A business credit report is a snapshot of a company’s financial health. It shows details about the company’s debt and how it handled debt payments in the past. It is broken into various sections, each showing different information for company liens, outstanding loans, derogatory payment information, and recent credit applications.

Lenders and investors often use the information in a report to determine whether to issue funding to a business — and, if so, what rates and terms to offer. A report can also be used by potential business partners trying to evaluate the company’s financial health. For these reasons, it’s important to understand what information goes into your business credit report and how to read it.

Business credit reports can be obtained from different credit bureaus, although Dun & Bradstreet (D&B) is most commonly used by lenders. D&B also provides other products and services that allow business owners to monitor their business credit profile.

How to read a business credit report

Although the exact format and details of a business credit report may vary slightly depending on the company issuing the report, there are many sections you’ll commonly see. These are summarized below using a sample report from Experian, a provider that can give you access to your report and credit score.

- Business profile is a general overview of your company, such as its contact information, years in business, and business type.

- Business credit score and risk rating is a numerical score reflecting a particular type of risk associated with a company.

- Credit summary is a high-level overview of a company’s credit accounts, such as total balances, payment amounts, liens, delinquent accounts, and more.

- Account payment history typically provides details of each individual account, including creditor names, balances, payment terms, account types, and payment history.

- Credit inquiries contain details of recent applications for credit, such as the creditor name and the date they pulled a business credit report.

- Significant derogatory information details late payments, judgments, tax liens, bankruptcies, and foreclosures.

- UCC filings may contain details on if the business has pledged any items as collateral.

Business profile

One of the first sections you’ll likely see on your business credit report is a general profile of your company.

