It’s normal for small business owners to want to switch business bank accounts when their banks no longer cater to their evolving business needs. The process of changing business banks requires you to research options, prepare required banking documents, and set up automatic payments again, but in the end, picking the right business bank is rewarding.

The common reasons for making a business bank switch are when:

- Your account costs are too high

- The account’s limits are too restrictive

- The provider lacks the products you need

- You’re unsatisfied with customer service

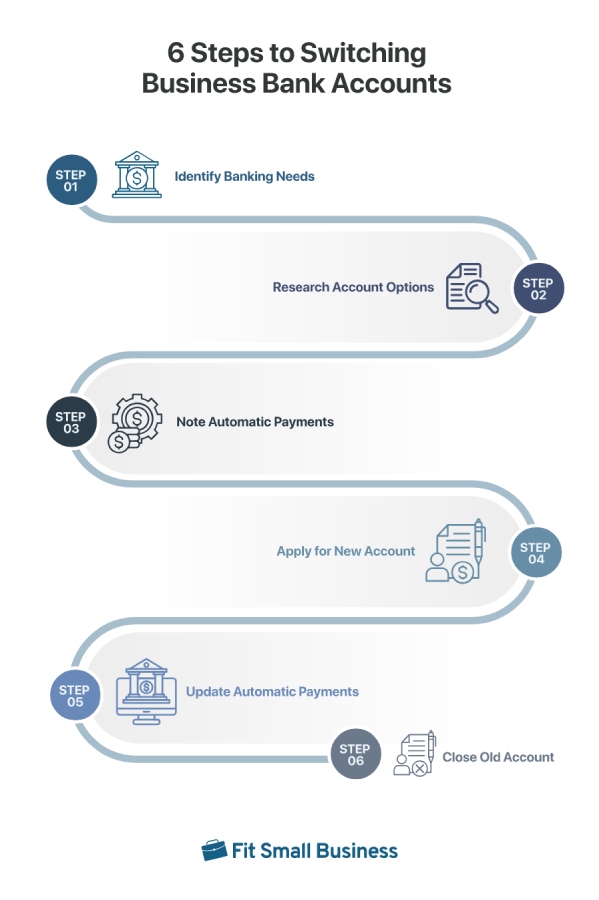

If you find that one or more of the above applies to you, the steps below can guide you on how to change business banks.

Step 1: Identify Your Business Banking Needs

Changes in business needs are the biggest reasons businesses consider switching business bank accounts. Identify your current business needs and future business goals to determine which banking features you need most.

For instance, a growing business might need to look for merchant services or online credit card processing companies to help process card payments. Meanwhile, a business that deals with international suppliers, contractors, or clients frequently might need a bank with affordable international wire transfer fees. For options, see our roundup of the top banks for international business to find a suitable provider.

Step 2: Research New Bank Account Options

After identifying your banking needs, it’s time to choose a small business bank that can meet those. The following factors can help you evaluate your options:

- Financial products: If you want to keep all your banking activity in one place, choose a bank that offers all the products you need. Commonly available business banking products include checking accounts, business savings accounts, and business lending products. Some banks also offer insurance and investment.

- Network size and availability: Determine how much in-person banking support you need. An online provider will suffice if you don’t need in-person customer service or cash transactions. If you want a provider that is attuned to local market needs, choose a credit union, community bank, or regional bank. If you want nationwide branch options, choose a national bank.

- Fees and rates: Assess your business’s ability to pay for banking fees. Smaller earners are better suited to digital-only providers, which typically charge no fees for account maintenance and day-to-day transactions. Higher earners may be able to afford accounts with traditional banks, which typically let customers waive monthly fees by meeting specific activity or minimum balance requirements.

- Scalability: If you intend to expand your business, ensure your bank of choice can accommodate growth. Many banks offer analyzed business checking and tiered savings accounts that scale to cater to higher transaction volume.

- Federal Deposit Insurance Corp. (FDIC) Insurance Limit: The more excess business funds you have, the more FDIC insurance protection you need. The standard FDIC coverage is $250,000, but some banks offer a higher FDIC insurance limit for business accounts through IntraFi Network Deposits. See our guide on FDIC Insurance for business accounts to learn more.

Top Business Bank Accounts

The best bank for your small business is whichever provider can meet your needs at the lowest cost. Here are a few options to consider:

Bank | Best For | For More Information |

|---|---|---|

Chase | Full-service small business banking tools and premium checking | |

Bank of America | Ongoing rewards and low cash deposit fees | |

U.S. Bank | Free business checking and businesses with low transaction volumes | |

Bluevine | Interest-earning account with international payments and access to high FDIC insurance |

Step 3: Take Note of Any Automatic Payments

In preparation for applying for a new bank account and closing your old one, ensure you take notes of any automatic payments you previously set up. Don’t close your old account before these payments are posted to avoid encountering issues with your suppliers.

Additionally, make a list of all your automatic payments. You can transfer these transactions to your new account once you open it.

