Commercial real estate statistics guide investors, property managers, and business owners in navigating the history and trends of various commercial property types. These data points provide details on the current market so you can ensure your commercial property investment will appreciate in value, that vacancies will remain low, and that rents will continue to increase. They also help you budget and plan for future capital investments.

In this article, I researched key commercial real estate statistics in 2024 from 11 different sectors and analyzed current trends. However, I excluded special-purpose commercial real estate (CRE) since it can overlap with other sectors.

General Commercial Real Estate Statistics

The general commercial statistics in this section serve as an overview of the commercial real estate market report, while the rest focuses on specific CRE sectors. According to the National Association of REALTORS (NAR), for most of 2023, nearly every commercial real estate market segment experienced a continuous rise in job growth and the inflation rate eased.

1. The commercial real estate economy added 2.8 million jobs to the market

In November 2023, there were more than 157.1 million jobs available across the U.S., with the commercial real estate economy adding about 2.8 million jobs in its sector. This growth indicates a positive impact on the economy, promoting business expansion and creating a higher demand for commercial real estate.

Month, Year | Number of Jobs |

|---|---|

March 2020 | 150.9 million |

November 2022 | 154.3 million |

November 2023 | 157.1 million |

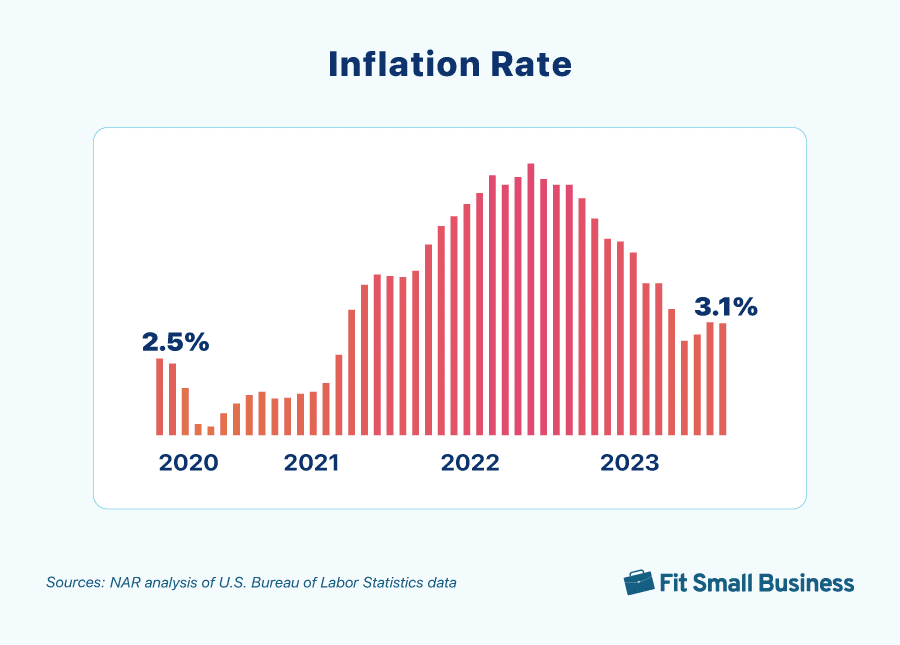

2. Inflation continues to ease at 3.1%

Inflation may not have yet reached the Federal Reserve’s goal of 2%, but it’s considerably lower than the previous year. As of November 2023, the inflation rate stood at 3.1%, significantly lower than 7.1% a year ago. However, NAR forecasts that the inflation rate will further ease in the following months, driven by a continued slowdown in rent growth, dropping to 2.7% in 2024. Since inflation continues to lower, this means a boost of purchasing power, which ultimately leads to an acceleration in economic growth.

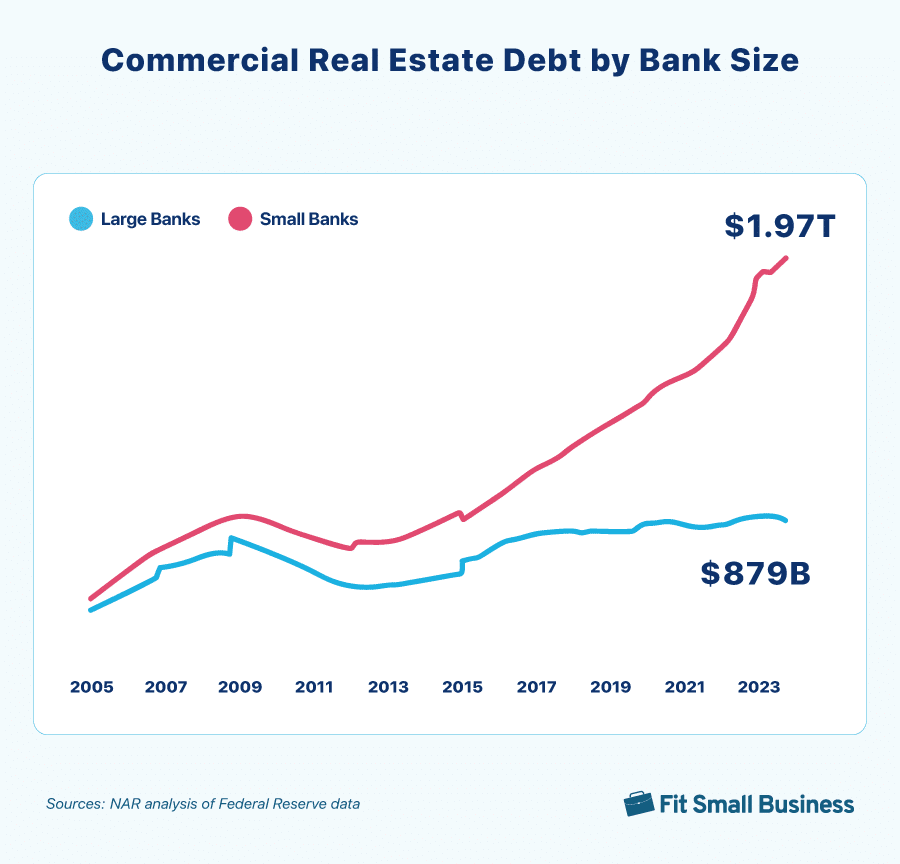

3. Commercial real estate debt is increasing

Commercial real estate debt continues to grow and is currently larger than the levels observed before the collapse of two regional banks—Silicon Valley Bank and Signature Bank. In April 2023, the CRE debt of small domestically chartered commercial banks was at $1.97 trillion; for large domestically chartered banks, it was $879 billion.

Key Takeaways on General CRE Statistics

- Comparing commercial and residential real estate in a post-pandemic world, the commercial economy continues to exhibit remarkable strength. It achieved new record highs in available jobs, reaching beyond 157 million.

- As inflation will continue to ease in 2024, we could expect inflation to decrease to 2.7% based on NAR’s forecast.

- The CRE debt for small banks will continue to rise while the debt for large banks is slightly lower.

Multifamily Sector Statistics

The commercial multifamily sector includes residential properties with five or more units, apartment complexes, and groups of multifamily complexes. According to commercial real estate market data, with mortgage rates above 7.5%, the multifamily sector saw an increase in apartment demand in the second half of the year after a nearly year-long decline.

Because of the construction boom, vacancy rates kept rising, hitting 7.4% at the end of the year, which reduced rent growth to 0.6%. Rent increases from the prior year persisted, albeit more slowly.

