IRS Form 8832 is filed by limited liability companies (LLCs) planning to be taxed as C corporations (C-corps). The form must be filed between one year prior and 75 days after its effective date. With late relief, the effective date can be extended up to three years and 75 days from when relief was requested, as shown in the IRS Form 8832 instructions.

LLCs also file Form 8832 to revert to being taxed as a sole proprietor or partnership if C-corp status was elected previously. An LLC that doesn’t file Form 8832 is taxed as a sole proprietor or partnership, and LLCs that wish to be taxed as S Corporations (S-corps) should file IRS Form 2553 instead.

You can download a PDF of IRS Form 8832 from the IRS website by clicking the thumbnail below:

Check out our article about the important tax differences between partnerships, S-corps, and C-corps for more information. You can also learn more about what is an LLC.

To best illustrate how to complete Form 8832, let’s assume the following set of facts:

New Business, LLC is a Delaware consulting company, under the sole ownership of Robert Newman. Since Robert is the sole owner of this single member LLC, in the absence of any special elections, the income and expenses for New Business, LLC would be reported on schedule C of Robert’s personal tax return. However, Robert decides that he would like for New Business, LLC to be taxed as a C corporation. He will need to complete form 8832 in order to make that election. Form 8832 for New Business, LLC was timely filed, so no late relief request is required.

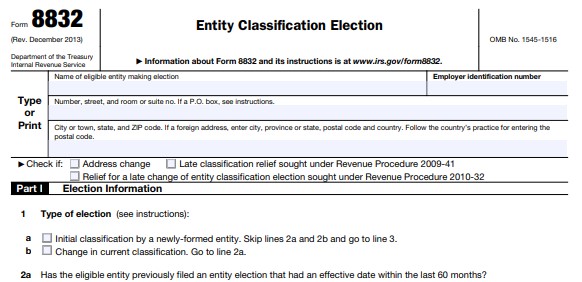

Step 1: Fill Out Basic Business Information

The top of Form 8832 requires some basic business information, including the following:

- Business name

- Business address

- Employer identification number (EIN). You must have an EIN—a tax ID for businesses—to submit Form 8832. The IRS won’t process the form if you leave this field blank or input your Social Security number instead.

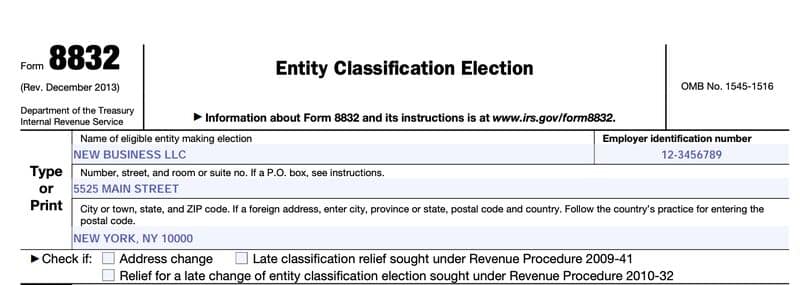

Basic Form 8832 information for sample company: New Business, LLC

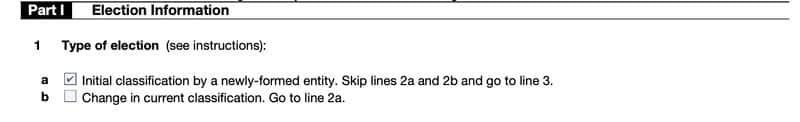

Step 2: Indicate the Type of Election (Part I, Question 1)

In Part 1, Question 1, you’ll be asked to choose your reason for filling out Form 8832:

- Initial classification by a newly formed entity: Choose this option if you just formed your business and are electing a tax classification for the first time. If you select this choice, you can skip Step 3 of our guide and go to Step 4.

- Change in current classification: Choose this option if you’ve already filed a tax return under one classification and now want to switch. For example, choose this option if you have a multi-member LLC that was taxed as a partnership but you would now like to be taxed as a C-corp. Similarly, choose this option if you have a multi-member LLC that is currently taxed as a C-corp but you want to go back to default partnership treatment.

Box 1a is checked for New Business, LLC, since it is a newly formed entity.

