A gross rent multiplier (GRM) is a financial metric that evaluates and compares various investment properties to determine a property’s potential profitability. It is used by investors, both beginner and experienced, to decide whether a property is worth investing in. The GRM formula is one of the simplest and quickest methods for initial screens of potential investment possibilities. In this article, you can use our GRM calculator, learn what a good GRM is and how to improve it, explore the pros and cons of GRM, and learn the difference between GRM and other metrics.

What Is Gross Rent Multiplier?

The gross rent multiplier (GRM) is a simple computation used to determine the prospective profitability of comparable properties in the same market based on gross annual rental income. It creates a ratio to assess and analyze similar investments in a similar market by dividing the building’s cost by the gross rent. Additionally, it estimates the unit’s or property’s payment terms.

However, remember that the GRM does not represent the time it takes for the investment to pay off because it does not include everything in net operating income. Also, although it is a valuable metric, GRM is only one of the formulas you should utilize to determine whether an investment is profitable.

GRM Calculator

Use our calculator below to guide you through the process of computing for the GRM.

The two variables to input into the gross rent multiplier calculator are:

- Property price: The asking price or market value of the property for sale

- Gross annual rental income: Annual rental income collected before expenses

The output will be the gross rent multiplier (GRM).

Keep in mind that this is an estimation because the calculation does not account for the net operating income.