4. Rockford, Illinois, has the fastest rent growth

Rockford, Illinois, has emerged as a significant player in the real estate market, ranking first with the fastest rent growth at 6.67% as of Q4 of 2023. This growth, which is 0.53% higher than the previous year, is a testament to the robust demand for multifamily units in the area. This trend is particularly advantageous for property owners as it opens up opportunities to generate more income. Rockford is followed by Providence, Rhode Island (5.52%), Anchorage, Alaska (5.42%), and Rochester, New York (5.23%).

Top 10 Areas With Fastest Rent Growth | ||

|---|---|---|

2023 Q4 | 2022 Q4 | |

Rockford, IL | 6.67% | 6.14% |

Providence, RI | 5.52% | 5.38% |

Anchorage, AK | 5.42% | 7.71% |

Rochester, NY | 5.23% | 5.69% |

Kingsport, TN | 5.12% | 12.52% |

Syracuse, NY | 5.03% | 6.41% |

Huntington, WV | 4.65% | 2.32% |

Lexington, KY | 4.63% | 7.32% |

Worcester, MA | 4.61% | 5.03% |

Springfield, MA | 4.54% | 5.89% |

While some areas are experiencing significant growth, it’s important to note that not all markets are thriving. Rent reductions are still significant in Austin, Texas, Fort Myers, Florida, and Ocala, Florida, with more than 5% year-over-year (YoY) drops. The situation is challenging for property owners in these areas, as they can only generate limited income and have little room for rent increase.

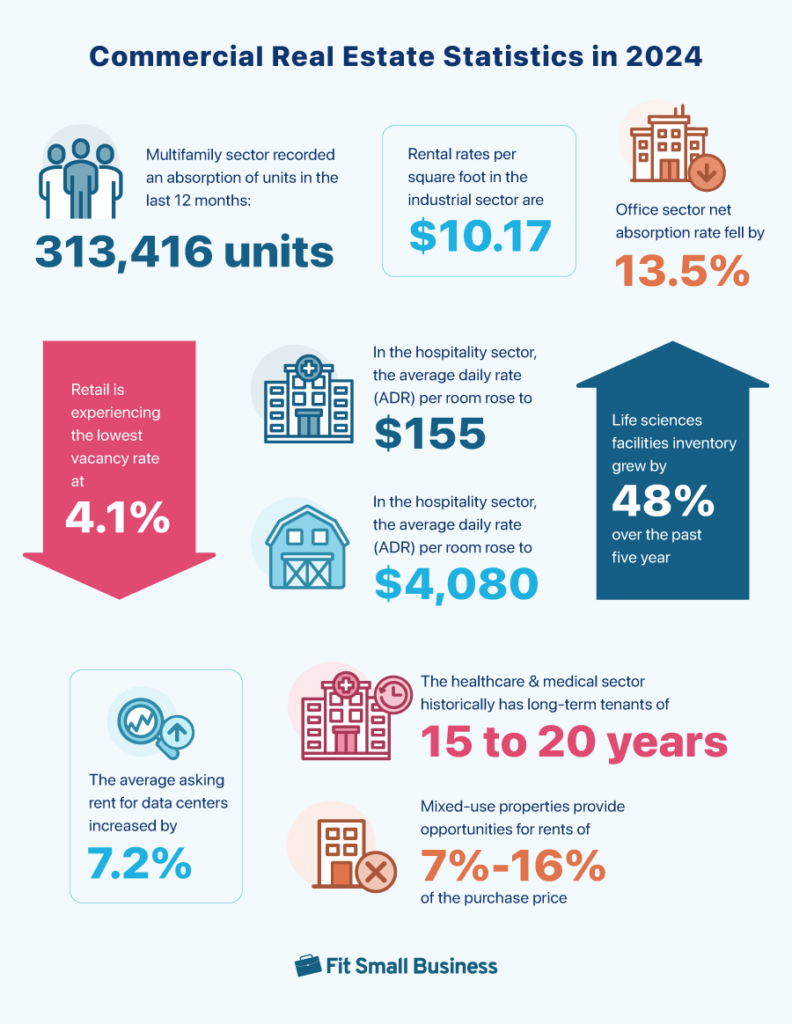

5. Absorption of units in the last 12 months increased to 313,416 units

Demand for multifamily properties is soaring, as evidenced by the 114% YoY increase in 12-month absorption of units, which reached 313,416 units and exceeded the 10-year median. The vacancy rate, however, has surged to a 10-year high of 7.4%, up 0.9% from the previous year, mainly due to a 22% increase in 12-month new unit deliveries.

Top 10 Areas With the Strongest 12-month Absorption | ||

|---|---|---|

2023 Q4 | 2022 Q4 | |

New York, NY | 18,992 | 27,254 |

Houston, TX | 12,880 | 970 |

Dallas-Fort Worth, TX | 11,925 | 2,949 |

Washington, DC | 11,543 | 8,571 |

Austin, TX | 9,684 | 6,650 |

Phoenix, AZ | 9,487 | 2,924 |

Minneapolis, MN | 8,943 | 7,038 |

Denver, CO | 7,618 | 7,701 |

Charlotte, NC | 7,460 | 3,626 |

Chicago, IL | 7,402 | 7,565 |

There is still a high demand for apartments in major urban areas, including New York, New York, Washington, D.C., and Houston and Dallas-Fort Worth, Texas. In 2023 Q3, these areas absorbed more than 10,000 multifamily units. Although many potential buyers’ purchasing power has decreased due to rising mortgage rates, the rental market is expected to continue to be strong in many high-cost areas in the U.S.

6. Over 950,000 multifamily housing units were under construction in Q2 of 2023

Due to surging housing demand in 2021 and 2022, more than 469,000 multifamily housing units were constructed, and over 950,000 units were developed into the second quarter of 2023. However, with slow job growth, the demand for multifamily housing decreased.

Key Takeaways on the Multifamily Sector

- Commercial real estate market statistics indicate that multifamily is an excellent real estate investment, especially for beginners, despite economic uncertainty and rising interest rates.

- More people will choose to rent rather than buy a home due to housing shortages, stagnant income, and lack of savings for a down payment.

