Investing in real estate requires you to buy homes in areas that increase equity, have a positive cash flow, and are profitable in the long run. The earning potential of a particular area is influenced by a wide range of factors, including home values, vacancy rates, cost of living, tax burdens, available inventories, and overall rental opportunities.

We examined these ranking factors to determine the 10 best states to invest in real estate, along with the five worst states. Based on these variables, we identified Georgia as the best and New Mexico as the worst state to invest in, with various states in between. Continue reading for details and data about each state.

1. Georgia

- Georgia has the fifth-highest available inventory at 28,952.

- It has the eighth-lowest tax burden at 8.90%.

- The state has the 12th-lowest cost of living in the country at 91.

- It has a high percentage of renters, ranking 15th (34.1%).

Due to its high population of renters (34.1%) and low cost of living (12th-lowest), Georgia is ranked as the best state overall to invest in real estate. With a high property appreciation rate year-over-year (Y-o-Y) of 4.70%, there is potential for rising rents and long-term equity growth.

Furthermore, Georgia has the fifth-highest available home inventory (28,952) and a low tax burden at 8.90% (eighth lowest), encouraging individuals to relocate there. Regarding job growth, population, and happiness score, Georgia ranked 14th, 10th, and 20th, respectively. These elements indicate that renters prefer Georgia because it offers a variety of job prospects and a pleasant living environment, making it the best state to buy rental property.

Isle of Hope, GA, USA – Historic residential district

Other factors contributing to its first-place spot are its increasing rent values, relatively high median household incomes at $66,559, and average monthly rent of $1,024. Median home values are also reasonable, at $375,300 (24th), so investors can profit from the high rents and inexpensive homes. These considerations make it the best state to buy an investment property.

2. New Jersey

- The state has the second-highest Y-o-Y home value change at 12.80%.

- It has the fourth-highest median household income at $89,296.

- It has an average monthly rent of $1,368, the fifth-highest in the country.

- It has a very low vacancy rental rate at 4.2%, the ninth-lowest.

- New Jersey has one of the highest percentages of renters of all 51 states at 36.7%, ranking eighth.

Although New Jersey has a high cost of living, ranking 40th out of 51, it also has the 14th-highest median income at $89,296. It has more available inventory (11,902, 20th) than some other states and the 16th-highest tax burden in the country, so this indicates an opportunity—with a need to proceed with caution.

Still, excellent deals can be found in New Jersey with solid due diligence. It ranks fifth-highest for its monthly rental income ($1,368), ninth for the lowest vacancy rates, and eighth for the highest percentage of renters (36.7%). These factors make it a top contender for the best states to own rental property and second on our list.

Houses on Bay Avenue in Somers Point, New Jersey

The Garden State has experienced high home and rental appreciation values, ranking second and 18th-highest, respectively. Hence, the income and home equity potential are strong. New Jersey has seen slow population growth but ranks sixth for happiness score and 24th-highest job growth. This indicates the state will likely see an influx of residents over time, and the population numbers should start increasing.

3. Texas

- Texas has the second-highest available inventory in the country at 88,508.

- It has the fifth-lowest tax burden among 51 states at 8.60%.

- The state ranks ninth for the highest percentage of renters in the country.

- It ranks second-highest for percentage of job growth (4.60%) and third-highest for population growth (1.55%).

Texas comes in third as the best state to buy investment property. The Lonestar State’s overall home value and supply factor ranks third collectively for median home value ($357,800), available inventory (second-highest), and tax burden (fifth-lowest), indicating opportunities for increased cash flow.

Texas’ overall location opportunity for residents ranks fifth in concentration for job growth, happiness score, and population growth, so investors know that residents will welcome moving to the area. Also, the state’s resident affordability is seventh-best, combining the cost of living and median household income, while property values have grown 1.30% Y-o-Y.

Austin, Texas, skyline at sunset

The vacancy rate is high (ranking 43rd). Still, the percentage of renters offset this by ranking eighth, showing that many individuals actively seek rental properties, with landlords collecting an average monthly rent of $1,082 (20th-highest). Texas also has the fifth-lowest overall tax burden in the U.S. at 8.60%, a significant factor when people consider moving to a new state.

4. Minnesota

- It ranked third for overall resident affordability.

- The state obtained the fourth-highest happiness score at 62.43.

- It has the 11th-lowest vacancy rate out of 51 states at 4.5%.

- Minnesota ranked 12th-highest in the country for Y-o-Y rent value change (7.44%).

Minnesota offers an excellent opportunity for real estate investors and is the fourth-best state to buy a rental property. It has fairly limited available inventory (ranking 24th), but the overall resident affordability ranks third, including the cost of living index (94.1) and median household income (14th-highest).