Gross Rent Multiplier Examples

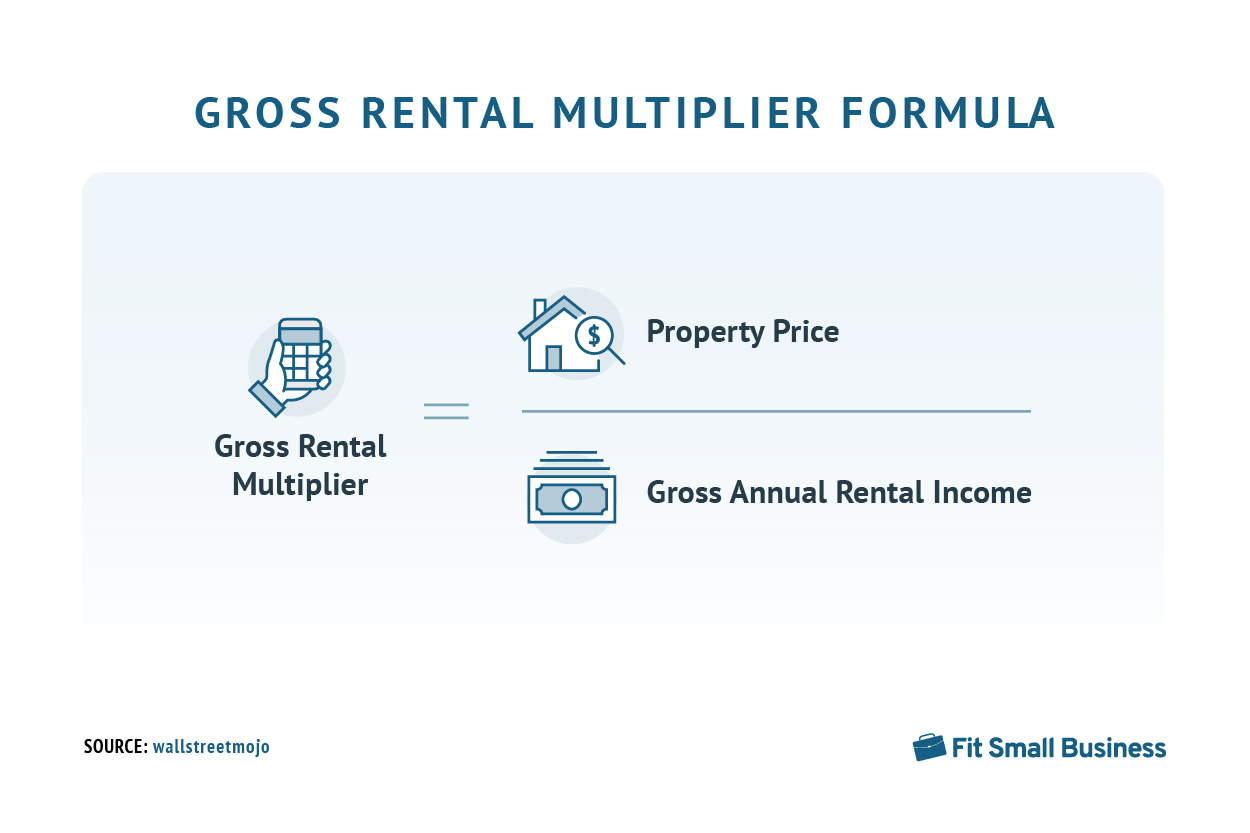

When calculating the GRM, divide a property’s total purchase price by the annual gross rental income. Don’t consider any other expenses associated with the property when determining rental income, like taxes, property management fees, and utilities. However, you want to include any additional income generated in association with the property, like parking, storage, laundry, and amenities.

Here are sample scenarios for applying the gross rent multiplier formula:

EXAMPLE #1 | EXAMPLE #2 |

|---|---|

Let's say you're looking at a multifamily investment property costing $300,000. The property has five units available for individual rental at $2,000 per month without any additional income revenue attached.

| Another calculation example considers other income revenue, such as storage access in the basement. The building costs $1,000,000. Seven units are rented for $3,000 plus $200 per month for storage, totaling $3,200 per unit.

|

What Is a Good GRM & How to Improve It

The GRM is specific to each housing market, and the GRM in one city may not apply to a neighboring area. Typically, investors should aim to have a GRM between 4 and 7. However, a low GRM isn’t always the better opportunity, which may mean you might have to invest more money in the property in the long run.

To improve your GRM, increase the rental income of a current property or lower the sale price of a potential property. Raising the rent, adding more units, or adding amenities that will draw higher-income renters are all ways to increase the rental income. To reduce the sale price of a potential investment property, you can bargain with the seller or wait for the market conditions to improve before purchasing or negotiating further.

Common Ways to Use the Gross Rent Multiplier Formula (+ Examples)

The gross rent multiplier formula consists of three variables: property price, gross annual rental income, and GRM. This allows investors to manipulate the variables in the equation to use it in numerous ways. Expand each accordion below to review the most common ways investors use the GRM formula.

One opportunity to use the GRM is to determine the value of the income generated from a current investment property compared to other investment properties. To calculate a fair GRM within a specific area, you should run a rental market analysis to find recent, comparable, and just-sold properties to see if the property value is set too high or too low.

Review the comparable properties and calculate the GRM for each property to find an average. Let’s say a neighborhood’s GRM is around 5. Then, calculate the gross rent multiplier of your property—for this example, we’ll say it’s 8. This tells us that your GRM is higher than the surrounding properties, which is an opportunity to raise rents to meet the fair market value.

A GRM calculation can also compare two properties of interest to you. For example, take a look at Property A and Property B below. These two properties have significantly different property prices along with varying rental incomes. Initially, an investor may see the sticker price and want to move forward with Property A because it costs much less. However, after considering the rental income, Property B has the lower GRM. This means that Property B is the more valuable opportunity.

Investors shouldn’t use GRM alone when proceeding to invest in property. Use the GRM to determine which opportunity is the better investment and then make a deeper financial analysis of the property to factor in other costs.