Office Building Sector Statistics

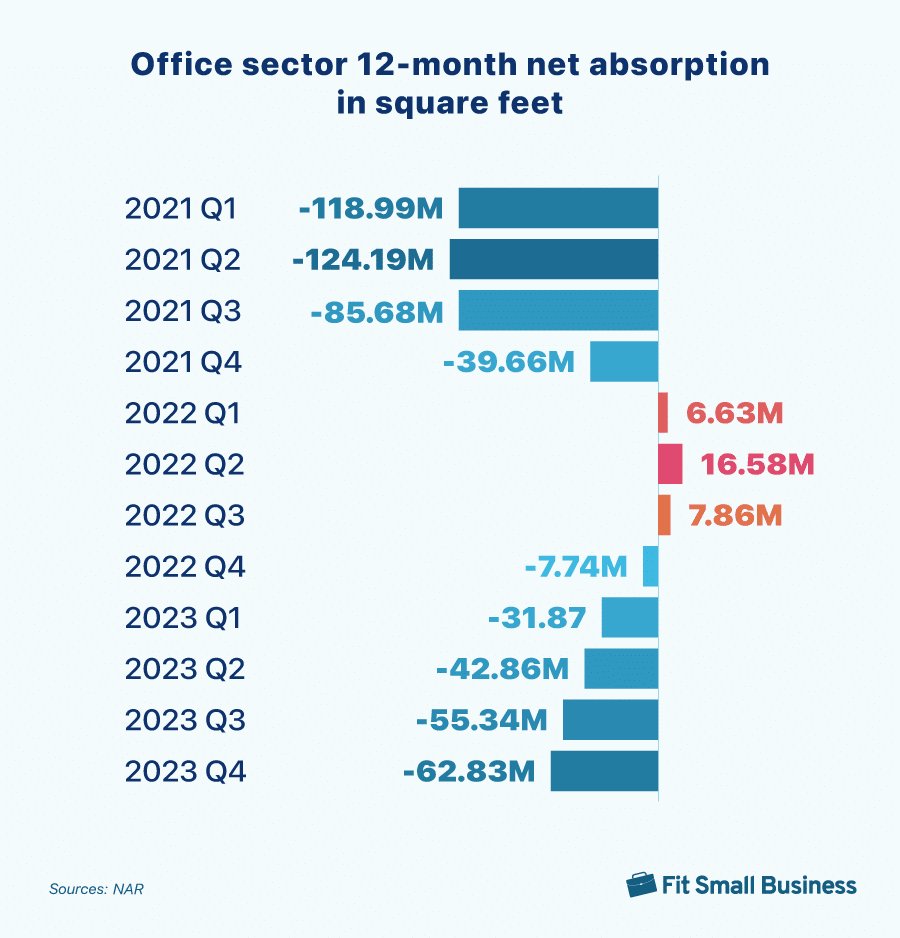

Office buildings offer leased spaces for small to large for-profit businesses and nonprofit agencies. With commercial real estate, the office sector continued to be the most severely impacted, suffering the most losses in 2023 and experiencing a record high of over 14% in office vacancy rates. Also, net absorption has been adverse throughout 2023 despite decreased leasing velocity and a significant surplus of office spaces.

7. Office sector net absorption rate fell by 13.5%

Over the past 12 months (ending in November), the net absorption rate for the office sector fell by 13.5%. This led to a subtle increase in vacancy rates of 0.2%, culminating in a record peak vacancy rate of 13.5%. This is due to the shift toward hybrid work arrangements becoming more prevalent, resulting in declining demand for office spaces.

8. San Francisco, California, has the highest vacancy rate

In 2023 Q4, a significant rise in vacancy rates occurred in prominent technology centers, such as San Francisco, California (21.46%), Houston, Texas, (18.74%), Dallas-Fort Worth, Texas, (17.98%), Austin, Texas (16.70%), and Washington, D.C. (16.51%). This shift has been driven by many businesses and people relocating to more affordable areas like Mississippi, Alabama, and Arkansas. High rental vacancy rates can indicate an oversupply of rental units, resulting in lower prices and less competition.

Top 10 Areas With the Highest Vacancy Rates | ||

|---|---|---|

2023 Q4 | 2022 Q4 | |

San Francisco, CA | 21.46% | 16.42% |

Houston, TX | 18.74% | 18.37% |

Dallas-Fort Worth, TX | 17.98% | 17.16% |

Austin, TX | 16.70% | 13.90% |

Washington, DC | 16.51% | 15.69% |

Denver, CO | 16.49% | 14.62% |

Chicago, IL | 16.22% | 15.20% |

Phoenix, AZ | 16.07% | 14.71% |

Los Angeles, CA | 15.44% | 14.33% |

Atlanta, GA | 15.24% | 13.88% |

9. Savannah, Georgia, has the lowest vacancy rate

Southern metropolitan areas are experiencing the lowest vacancy rates. Savannah, Georgia, with a vacancy rate of 1.59%, and Wilmington, North Carolina, with a rate of 1.76%, are the most sought-after areas for office space. These low vacancy rates indicate a high demand for properties, and as a result, landlords can charge higher prices because of more competition for available units.

Top 10 Areas With the Lowest Vacancy Rates | ||

|---|---|---|

2023 Q4 | 2022 Q4 | |

Savannah, GA | 1.59% | 2.18% |

Wilmington, NC | 1.76% | 1.98% |

Hickory, NC | 2.08% | 2.98% |

Huntington, WV | 2.09% | 1.92% |

Olympia, WA | 2.25% | 2.21% |

Pensacola, FL | 2.27% | 2.33% |

Myrtle Beach, SC | 2.28% | 2.05% |

Davenport, IA | 2.30% | 3.19% |

Asheville, NC | 2.44% | 2.58% |

Gulfport-Biloxi, MS | 2.47% | 3.17% |

Key Takeaways on the Office Sector

- The commercial real estate statistics show that since the COVID-19 pandemic, office buildings have suffered the most of all commercial real estate types due to many businesses switching to totally remote or hybrid office/remote work arrangements.

- If vacancies are a concern, consider repurposing office space into a mixed-use property with a combination of retail, office, and multifamily housing or different viable combinations.

Industrial Sector Statistics

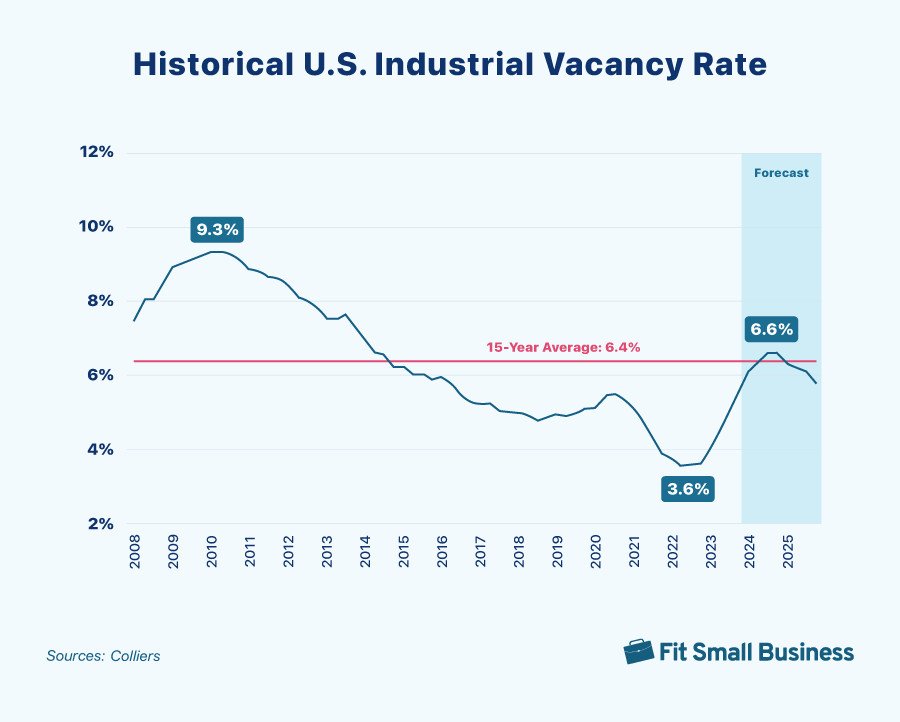

Industrial real estate is used for manufacturing, warehousing, distribution, storage, research, and assembly. In 2023, the industrial sector outperformed all other sectors, with online shopping creating a need for more warehouses and storage facilities. Although the rent prices did not increase as quickly as in 2022, the cost of renting industrial space increased by 6.6% YoY. However, vacancy rates and net absorption decreased even further after a 31% increase in delivered square footage over the past year.

10. Supply & demand issues caused vacancy rates to rise to 5.55%

Due to overall supply outpacing demand, including new developments, the average vacancy rate in the United States grew by 194 basis points during the past year to 5.55%, the highest level since 2016. Vacancy rates are anticipated to level out in the second half of 2024 at roughly 6.6%, a workable point where renters have more lease options and the market isn’t overly crowded. This gives industrial property owners more room for rent growth and competition, allowing them to generate more potential income.