Downtown St. Paul, Minnesota

The state’s overall location opportunity for resident score ranks seventh, which includes population growth (0.41%), job growth (2.50%), and happiness score (62.43). The Gopher State also has a +2.1% Y-o-Y home value change and a +7.44% rent value change, so there’s potential for investors to benefit from increased equity and cash flow. Although the state has a low percentage of renters, ranking fourth lowest, the current monthly rent is $1,010. Its low vacancy rate (11th-lowest) will allow landlords to increase rent and gain a steady income stream

5. New Hampshire

- New Hampshire has a 13.07% Y-o-Y rent value change, the fourth highest among 51 states.

- The state has the fifth-highest median household income at $88,465.

- It has the fifth-lowest vacancy rate in the country at 3.2%.

New Hampshire ranked fifth as the best state to buy a house for investment, beating out other states for its high Y-o-Y rent value change (fourth), low vacancy rate (fifth), and high median household income (fifth). Properties also have appreciated by 5% Y-o-Y, and median property values are the 13th-highest at $452,700, showing that it’s a reasonably affordable place for investors to buy. Therefore, as more people move to the state, equity and rents will continue to climb.

Riverfront buildings of Exeter, New Hampshire

The state ranks 22nd overall for its employment, happiness score, and population growth, displaying a moderately paced upward trend. In addition, 26.3% of its citizens chose to rent over owning a property, and it has the 17th-highest rental income at $1,145, creating a healthy rental market with a demand for more housing and putting it mid-range for best states for real estate investing.

Here are some calculators and tools to help you with investment property math:

- Free Rental Property Calculator to Analyze Your Investment Property

- Vacancy Rate: What It Is, How to Calculate & Why It’s Needed

- Guide to Gross Rent Multiplier for Investors + GRM Calculator

6. District of Columbia (Washington, D.C.)

- Ite has a percentage of renters of 55.3%, which is the first highest in the country.

- It has the second-highest median household income at $90,088.

- The District of Columbia has the second-highest average monthly rent at $1,607.

- It has a 62.6 happiness score, the second highest among all states.

District of Columbia (Washington, D.C.) ranks in the top 10 for its overall rent potential, ranking sixth collectively, with an average monthly rent of $1,607 (second-highest), a median vacancy rate of 6.3%, and the second-highest median household income, with 55.3% (first-highest) of its residents are renting. These numbers bode well for investors because they support higher rents, low tenant turnover, and renters who can typically afford to pay each month.

United States Capitol Building, Washington, D.C.

The state boasts the 19th-highest overall location opportunity for residents, which includes job growth, population growth (seventh highest), and happiness score (second highest). These figures show that the state has a lot of employment opportunities and a great living environment, enticing people to relocate.

Median property values are the fourth highest, and available properties are relatively low, which indicates the need for more housing. However, investors need to be mindful of how quickly they can raise the rent since its increase in rental income appreciation is the nineteenth lowest in the country.

7. Utah

- Utah garnered a 62.41 happiness score, the fifth highest in the country.

- The state has the seventh-highest percentage of job growth (3.20%) and the ninth-highest population growth (1.07%).

- The state’s residents earned a median household income of $79,449, the 12th-highest among all states.

Ranking first collectively for its overall location resident opportunity, which includes happiness score (first), job growth (seventh), and population growth (ninth), Utah is the seventh-best state to buy an investment property. This increases home prices, which points to a supply issue and generates a sizable demand for homes. On our ranking, Utah has the eighth-highest median home price ($529,600), and since prices are out of reach for many buyers, investors benefit from the demand for rental units.

Bryce Canyon National Park, Utah, USA

Utah residents pay an average monthly rent of $1,090 (ranked 19th), and the area has the 20th-lowest vacancy rate among all states (5.4%), which causes a rise in housing demand for renters. Its median household income ranks 12th-highest, the cost of living is high (22nd-highest), and the state tax burden ranks 10th-highest. Still, with its high-income state and other positive variables, it’s one of the best states to invest in real estate.

8. Virginia

- Virginia has a $1,257 average monthly rent, ranking 10th-highest in the country.

- The state’s residents have a high median household income of $80,963, the 11th-highest out of all 51 states.

- It has the 12th-highest Y-o-Y home value change at 7.90%.

- It obtained a 57.84 happiness score, ranking 12th-highest among all states.

Virginia is the eighth-best state for real estate investing. Property values are the 15th-highest but have a high median household income ($80,963), ranking 11th of all 51 states, making it appealing to residents and investors. Additionally, its home inventory is fairly low (ranked 18th), which has increased property values by 7.9%, so there is a demand for housing. It has experienced moderate job, population, and happiness scores, ranking 19th for overall location opportunity.

Downtown Richmond, Virginia, USA

The Mother of Presidents State has a reasonably high percentage of renters at 30.6% (29th-highest), a high average monthly rent at $1,257 (10th-highest), and a low vacancy rate at 4.9% (13th-lowest). With the low inventory and rent value increases, there is room for further raising the rents. When you evaluate these statistics, it makes sense why Virginia is one of the best states for rental properties.

