If you have a business checking account you aren’t using regularly or are dissatisfied with your current bank, it may be time to close your account. This will help you avoid dormant account fees. In this guide, I’ll outline the process of how to close a business checking account effectively. This will ensure minimal impact on your business and reduce any disruptions for your clients and customers.

Step 1: Open a New Business Checking Account

As long as your business is still operating, you’ll need a new business checking account that serves your needs before closing your old one. If you haven’t chosen a new bank, check out our list of the leading small business checking accounts. Once you select one, see our guide on how to open a business bank account.

Step 2: Ensure All Outstanding Checks Have Cleared

Once your account is closed, the bank will return any checks that arrive, which can delay payments to customers and vendors, cause frustration, and possibly harm your business. So, if your finances allow, maintain some overlap between the opening of your new account and the closing of your old one. This will give ample time for all checks from the old account to clear. Once you have your new business checking account, start issuing checks from it as soon as possible.

Step 3: Transfer All Automatic Withdrawals to Your New Account

Like checks, any auto withdrawals that occur after your account has been closed will be returned unpaid, which could create issues for your business. As such, transfer any recurring automatic withdrawals from your old account to your new one. Also, keep a master list of these withdrawals as part of your business accounting, which will make it easier to ensure they are all moved before closing the account.

Step 4: Gather All Documents Needed for Account Closing

Before closing your account, ensure you have the necessary documents on hand. These documents may include:

- The name of your business

- The address of your business headquarters

- Business incorporation/partnership documents, including banking details, registration information, incorporation or partnership date of formation, and business structure

- Information detailing who has the authority to open and close accounts

- Details about any outstanding debts to the bank (if applicable)

- A formal letter requesting the account closure, specifying which accounts are being closed and where the account funds are to be transferred

Most of this information is similar to what you used to open your new business checking account.

Step 5: Determine Who Must Initiate Account Closing

Your company’s organizational documents should state who has the authority to conduct financial transactions, including opening and closing accounts. This authority may belong to a single person or a group of individuals. Confirm who is responsible for this task, and ensure they sign your formal request letter.

Step 6: Have Authorized Persons Notify the Bank of Account Closing

Once you have the formal request letter signed by all authorized persons, it’s time to send it to your financial institution to close the account. This can be done by mail, via email, or in person at a branch.

Depending on your bank’s policies, you may need to complete the closing process in person at a branch. For online-only banks and larger corporate banks, you might be able to handle the entire process over the phone or online.

In some cases, the letter may be enough to close the account, leading the bank to transfer the funds electronically or issue you a cashier’s check in the business’s name. Your old bank may also require you to settle any debts owed before closing the account, so it’s best to address this before transferring funds to your new account.

Step 7: Transfer Funds From Closing Account to New Account

You can transfer funds either before closing the account or at the time of closure. As long as you have ensured all checks have cleared and auto withdrawals have been moved to your new account, you can proceed with the transfer. Keep in mind that there might be wire transfer fees, regardless of whether you transfer funds before or at the time of closing.

Step 8: Finalize Account Closing

The final step is to ensure the closing is finalized with your old bank. This is completed once you have signed whatever documentation it requires to close the account and the funds have been transferred to your new account.

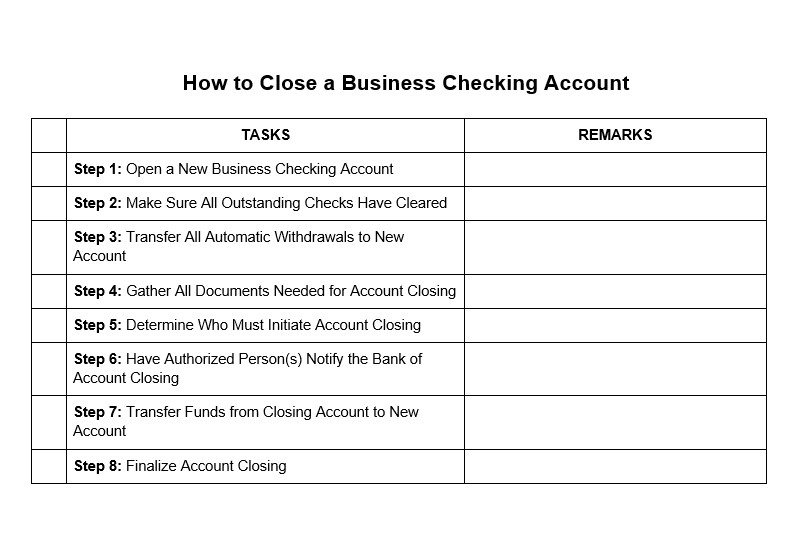

To assist you, we created a checklist for closing your business checking account.