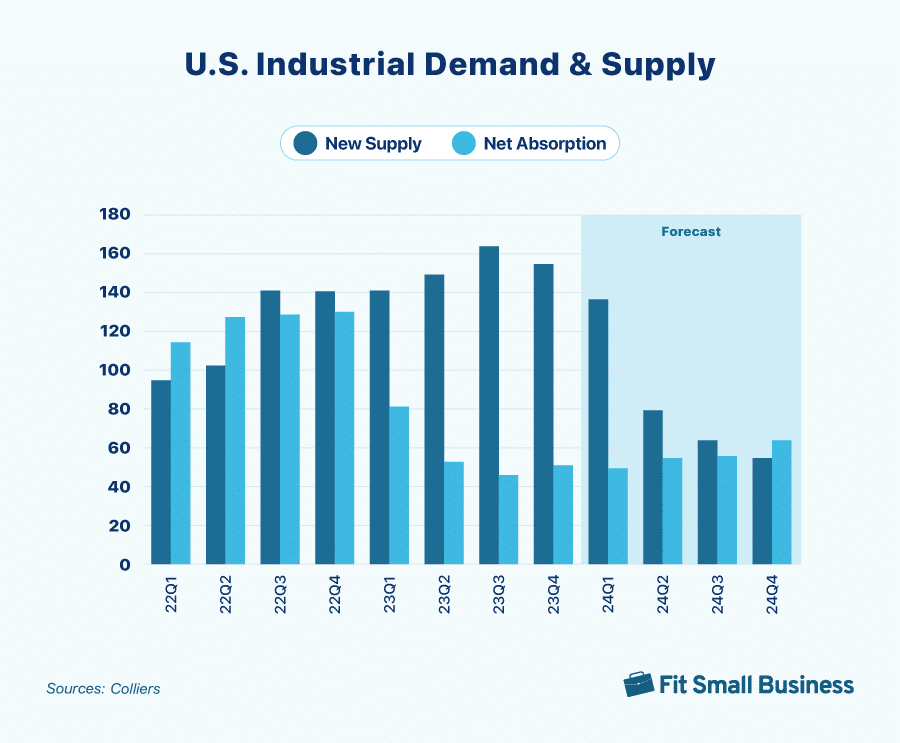

11. The 2023 net absorption is recorded at 230.6 million square feet

In response to the high demand in 2021 and 2022, industrial developers completed a record 607 million square feet of new supply in 2023. Meanwhile, as shown by net absorption, the demand came to almost 231 million square feet, which was higher than the pre-pandemic total of 219 million square feet in 2019 but a 54% decrease from 2022. The forecasted continuous increase in net absorption indicates a good demand for industrial commercial space. This means the industrial market is growing healthily.

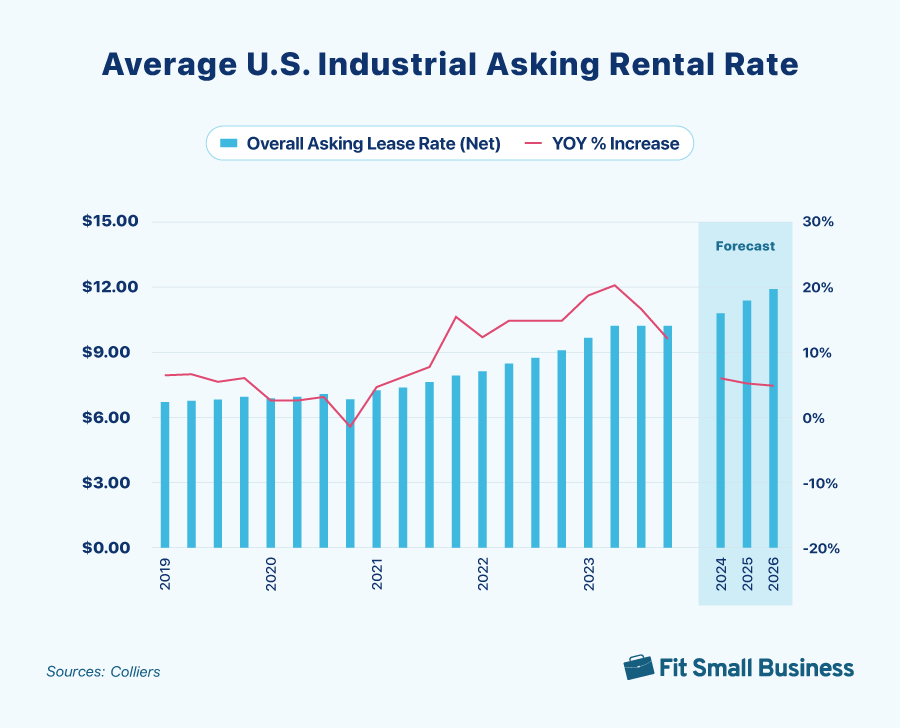

12. The CRE rental rate per square foot is $10.17 in the industrial sector

During the second half of 2023, rent growth slowed after many quarters of historically high increases of over 15% YoY. After exceeding $10 per square foot on average in 2023, average net rents are projected to increase over the next three years at a pace more consistent with the historical average of about 5%. This is good news for commercial property owners and investors as there will be more room for growth and profit.

Key Takeaway on the Industrial Sector

- The industrial real estate sector experienced extensive growth after the pandemic, but in 2024, it is expected to become more balanced with the current economic uncertainty.

Retail Sector Statistics

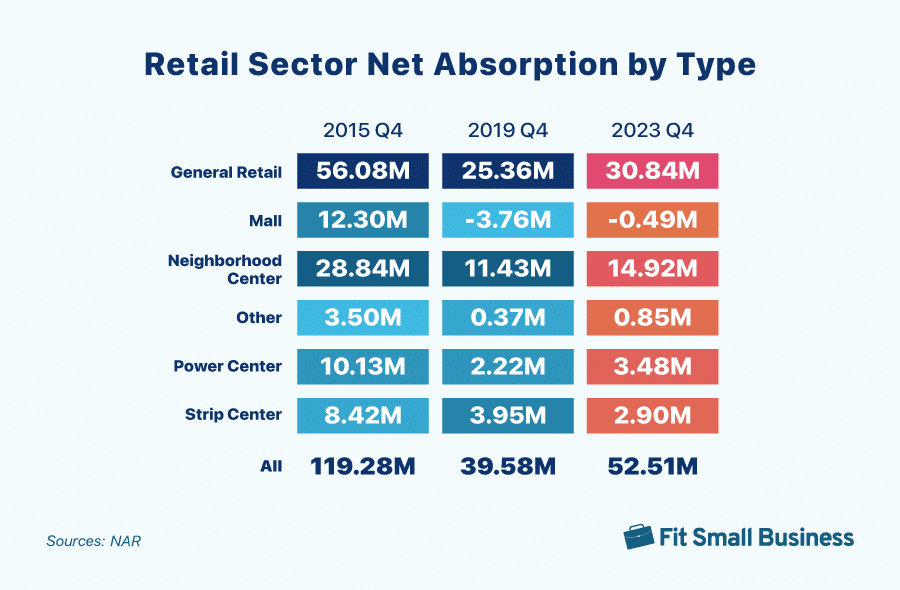

Retail CRE is property used for commerce, such as shopping centers, malls, stores, and franchises. Retail statistics show that slower rent growth has also been observed. However, despite the challenges brought on by high consumer prices, this sector outperformed the pre-pandemic in 2023. As shown in the retail real estate trends: rent prices increased faster, the absorption of retail space increased, and the vacancy rate held steady at 4.1%, a 10-year low.

