Renting out a property, whether it’s your home or an investment property, is a powerful way to generate cash flow. An aggressive rule of thumb says rent should be about 1% of the property’s value. However, there are many factors that a smart investor will take into consideration, like market trends, amenities, seasonality, expenses, rent control laws, and rental inclusions. Read on to learn how much you can rent your house for.

Rent Calculator: How Much to Charge

As mentioned above, the general rule of thumb when calculating how much rent to charge is 1% of the property’s value. For example, if the house is worth $300,000, the 1% rule would say the monthly rent should be $3,000.

However, the national average rent price is about $1,372, with single-family rentals averaging $2,123. It’s important to note that the 1% rule generally calculates aggressive prices that may be significantly higher than competing rental pricing in your area. A more realistic range may be between 0.8% and 1.1%, depending on your location, home type, amenities, and the current rental market.

Calculate how much rent you should charge by inputting the following variables:

Purchase Price of Property x Percentage of Property Value = Rental Price

- Purchase Price of Property: Input the price you paid for the property

- Percentage of Property Value: Input the percentage you would like to charge for rent determined by the market value of your property. Typically, this is 1%, but can be higher or lower than that amount, depending on your property.

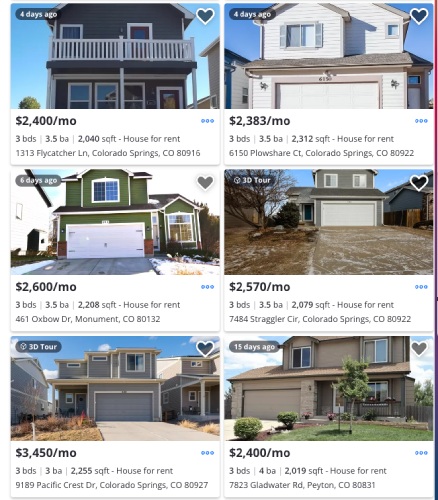

For example, homes with 2,000 square feet, three bedrooms, and three bathrooms in Colorado Springs, Colorado, are currently listed at prices between $395,000 and $556,000. However, the prices of similar homes available for rent range from $2,000 to $3,500. Depending on your market, calculating a slightly lower or higher percentage may be a more accurate method to calculate the rental rate.

Sample rent prices in Colorado Springs (Source: Zillow)

7 Factors to Determine How Much Rent to Charge

There is no hard and fast rule that shows real estate investors exactly how much they can charge for rent, but there are a few methods to make your decision as clear as possible. By using the 1% rule, researching and evaluating important property details, and performing a rental market analysis, you’ll be prepared to list your rental at the right price.

All landlords need a system to manage their finances, find qualified tenants, and organize paperwork. TurboTenant is an all-in-one system that can accomplish those tasks and more. |