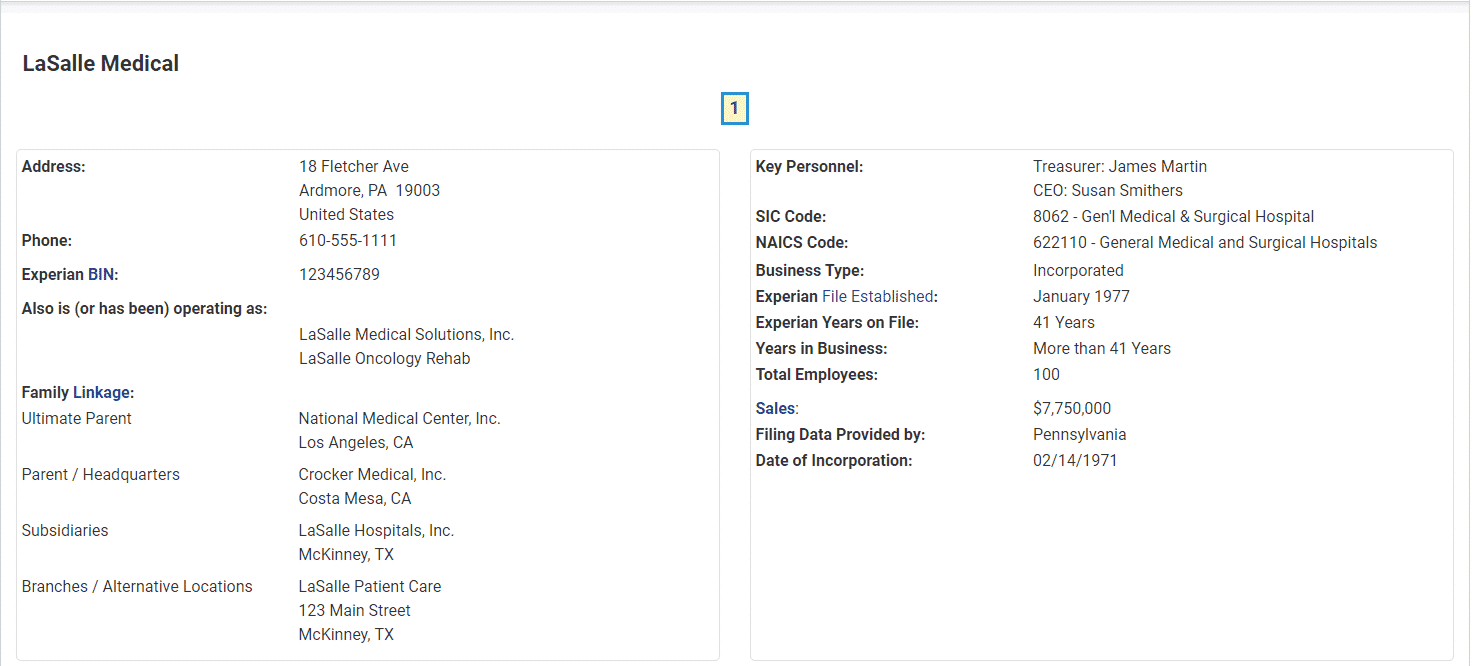

A business profile section taken from a sample credit report by Experian for a fictitious business. (Source: Experian)

This section contains information about your business, such as your company’s name, address, and other contact information. While most of the items are self-explanatory, this section may also contain less commonly used terminology that may include the following:

- BIN (Business Identification Number) is a unique number that the credit bureau uses to identify your company. It operates similarly to an Employer Identification Number (EIN) or Social Security Number (SSN).

- SIC (Standard Industrial Classification) Code corresponds to a US government system for identifying the industry in which your business operates. You can visit the US SEC’s SIC Code List to locate the SIC code for your industry.

- NAICS (North American Industry Classification System) Code is used to classify which industry your company operates in. Although similar to SIC codes, NAICS codes can provide a greater level of detail. You can visit the NAICS’s code by industry page to find your code.

