for sale, property management companies can help. These firms often maintain extensive networks of real estate agents and industry experts, which can provide access to off-market properties and exclusive opportunities. If you discover a company that aligns with your goals, property managers from these firms can efficiently oversee the daily operations of your owned properties, allowing you to dedicate more time to acquiring new investments.

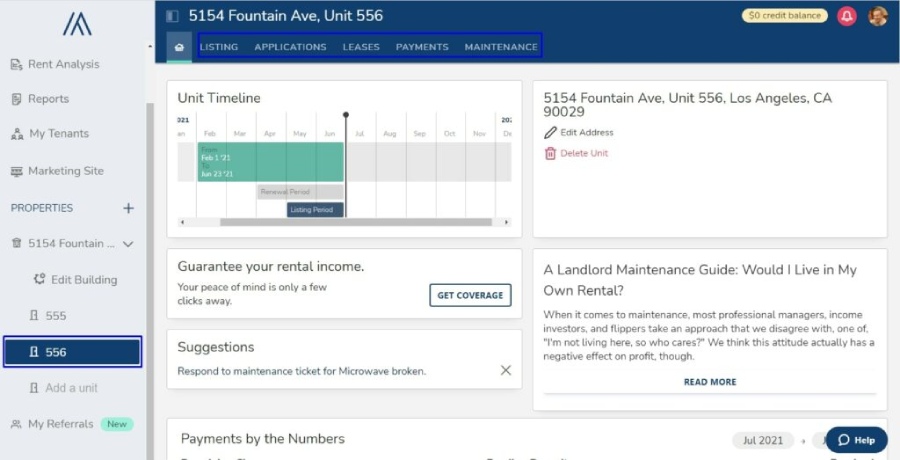

The Avail platform (Source: Avail)

If you prefer to do it yourself, property management software like Avail can help you streamline your workload, find reliable tenants, and track your finances effortlessly. Try Avail for free today and experience the convenience of hassle-free property management. Take the first step toward simplified, efficient, and profitable real estate investing. Learn more in our Avail review.

9. Direct Mail Services

Real estate investors can leverage direct mail to connect with potential sellers. Effective direct mail campaigns enable real estate investors to establish a consistent pipeline of potential investment properties while showcasing their expertise and dedication to meeting sellers’ needs.

Start by compiling targeted properties, then gather the property owner’s contact information through the tax assessor’s office, online database, or an online property search. Craft a personalized, compelling message that may resonate with a seller’s needs and motivations, addressing how you can provide a solution to whatever challenge the property owner may be facing. They may feel overwhelmed, tired of dealing with tenants, or underwater on their loan. This message should highlight your experience, track record, and unique value proposition as an investor.

Here are some additional tips:

- Use professional design and printing services to create visually appealing direct mail materials.

- Include eye-catching visuals and testimonials from satisfied clients, if available.

- Incorporate a clear call to action that encourages sellers to initiate contact.

- Implement a follow-up strategy to respond to inquiries and engage with interested sellers promptly.

- Remember that building rapport and fostering trust are essential in the follow-up process.

MapMyMail targeted mailing lists (Source: ProspectsPLUS!)

Real estate investors can harness the power of ProspectsPLUS!, including its innovative MapMyMail feature, which provides targeted direct mail based on location, demographics, or lifestyle. The platform offers user-friendly tools to create personalized and impactful direct mailers. With ProspectsPLUS!, you can effectively engage with potential sellers and tap into the power of highly targeted direct mail. Find out more about this tool by checking out our review page.

10. Preforeclosures, Foreclosures & Auctions

Real estate investors seeking distressed properties can use online platforms like foreclosure listing websites, enabling them to access information on preforeclosures and upcoming auctions while setting up alerts for new opportunities. Attending foreclosure auctions in person or online allows direct bidding, but investors should conduct in-depth research, understand the local market, and secure financing before pursuing such deals.

For those interested in tax lien auctions, contacting their local county tax collector or visiting the official website for their area provides lists of properties with unpaid taxes or liens. Investors can participate in tax lien auctions by bidding on liens to earn interest or acquire the property if owners default. Thorough due diligence and building relationships with local tax authorities and experienced tax lien investors for valuable guidance are essential.