9. California

- California has 45.4% of renters (second highest) and has an average monthly rent of $1,586 (third highest).

- It has the second-highest median home value ($785,900) and third-highest available inventory (40,313).

- The state’s residents have a median household income of $84,907, the sixth highest in the country.

- The state garnered the eighth-highest happiness score among all states, with a score of 59.97.

California is a good option for investing in rental property because of the state’s overall rent potential (ranking first), which includes a high average monthly rent of $1,586 (third-highest), a low vacancy rate at 4.1% (eighth-lowest), and a high percentage of renters at 45.4% (second-highest). It also has a high median home value and inventory, ranking second and third highest, respectively. These factors make it a sound choice for many investors.

Laguna Beach, California, USA

However, its overall tax burden (13.50%) is the fifth highest, so population growth (-0.19%) will be lower than average, ranking 46th. The Golden State also has a high happiness score (59.97) and job growth (2.80%), ranking eighth and 15th of all 51 states. These data indicate that residents have a lot of career opportunities and are satisfied with their living environment, encouraging people to relocate to the state.

10. Arizona

- The state has 18,787 available inventory, ranking ninth highest in the country.

- Arizona’s population growth increased by 0.88%, which is the 12th-highest among all states.

- It has the 15th-lowest tax burden at 9.50%.

- The state has the 16th-highest median home value at $436,100.

Arizona rounds out our list of the top 10 best states for rental property. While its other rankings are moderately low, the overall home value and supply ranked fifth collectively, making it the primary reason for its inclusion in this list. It has a high median home value at $436,100 (16th) and a low tax burden at 9.50% (15th), another reason people are flocking to the Grand Canyon State, but this is positive for investors if they can find a property to buy.

Downtown skyline view of Phoenix, Arizona, USA

The state’s job growth, population growth, and happiness scores rank 18th, as Arizona is experiencing an influx of newcomers and has one of the highest available home inventories in our research, ranking ninth out of 51 states. Its overall rent potential is the 17th best, with an average monthly rent of $1,097 (18th-highest) and 32.8% of its residents renting. Vacancy rates of 6.7% are higher than two-thirds of its population (ranked 30th), but this is likely due to seasonality.

5 Worst States to Invest in Real Estate in 2024

Contrasting with the 10 best states to invest in real estate, we also evaluated the worst five states to invest in real estate. These generally have low rents and high vacancy rates. These five worst states for landlords suffer from low housing inventory, slow job growth, decreased population growth, and a low happiness score, indicating weak demand for rental properties. Household incomes are low compared to other states, and high vacancy rates indicate too many vacant units to affect supply and demand.

- New Mexico’s residents have a low median household income of $53,992, ranking 46th out of 51 states.

- The state has one of the lowest Y-o-Y home value changes at 2.80% (42nd) and rent value changes at -3.30% (44th).

- The state only obtained a 43.64 happiness score, ranking 43rd.

The Land of Enchantment ranks first among the worst states for real estate investing. Like the other states on this list, the overall resident affordability ranking is low at 48th for the cost of living index (22nd) and median household income (46th). Also, the tax burden of 10.20%, ranking 26th out of 51, is very high, and with average rent prices at $857 per month, investors will be waiting a while to get a significant return on their investment.

Downtown Albuquerque, New Mexico

Although the percentage of renters is 30.8% (26th), the job growth rate is slow, ranking 20th, and the happiness score is very low (43rd), which could indicate a changing housing market in New Mexico. Also, a very low Y-o-Y home and rent values make it challenging for investors to attract tenants in this state. While it might not be time to purchase a rental property, investors should keep an eye on this state.

- Kentucky has one of the lowest median home values at $251,300, ranking 48th out of 51 states.

- The state has only $783 average monthly rent, the fourth lowest in the country.

- It ranked 48th among all states for happiness score, garnering a score of 38.36.

- Kentucky’s residents only have a $55,573 median household income, the sixth lowest in the country.

A major contributing factor to Kentucky’s lower ranking is the overall location opportunity for residents, which ranks 46th. This ranking is a combination of low job growth at 2.20% (34th) and population growth at 0.32% (29th), as well as a low happiness score of 38.36 (48th). The lack of opportunity in these areas deters renters from moving to Vermont. It also has a low number of available homes at 8,154 (28th) and a median home value of $251,300 (48th), making it a complex state for investors to find affordable properties to purchase.

Louisville, Kentucky, USA

Although the state has a low vacancy rate at 4.9%, ranking 16th, a reason for its low state rating for overall rent potential is that the average monthly rent is very low at $783 (48th) and a moderately low percentage of renters at 30.1% (34th). Also, combined with a negative Y-o-Y rent value change of -2.36% (40th), there is a slight opportunity for growth down the line.