Business credit score & risk rating

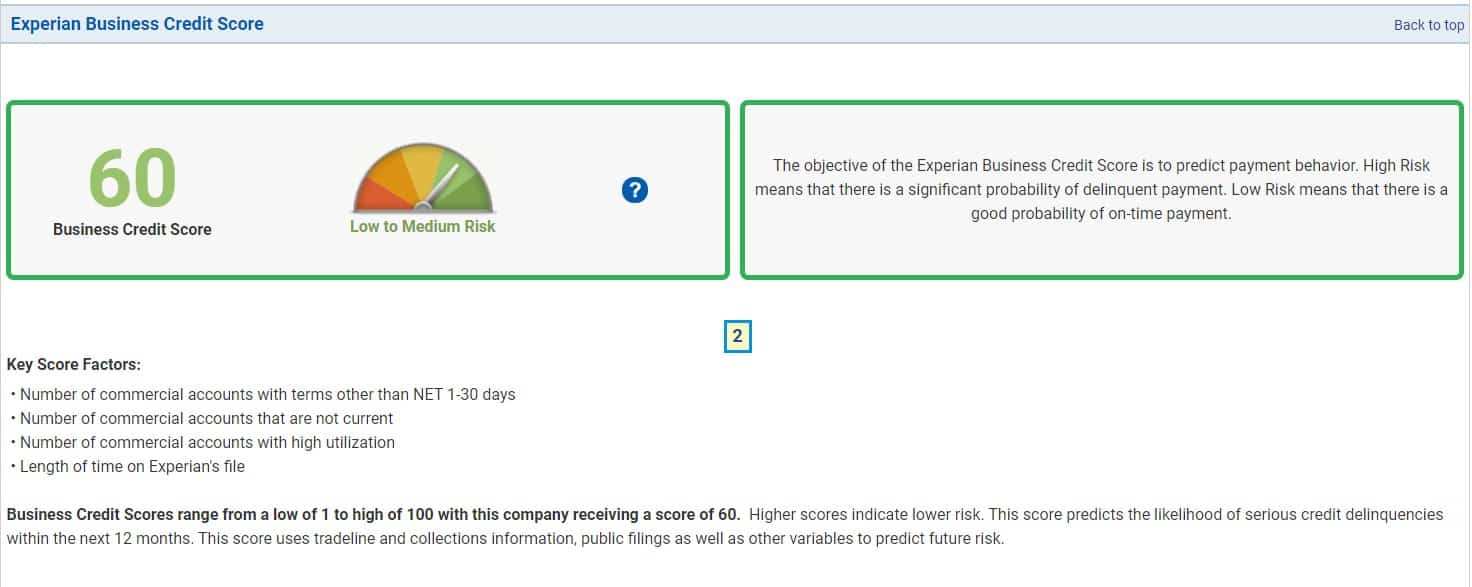

Depending on where you get your business credit report, you may also get a credit score. The image below is one example of a score you might get if you obtained a credit report through Experian.

An example of how Experian might display credit scores on its credit reports. (Source: Experian)

Credit scores are designed to illustrate your overall risk level, and different types of scores measure various risk factors. For example, some credit score models measure the likelihood of defaulting in the next 12 months, while others may assess the chance of your business going bankrupt.

Credit summary

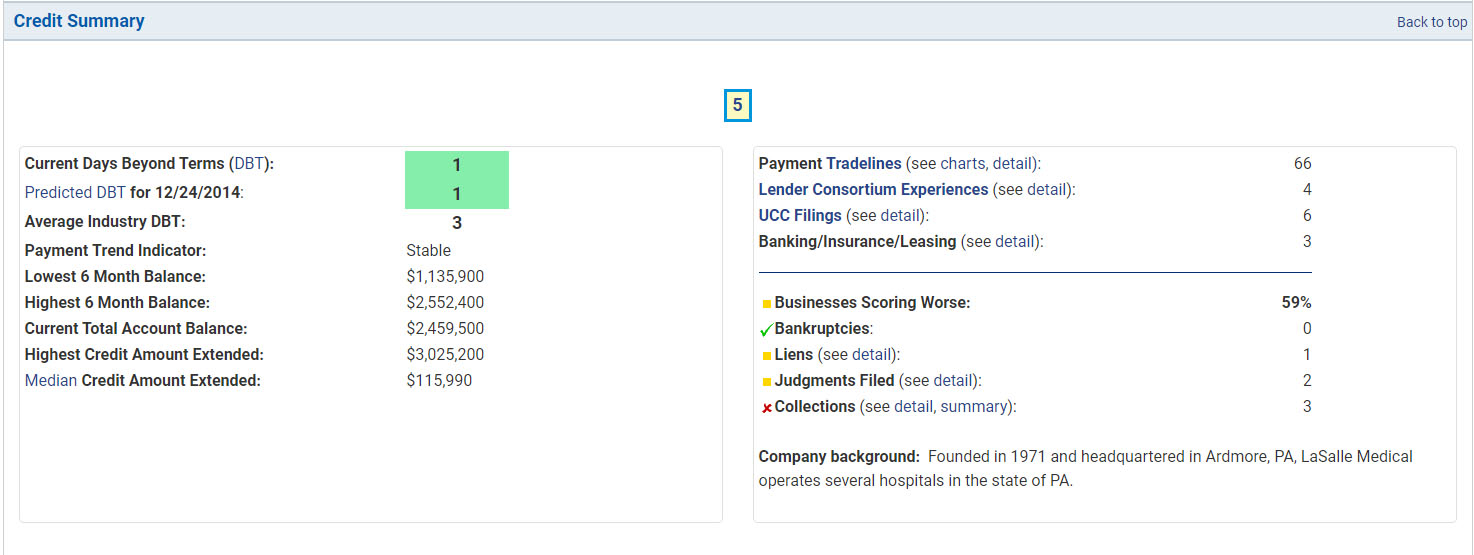

This section of your business credit report is a quick overview of various aspects of your credit. It will provide a summary of your loan payment history and reflect how you utilize your credit accounts. It will typically also include information on UCC liens for any assets pledged as collateral.

Credit reports often include a summary of your credit history, such as this one on a sample Experian credit report.