Step 4: Choose & Apply for a New Business Bank Account

Once you have chosen which bank account will work best for your business, it’s now time to open a new bank account. The process for applying for a new business bank account is typically the same as when you applied for your old bank account. However, this may vary depending on the bank.

Check if there is an option for an online application or if you will need to go to a physical branch to process the account opening. Either way, make sure to gather all the necessary information. Banks typically ask applicants to provide personal and business information, including submitting the following:

- Government-issued ID, such as a passport or driver’s license

- Employer identification number (EIN)

- Business documents, such as articles of incorporation, articles of organization, and business licenses

After opening your account, check your online and mobile access, debit cards, ATM access, and funds transfer capability. You want to make sure that everything is working correctly.

Step 5: Update Any Automatic Payments

Once everything is up and running with your new business bank account, do not forget to set up your automatic payment transactions. Check the list that you have created from step three and make sure that you don’t leave anything out. Update your automatic payments as necessary to ensure that you don’t miss any deadlines.

Ask your new bank if it offers a “switch kit,” which refers to a service that helps businesses change bank accounts seamlessly. With this kit, the bank will notify any service providers and suppliers who do business with you when you transfer any automatic transactions. Some banks have an account transfer form that you can send to your suppliers, service providers, or even customers to notify them that you have changed to a new bank account.

Step 6: Close Your Old Bank Account

When you’re certain that your new bank account is set up completely and working properly, all automatic payments have been transferred, and all physical checks drawn on your old account have cleared, you may now close your old bank account. In most cases, closing a business account needs to be done in person.

Your bank will most likely ask you to fill out certain forms for account closure. If there are any pending transactions, ensure there’s enough balance in your account to cover them. The bank will release the remaining funds to you or your business’s authorized representative after all pending transactions are processed.

Signs You Need to Switch Business Bank Accounts

Switching business bank accounts requires a lot of time, effort, and research. Before investing time in the process, determine whether the change is necessary.

Here are the top five signs you need to switch business bank accounts.

1. Your Account Costs Are Too High

Most bank products and services have corresponding fees. It’s important to consider your monthly and annual costs in maintaining your bank account. Fees for account maintenance, excess transactions, account inactivity, paper statements, ATM withdrawals, cash deposits, and other extra charges can add up and can greatly affect your business’s finances.

A National Federation of Independent Business (NFIB) survey showed that 62% of small business owners consider low banking fees vital in choosing their business bank. If you think you’re paying too much to keep your account, that means it’s time to find other, cheaper options.

2. Your Bank Doesn’t Meet Your Needs

Most bank accounts have certain restrictions, such as the number of free monthly transactions, whether you’re allowed to deposit cash, or the number of deposits you can make. These restrictions may hamper your business growth.

Additionally, you may have needs that your current bank doesn’t offer, such as overdraft protection, business software integration, higher FDIC insurance coverage, or other services that are important to your business transactions. If your current bank cannot meet your growing needs, it’s a sign that you should find a new one.

3. You Want to Bank Completely Online

According to a national survey released in October 2023 and performed on behalf of the American Bankers Association, 48% of customers prefer using mobile apps to manage their bank accounts, whereas 23% opt for online banking using a laptop or PC.

If your business has outgrown the traditional banking system and you now prefer to bank completely online, it’s another signal that you need to switch to an online-only business bank account. Perhaps you’ve become too busy to visit a physical branch to process your banking transactions, or you travel too often and still want to access your bank account.

4. You’re Unsatisfied With the Service

The same survey by NFIB mentioned above found that 87% of small business owners consider customer service as the most critical factor in deciding to choose a bank for their business. If you are unsatisfied with your current bank’s customer service, this is another good reason to switch to a different bank.

When a provider’s customer service staff fails to meet your concerns or build a good banking relationship, it’s best to take your business where you can get better service and value for your money.

5. You Need Access to More Business Products

Limited access to the products your business needs will inevitably restrict your business growth. If you need to access other business products that your current bank doesn’t offer, such as loan products, credit cards, and merchant services, it’s a good idea to switch to another bank that can cater to your needs.

Frequently Asked Questions (FAQs)

No. If you plan to switch business bank accounts, it requires some effort and a significant portion of your time. However, it’s a crucial step if your current bank no longer serves your business needs and fails to provide the business banking products you seek.

If you’re looking to save on banking fees, earn high APY, and receive better service, then it’s wise to switch to a new bank. However, frequently changing business banks can affect the approval of a pending credit application or business financing since it can portray a lack of stability when your files are reviewed.

There are plenty of reasons for business owners to change their banks. These can include an attractive cash bonus or introductory rate for new business accounts, excellent customer service, or more product offerings from other banks. See our top business bank account promos and offers for options.

Bottom Line

When choosing a business bank account, it’s important to consider its scalability with your future needs as your business expands. If your current bank account can no longer meet your needs, or if you encounter one of the signs cited above, changing business banks may be the best way.