13. General retail is experiencing the lowest vacancy rate in the sector at 4.1%

The industry is seeing the lowest commercial property vacancy rates in 10 years, despite absorption declining by 28% from 2022. Of all the commercial real estate categories, the retail sector currently has the lowest vacancy rate (4.1%). This means that general retail continues to be in high demand, although there is still hesitation because of rising consumer costs.

14. Shopping malls are experiencing vacancy rates of 8.8%

In contrast to discount and dollar stores, shopping malls are experiencing high vacancy rates (8.8%) due to changes in consumer spending. This has led to more bankruptcies and single-use spaces becoming available or purchased by Quick Service Restaurants (QSR) and fast-casual restaurants offering fast food items with minimal preparation time and delivery.

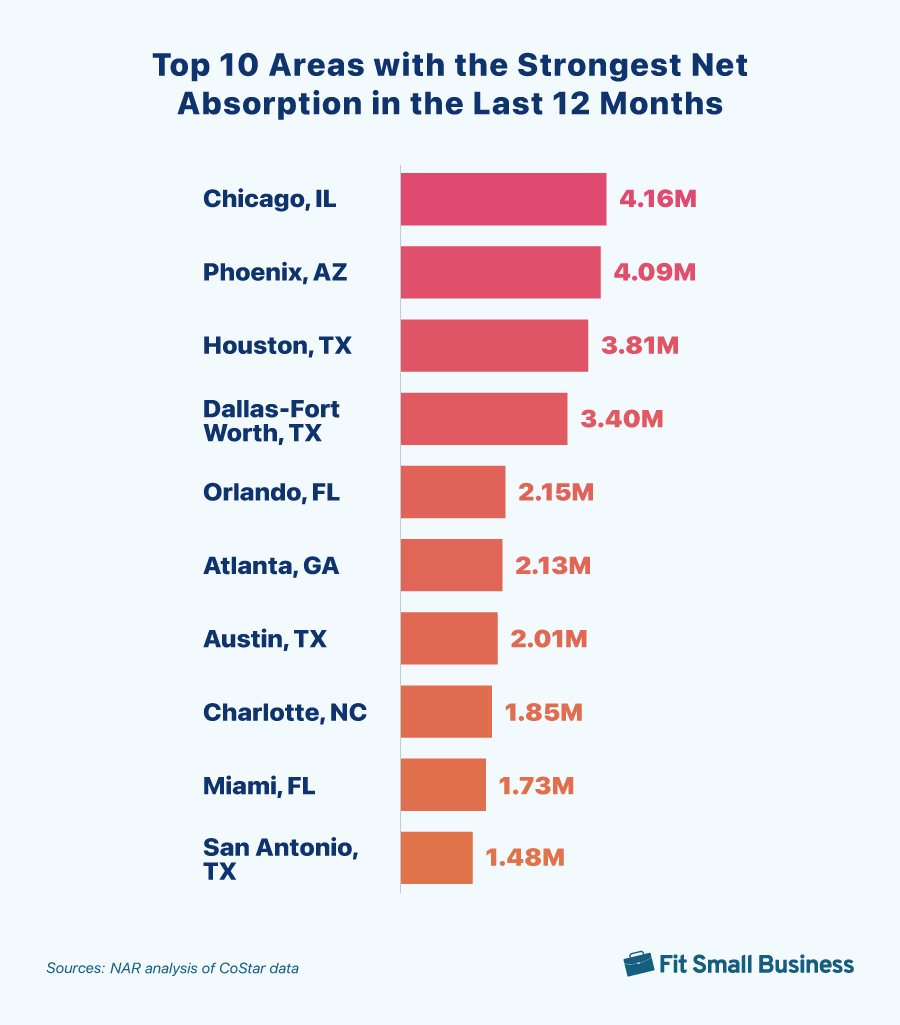

15. Chicago, Illinois, has the strongest net absorption in the last 12 months

Areas like Chicago, Illinois, Phoenix, Arizona, Houston, and Dallas-Fort Worth, Texas, have had a significant amount of net absorption in the retail sector. In the year preceding November 2023, these locations occupied more than 3 million square feet.

Key Takeaways on the Retail Sector

- General retail commercial real estate has experienced the most vigorous growth and will continue as more people shift their shopping habits.

- Commercial real estate market statistics show that with lower prices, online retailers and discount stores shift consumer spending as household incomes decline.

Hospitality Sector Statistics

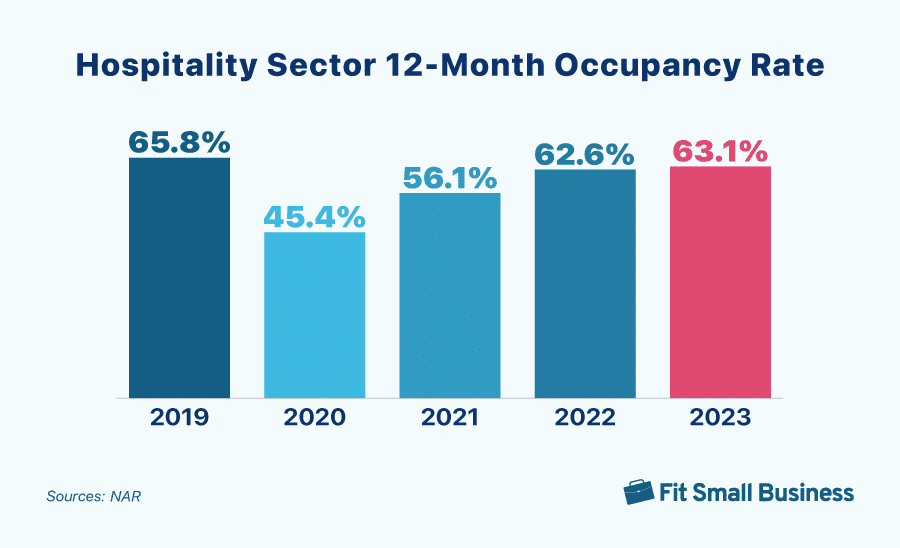

The hospitality and leisure commercial real estate sector includes many investment types, such as lodging, restaurants, spas, and resorts—providing leisure services for relaxation, vacation, and enjoyment. But even with the post-pandemic savings and pent-up desire for travel, hotel occupancy hasn’t fully recovered to pre-pandemic levels and isn’t predicted to do so in 2024.