|

1. Comparable Properties & Market Trends

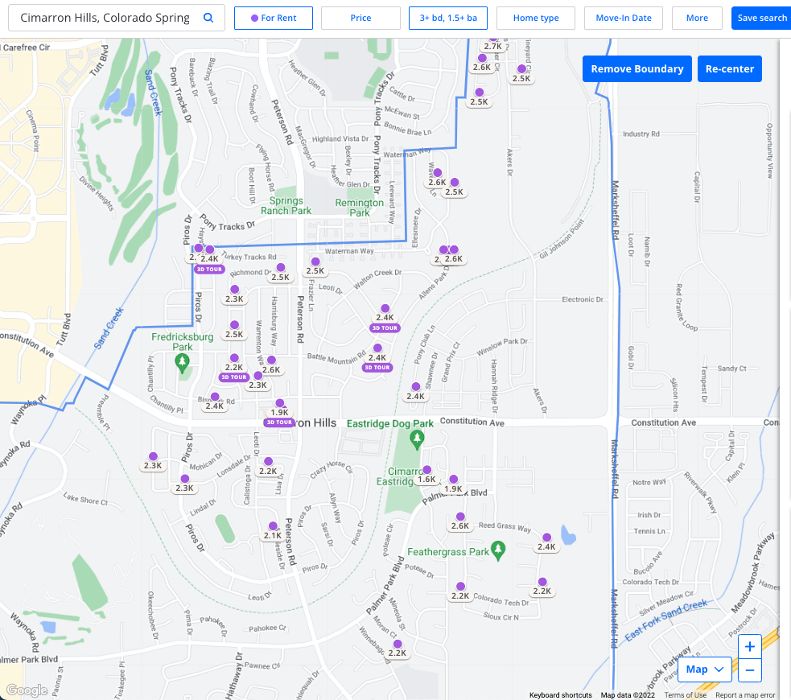

The first step in learning how to calculate the rental rate is to research home values, rent prices, and the state of the rental market in your area. Since your potential tenants will evaluate comparable properties and prices using tools like Zillow, you should also be well aware of your competition. On Zillow, you can input many criteria, like the number of bedrooms and bathrooms, pet restrictions, and parking, and easily see rental pricing in your area.

Sample rental property search (Source: Zillow)

However, as an investor, your methods of determining how much you can rent your house for should be more in-depth. Ideally, before purchasing your first rental property, you should complete a rental market analysis (RMA) to assess an area’s local market and rental potential. The RMA should include evaluations of the neighborhood, comparable properties, calculations of rent per square foot, and amenities. You’ll use these criteria to compare and contrast your property to arrive at a price for your property.

2. Rental Property Characteristics & Amenities

A rental property’s features, conditions, and amenities greatly influence tenant interest and pricing. In general, well-designed properties with valuable amenities tend to command higher rent prices. For example, newly built or renovated homes generally attract more tenants than dated ones, even with similar specifications. Amenities, such as included appliances, can also impact rental rates, with some tenants valuing convenience over cost.

$1,795 Jacksonville home for rent (Source: Zillow)

$2,200 Jacksonville home for rent (Source: Zillow)

There are generally two types of amenities that impact how much you can rent your house for:

- Community or on-site amenities: These are available and would benefit everyone living in the building or homeowners association community. They may include a swimming pool, game room, valet parking, fitness center, or on-site laundry center.

- In-unit amenities: These are only accessible within the rental units. They may include a terrace, washer and dryer, walk-in closets, or dishwashers.

There isn’t a rule or specific calculation for how home features and amenities affect the house rental cost. However, by researching your area’s amenities and property features, you can choose the best upgrades for rental properties.

In general, here are some factors and amenities that affect your rent price:

Increases Rent | Decreases Rent |

|---|---|

|

|

3. Seasonality

Renting is a heavily seasonal business for both short-term Airbnb investment businesses and long-term rentals. The peak season is typically during the summer, around May through September, because of school schedules, warmer temperatures, and a limited number of holidays. Because of this, the demand for rentals is higher in the summer, which allows landlords and property owners to charge more for the same property.

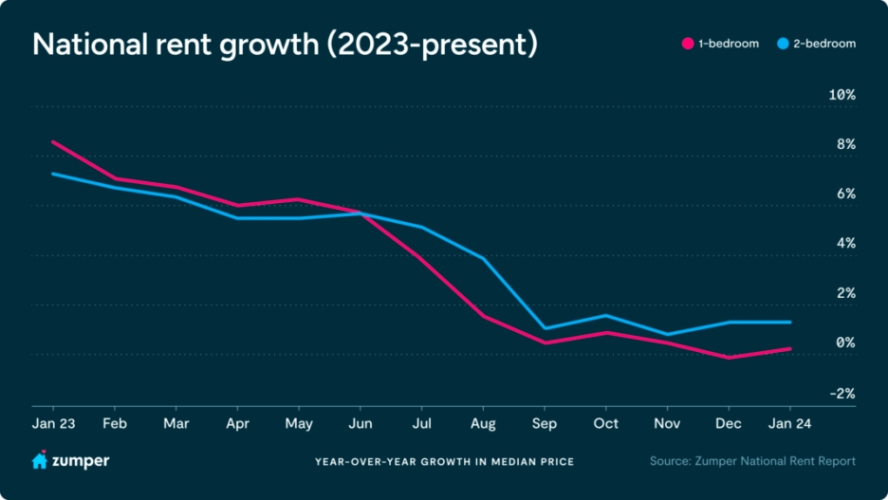

National rent growth 2023-2024 (Source: Zumper)

On the other hand, listing a rental in the dead of winter means there will be less demand and more competition for low prices. In fact, according to Zumper’s annual rent report, demand for rental properties in 2024 is lower than it has been in many recent years. Because of the low demand and the winter season, rent prices at the beginning of 2024 are extremely low. When you consider how much you should rent your house for, make sure you also consider the time of year and how it will impact demand and potential rent prices.