- The state has the lowest average monthly rent at $732 and the lowest percentage of renters at only 22.2% in the country.

- Among the 51 states, West Virginia has the lowest percentage of job growth at only 0.40% and the lowest happiness score at 33.83.

- West Virginia’s residents have only a $51,248 median household income, the second lowest in the country.

- The state also has a low number of available inventory at 3,085, ranking 42nd out of all states.

- It has a high vacancy rate at 9.3%, ranking 45th among all states.

The Mountain State ranks third among the worst states for owning rental property. This is primarily due to the overall ranking for rent potential, which looks at the percentage of renters at 22.2%, average monthly rent at $732 (both ranked 51st), and vacancy rate at 9.3%, ranked 45th. These statistics show a very low number of renters in the state; therefore, vacancy rates are high and rent prices are low, leaving a lot of supply and little demand. This is not ideal for investors who want to market their properties for top dollar and get quality tenants.

West Virginia State Capitol in Charleston, West Virginia

In addition, this area’s job growth, population growth, and happiness scores are low, ranking 51st overall, indicating fewer opportunities for residents. Also, its home values are at $304,400, ranking 32nd in the country, and it has a cost of living index of 90.3 (ranked ninth). While this bodes well for buyers, investors should be cautious when purchasing in this state.

- The state has one of the lowest percentages of renters at only 23.8%, ranking 48th.

- Maine has one of the highest tax burdens at 12.40%, ranking 42nd out of 51 states.

- It has only 2,935 available inventory, the ninth-lowest in the country.

- The state ranked 40th for the percentage of job growth, with only a 2% increase.

Maine is the fourth-worst state for investing in real estate due in part to its low resident affordability, ranking 51st collectively. The cost of living index is relatively high (13th-highest), considering the median household income is $64,767 (33rd). Plus, the state lacks opportunities for residents, e.g., the happiness score and job and population growth were low at 25, 40, and 21, respectively. These numbers limit the number of renters willing to live in the Pine Tree State.

Augusta, Maine, USA

The average monthly rental income is the 18th lowest in the country ($873), and it has a very low percentage of renters (23.8%), ranking 48th, which doesn’t provide much profitability for investors. Y-o-Y home (9.60%) and rent (3.80%) values were fairly high, ranking seventh and 24th-highest, respectively, so investors might have some potential in Maine.

- Louisiana’s residents have only a $52,087 median household income, the third lowest in the country.

- The state ranked 44th out of 51 states for median home value at $257,400.

- It has one of the highest vacancy rates at 10.1%, ranking 47th.

- The state has experienced a -2.20% Y-o-Y home value change, which is the third lowest.

- It has the second-lowest population growth (-0.31%) and happiness score (34.81) among all states.

Rounding out our list of the five worst states is Louisiana. The Bayou State has a slow job and population growth (42nd and 50th, respectively), a low happiness rating (50th), and ranks third for the lowest median household income. Property values have decreased by 2.20%, which doesn’t make Louisiana attractive to new residents and, therefore, it is not one of the best states for real estate investing.

The French Quarter, New Orleans, Louisiana

The percentage of renters in the area is 30.2% (33rd), and vacancy rates are at 10.1 (47th), which are extremely low compared to other states. Its Y-o-Y rent value increased by 2.14% with an average monthly rent of $876 (32nd), still showing some rental income potential for the future. In addition, the median home price of $257,400 (eighth-lowest) makes it affordable for investors to buy. However, these overall factors combined make it the worst state to invest in real estate for the time being.

Complete Data & Rankings for Each State

If you’re curious about how your state stacks up against the best states to buy a rental property, check out our map below. Click on your state to see the rankings for each evaluation category.

Rankings for Each State

If you’d like to see all the information used to conduct our study, click here for all the data.