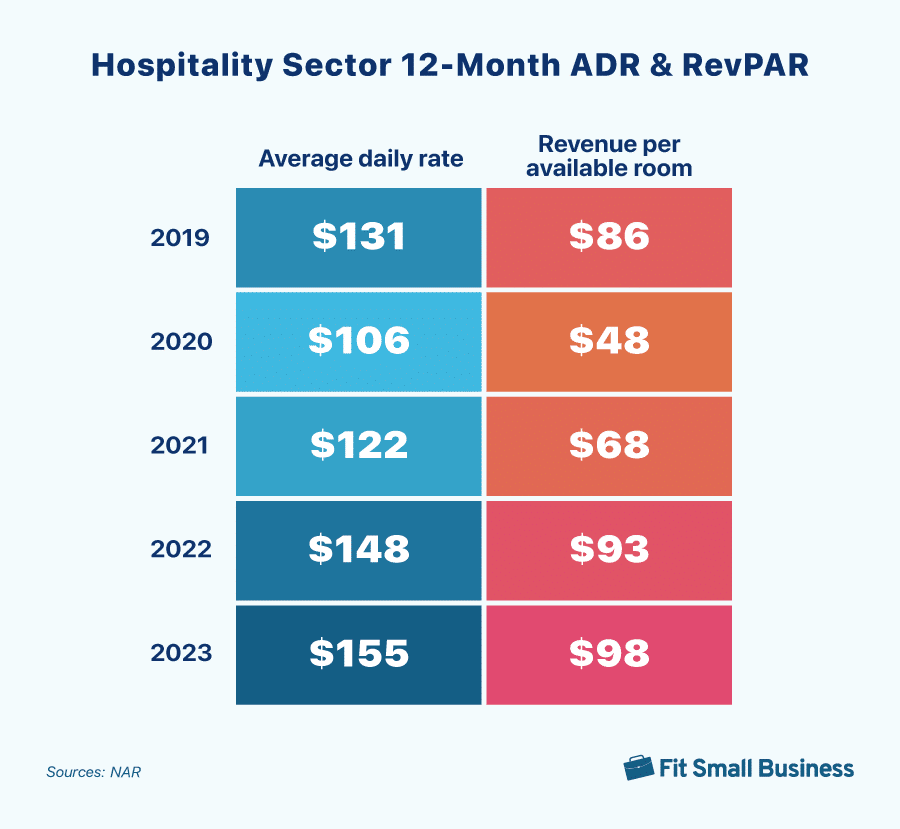

16. In the hospitality sector, the average daily rate (ADR) per room rose to $155

In the hospitality sector, the 12-month occupancy rate is 2.7%, lower than the pre-pandemic benchmark. However, in November 2023, the average daily rate (ADR) per room rose to $155 per room, up 18% from November 2019. The revenue per available room (RevPAR) also increased to $98 per room, up 13% compared to the same period in 2019.

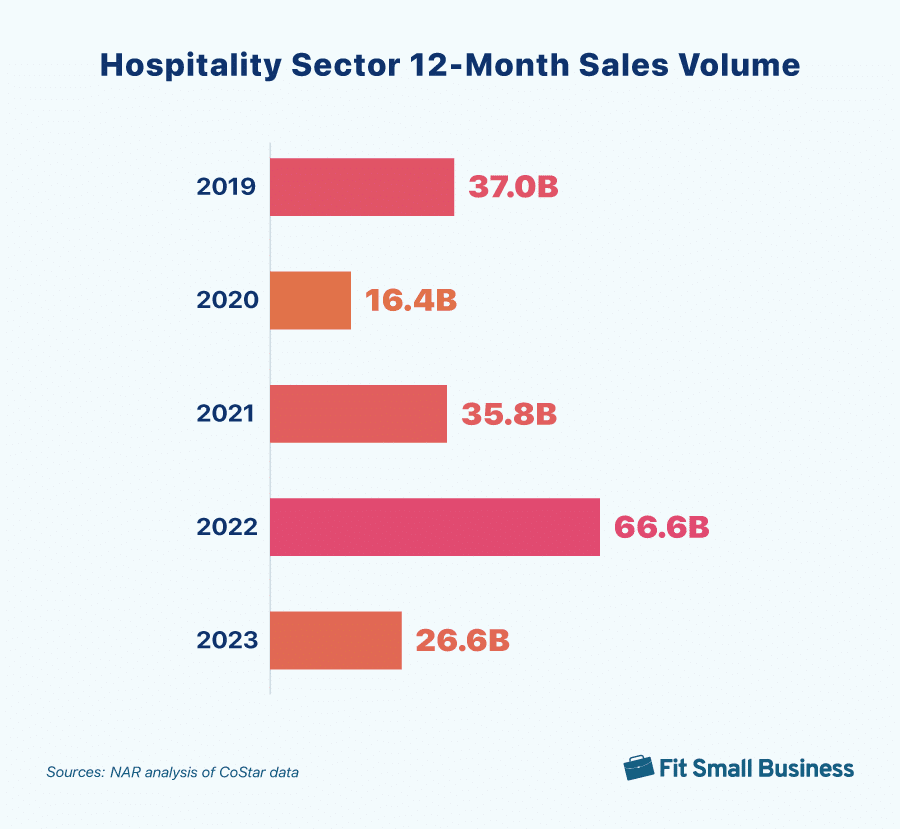

17. In November 2023, the sales volume dropped to $26.6 billion

Since the previous year, sales volume has significantly dropped. The 12-month sales volume decreased from $66.6 billion in November 2022 to $26.6 billion in 2023. This significant drop demonstrates how individuals are not traveling as much as in the past, which can be attributed to several factors, like loss of jobs, lower wages, or less disposable income.

18. Maui Island in Hawaii has the highest ADR & RevPAR

Hawaii’s Maui Island has experienced a notable increase in ADR of 54% since the start of the pandemic, making it a noteworthy player in the hospitality sector. It also boasts the highest ADR and RevPAR in the country, at $604 and $395, respectively.

Meanwhile, New York City reigns supreme as the busiest hotel center, with an 81% occupancy rate, and Sarasota, FL, has experienced an impressive 50% increase in hotel RevPAR. If you are considering investing in the hospitality real estate market, you may want to focus on New York and Hawaii for the optimal return on investment.

Key Takeaways on the Hospitality Sector

- The outlook for 2024 remains favorable, with stable leisure travel and increased business, group, and international travel. However, the sector will face challenges due to shifting consumer behavior and economic uncertainty.

- In 2024, growth in both ADR and RevPAR would likely moderate even further, and the occupancy rate is expected to stay below 65%.

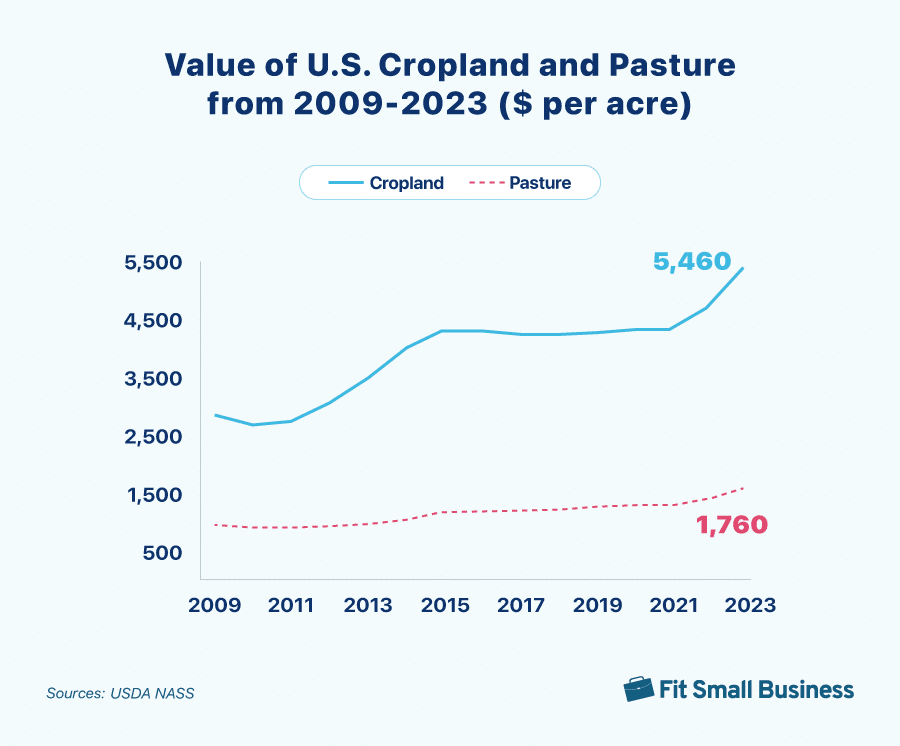

Commercial Land Sector Statistics

Commercial land is vacant real property typically bought, held, or used for development. Most commercial land statistics focus on crops and pasture farming properties. The CRE land sector is performing well overall, with commercial land lease rates, investment, and appreciation increasing across all land types.

