A certificate of insurance (COI) is a document that provides proof of insurance. It includes policy details like your specific coverage, limits, and effective dates, but it is not an insurance contract. Companies often require businesses they partner with to carry liability insurance because they don’t want to risk being held solely responsible. In those situations, the company will request proof of insurance or a COI.

If you’re a business owner who needs to provide proof of liability insurance regularly, then you should apply with Next Insurance. This small business insurance provider lets you create free and instant COIs—either online or through its app—and quickly share them as many times as you need.

How Do I Get a Certificate of Liability Insurance?

You should receive a COI when you receive your initial policy documents. However, you may need additional copies as your business grows or if you need to change coverage and show proof of the change. You can request a COI through the insurance provider who originally sold you the policy. This can be the carrier, agent, or commercial broker.

If you need to change coverage, then you can obtain a new COI by following this process:

- Step 1: Find out what coverages and limits you need. If the company requires higher limits than what you already have, getting your insurance liability certificate may take a bit longer as you wait for your coverages to be adjusted.

- Step 2: Confirm coverage limits with your provider. If you need to increase your limits, you can adjust the policy, or you may be able to purchase a rider to cover the duration of the contract. Your insurance agent can help with this process.

- Step 3: Request the certificate of insurance after making any changes. This requires filing the paperwork required to adjust your coverage adjustment, submitting payment, and requesting the certificate that lists the appropriate limits.

- Step 4: Give the certificate of insurance to your client. Some companies require a paper copy they can keep on file, while others are satisfied with an emailed PDF.

Some insurers charge up to $50 per COI, while others provide them for free. Certificate requests can take anywhere from minutes to days to complete. Yours may take longer if the company you’re working with requires unique wording on your certificate.

When Do You Need a Certificate of Liability Insurance?

You will usually be asked to provide a COI when you are involved in bidding for a project or contract where insurance is important. In a bidding situation, the project manager will often request proof of insurance to be submitted along with the bid.

Clients typically will ask to see your COI because they want to protect their business. When they see you have liability insurance, they can trust that you have the financial resources to cover any allegations of damages, injuries, or substandard work that result from your business dealings. As a business owner, you may also want to request another business you work with to show proof of liability insurance.

Who Needs a Certificate of Liability Insurance?

If your business regularly works with vendors, bids on contracts, or participates in events, then you will likely need a certificate of liability. Some examples of business owners who need a certificate of liability include the following:

- A food truck owner who wants to work at a food truck show, but the venue requires proof that the food truck carries at least $1 million in general liability insurance to participate; see our roundup of the leading food truck insurance companies for options

- A fitness instructor who wants to teach at a new studio, but the owner wants to see a COI first; read our guide to personal trainer insurance

- A cleaning business owner who is bidding on a large commercial contract, and the company is requiring a COI showing general liability and workers’ compensation; check our list of the top cleaning business insurance companies

- A painter who has an opportunity to work on a construction project, but the general contractor only works with subcontractors who have their own workers’ comp insurance; for options, see our recommendations for the best painting insurance companies

When to Add Certificate Holders

Certificates are often needed when a business owner signs a new contract, applies for a professional license, or signs a commercial lease. In these situations, your agent creates a certificate with the other party’s name listed as the certificate holder, and each certificate holder gets a copy for their records.

If another party has a financial interest in your business, they may need to be more than a certificate holder. In those situations, it may be necessary to make them an additional insured. This is a status that grants them some of the protections found in your liability insurance.

For example, commercial landlords usually want to be additional insureds in case your injured customer sues them for damages. Likewise, general contractors may ask for additional insured status to protect against lawsuits stemming from a subcontractor’s work.

What Are the Benefits of a Certificate of Liability?

Being able to provide a COI quickly and regularly can help your overall business. It can do so in several different ways, and here are a few.

- If you are bidding on a project and need to show proof of insurance or need to adjust your limits to match the job and then show proof of insurance, a quick COI can be the difference between your bid winning or not even being able to bid on the project.

- If you are seeking a license with a local governing authority, a COI will come in handy to show you’ve met the requirements for insurance.

- If you are participating in a venue or event, then you can add the host as an additional insured, as many presenters must show the event host they are properly insured to participate. If you can quickly produce a COI or add the host as an additional insured, then you are a step ahead of any competitor who has to request one and then wait for the request to be processed.

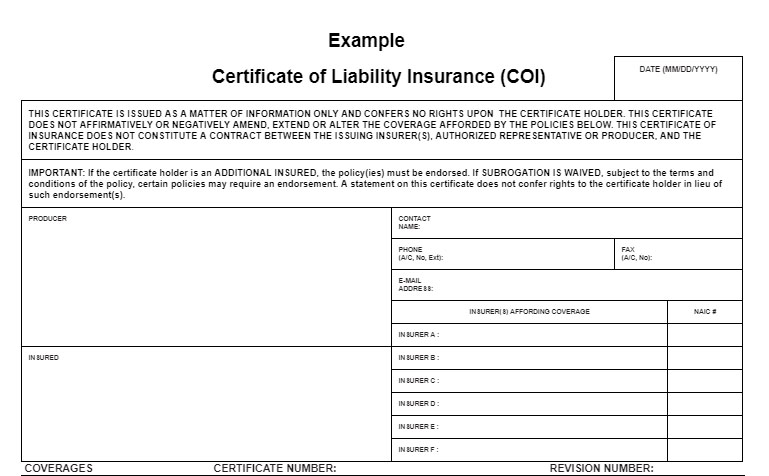

What a Certificate of Liability Insurance Looks Like

There are nine sections in a COI that summarize what insurance policies a business owner has, the limits for each policy, the name of the insurer, and several other key details.

Having a COI can help protect you in a variety of situations, but understanding the information contained within it is almost as important as the certificate itself. Here are the key sections of a certificate of insurance:

- Disclaimer: A statement explaining the COI and the intended use of information

- Producer: The insurance company, broker, or agent representing the insured

- Insured: The named person or entity listed on the policy

- Insurers affording coverage: The insurance companies that provide the coverage listed in the COI

- Coverages: Descriptions of the specific policies purchased by the insured

- Description of operations, locations, and vehicles: Detailed information about elements of the business

- Certificate holder: The person or business to which the certificate is issued

- Cancellation: An explanation of cancellation notification requirements for the insurance company

- Authorized representative: The insurance company, agent, or broker authorized to sign the certificate

Frequently Asked Questions (FAQs)

Typically, a COI is free. However, some providers will charge up to $50 for any additional COI, especially if it requires a change, like adding an additional insured to the policy.

There is none. A COI is an abbreviated term for a certificate of insurance. These certificates serve as proof of insurance, so a COI is proof of insurance.

A certificate of liability is requested in various situations, but the ultimate purpose is the same: some party needs to verify that your business is currently insured. Sometimes, the request is to verify that your business meets the coverage requirements for a job bid or to participate in an event. Other times, it lists an additional insured who requests to be on the policy for a specific job.

Bottom Line

A COI is a certificate that serves as proof that you have active insurance and lists all of the essential information about the policies your small business carries. Almost any business owner who works with the public should have a COI on hand. Even if it’s not requested, presenting the COI demonstrates a high degree of professionalism and can help you win contracts and bids on projects.