(Source: Experian)

Common items covered in this section include:

- Days Beyond Terms (DBT): This indicates how many days past the due date your firm pays. Your DBT figure may be reflected as your current, average, or historical worst.

- Account Balances: How much credit you’re using will be summarized here, including the balance of your accounts and the amount of available credit you can use. This section may also include data on your highest balances in a given period.

- Number of Tradelines: The total number of credit accounts will be displayed here. Accounts can include credit cards, loans, lines of credit, and leases.

- UCC Filings: If collateral has been pledged in exchange for financing, it may appear in this section.

- Derogatory Information: Negative payment history will be displayed here and can include late payments, collections, and bankruptcies.

Account payment history

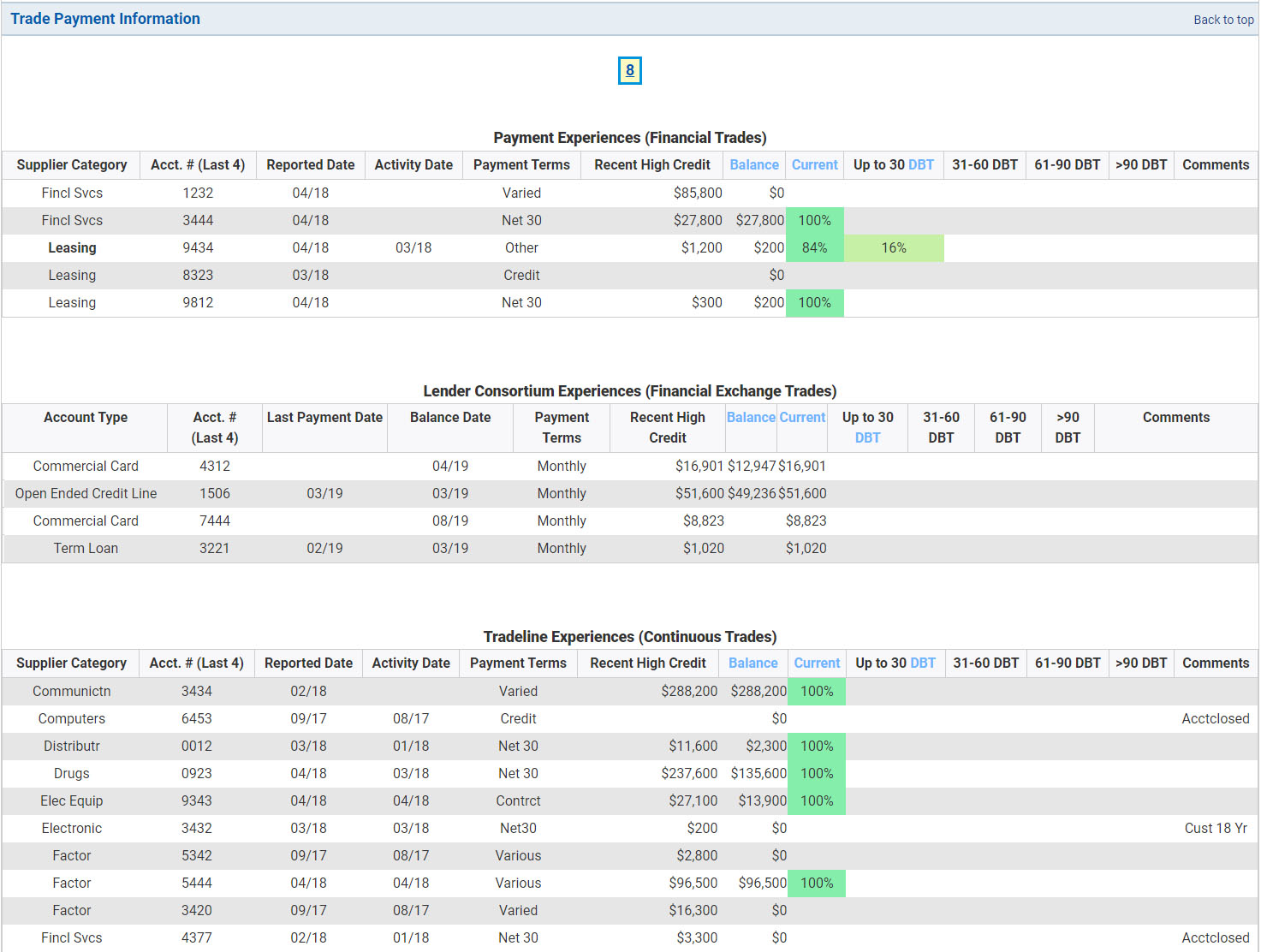

The payment history of your credit report will contain details about each of your individual accounts Accounts can include credit cards, lines of credit, other loans, and payments to vendors. as reported by your creditors. It will include detailed information about your payment history, account balances, payment terms, and payment amounts. The more accounts that show you pay on a timely basis, the easier it will be to build business credit.