Working With Distressed Properties & Owners

Real estate investors can target properties where landlords may be motivated to sell due to financial difficulties, property management challenges, or other personal reasons, such as a divorce or death in the family. Investors should approach distressed landlords sensitively, offering solutions that alleviate their problems while presenting a fair and beneficial deal. Find distressed owners through probate leads by searching public courthouse records or using an online database.

As mentioned, investors can monitor foreclosure for distressed properties and look for short-sale listings. Building relationships with local real estate agents, attorneys, and property wholesalers specializing in distressed properties can also provide access to off-market deals. Creative financing options like lease-purchase agreements or seller financing can be mutually advantageous. Conducting thorough property inspections and due diligence remains crucial to assess the property’s condition and financial potential.

Type in search criteria to find foreclosure listings (Source: Foreclosure.com)

Foreclosure.com is an essential online resource for real estate investors. It offers a comprehensive database of distressed properties, aiding investors in finding potential deals. The site provides detailed property information, auction dates, and educational resources. Investors can rely on Foreclosure.com to guide them through acquiring distressed properties, making it a one-stop destination for seizing foreclosure and preforeclosure opportunities.

11. Bank-owned Properties

Investors may find bank-owned or real estate-owned (REO) properties by contacting local agents specializing in distressed properties. These agents often have access to listings of REO properties provided by lenders and can provide valuable insights into the local market.

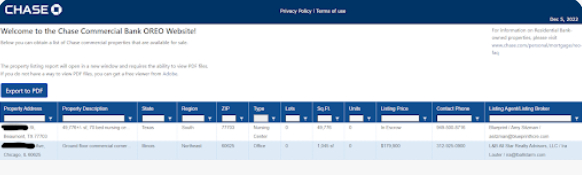

Available REO properties from Chase (Source: Chase)

Many banks and financial institutions have dedicated departments or websites where they list their REO properties for sale. These listings can include detailed property information, pricing, and contact details for inquiries. Regularly monitoring these bank websites and signing up for email alerts can help investors stay updated on available REO properties.

Here are some tips on approaching a lender about their REO:

- Conduct thorough research on the REO property and its market value.

- Identify the appropriate point of contact within the lender’s REO department.

- Express interest in the property and convey seriousness and preparedness.

- Highlight financing arrangements, such as pre-approval for a mortgage or proof of funds.

- Be prepared to negotiate, considering that REO properties are typically sold “as-is” and may require flexibility in terms to secure a favorable deal.

As always, due diligence, including property inspections and title research, is crucial to assess the condition and potential value of the REO properties before making a purchase. Working with real estate professionals, monitoring bank listings, and using online resources enable investors to find and acquire bank-owned and REO properties for their investment portfolios.

12. For Sale by Owner (FSBO)

When searching for how to find investment properties, real estate investors can effectively leverage for sale by owner (FSBO) listings as a valuable resource to identify potential investment properties. FSBO properties are those where the owner is selling directly without the involvement of a real estate agent. Investors can often find FSBO listings on various online platforms, local classified ads, or even through word-of-mouth referrals.

To leverage FSBO listings successfully, investors should actively monitor these sources, as these properties may not be as prominently advertised as those listed by real estate agents. Additionally, they can approach FSBO sellers with attractive offers and flexible terms, as these sellers may be more open to negotiation than traditional sellers. By tapping into this market segment, investors can access a broader range of potential investment opportunities and possibly secure properties at favorable terms.

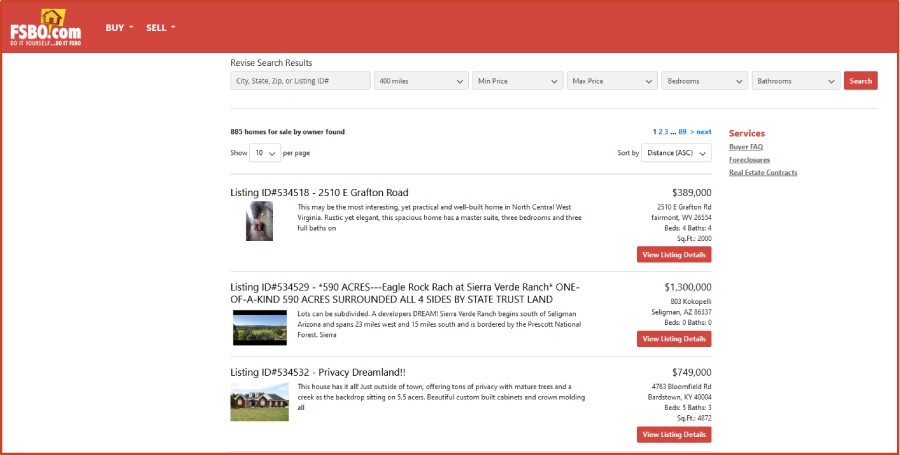

The FSBO.com search page (Source: FSBO.com)

