Commercial auto insurance premiums have been rising over the years, often at a rate greater than inflation. So it is no surprise that when people are looking for car insurance, they’re trying to find the cheapest commercial auto insurance. Cheap doesn’t mean you have to sacrifice quality. Cheap commercial vehicle insurance providers offer excellent customer service, coverages, and endorsements you need while doing so at an affordable rate.

After using our proprietary rubric to evaluate the leading commercial carriers and taking into particular account their published average commercial premiums, we have found the five cheapest commercial auto insurance companies.

- Next Insurance: Cheapest commercial auto insurance provider

- Progressive: Best for multiple ways to save

- FLIP: Cheapest carrier for food trucks

- The Hartford: Best for bundling auto with other commercial insurance

- Tivly: Best for helping you find cheap commercial auto insurance

Cheapest Commercial Car Insurance Providers Compared

Quote Process | Hours of Operation | Policy Purchase Process | Financial Rating | ||

|---|---|---|---|---|---|

| Online or over the phone | $167 | Monday-Friday, 8 a.m.-5 p.m. CT | Online or over the phone | A- (Excellent) |

Online or over the phone | $270 | 24/7 call center | Over the phone | A+ (Superior) | |

| Online or over the phone | $25.92 for general liability | Monday-Friday, 8 a.m.-8 p.m. ET | Online or over the phone | A+ (Superior) |

| Over the phone or through an agent | $574 | 24/7 call center | Over the phone or through an agent | A+ (Superior) |

| Over the phone | $150 | 24/7 call center | Over the phone | A- (Excellent) to A++ (Superior) |

Next Insurance: Cheapest Commercial Auto Insurance Provider

Pros

Cons

- No motorcycle insurance

- Next will not provide any quote without your driver's license number—online or in person

- There is no coverage for food trucks and mobile service types of business

Standout Features

- Monthly premiums for commercial insurance can be as low as $12.50 a month.

- 43% of Next policyholders pay less than $143 monthly for commercial auto insurance.

- Discounts are up to 10% when you bundle commercial auto insurance with another coverage.

- Next’s Android or iOS app lets you manage your policy, adjust cover, file a claim, and instantly create proof of insurance.

Financial Stability: Next Insurance has a financial rating of A- (Excellent) from the insurance credit rating AM Best.

Next Insurance has been around since 2015 but only recently launched its line of commercial auto insurance. That may be why its pricing is so competitive and far below anything else I came across in my research. Unbelievably, it states that commercial auto insurance can cost $12.50 monthly for Yoga instructors or accountants. Nearly 50% of its customers pay less than $150 monthly for commercial vehicle insurance, making it the cheapest commercial auto insurance provider.

Quotes can only be obtained online or over the phone by providing a valid driver’s license. However, it is one of the only commercial carriers that will offer an online quote. Regarding coverage, Next’s offering for commercial insurance is the standard coverage that carriers have to offer: liability (property damage and bodily injury), collision, comprehensive, and uninsured motorist.

You can save more money by bundling your auto insurance with other lines of business through Next. If your business needs general liability or property coverage, purchasing that and the auto insurance can save you at least 10%.

Remarkably, for 2022 and 2023, only one complaint was filed with a state Department of Insurance (DOI) against Next. This statistic refers specifically to its commercial auto insurance product. Insurance companies usually have some claims go sideways, and a customer or claimant gets upset enough to file a complaint. This is even more normal when it comes to auto claims. So, for Next to have only one complaint in two years is a testimony to its commitment to customer service.

So, while it definitely offers some of the cheapest commercial vehicle insurance, providing a high level of customer service remains a priority for Next.

Progressive: Best for Multiple Ways to Save

Pros

- Online quotes are available

- Available in all 50 states

- Leading provider of commercial auto insurance

Cons

- Complaints are higher than average

- It does not offer many business insurance options

- Coverage is not available in Washington, D.C.

Standout Features

- As the leading provider of commercial auto insurance, Progressive has years of experience to draw on in crafting a great user experience for claims and customer service.

- The average cost of business auto insurance with Progressive is $207, and for tow trucks, the average price is $600 a month.

- Progressive has over nine different ways to save money on your commercial auto insurance.

- It has an appetite for multiple vehicles and trucks for small business insurance.

Financial Stability: Progressive has been in the auto insurance business for decades and is in a solid financial position, with an A+ (Superior) rating from AM Best.