When selling a property or looking to purchase a property that’s on the market, the GRM formula can be used to estimate the property’s price. If you have the gross rent multiplier and the gross rental income of the property, you can use these figures to calculate the estimated property price:

Example: You’re looking to potentially purchase a five-unit building, and the comparable buildings in the neighborhood have asking rents of $2,000 per unit on the market. The GRM for similar properties on the market is 3.5. First, find your gross annual rental income and then input the income and GRM into the estimated property price formula:

- Your gross annual rental income would be: $2,000 x 5 units x 12 months = $120,000

- Input your gross rent ($120,000) and GRM (3.5) into the equation

$120,000 x 3.5 = $420,000 Estimated Property Price

Do the calculations before buying your first or next rental property. Estimate rental income before purchasing if your goal is to generate positive monthly cash flow. Use the formula below to estimate the gross rental revenue to determine if you should rent, buy, or forgo the investment.

Example: You can reverse engineer the GRM equation to find the estimated rental income. Using the same GRM above (3.5), you have a potential investment opportunity with an asking price of $400,000 for a five-unit building. To find the estimated rental income, use the following equation:

- Input your property price ($400,000) and GRM (3.5) into the equation

$400,000 / 3.5 = $114,285.71 Estimated Gross Rental Income

As an investor, you should run the estimated rent compared to what is on the market to see if you can adjust your rent higher to increase profitability.

Pros & Cons of Using the GRM

Using the GRM to create a baseline for understanding investment opportunities has advantages and disadvantages. Although it’s an easy-to-use formula for understanding property value, if the financial metric is misused, it can be a costly decision and put your investments at risk. After understanding the pros and cons of the formula, investors can use it to decide how they apply GRM to their investment strategies.

There are many reasons why it’s beneficial and disadvantageous to use the GRM calculation due to the following:

| PROS | CONS |

|---|---|

| Easy to calculate | Does not consider operating expenses |

| Keeps you up to date on market changes | Can only compare in similar markets |

| Compare several properties at once | Doesn’t take vacancies into account |

| Can be used by experienced or novice investors | Missed opportunities can exist |

| Useful to buyers and sellers of properties as it helps to price out the property | Only measures gross potential income |

Difference Between GRM, Cap Rate & Gross Income Multiplier

Given how easily these metrics are easily confused, understanding the distinctions between the GRM, cap rate, and gross income multiplier calculators is crucial. It is common for these terms to be used interchangeably while the calculations themselves are different. Continue reading to understand their key differences and learn which formula is best for evaluating your property’s potential income and value.