4. Rent Control Laws

There are many laws involved with renting out a property, so it’s crucial to know your state and county laws. Every state has varying landlord-tenant laws that specify each party’s rights and obligations for the agreement and the rental property, and some areas have rent control laws.

In most states, rent control restrictions are imposed by each municipality, so you might even have different requirements if you own rental properties in multiple states. These laws can restrict increases in the price of rent, so you need to clearly understand these laws before you set your rent prices the first time.

There are currently seven states, as well as Washington, D.C., that include cities with rent control laws, and only two states with statewide laws:

States | Regulations |

|---|---|

| |

| |

| |

| |

| |

| |

| |

|

5. Financial Needs

Beyond comparing your rental to the local competition, investors must consider their property and business’ ongoing, seasonal, and unexpected expenses. The right rent price must cover all expenses, generate cash flow, and attract high-quality tenants.

Some of the most common expenses to account for are:

- Mortgage payment: Unless you purchase the rental property with cash, you will owe a monthly mortgage payment to your lender. Consider starting a real estate holding company to get tax advantages and minimize risk on any and all rental properties you purchase.

- Maintenance and repair costs: Some maintenance costs will be regular and ongoing, and you can plan for those with a rental property maintenance checklist. However, unexpected expenses and necessary repairs are inevitable and must be accounted for within your plans.

- Property taxes: Depending on the way in which you purchased the property, you may pay property taxes in your monthly mortgage payment or an annual sum.

- Employees and vendors: Investors who own multiple rentals or an apartment complex often hire part-time or full-time staff members to help with administration, maintenance, marketing, or a variety of other needs. Your budget must include this expense.

- Property insurance: Rental property insurance protects property owners from liabilities like tenants, weather, or crime, which is an important element of your expense calculations.

- Property management: Managing even a single property requires a lot of time, effort, and organization. Many landlords hire a property management company to outsource all management tasks, while others use property management software.