Form 8832: Line 1a marked for initial entity classification for sample company: New Business, LLC

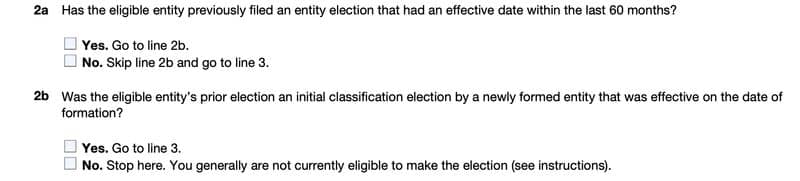

Step 3: Indicate Previous Elections (Part I, Questions 2a and 2b)

The IRS typically allows one change in your tax election every five years. An exception is if the previous election was for a newly formed entity and the election was effective on the business’ date of formation.

There is a second exception if more than 50% of the business’s ownership interests have changed since the previous election. However, filing a new Form 8832 under this exception requires a private letter ruling from the IRS, which requires a hefty user’s fee along with professional fees to hire a tax attorney.

Lines 2a and 2b are skipped for New Business, LLC, since the instructions from line 1a indicate that line 3 is the next line to be completed.

Form 8832: Part I, lines 2a and 2b left blank for sample company due to initial entity classification

Your answers to Questions 2a and 2b determine if you are eligible to change your business’s tax treatment. If you’ve filed another Form 8832 within the last five years, then answer “yes” to Question 2a and proceed to Question 2b. If you did not fill out another Form 8832 within the last five years, then answer “no” to Question 2a and proceed to Question 3.

Question 2b asks whether your previous election was for a newly formed entity and whether the election was effective on the date of the formation. If your answer to Question 2b is “yes,” then proceed to Question 3. If your answer is “no,” then you’re not eligible to submit Form 8832.

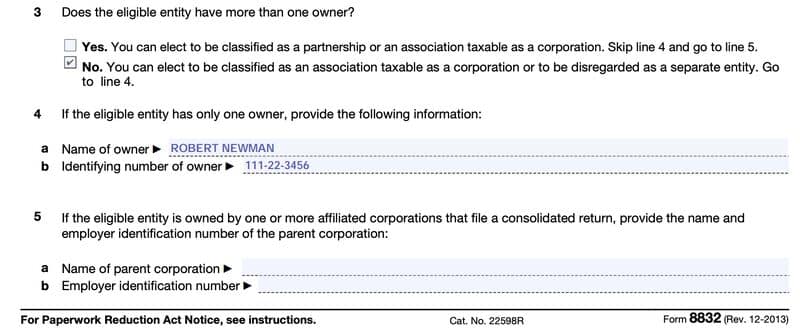

Step 4: Identify Owner Information (Part I, Questions 3 & 4)

Questions 3 and 4 ask about owner information. In Question 3, you need to specify if the business has one owner or multiple owners. If the business has only one owner, indicate the name of the owner in Question 4, along with the owner’s “identifying number.” The identifying number usually means the owner’s Social Security number. If the owner is a business entity, then the identifying number may be an EIN.

For New Business, LLC, Line 3 is marked “no,” since Robert is the sole owner. Lines 4a and 4b are completed with Robert Newman’s personal identifying information.

Form 8832: Owner information showing Robert Newman as 100% owner

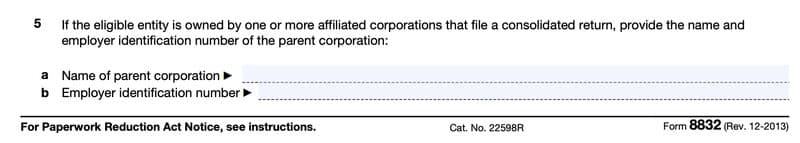

Step 5: Indicate Affiliated Companies (Part I, Question 5)

If the owner or owners of your business are a group of affiliated companies that file a consolidated return, you’ll need to specify the parent company and its EIN in Question 5. This question is to ensure that each company in the group receives the correct tax treatment.

Lines 5a and 5b are not completed for New Business, LLC, since it is not owned by a consolidated corporate entity.

