An employer identification number (EIN) is a unique nine-digit number that identifies your small business when you file taxes, open a business bank account, get a business loan, or perform other business activities. Obtaining an EIN is free, and you can apply for it online, by fax, or by mail if your business is in the United States or US territories.

Step 1: Collect the Necessary Information

If you are applying for an EIN, you’ll need to have on all EIN applications the name and taxpayer identification number (TIN), such as EIN, Social Security number, or individual TIN (ITIN) of the true principal officer, general partner, grantor, owner, or trustee of the business. So, you’ll need to gather this information beforehand.

You’ll need the following information:

- Business name and address

- Responsible party for the business; generally, this is the same person who is completing the form. This can be an owner, partner, or officer of the business

- Social Security number of the responsible party

- Reason you need an EIN

- Type of business you have, such as a corporation, partnership, limited liability company (LLC), or nonprofit organization

- If LLC, the number of members

- Date the business started and number of employees

- Last month of your business’ accounting year, usually December

Step 2: Apply for Your EIN

Once you have gathered all the necessary information, you can apply online, by mail, or by fax.

Online

The quickest and most efficient way to apply for an EIN is via IRS’s website. The online questionnaire takes about 10 minutes, and there are no forms to fill out. You’ll receive an EIN right away online, and it can be used immediately for most business purposes. However, you’ll need to wait about two weeks before you can use the EIN to file taxes electronically.

Mail or Fax

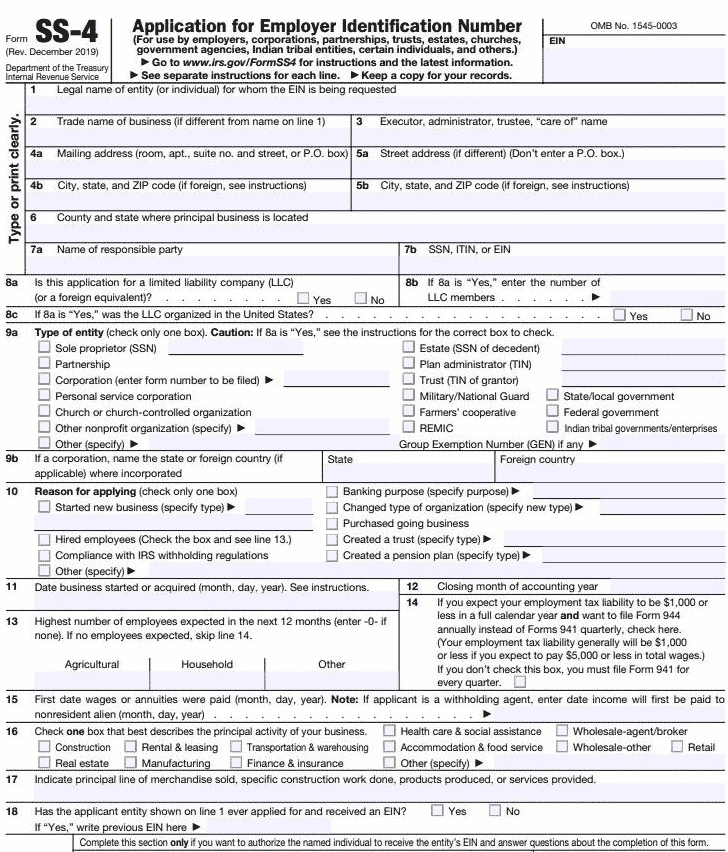

If you’d rather apply by mail or fax, first you’ll need to fill out an IRS Form SS-4 Application for EIN.

Form SS-4 (Source: IRS)

Form SS-4 is a one-page form that’s easy to fill out. There’s also a question on Form SS-4 that asks if your estimated employment tax is under $1,000. If it is, then you can file Form 944 annually instead of Form 941 quarterly. Businesses must submit Form 941 or 944 to the IRS if they withhold income, Social Security, or Medicare taxes from employee wages.

Faxed SS-4 applications take about one week to process. Mailed applications take about four weeks to process.

Who Needs an EIN?

Unless you’re a sole proprietorship or single-member LLC with no employees, you’re required to have an EIN. Even if you do fall into one of those categories, you may still want an EIN when getting a business loan or business credit card, supplying 1099s to contractors, and paying vendors. If you don’t have an EIN, you’ll need to disclose your social security number on tax forms.

Additionally, you’ll need an EIN if you answer yes to any of the following questions below:

- Do you operate as a corporation, partnership, multimember LLC, or nonprofit organization? (Learn more about the different structures through our LLC vs S corporation (S-corp) vs C corporation (C-corp) comparison.)

- Do you have employees, including your spouse or children?

- Do you have a Keogh plan (a tax-deferred retirement plan for self-employed individuals)?

- Do you file an Employment, Excise, Alcohol, Tobacco, or Firearms tax return?

- Do you withhold taxes on income other than wages paid to a nonresident alien?

- Are you involved with a trust, estate, real estate mortgage investment conduit, farmers co-op, or plan administrator?

What To Do If You Misplace Your EIN

If you lose your EIN, it’s relatively simple to retrieve—you can look up an old tax return or bank records to find it. Alternatively, you can call the IRS Business & Specialty Tax Hotline at (800) 829-4933 and select EIN from the list of options. The hours of operation are 7 a.m. to 7 p.m. local time, Monday through Friday.

Once connected with an IRS representative, tell them you lost or misplaced your EIN. They will ask you a few security questions before providing the number.

If you applied for your EIN by fax or mail, keep your EIN letter in a safe place. If you applied online, you’ll be given an opportunity to print out a confirmation of your EIN and store it in a safe place. If you use accounting software like QuickBooks Online, you can scan important documents like your EIN letter and store them in your system for quick reference. Read our review of QuickBooks Online if you want to learn more about the solution.

When You Need a New EIN

In most cases, once you get an EIN, it’ll be yours for the life of the business. However, there are a few specific cases where you’ll need a new EIN:

- You change business structures, such as a sole proprietor becomes a partnership or corporation

- A partnership is terminated and a new partnership is started

- You purchase or inherit a business

- Corporation receives a new charter from the secretary of state

- You become a subsidiary of a corporation

- Sole proprietorship declares bankruptcy

You don’t need a new EIN for the following scenarios:

- Business name changes

- Business location changes

- Operating multiple businesses

- Corporation or partnership declares bankruptcy

For more information, read IRS’s resource on when a new EIN is necessary.

Frequently Asked Questions (FAQs)

No. You can use any computer that can connect to the internet to visit IRS.gov. You should have an up-to-date Internet browser so that you can see the application process and finish it. If you want to get a confirmation letter online, you will need Adobe Reader installed.

No. An EIN can be applied for online by anyone whose main business, office, agency, or legal residence (in the case of a person) is in the U.S. or one of the U.S. Territories.

No. In a business name, the IRS can only recognize the letters A–Z, the numbers 0–9, the hyphen (-), and the ampersand (&). If your business’s legal name is something other than those above, such as a dollar sign ($), then you will need to figure out how to put it into the online EIN application.

Bottom Line

If your small business has employees or is a partnership or corporation, an EIN is required. Receiving an EIN is free, and you can easily apply for an EIN online through the IRS.