How We Evaluated the Best & Worst States for Real Estate Investing

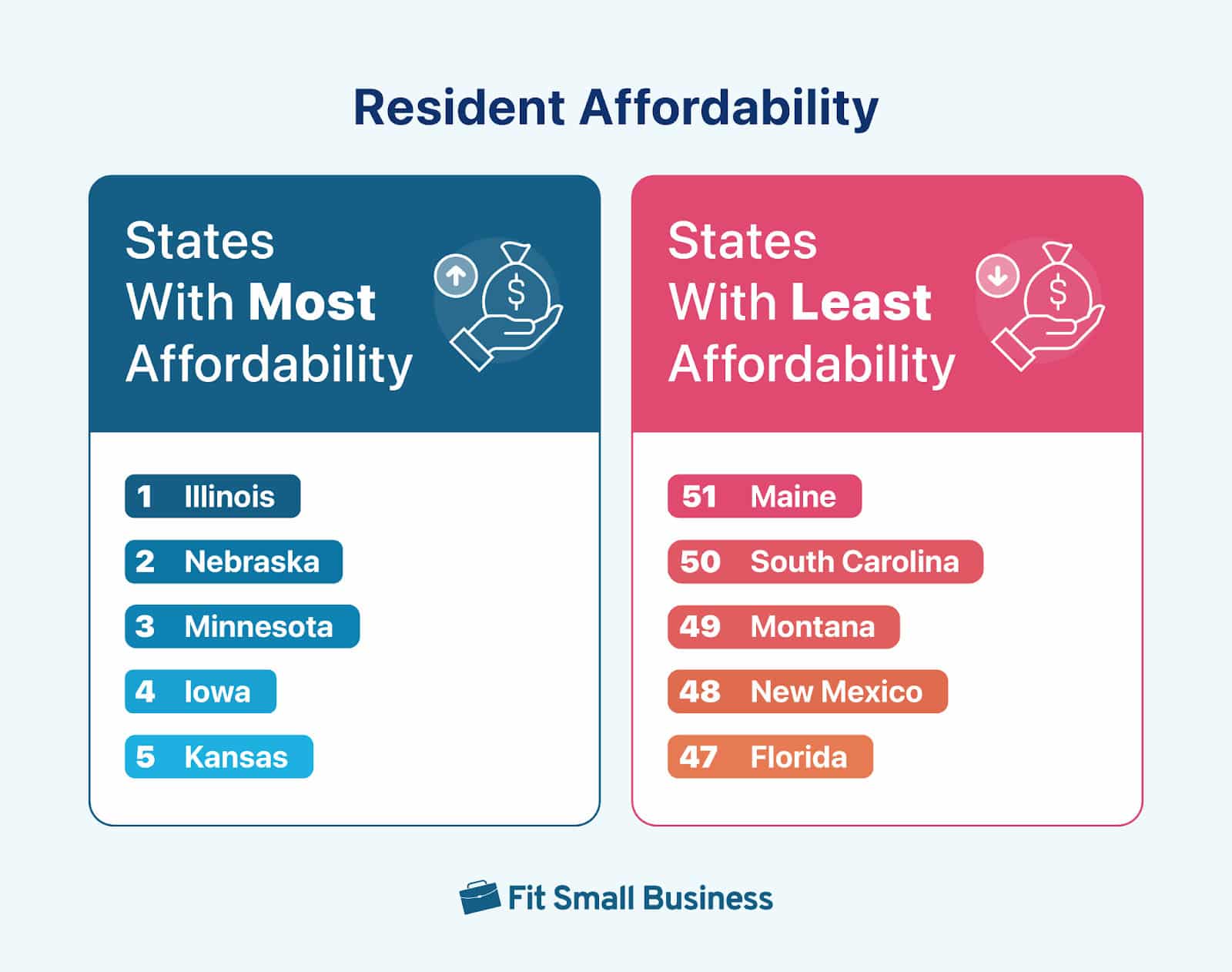

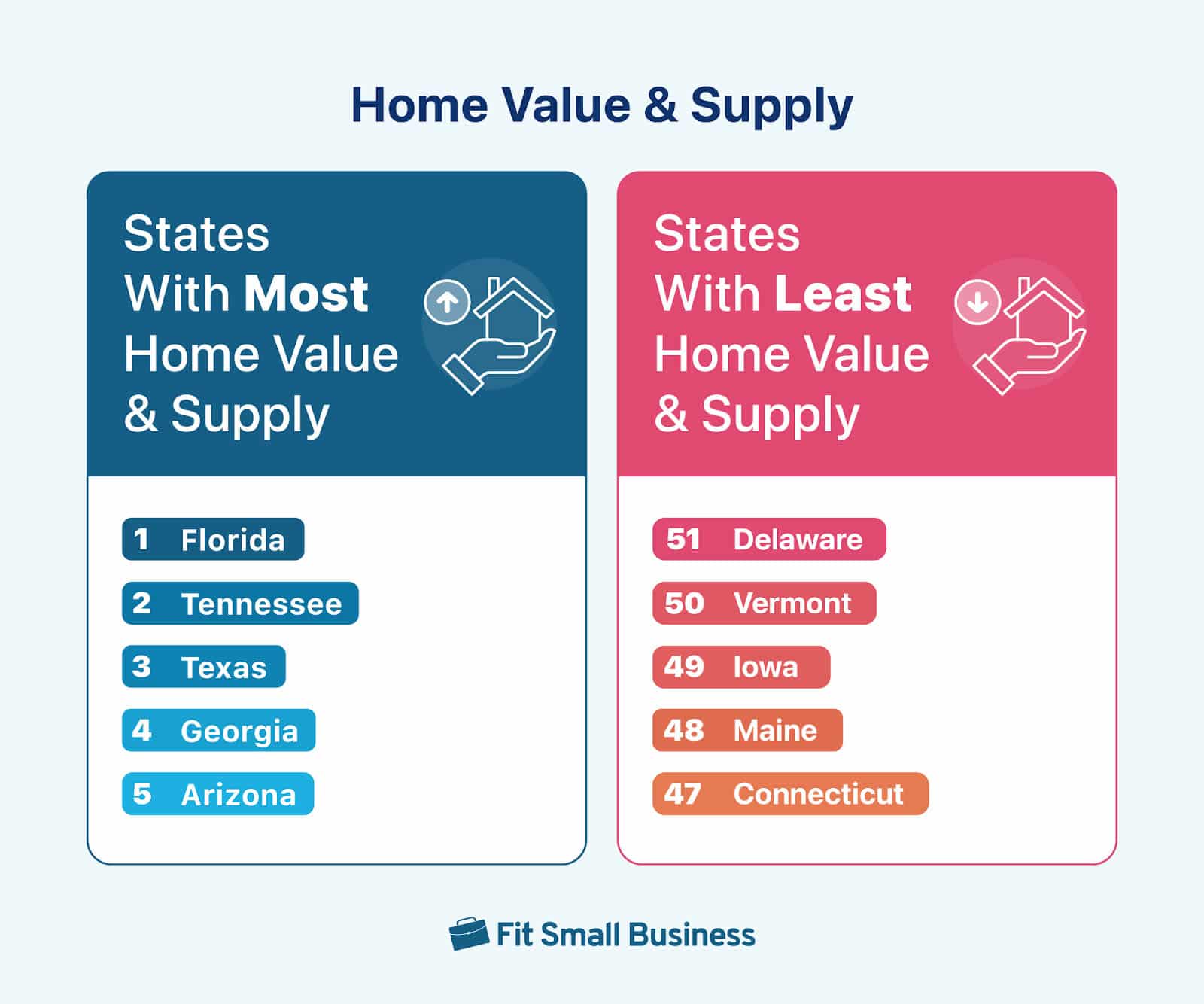

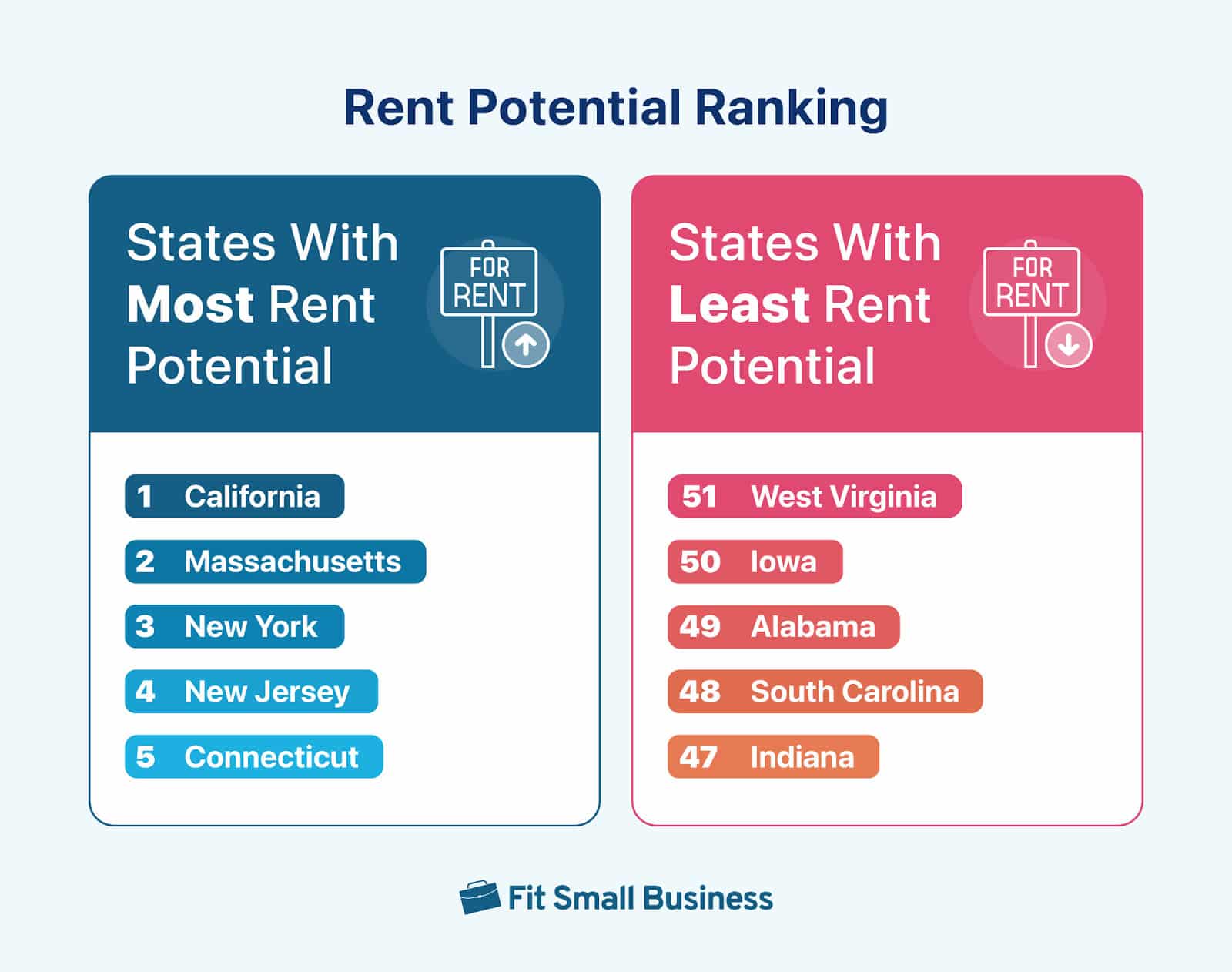