Form 8832: Line 5 left blank for New Business, LLC since there are no affiliated corporations

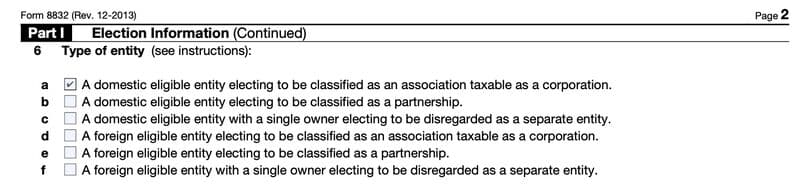

Step 6: Select Type of Entity (Part I, Question 6)

This is the heart of Form 8832. This is where you elect how you want to be taxed. Below you will find a list of your choices along with a brief explanation of each:

- Choose “a” if your business was formed in the US and you want to be taxed as a C-corp. Remember: if you want to be taxed as an S-corp, fill out IRS Form 2553, not Form 8832.

- Choose “b” if your business was formed in the US, has more than one owner, and you want to be taxed as a partnership.

- Choose “c” if your business was formed in the US, has just one owner, and you want to be taxed as a sole proprietorship.

- Choose “d” if a company is a “foreign entity” and you want to be taxed as a C-corp.

- Choose “e” if a company is a “foreign entity,” has more than one owner, and you want to be taxed as a partnership.

- Choose “f” if a company is a “foreign entity,” has a single owner, and you want to be taxed as a sole proprietorship.

Box “a” is checked on line 6 for New Business, LLC since it is a Delaware entity and Robert wishes for it to be taxed as a C corporation.

Form 8832: Line 6a checked for New Business, LLC to be taxed as a corporation

This is a very important decision with long-term tax consequences that can’t be undone. We recommend talking to your accountant or tax professional before submitting the form. If you don’t have a tax advisor, Block Advisors has a team of professionals that can help you get your business properly organized. To learn more, read our review of Block Advisors.

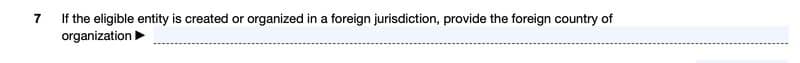

Step 7: Indicate Foreign Entities (Part I, Question 7)

Provide the country where the business was created, if not in the US. Some US territories are considered foreign entities for tax purposes. If you’re unsure, see page 8 of Form 8832 for a list of countries.

This line is not applicable to New Business, LLC since it is a domestic entity.

Form 8832: Line 7 left blank since New Business, LLC is organized in the US.

Step 8: Add Effective Date of Election (Part I, Question 8)

In Question 8, you choose when you want your tax election to take effect. If you are a new business, then the effective date should be the date your business began operations. An election effective after operations begin creates a complex tax scenario. If this is the case, you should consult a tax professional.

As shown below, Robert is requesting that New Business, LLC be treated as a C corporation as of 1/1/23.

Form 8832: New Business, LLC corporate election date shown as January 1, 2023

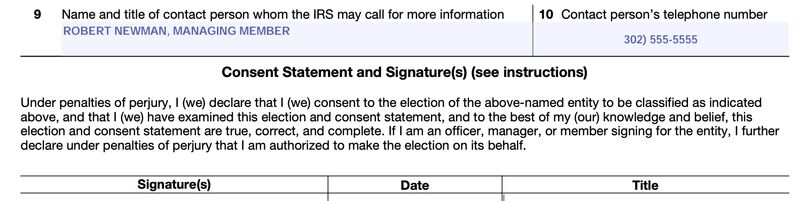

Step 9: Add Signature and Telephone Number (Part I, Questions 9 & 10)

For this question, provide the name, title, and phone number of the person that the IRS should contact, should there be any questions about your form. Form 8832 should be signed by a business owner, manager, or officer of the business.

As the sole owner, Robert’s information is provided on lines 9 and 10. Robert will also need to sign, date, and title the consent statement.