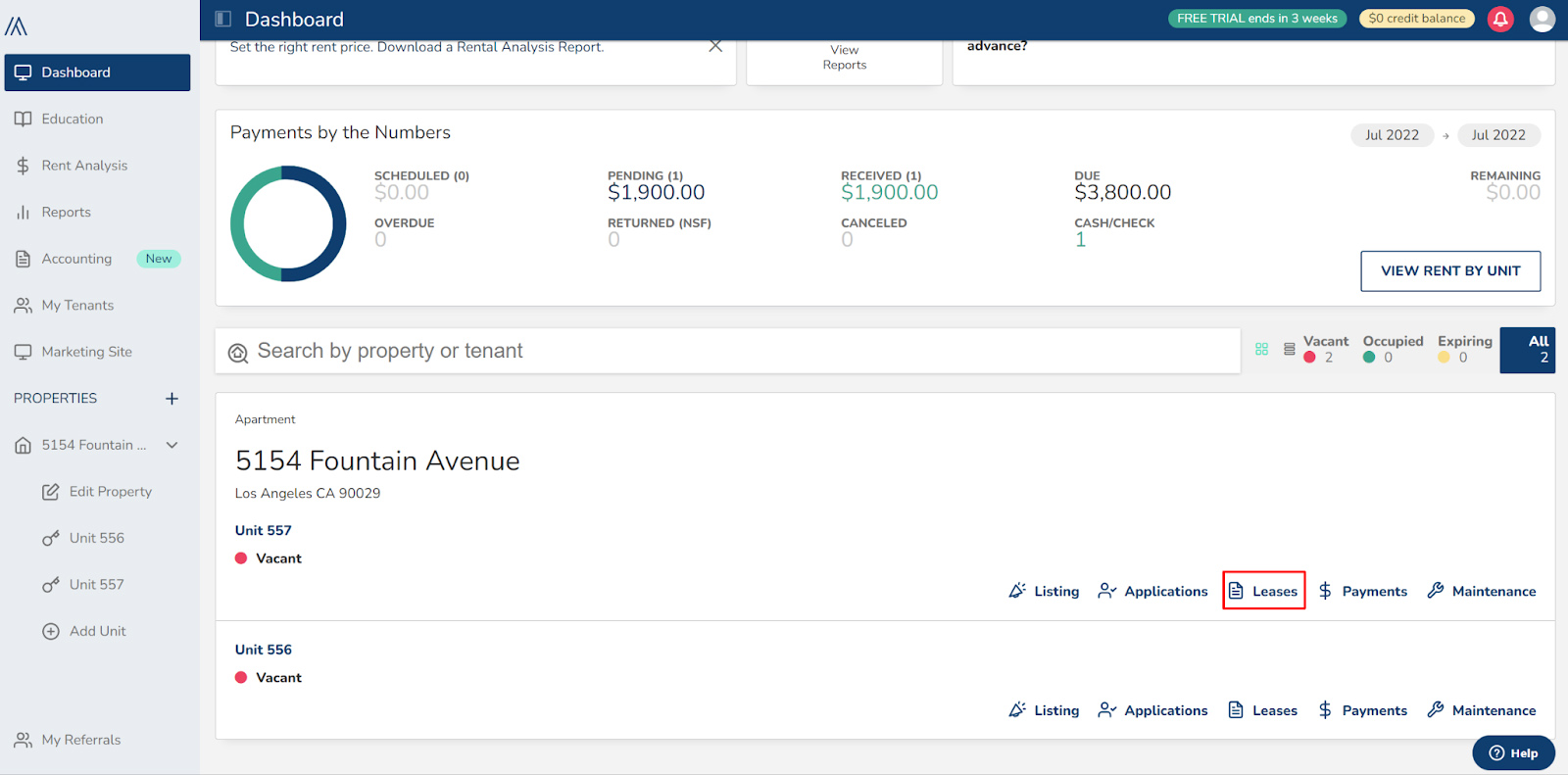

Rent analysis tool (Source: Avail)

To help manage the expenses, income, and logistics of owning rental properties, an alternative to hiring a full-time company is using property management software. For instance, Avail is an all-in-one property management tool that includes features for every part of renting a home—from creating rental applications, screening tenants, collecting rent to tracking maintenance, and evaluating new rental properties and prices. It even includes a rent analysis tool to automatically find comparable properties and gather relevant data to help you determine how much you can charge for rent.

6. Rental Inclusions

Another important factor in calculating how much you should charge for rent is carefully establishing what is and is not included in the rent price. Unconventional rental inclusions can benefit both parties, help landlords attract good-quality tenants, and generate a higher rate of profit.

Here are a few examples of rental inclusions to consider:

Utilities | Include one or two utilities (e.g., heat or electricity) to make the costs more affordable for renters while minimizing unpredictable payments. Alternatively, landlords can include utilities in an increased rent price for short-term renters who pay rent on a monthly or even weekly basis. |

Maintenance | Clearly define who is responsible for maintenance tasks like lawn maintenance, snow removal, and minor repairs like changing light bulbs. More maintenance services will justify a higher rent price. |

Reserved or Covered Parking | Reserved or private parking spots are especially appealing in areas with limited street parking or high traffic. Landlords can leverage parking options as a premium feature to attract tenants willing to pay extra for convenience and security. |

Pet-friendly Policies | Allowing tenants to have pets within the rental property will expand the pool of prospective tenants. Landlords can capitalize on this inclusion by charging pet fees or pet rent, increasing cash flow while mitigating the risks and costs associated with pets. |

Flexible Lease Terms | Provide tenants with options for month-to-month leases, shorter lease durations, or even rent-to-own options. By offering this flexibility, you’ll appeal to a broader range of tenants with a higher rent price. Plus, flexible lease terms with effective marketing can minimize vacancy rates. |

7. Rent Concessions

In contrast to rental inclusions, rent concessions are incentives offered by landlords or property managers to attract or retain tenants. Concessions are necessary during rental markets with low demand and when landlords are dealing with a high vacancy rate. For instance, 32.7% of rental listings on Zillow in December 2023 included concessions. Although it’s generally not ideal for investors to offer incentives, they can be a powerful tool to attract tenants with added value or minimized upfront costs.