Progressive Insurance is a well-established provider of commercial auto insurance. It has consistently cut some of our other guides, including semitruck insurance and commercial auto insurance. Progressive has an appetite for auto insurance and a willingness to take on nearly any type of vehicle.

This, coupled with almost ten ways to save on auto insurance, makes it an excellent option for small businesses that need commercial vehicle insurance and are looking for ways to save money on their premium. This is why we also picked it as one of the best providers of commercial auto insurance.

Progressive offers quotes online for commercial auto insurance. Alternatively, you can contact a local agent to get started.

In 2023, the average monthly cost for commercial auto insurance for contractors was $257, and it was $1,041 for for-hire transportation trucks.

For auto insurance, Progressive has the standards plus several additional options for larger commercial vehicles, such as non-trucking liability insurance and bobtail coverage.

Conveniently, Progressive is the only large provider on this list that offers online quotes. You will need a VIN Vehicle Identification Number and driver’s license to complete the quote online. It has several telematic programs to help you save money on your premium, and its online account management benefits are in keeping with The Hartford, so you can manage your policy, pay your premium, and file a claim.

The National Association of Insurance Commissioners (NAIC) tracks complaints filed against insurance companies at the state level. You can sort these complaints by coverage type. Progressive has higher-than-expected complaints for its commercial auto insurance. However, they are the lowest they have been for three years, indicating it is working to deliver better customer service.

FLIP: Cheapest Carrier for Food Trucks

Pros

- Cheap food truck insurance

- Get a quote and purchase insurance online in minutes

- Create instant COI for festivals or shows

Cons

- Does not offer collision, comp, or auto liability

- There is no 24/7 call center for customer service

Standout Features

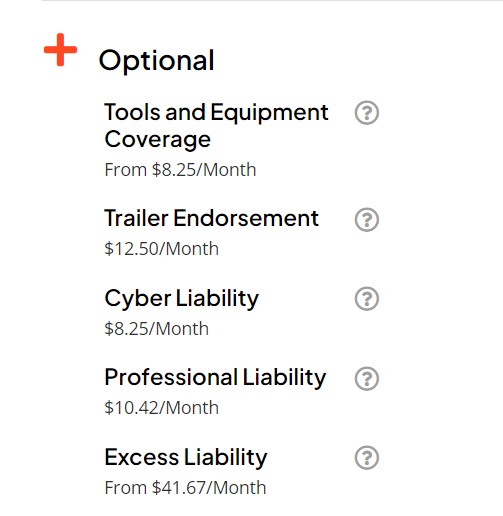

- FLIP specializes in offering liability insurance for food vendors. One of its product lines is geared toward food trucks and includes liability coverage for trailers. If you own a food truck, you pull and do not drive. This is the cheapest option for your business.

- FLIP has some of the cheapest commercial auto insurance for a food truck, with a policy starting at $25.92 monthly.

- Commercial auto doesn’t cover the contents of your vehicle, but FLIP has a very cheap add-on for tools and equipment.

Financial Stability: Great American Insurance Company underwrites the FLIP insurance program, which has an A+ (Superior) rating from AM Best.

FLIP insurance, short for Food Liability Insurance Program, is designed for food vendors. A significant part of its clientele is food truck owners. Not only is it a cheap option for insurance, but it is also our top pick for food truck insurance.

The company doesn’t offer traditional commercial auto insurance. Instead, it has a very robust general liability package for food trucks that includes liability for any trailer being hauled. I included them in this guide because when I was reviewing different providers, almost everyone had an FAQ asking if commercial auto covers food trucks, and the answer was no.

Since many people with food trucks are looking for coverage, and this is the cheapest for food trucks, it seems appropriate to include it in this list. That said, if you drive a food truck, you will still need commercial auto insurance. Veracity Insurance owns FLIP; its brokerage can find other types of insurance not directly offered through it, so you may still be able to get commercial auto insurance through it.

FLIP’s core package is general liability, which includes product liability and premise liability. The limits are $2 million general liability and $2 million product liability for $25.92 monthly.

It also has these additional coverages, and the price is set at the listed price:

On FLIP’s website, there are many positive testimonials from customers. Great American Insurance has below-average complaints.

With FLIP, you manage your policy through your online account. This includes filing a claim or creating a certificate of insurance. As a food truck vendor, it is essential to be able to produce a COI quickly for festivals or business parking lots where you are serving, and FLIP makes it easy to do so.