Unlock exclusive opportunities for real estate investors to discover prime for sale by owner properties at FSBO.com—one of the most popular websites for FSBO listings. Explore the platform and gain access to unique investment opportunities. You can search by location, price, and property features to find “by owner” investment properties for sale.

13. Real Estate Wholesalers

Real estate investors can strategically leverage wholesalers to identify promising investment properties. Wholesalers are individuals or companies that specialize in sourcing distressed or off-market properties at a discount and then selling them to investors for a profit. Investors can connect with wholesalers through local real estate networks, attend networking events, or explore their company or personal websites. By doing so, they can access a stream of potential investment deals that may not be readily available on the open market.

14. Social Media

Real estate investors can effectively leverage social media to discover investment properties for sale. Platforms like Facebook, Instagram, and LinkedIn host many real estate groups and communities where investors can network and share insights. Investors can also harness the targeted advertising features on platforms like Facebook and Instagram to reach specific demographics and geographical areas.

By crafting well-targeted social media ads that showcase their investment preferences and goals, investors can capture the attention of potential sellers who align with their criteria. Social media platforms also serve as valuable sources for staying updated on local real estate trends, engaging in discussions about property markets, and accessing industry news—providing crucial insights for making informed investment decisions. A professional social media page is an excellent way to attract and build a network, which also helps with targeted ads.

LinkedIn is an excellent platform for building your professional brand and leveraging your network. Use these steps to find investment opportunities on other social media platforms besides LinkedIn to develop brand awareness, grow your network, and find prospective sellers.

15. Advertisements

Placing ads to find investment properties for sale can be a strategic approach to discovering lucrative opportunities. Begin by crafting compelling ads highlighting your investment criteria, such as property type, location, and budget. These real estate ads can be placed in local newspapers, magazines, and online platforms like Craigslist. Including your contact information and a clear call to action will allow potential sellers to contact you directly.

In addition to traditional advertising, you can use social media to engage online, express your interest in purchasing investment properties, and actively participate in real estate-related discussions. Building relationships within these networks can lead to valuable connections with sellers who may have yet to publicly list their properties. Combining traditional advertising with digital strategies, you can significantly enhance your prospects of finding investment properties for sale through strategic ad placements.

Market Leader marketing automation (Source: Market Leader)

Easily establish a direct lead funnel using Market Leader. Benefit from its marketing automation tools, including single-property websites, posting on Facebook and LinkedIn, predesigned flyers and postcards, and access to a comprehensive digital and print marketing content library.

The more specific you are in your ads about the type of investment property you’re looking for, the easier it will be for prospective sellers to find you. If you’re unsure of which type of investment property you want to buy, here are a few articles on some types to consider:

- How to Buy an Apartment Complex: Guide for First-time Buyers

- How to Buy & Manage a Vacation Rental Property in 9 Steps

- What Is a Duplex vs Triplex vs Fourplex? A Comprehensive Guide

- How to Buy a Mobile Home in 8 Steps

- How to Buy Land in 7 Steps

16. Cold Calling

Cold calling is a strategic way to find properties not yet for sale. Begin by outlining your investment criteria—choosing a location, property type, or specific targeted properties. Next, gather property owner contact data from public records, online databases, or providers. Create an engaging cold-calling script to introduce yourself, express interest in their property, and highlight the advantages for potential sellers.

Cultivate a professional rapport with property owners, listening attentively to their needs and customizing your pitch to address their financial or maintenance-related concerns. Although not every call may yield instant results, persistent follow-up with interested sellers and meticulous lead tracking via a customer relationship manager (CRM) system can sustain a steady stream of potential investment opportunities. Always maintain compliance with solicitation laws and regulations, including “Do Not Call” lists and local statutes.