19. The cropland value increased to $5,460 per acre; pastureland value increased to $1,760 per acre

The average value of U.S. cropland (irrigated and nonirrigated) was $5,460 per acre in 2023, increasing 8.1% from 2022. Meanwhile, for the pastureland, the average value in 2023 was $1,760 per acre, a $110 increase over 2022. This increase is good for real estate investors who want to purchase and rent farmland to startup farmers and food producers.

20. The farm real estate value averaged $4,080 per acre

The value of all farmland and buildings in the United States was $4,080 per acre on average in 2023, up $280 over the previous year. The highest increase in farm real estate values, at 13.7%, was seen in the Northern Plains region. This rise is advantageous for real estate investors as it indicates a positive effect regarding potential profit from property appreciation, rental income, or both.

Key Takeaway on the Commercial Land Sector

- Land is an excellent investment with proper business planning and due diligence for the reason that we cannot create more. However, investors and real estate agents who serve investors want to research the zoning ordinances and look for growth opportunities within the land’s location.

Mixed-use Property Sector Statistics

Mixed-use property is a type of commercial real estate with multiple purposes, such as multifamily apartments above a restaurant or retail shop. One benefit of mixed-use real estate is that the rent potential for commercial real estate is higher than for residential units, so they can offset each other in a challenging housing market.

21. Mixed-use properties provide opportunities for rents of 7% to 16% of the purchase price

A mixed-use property with both residential and commercial units can raise profits when combining the rent value of the two. Commercial rents are approximately 6% to 12% of the purchase price, whereas residential rates are between 1% and 4%. This is beneficial for investors as it indicates higher profits.

22. Office vacancies of 16.8% provide an opportunity for creating mixed-use rentals with higher income potential

With the rapid increase in office space vacancies (rising 16.8% in Q1 2023) and hybrid employment, mixed-use properties provide an opportunity for multiple rental units and revenue streams in a sector with higher demand.

Key Takeaway on the Mixed-use Property Sector

- Mixed-use CRE has two or more rental types within one property and can provide a hedge against declines in commercial real estate sectors. For example, in a mixed-use building with retail and multifamily housing, investors still have rental income in the balanced subsector if one is experiencing high vacancies and the other is stable.

Healthcare & Medical Sector Statistics

Healthcare and medical commercial real estate are properties leased to medical facilities, researchers, and private practices. With people living longer, the need for quality healthcare will continue to rise. Patients also want to find care closer to home, so hospitals and private practitioners have set up care centers and offices in more urban areas, and urgent care facilities are also increasing.

23. The healthcare & medical sector historically has long-term tenants of 15 to 20 years

During 2022 and 2023, the healthcare and medical sectors have provided an opportunity for real estate investors with tenant lease renewals of 80% or higher and steady rent increases of 2% to 3% a year. This sector historically has long-term tenants, some staying 15 to 20 years, making it an excellent investment.

24. Capitalization rates have seen an increase of 20 to 30 basis points

Medical office building capitalization rates (cap rates) have seen a steady upward trend from Q4 2022 to Q1 2023, a rise of 20 to 30 basis points. This indicates a risk in investing in this sector, despite growing demand. It also makes it harder to secure financing.

Medical office building cap rate and yield trends (Source: Revista)

Key Takeaways on the Healthcare & Medical Sector

- With an aging population, increased alternative medicine, and patients wanting medical services closer to home, the healthcare and medical sectors continue to grow.

- Urgent care, small private practices, hospitals, and hospital centers provide investment opportunities.

Life Sciences Sector Statistics

Life sciences facilities are used for research and development, laboratories, biotechnology, testing cures for diseases, and creating new medicines to advance health. They saw rapid increases during the pandemic and have now become steadier.

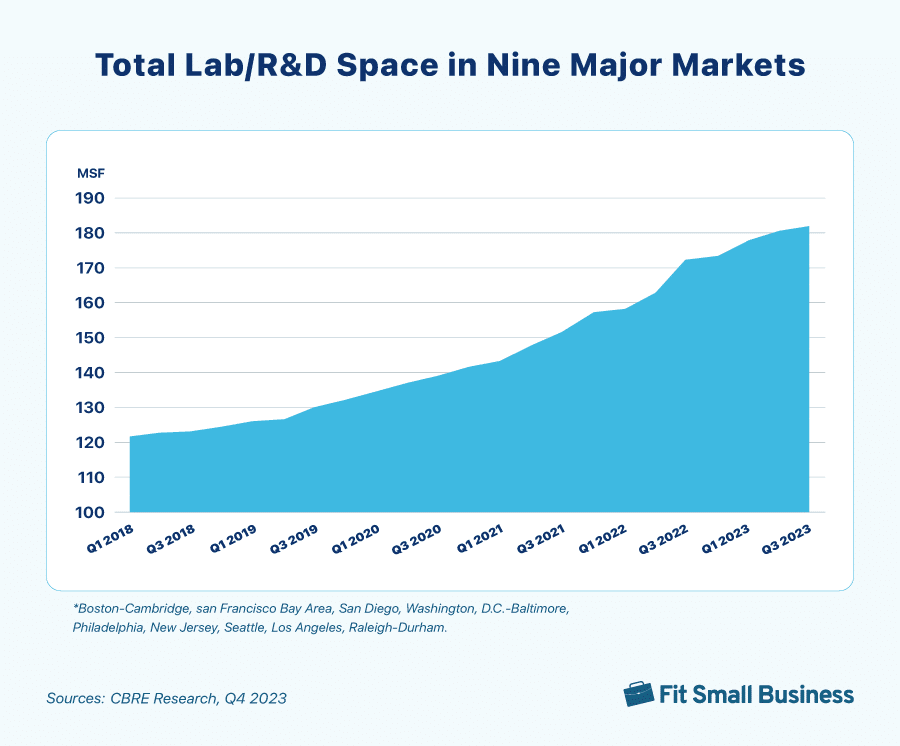

25. Life sciences facilities inventory grew by 48% over the past five years

The total inventory of lab and research and development space has grown by 48%, or roughly 59 million square feet, over the past five years. In 2024, construction deliveries of several million more square feet are expected to meet the increasing demands. These statistics indicate that the demand and competition will continue to rise, and more facilities will be available to produce more profits and advancements in healthcare.

26. Vacancy rates increased to 6.7% in 2023

There is still a significant demand for space, but there’s also a moderate uptick in vacancy rates in the life sciences sector, increasing 170 basis points YoY from 5.4% in 2022 to 6.7% in 2023. However, given the strong demand for life sciences, this increase in vacancy rates is expected to level off in the next year or two. This presents a good opportunity for real estate investors to take advantage of the market, as the demand is predicted to continue rising, leading to further opportunities for growth.

Key Takeaways on the Life Sciences Sector

- Commercial real estate market statistics show that life sciences saw a boom in 2021 and 2022 and leveled off in 2023. However, it is still above pre-pandemic growth.