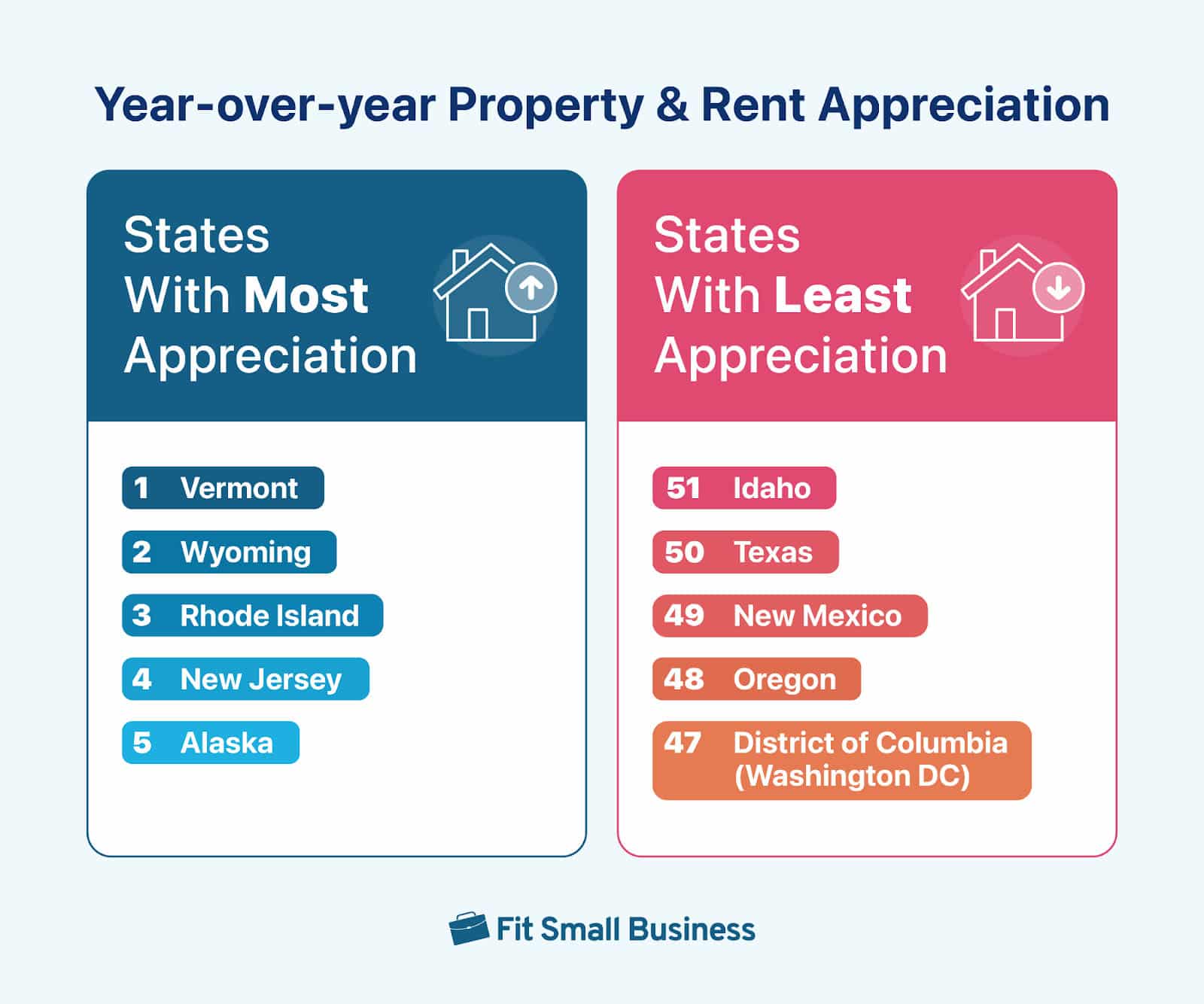

To determine the best states for real estate investing, we examined factors that indicate a state’s strengths and weaknesses, supply and demand driven by market appreciation, population and economic growth, and resident satisfaction. In particular, we evaluated 14 data points that culminate in the following five key metrics:

- Resident affordability

- Home value and supply

- Rent potential

- Year-over-year property and rent appreciation

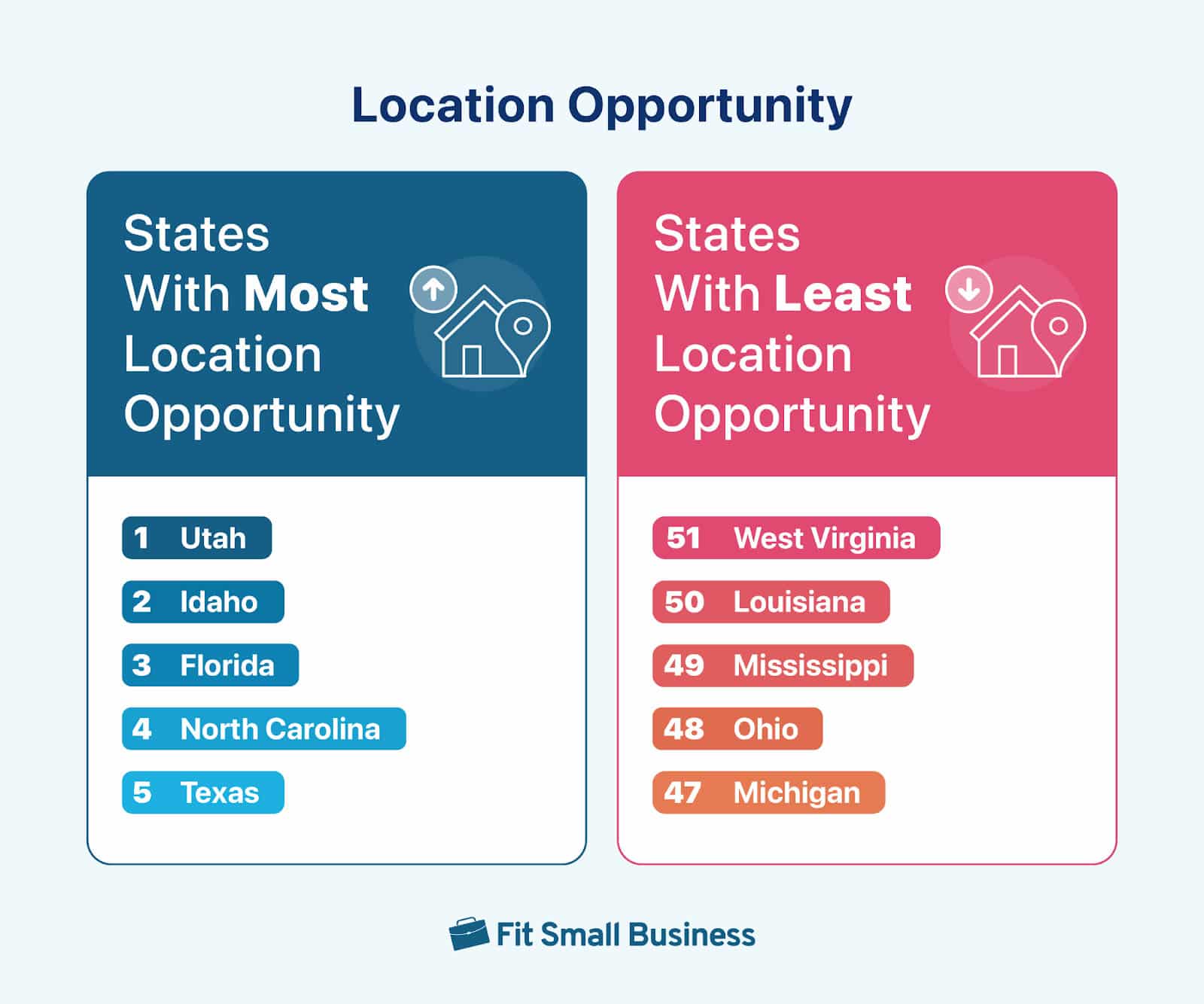

- Location opportunity

Each category was given an equal weight of 20% based on the importance of each metric to the potential for a positive return on investment (ROI). We then averaged the rankings for each state to obtain an overall ranking.

Bottom Line

Before purchasing an investment property, investors must research each housing market to understand the profitability potential and challenges they will face in the area. Choosing a state with location opportunities for residents, rising appreciation rates, high rents and percentages of renters, and low vacancy rates will yield the best results. However, change is constant in the real estate industry, so keep your investment options open in every market.