A DUNS number, short for Data Universal Numbering System, is a nine-digit number that identifies your unique business to Dun & Bradstreet (D&B). D&B is one of several major business credit bureaus, and having a DUNS number helps build a business credit profile which can not only make it easier for vendors to verify your company, but it can also help you get approved for business financing more easily.

Who Is Dun & Bradstreet (D&B) & What They Do

In the context of business lending, D&B is one of three major business credit bureaus. It houses data for various companies, using that information to provide decision-making data and analytics. Examples of products and services offered by D&B include providing access to a company’s credit profile and credit scores.

A D&B business credit report includes data and insights on various aspects of your company, such as its legal name, operating history, payment history, creditworthiness, and stability. Companies commonly use that information to determine if they want to develop a partnership with your business. This can be for the purposes of things like extending credit, lending money, allowing you to become a vendor or supplier for a product or service, and more.

How to Get a DUNS Number

Getting a DUNS number is a fairly simple process. After ensuring you don’t already have one, you can apply for one for free via D&B’s request page. Here are the applicable steps:

Step 1: Choose Your Company Type

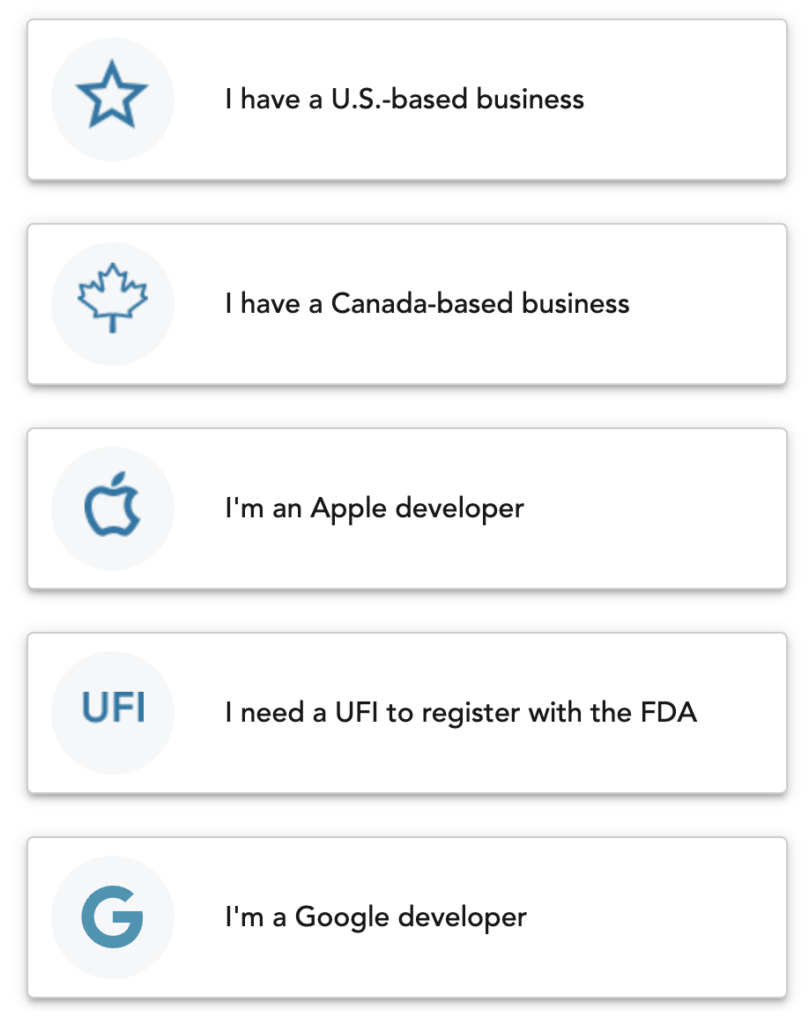

The first step is to pick the best option to describe your company type. Depending on your selection, you’ll be redirected to the corresponding page to fill out your company information.

Options describing your company type

Step 2: Fill Out Requested Information

Depending on your company type, you may have to provide supplemental information. This could include:

- Legal name of your business

- Business address

- Business phone number

- Name of the business owner, president, or CEO

- Legal structure of the business

- Year of business creation

- Primary business industry

- Total number of employees

Step 3: Go Through the Checkout Process

You’ll be directed to checkout and presented with the option of expediting the process to receive the report within eight business days for a $299 fee. You could also wait the standard 30 days, in which case the request is free.

Step 4: Receive DUNS Number in Email

Once your company has been authenticated, the steps are complete. You should then receive your DUNS number via email. If further validation is needed, a D&B representative may contact you.

Benefits of Having a DUNS Number

Getting a DUNS number isn’t required to run a business. However, as it’s free to apply for and get, it carries a lot of benefits with little downside. Below are two primary benefits of having a DUNS number and why you should get one.

Greater Access to Funding

Having a DUNS number adds a layer of credibility to your business, making it easier to get approved for loans and develop business partnerships with vendors. This is because other companies can more easily verify the legitimacy of your business, such as its operational history, legal name, location, and other information relating to your creditworthiness. With a stronger credit score, you’ll be better positioned to negotiate more favorable rates and terms when applying for small business loans.

Even if you’re not looking to apply for loans, getting a DUNS number can help if you are trying to get other individuals or entities to invest in your company. A DUNS number can help strengthen your business credit score, which is something that can give investors more confidence in the stability of your future business operations.

Increased Access to International Business, Government Contracts, and Grants

Many state and local agencies require your company to have a DUNS number in order to bid on contracts. The same is true of many small business grants and businesses that operate internationally. Even if it’s not required, having a DUNS number can help as it provides additional transparency and confidence in your company’s reliability. As a result, having a DUNS number allows you to access significantly more revenue streams.

How to Look Up Your DUNS Number

Your DUNS number can be found by accessing D&B’s Lookup Tool. There, you can search for your number using your company name and address. If you’ve already established a DUNS number, your profile should appear, and you should have the option of sending your number directly to your email address.

If you can’t find your number, it’s possible you might not yet have one. It’s worth noting that owning and operating a business doesn’t automatically provide you with a DUNS number. Keep in mind you may have been assigned one if information about your company is requested from a lender or partner. You can request one free of charge directly from the D&B Website or by speaking with a D&B representative.

Managing Your DUNS Number

In the event your business has been closed or purchased, your DUNS number will remain the same—and it can never be altered. In part, your DUNS number also has no expiration date. However, should you need to make changes to your profile, such as updating your address or contact information, you can request updates through the D&B’s D-U-N-S Manager form.

There is no maintenance requirement of your DUNS number that involves the purchase of products or services. It’s a completely free number that will follow you through the lifetime of your business.

Frequently Asked Questions (FAQs)

It typically takes up to 30 business days to process your DUNS number request. However, you can also get it within eight business days if you pay for expedited processing.

There is no charge to get a DUNS number. However, if you need a DUNS number more quickly than the standard processing time of up to 30 business days, you can pay a $299 fee for expedited processing.

You can look up a number for any company for free using the D-U-N-S Number Lookup Tool.

No. If you have multiple business locations, you must apply for a different DUNS number for each location.

Bottom Line

A DUNS number is attached to your D&B business credit report and can be publicly accessed by lenders, suppliers, or business partners to assess the creditworthiness of your business. It’s a simple, free process that can promote the growth and credibility of your business. It’s not uncommon for a DUNS number to be a small business loan requirement, and since it can take up to 30 business days to get, I recommend registering for a DUNS number for each business you run.