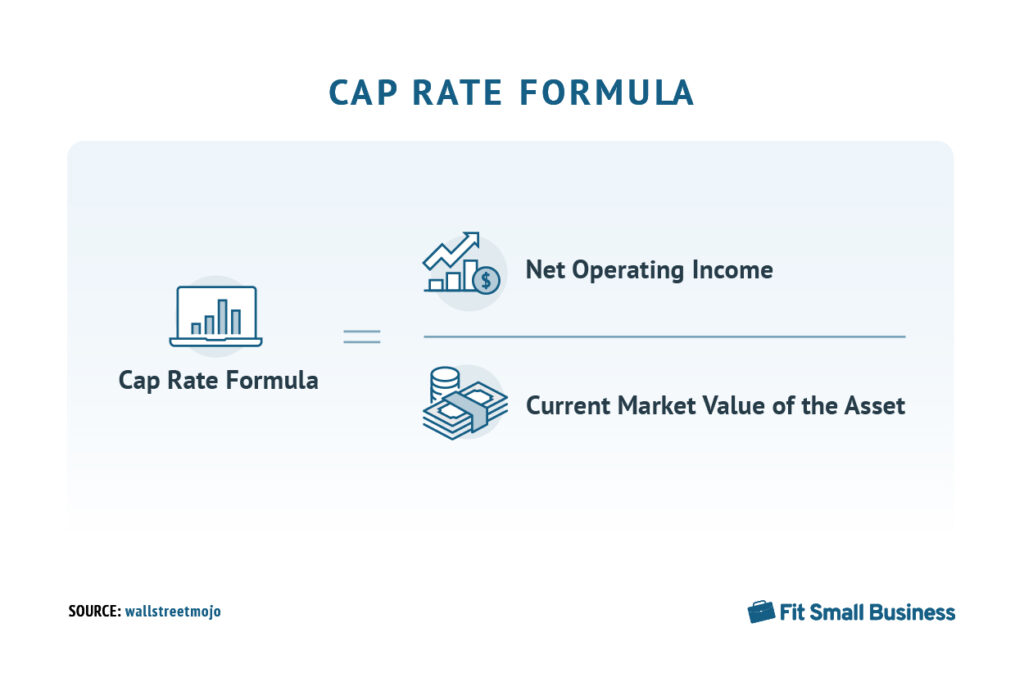

GRM vs Cap Rate

While both the GRM and capitalization rate, or cap rate, are used to evaluate property income and value, there is a distinct difference between them. The GRM is used to evaluate an income property and determine its value based on the rental income it can generate. The cap rate is a percentage value that measures the relationship between the net operating income (NOI) of an income property and its current market value.

The biggest difference is that the GRM uses the gross rental income, while the cap rate includes the NOI, which includes operating expenses and vacancy rates. While this typically makes the cap rate more accurate, if investors are looking at a potential property, they often do not have all of the data to calculate the cap rate, which makes the GRM their best option for estimations.

Real estate investors worldwide utilize the cap rate and the GRM for real estate analysis, and they are both regarded as valuable techniques for assessing an income property. While these metrics are essential, GRM offers a more efficient method to evaluate investment properties quickly than cap rate or NOI.

To find out your property’s cap rate, use our capitalization rate calculator and learn about the formula and what it is. This will help you determine if your property investment is a good deal.