- Life sciences will continue to be a good investment in the coming years and may increase by 20% over the next few years.

Data Center Sector Statistics

Data centers provide data management, backup, storage, and recovery. They are either owned by large companies or leased. Everything we do online is housed in a data center, so the demand for more space is increasing rapidly.

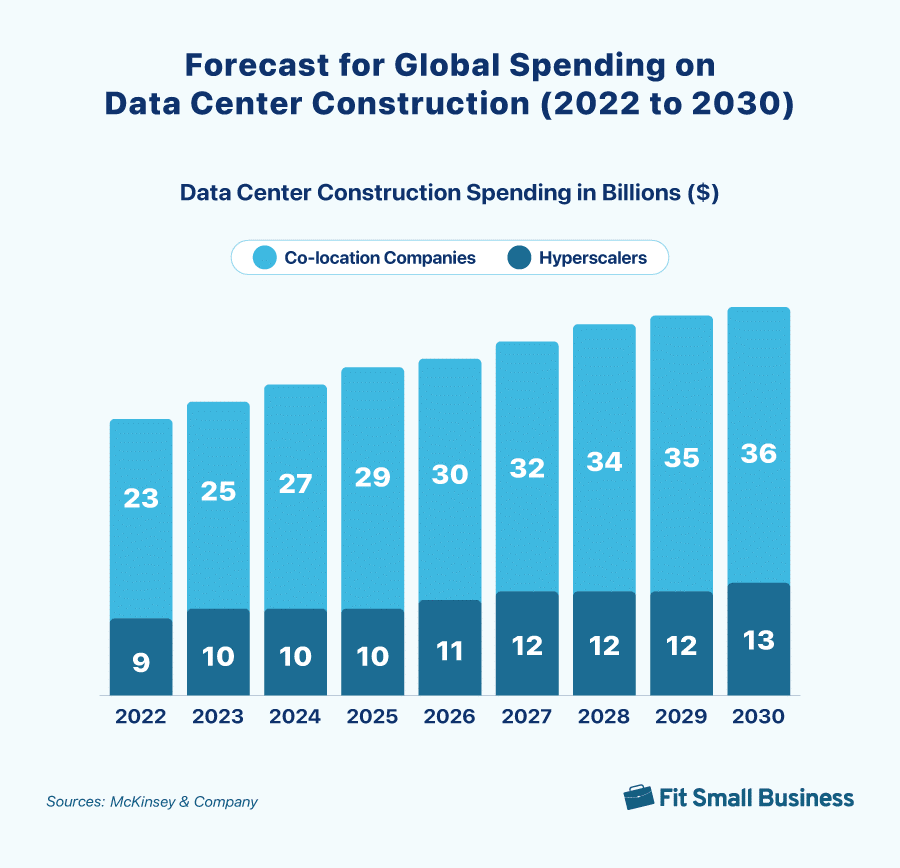

27. By 2030, data center construction spending is poised to reach $49 billion

According to McKinsey & Company, by 2030, spending for the construction of data centers will reach $49 billion. Since this is a growing trend, it’s wise for investors to get involved early on to reach the highest return on investment (ROI).

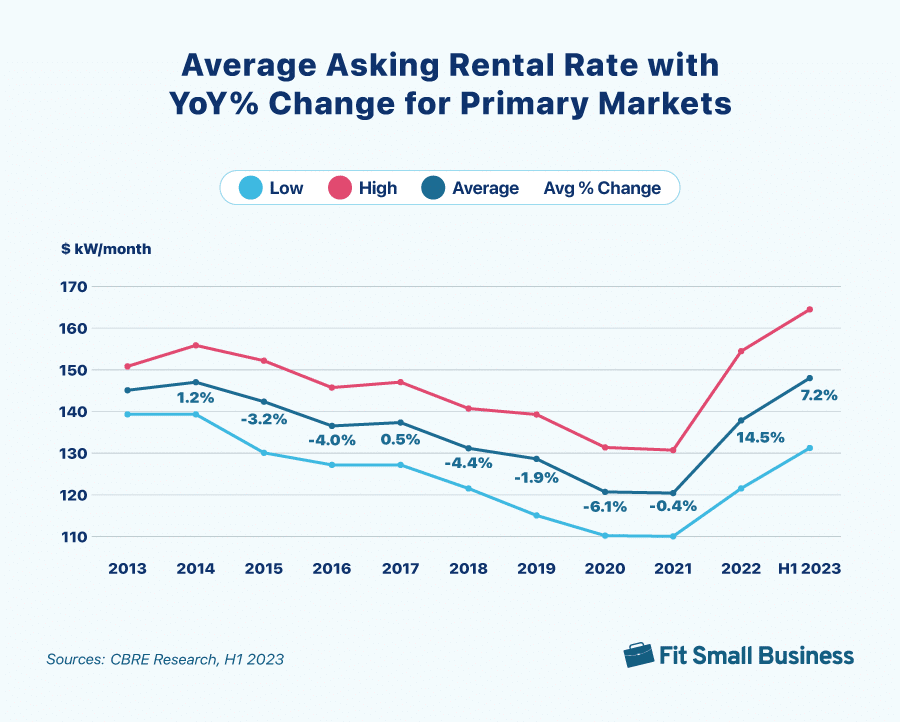

28. The average asking rent for data centers increased by 7.2% YoY

Due to limited supply and strong demand in the first half of 2023, the average asking rental price increased YoY by 7.2%. This increase is driven by access to a power supply and not geography, so investors should evaluate the location if they want to invest in existing data centers. Renewable energy sources should be assessed when planning to build a data center.

29. The construction pipeline showed record-low vacancy rates of 3.3%

The construction pipeline went up 25% YoY in primary markets and showed an overall vacancy rate of near a record low at 3.3%, whereas Northern Virginia’s vacancy rate is 0.94%, the lowest of all U.S. markets. This shows high demand for data centers and low available inventory, so new construction provides a strong investment opportunity.

Key Takeaways on the Data Center Sector

- Power supply issues will be the main barrier to additional growth in certain key markets. Hyper-scale demand will increase in secondary markets with less expensive land, more abundant power, and good tax incentives.

Frequently Asked Questions (FAQs)

According to Statista’s U.S. commercial real estate statistics[1], by 2024, the U.S. commercial real estate industry is expected to grow to an astounding $25.37 trillion. A noteworthy annual growth rate of 2.66% is also anticipated, resulting in a market volume of $28.18 trillion by 2028. Furthermore, the rise of remote work and the need for adaptability drive demand for flexible office spaces in the CRE market.

Based on Mordor Intelligence[2], Simon Property Group has the largest 2023 and 2024 market share in the United States. It is followed by Shannon-Waltchack, Progressive Real Estate Partners, John Propp Commercial Group, and Mohr Partners, ranking second, third, fourth, and fifth, respectively.

Hamid R. Moghadam is the co-founder, chairman, and CEO of Prologis, the largest logistics real estate company, with a portfolio of over 1 billion square feet in 19 countries. The company provides modern distribution facilities to support the global supply chain.[3]

Bottom Line

Understanding the current commercial real estate statistics, climate, and trends can point investors and agents toward properties with long-term growth and profitability potential. Due diligence is always vital, but additional information on CRE prices, vacancy rates, rent growth, construction, and top-performing sectors can narrow down which properties to consider.

1 Commercial Real Estate – United States by Statista

2 United States Commercial Real Estate Top Companies by Mordor Intelligence

3 Hamid R. Moghadam | Prologis