Your business credit report will also show details of individual tradelines. (Source: Experian)

Credit inquiries

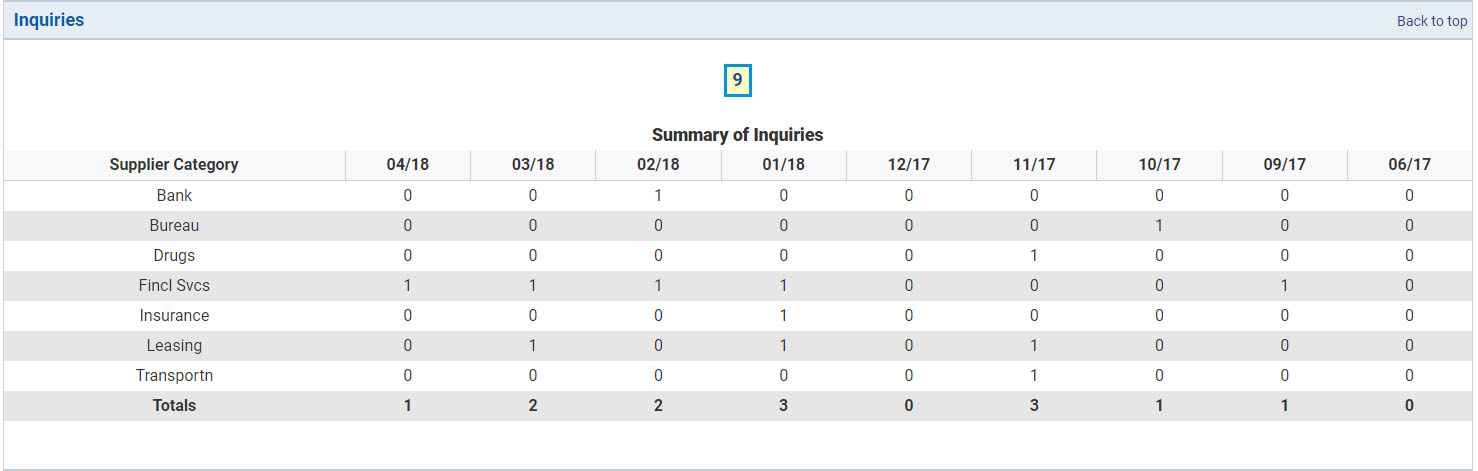

In most cases, lenders will check your business credit report when you apply for financing — and these requests will appear as a credit inquiry. Experian lists inquiries from the past nine months and breaks them down into which types of companies have checked your credit. Depending on the company you get your business credit report from, you may be able to see inquiries further back than nine months.

Creditors and other companies that have checked your credit will appear in the credit inquiries section of your credit report. (Source: Experian)

In general, lenders view businesses with a large number of inquiries as more risky. This is because it could be an early sign that a company may be overextended or desperate for credit. Businesses with few credit inquiries, by comparison, are seen to be lower risk as they have not demonstrated any need for credit or signs of possible financial distress.