Other Considerations When Closing a Business Checking Account

While the steps above should address most potential issues that may arise during the account closing process, there are additional factors you might want to consider.

What To Do if Your Company Is Dissolving

It’s important to contact your bank immediately upon the termination of your business. Using your business organization agreement as a guide, the bank can assist you as you navigate the final days of your business before closing the account and distributing any remaining funds. Also, any existing business line of credit with your bank will likely convert from revolving credit accounts to amortizing loans. All parties involved may share liability for any outstanding debts, so keep this in mind.

Typically, your bank will allow you to keep your business checking account open long enough for final checks to clear and to process any expenses that arise during the closure. You generally will be unable to conduct new business transactions through this account.

There is no tax impact to consider when simply closing a business account. However, if your business is dissolving, I recommend that you consult a tax professional or legal advisor to determine your tax liabilities and ensure all obligations are met. This step is vital for planning the payment of both personal and business tax liabilities.

After handing out the final wages to employees, business owners must complete federal tax deposits and report employment taxes to the IRS. You still need to send W-2 forms to all employees even if your business has ceased operations before the annual tax deadline.

Your credit score will not be directly affected when you close your business account. However, there may be an indirect impact on your credit score in certain situations. For example, if your business account is linked to a credit card or an outstanding loan, you might miss payments if you have an autopay setup.

Additionally, if the bank closes your account due to an unpaid negative balance, this could negatively affect your credit if a debt collection agency reports your debt to the credit bureaus.

How to Avoid a Dormant Business Checking Account

To avoid a dormant bank account, simply close the business checking account if you no longer use it. Note that when an account is dormant, funds will be turned over to the state and the account will be closed. While you can petition the state to return your funds, it is far simpler to close the account if it’s not in use.

How to Close a Business Checking vs Business Savings Account

Closing a business savings account is generally easier than closing a business checking account. Given that savings accounts have a limited number of allowable transactions, it is usually straightforward to ensure all withdrawals are accounted for before closing the account.

If you have a business checking account at the same bank and aren’t closing that account, you can simply move your savings funds to your checking account and then close the savings account. If you haven’t exceeded your monthly transaction limit on your savings account, this transfer can be done for free.

Potential Consequences When Closing a Business Checking Account

Closing your business checking account can present some issues, so it’s best to know how to handle these situations effectively.

1. Your Bank May Charge Fees or Subject Your Account to Penalties

Many banks impose an early account closure fee if you close your business checking account within a specific timeframe after opening it. Typically, this fee is charged if the account is closed within 90 days from the opening date. Some banks may waive this fee only if you keep the account open for 180 days.

Even if you already notified the bank about your intention to close the account, the actual closure process may take some time. You may still need to pay the monthly service fee if your account remains active during the statement cycle.

2. Bank Account Closure Delays Can Occur Even If You Want to Close Your Business Account Immediately

Some of the reasons for an account closure delay can include pending transactions due to uncleared checks, discrepancies in account balances, or incomplete documents. To resolve this, review the closure requirements, submit the necessary documents, and consult with your bank representative. If the account remains active after a few weeks, contact customer service or speak with the bank manager for assistance.

Frequently Asked Questions (FAQs)

To close your business account, follow these steps:

- Open a new account.

- Ensure all checks have cleared.

- Transfer all automatic withdrawals.

- Gather necessary documents for account closure.

- Determine who will initiate the closing process.

- Notify the bank of the account closing.

- Transfer funds to the new account.

- Finalize the account closure.

It depends. If your account was well-managed, without outstanding payments or dormancy issues, and met minimum balance requirements, then closing it should not directly impact your credit score.

This depends on your bank’s policy. Many banks offer customers the option to request account closure online or over the phone.

Generally, banks don’t charge a fee for closing a bank account. However, an early closure fee may apply if you close your account before the required period, which can vary from bank to bank. Some may require you to keep the account open for six months, while others may have shorter requirements.

Bottom Line

Closing a business checking account is a straightforward procedure. Of the eight steps above, four are critical: ensure you have a new account open before closing your old one, and see to it that all outstanding checks have cleared. Then, check that automatic withdrawals are changed or canceled and, finally, know who in your business is authorized to close the account. If you follow the steps in this guide, you should be able to close your business checking account with minimal impact on your business.