The Hartford: Best for Bundling Auto With Other Commercial Insurance

Pros

- Special auto endorsements available

- Proof of insurance available online

- Strong knowledge of small business insurance

Cons

- No online quotes for commercial auto

- Higher-than-average complaints for the auto segment

Standout Features

- The Hartford is a traditional insurance carrier with a very large small business customer base: over 1 million small businesses are insured through it.

- It has all of the traditional types of coverages that a business needs: general liability, property, BOP, and workers’ comp, just to name a few.

- It has an in-house claim team, 24/7 customer and claims service, and also a great online account management system for its customers.

Financial Stability: While some traditional carriers are struggling financially, The Hartford has maintained its rating of A+ (Superior) from AM Best.

Most small businesses have more to their business than a vehicle. So, while commercial auto insurance is important (and likely required) for your business, it isn’t the only type of coverage you need. That is why The Hartford is the best option for a business looking to have all their policies through one provider. The Hartford offers nearly every type of small business insurance, so whatever your industry, you can get coverage for your business and your business vehicle.

According to The Hartford, $574 is the average monthly price for commercial auto with its customers.

In terms of coverage, The Hartford offers traditional commercial auto insurance, such as collision, comprehensive, and medical payments. It also offers other coverages, like “Driver Other Car” insurance. This special coverage is designed for executives and spouses who drive vehicles not listed on the company policy.

Overall, Hartford has a strong record of excellent customer service. It has lower-than-average complaints as a company. However, for the auto segment, it does have higher-than-average complaints. The number of complaints in 2023 was lower than in 2022, so it is trending in the right direction.

Conveniently, it offers 24/7 claims and customer service. Its online account management is one of the best for a larger carrier. In five minutes or less, you can manage your policy, file claims, and create proof of insurance to share with others.

Tivly: Best for Helping You Find Cheap Commercial Auto Insurance

Pros

- Service is free

- Commercial auto insurance and business insurance are offered

- Save money by working with Tivly to find the right provider

Cons

- Quotes are done exclusively over the phone

- Account maintenance and services depend on the provider

Standout Features

- While not an insurance provider, Tivly is an excellent option for commercial auto insurance. It is a small business insurance marketplace that works with over 200 different insurance companies and agencies.

- It does not offer online quotes, but you can initiate a quote online by filling out a contact request form. A representative will contact you very quickly, or you can just call it directly.

- When it comes to finding cheap commercial auto insurance, Tivly is a great option. Because it works with so many different companies, it can help you find one that is the right fit for your budget.

Financial Stability: Tivly does not have a financial rating from AM Best. However, the carriers it works for do have ratings. One partner is Farmers Insurance, which has an A (Excellent) rating.

As a marketplace for small business insurance, Tivly is a great option for finding your business’ cheapest commercial vehicle insurance. By drawing on its network of over 200 carriers and insurance agencies, Tivly connects the buyer with the seller. It does so without any charge to you.

According to Tivly, the average cost for commercial auto insurance is between $1,200 to $2,400 annually. If you can get insurance through Tivly for that amount, it would be a great way to save money.

Depending on what type of auto business you have, the price can increase. For example, livery services (like limousine drivers) can expect to pay between $4,000 and $10,000 annually.

Since it specializes in small business insurance, Tivly can offer other coverages like workers’ comp, general liability, and commercial property that can be acquired through its free services.

Tivly connects you to the right insurance company for your business. But really, that is the end of its relationship with your business. The turnaround time from requesting a quote to receiving a call is very quick: in just minutes, you can get matched up with a top insurance provider and have a quote.

If you need to reach someone, its hours of operation are 8 a.m. to 8 p.m., Monday through Saturday. The service it offers is free, so you are under no obligation when working with them, and the quote is free.

Methodology

I determined the cheapest commercial auto insurance company through a proprietary rubric. In evaluating, we focused on the customer’s needs. We paid particular interest to convenience, financial ratings (AM Best), customer service, types of policies offered, and the overall experience as a policyholder for a specific provider.

When evaluating providers for particular industries, we consider critical key coverages, any specialized endorsements or packages the provider has created for that industry, and additional services that would enhance the customer experience.

Bottom Line

Insurance premiums continue to rise, but choosing to be uninsured is not an option—especially for auto insurance. When finding the cheapest commercial auto insurance, you can have your cake and eat it, too. It is possible to save money without sacrificing customer service. Next Insurance is a great place to start when looking for cheap commercial vehicle insurance online.