Form 8832: Lines 9 & 10 completed for Robert Newman as authorized signer

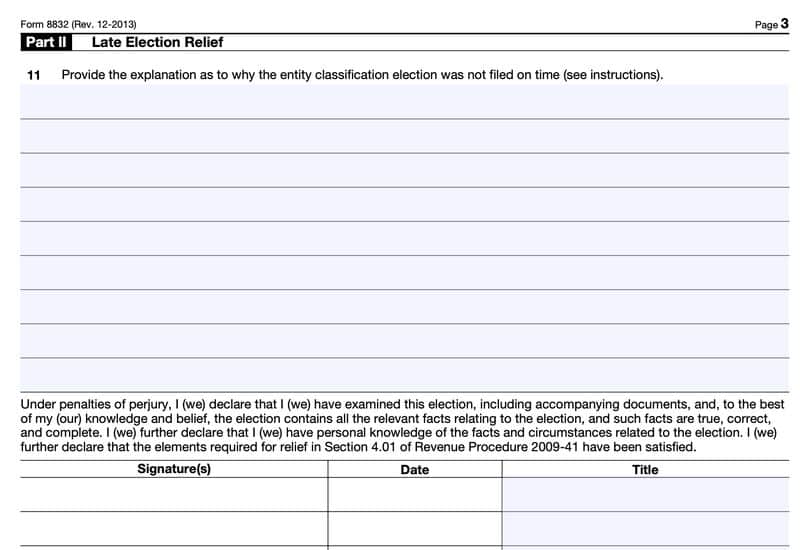

Step 10: Fill in Late Election Relief (Part II)

Since Form 8832 was timely filed, New Business, LLC did not require late election relief. However, for entities where this might apply, it’s important to note that Form 8832 is due 75 days after the effective date. You may be eligible for late election relief if you meet the following criteria:

- You have already submitted a Form 8832 and were denied solely because it was filed late

- You are up to date on all your taxes

- There’s reasonable cause for the delay

- Form 8832 is no more than three years late

If these apply to you, explain the reasonable cause for the delay in the blank space on the form.

Form 8832: Late election relief

Who Must File Form 8832

Form 8832 must be filed by an LLC that elects to be treated as a C-corp. A single-member LLC wishing to be treated as a sole proprietor or a multi-member LLC wishing to be treated as a partnership doesn’t have to file any form as these are the default treatments. Any LLC wishing to be treated as an S-corp should file Form 2553 instead of Form 8832.

Here’s a summary of LLC choices and how they make the election:

Choosing how to be taxed has long-term consequences and is one of the most important decisions made on behalf of an LLC. Form 8832 can be filed again if an LLC wants to change how they’re taxed. For example, an LLC can elect to change back from an S-corp or C-corp to a partnership. However, changing from one type of entity to another after operations have begun is usually a taxable event.

When to File Form 8832

Form 8832 must be filed between one year prior and 75 days after its effective date. Most LLCs want their Form 8832 to be effective for their first tax year, so the form must be filed no sooner than one year and no later than 75 days after beginning business. For example, if you started operations on February 1, 2024, Form 8832 must be filed between February 1, 2023, and April 16, 2024.

The Form 8832 instructions provide certain conditions that will allow the filing of Form 8832 up to three years late. See the discussion of Form 8832 in step 10 for more information.

Where to File Form 8832

Form 8832 cannot be filed electronically. The Form 8832 instructions provide two different mailing addresses, depending upon where the LLC is located.

Select your state to see where to mail Form 8832:

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Internal Revenue Service

Kansas City, MO 64999-0002

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Internal Revenue Service

Kansas City, MO 64999-0002

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Internal Revenue Service

Kansas City, MO 64999-0002

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Internal Revenue Service

Kansas City, MO 64999-0002

Internal Revenue Service

Kansas City, MO 64999-0002

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Internal Revenue Service

Kansas City, MO 64999-0002

Internal Revenue Service

Kansas City, MO 64999-0002

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Internal Revenue Service

Kansas City, MO 64999-0002

Internal Revenue Service

Kansas City, MO 64999-0002

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

You should also attach a copy of Form 8832 to your federal income tax return in the year the election is effective.

Frequently Asked Questions (FAQs)

If you would like your LLC treated as a C-corp for income taxes, you will need to file IRS Form 8832. If you wish your LLC to be treated as an S-corp, you should file IRS Form 2553. If you want your LLC treated as a sole proprietorship or partnership, neither form is required.

If you don’t send in IRS form 8832 on time, you will receive Notice CP278 from the IRS. CP278 will tell you that your request to change your business classification has been turned down because you failed to submit Form 8832 on time.

If your request has been denied, you should file your return in the same manner you filed your return before making the request. For example, if you previously filed 1040 Schedule C, you should continue to file this form after the denial.

Bottom Line

IRS Form 8832 is used by an LLC to be classified as a C-corp rather than a sole proprietorship or partnership. The election or change of tax classification is incredibly important, and we recommend you seek professional tax advice before making any decisions.