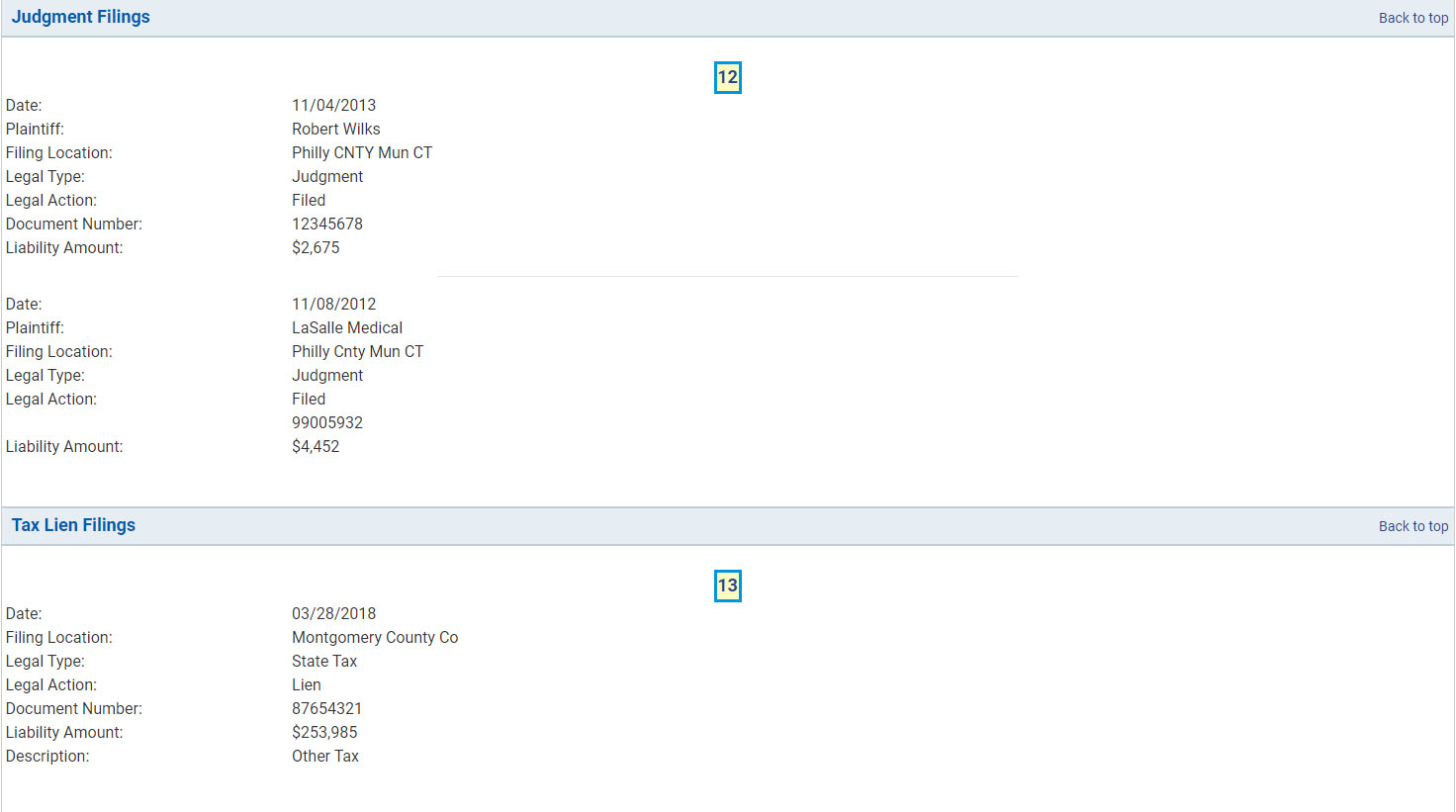

Significant derogatory information

In addition to late payments, significant derogatory items will appear in this section. While some credit bureaus will separate items into individual categories, these items typically include tax liens, collections, judgments, and bankruptcy filings.