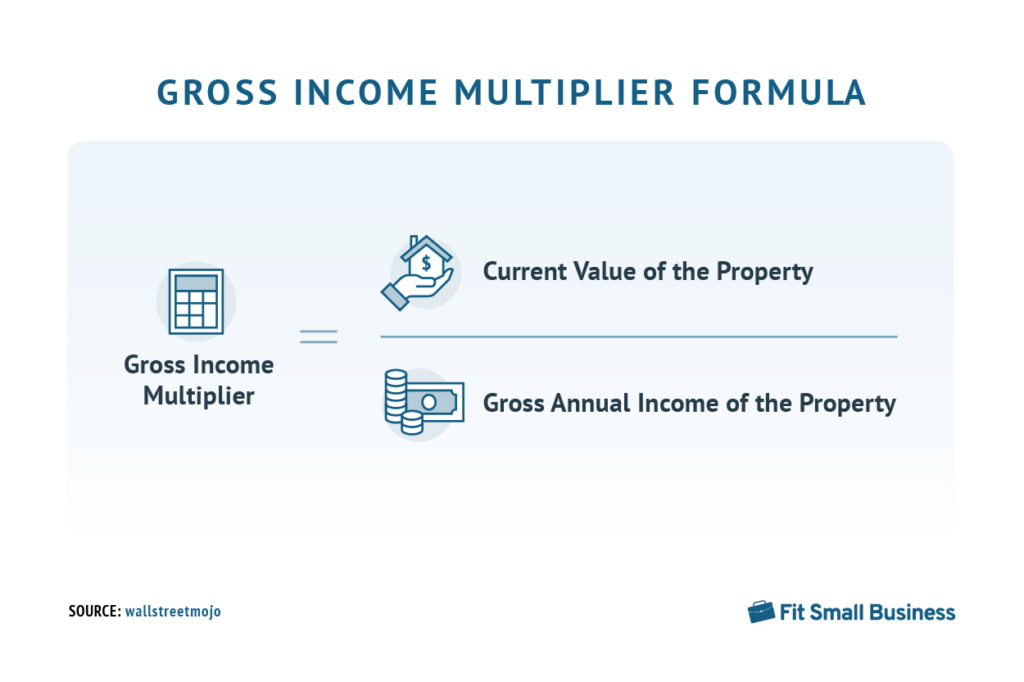

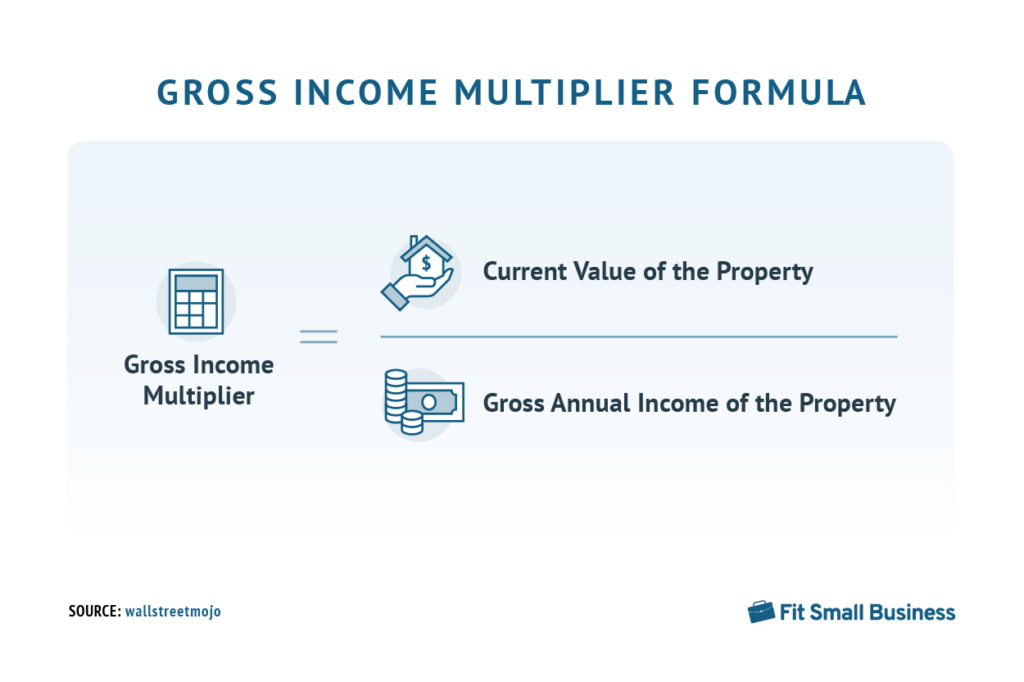

GRM vs Gross Income Multiplier (GIM)

The GRM is calculated using the property’s gross rental income. In comparison, the gross income multiplier (GIM) is calculated by dividing the property’s sale price by its gross annual income. GIM uses gross potential income, which considers all sources of income for a property, such as income from parking, vending, and laundry. Additionally, GIM enables investors to easily compare properties of different types and sizes.

However, GIM solely considers a property’s gross annual income. In particular, operational expenses like insurance, property taxes, NOI, and vacancy rates are not taken into account when valuing a real estate property. All of these are crucial components of the most common discounted cash flow model, the gold standard, which is used to evaluate potential investment opportunities. Because of this, the GIM is best used as a deal screening tool and cannot be used for creating a comprehensive valuation model.

Bottom Line

If you’re a property investor weighing your investment opportunities, use the GRM calculation to help you make the best financial decision. The GRM is used to determine a property’s value and gives a baseline for investment performance. It should not be used to give the complete property analysis, but it provides a quick estimation to help you decide which properties to pursue.

Frequently Asked Questions (FAQs)

GRM is an essential technique in determining a property’s profitability compared to other comparable properties in the same real estate market. When an income-producing property’s value is unknown, GRM can be used to make an educated guess, giving a real estate investor an estimate to use when comparing different properties.

The best GRM for a rental property is typically between 6 and 10. If the GRM is higher, the property is overpriced; if the GRM is lower, the property is underpriced.