17. Neighborhood Drive-bys

Real estate investors can learn how to find investment properties by driving through neighborhoods where they want to own property. Begin by selecting neighborhoods matching your investment criteria, considering the location, property type, and budget. During your drive, watch for “For Sale” signs, properties in disrepair, or homes with overgrown lawns, as these may indicate motivated sellers or distressed properties worth exploring further. Note down property addresses and conduct thorough research to assess their investment potential, including market trends, rents, and property values in the area.

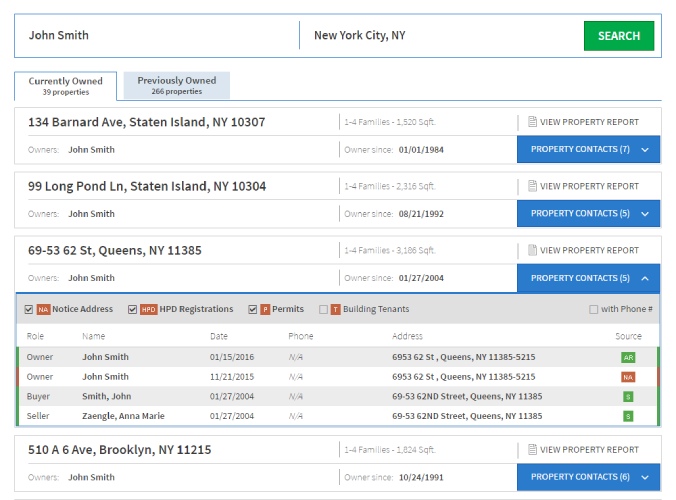

Real estate search and property information (Source: PropertyShark)

PropertyShark is a comprehensive real estate data and analytics platform that offers vital insights for property professionals and investors. It provides access to detailed property records, ownership information, sales history, and property values, making it valuable for in-depth property analysis and market research. PropertyShark empowers users to make informed real estate decisions by providing access to crucial data and market trends.

18. Passive Real Estate Investing

Real estate investors can use passive investment avenues like Real Estate Investment Trusts (REITs) and real estate crowdfunding to invest without the responsibilities of direct ownership. These opportunities provide regular dividends and potential capital appreciation, ideal for passive income. Real estate crowdfunding allows investors to pool resources for property projects or acquisitions.

REITs and real estate crowdfunding enable investors to tap into real estate’s wealth-building potential without active property management. However, due diligence is crucial. Understanding risks and aligning investments with financial goals is essential when exploring these passive real estate investment options.

You can find REITs on major stock exchanges and buy shares through brokerage accounts, just like individual stocks. Additionally, REITs are often available through mutual funds and exchange-traded funds (ETFs) that focus on real estate, providing a diversified approach to REIT investments.

Frequently Asked Questions (FAQs)

The “1 rule,” also known as the “1% rule” in real estate investing, is a guideline used to assess the potential profitability of a rental property. It suggests that a property’s monthly rental income should ideally equal or greater than 1% of its total acquisition cost (including purchase price and initial renovation costs). Meeting this rule can indicate that the property has the potential for positive cash flow and may be a viable investment.

Buying real estate as an investment involves setting clear objectives and assessing your finances. Research the market to identify suitable properties that align with your investment goals. Once you’ve found a property, conduct due diligence, which includes inspections and financial analysis. Negotiate terms and, upon agreement, complete the purchase. If you plan to rent the property, consider property management or self-management and consistently monitor and optimize your investment for long-term success.

To invest in real estate for passive income, define your investment goals, such as rental income from property, dividends from real estate stock, or passive income from crowdfunded real estate. Next, research and identify the right type of property or investment platform that aligns with your objectives. Acquire the property or invest through the platform, and then delegate property management responsibilities, like maintenance and tenant management, to a property manager, allowing you to enjoy passive income while others handle the day-to-day operations.

Bottom Line

You can use these 18 tips on how to find investment properties for sale to locate a good deal, but make sure to do your due diligence. Start by working with a local real estate agent specializing in investment properties, and then use online real estate listing platforms to broaden your search, join investment groups, leverage your network, and make a few calls. Carefully analyze property details, location, and rental income or appreciation potential before making a purchase decision.