Derogatory information often has its own section on your credit report. (Source: Experian)

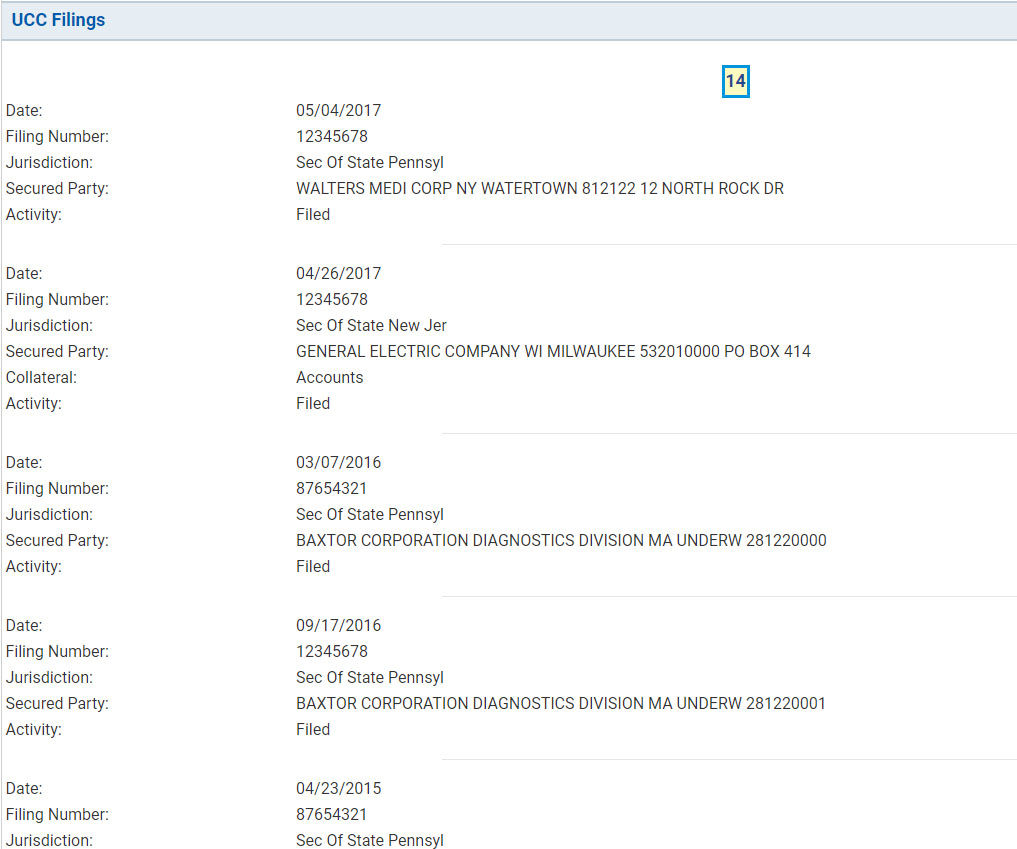

UCC filings

Business assets pledged as collateral will typically appear in the UCC filings section of your business credit report. Other lenders accessing this information will be able to see the date it was filed, the type of collateral being used, and the secured party.

Any assets pledged as collateral can be listed under the UCC filings section of your credit report. (Source: Experian)

UCC filings are used to lower the risk of lending money by claiming a public interest in the collateral, allowing the party to take legal possession of it in the event of a default. Common types of collateral that can be pledged include:

- Accounts receivables

- Contracts

- Business equipment

- Inventory

- Leases

- Notes receivable

How business credit reports are used

Business credit reports are primarily used for three purposes. They’re used to verify identity, evaluate whether your company will be approved for a loan, and determine the rates and terms you’ll get.

1. Business verification

A business profile is part of most business credit reports. Lenders review this information to see if there are any discrepancies among your loan application, your supporting documents, and the business credit report. This process is done in part to verify that it’s evaluating the correct company and that funds are issued to authorized parties.

2. Loan approval

Business credit reports contain data about your company’s finances and repayment history. These speak to your company’s ability to take on more debt and track record of making timely payments, two critical factors lenders consider when deciding whether to issue additional financing.

3. Rates & terms

If you are approved for financing, the strength of your company’s finances and credit will typically dictate what rates and terms you’ll get. Lenders look at companies with strong finances and credit as less likely to default and will reward them with more favorable rates and terms.

Where to get your business credit report & business credit scores

The following are four providers that you can visit to get a copy of your business credit report. Each has additional products and services to help you monitor your credit and track your business credit score.

1. Dun & Bradstreet

D&B is one of the most commonly used credit bureaus by lenders. It offers different types of business credit scores and multiple services to help companies monitor their credit. You can read our guide on the D&B credit report to learn more.

- PAYDEX® Score: This score ranges from 0 to 100 and is determined by a company’s past payment performance. Higher scores are correlated to companies that pay bills early or on time. Scores of 80 and above are generally considered to be low risk.

- Delinquency Predictor Score (DPS): Measured on a scale from 1 to 5, with lower scores indicating lower risk, the DPS is meant to show the probability that a business might become delinquent or go bankrupt.

- Failure Score: This also operates on a scale from 1 to 5 and is designed to reflect a company’s likelihood of filing bankruptcy or encountering financial difficulties within 12 months.

- Maximum Credit Recommendation: As the name suggests, this gives creditors a guideline on how much credit to extend based on a company’s industry, payment history, and other characteristics.

- D&B Rating: This is an overall rating of a company’s creditworthiness and is determined by information from a company’s balance sheet and overall size.

2. Experian

Experian issues a score called Intelliscore Plus. The most recent version of this, called Intelliscore Plus V3, ranges from 300 to 850, with higher scores being more favorable. A blended data option is also available for lenders wanting to combine business information with that of individual owners. Some older versions of Intelliscore operated on a scale from 1 to 100, with scores above 75 generally considered low risk for lenders.

3. Equifax

Equifax has two main types of credit scores lenders can utilize.

- Business credit risk score: This is the likelihood of a business being over 90 days late on financial obligations. The range is from 101 to 992, with 992 being the least likely.

- Business failure score: This is the risk that a business will go bankrupt in the next 12 months. Scores range from 1,000 to 1,610, with 1,610 being the least likely.

4. FICO Small Business Scoring Service (SBSS)

FICO SBSS scores are most commonly used for Small Business Administration (SBA) loans. Scores range from 0 to 300, with higher scores representing lower risk for lenders. For most SBA loans, I recommend having an SBSS score of 155 or higher. You can visit Nav to obtain a copy of your FICO SBSS credit score.

Frequently asked questions (FAQs)

A personal credit report typically only contains information related to yourself as an individual, whereas a business credit report contains information on debt and other tradelines which your business is liable for. The type of report a lender uses may depend on whether the company’s finances are sufficient to qualify alone or if a personal guarantee is required.

I recommend checking your business credit report no less than once every three to six months. You can also consider enrolling in credit monitoring services, some of which are free and designed to alert you of any material changes to your credit profile.

No. The information you see on your credit reports can differ if creditors decide to report data only to certain credit bureaus. Additionally, different credit bureaus may occasionally experience a delay in reporting or receiving data.

Inaccuracies in your business credit report can make it difficult for your company to get funding. For example, the information in your credit report is used to determine your credit score, one of several factors that can impact your ability to get approved for a loan as well as the rates and terms you can get.

Bottom line

Lenders use the information in your business credit report to determine whether to issue financing and at what rates and terms. Knowing how to read your credit report and being aware of what goes into it can expand your access to credit.

Dun & Bradstreet, Equifax, Experian, and Nav are four providers that can give you access to your various reports and credit scores. You can also take advantage of each company’s services to monitor changes to your business credit reports.