Rent concessions can include:

- Discounted rent for a specified period (e.g., one month of free rent)

- Waived application fees or security deposits

- Complimentary amenities (e.g., gym memberships, parking spaces)

- Flexible lease terms (e.g., shorter lease durations)

- Reduced rent increases for lease renewals

- Complimentary upgrades or renovations to the rental unit

- Rent credits for referrals or positive reviews

- Incentives for early lease termination or lease extensions

Rent concessions are also valuable for landlords who are struggling to attract tenants. Different concessions can reveal tenant preferences and help you improve your long-term marketing and rental strategy. To learn more about when and how to use concessions, read our Rent Concession Guide for Landlords: When to Offer + Pros & Cons.

Why Setting the Right Rent Price Is Important

When considering how much you should rent your home for, you must research the local rental market and competing rent prices. Consider the seasonality of your rental, the condition, expenses, and potential inclusions or concessions. This will allow you to calculate a rental rate that benefits you and your tenants.

The right rent price will do two key things:

- Cover costs and generate profit: Without a strong understanding of your property expenses, you can easily set a price that does not break even with your costs. You need to have all the property and rental market data in order to create a margin and generate a profit.

- Attract good quality tenants: Setting a rent price at fair market value is key to avoiding vacancies and attracting tenants who will take care of the property, be respectful, and follow your lease.

Considering the above factors before renting your property, you’ll set yourself up financially for success and prevent many potential problems with your tenants and your property. Even though setting the price of a rental includes many calculations, it is not a strictly numerical process. Instead, you have to weigh the desires and priorities of local renters in the calculation. You should do local research to determine what renters in your area want and consider how the responses align with national research.

Here are some examples of priorities for renters across the country, according to Apartments.com:

Average Rental Prices per State 2024

Rental prices vary drastically throughout the U.S. and even throughout individual neighborhoods and cities. For instance, the median price of rent in the U.S. ranges from $732 in West Virginia to $1,651 in Hawaii, with the United States average being $1,326. While evaluating your local rental market and competing prices is important, it’s also extremely useful for investors to be familiar with the real estate and rental markets in surrounding areas.

Learn more about the median cost of rent throughout the states below:

State | Average Rent Price | State | Average Rent Price |

|---|---|---|---|

Alabama | $811 | Montana | $836 |

Alaska | $1,240 | Nebraska | $857 |

Arizona | $1,097 | Nevada | $1,159 |

Arkansas | $760 | New Hampshire | $1,145 |

California | $1,586 | New Jersey | $1,368 |

Colorado | $1,335 | New Mexico | $857 |

Connecticut | $1,201 | New York | $1,315 |

Delaware | $1,150 | North Carolina | $932 |

District of Columbia | $1,607 | North Dakota | $828 |

Florida | $1,218 | Ohio | $825 |

Georgia | $1,042 | Oklahoma | $818 |

Hawaii | $1,651 | Oregon | $1,173 |

Idaho | $887 | Pennsylvania | $958 |

Illinois | $1,038 | Rhode Island | $1,031 |

Indiana | $844 | South Carolina | $918 |

Iowa | $806 | South Dakota | $761 |

Kansas | $863 | Tennessee | $897 |

Kentucky | $783 | Texas | $1,082 |

Louisiana | $876 | Utah | $1,090 |

Maine | $873 | Vermont | $999 |

Maryland | $1,415 | Virginia | $1,257 |

Massachusetts | $1,336 | Washington | $1,337 |

Michigan | $892 | West Virginia | $732 |

Minnesota | $1,010 | Wisconsin | $872 |

Mississippi | $789 | Wyoming | $853 |

Missouri | $843 |

Frequently Asked Questions (FAQs)

To calculate the rental rate for your home or a potential investment property, there are various factors to consider. Start by evaluating the local rental market, rent prices of similar properties, and the condition and features of the property. Then, consider the time of year, rent control laws in your state or municipality, and potential rental inclusions or concessions. For even more data, use our free rental property calculator.

Learning how to calculate the rental rate includes numerical calculations and educated estimations based on the rental market. Start by estimating the expenses of owning a rental property, like mortgage payments, property taxes, insurance, and maintenance. Next, perform a rental market analysis (RMA) to evaluate prices for similar rentals in your area.

Finally, consider the condition of your potential property, other properties, and renters’ preferences in your area. For example, if your rental is one of the only homes offering a private outdoor space in an area, you can charge a higher rent than competing units.

Like all real estate investments, there aren’t any cut-and-dry calculations to determine exactly how much profit you’ll generate from one or multiple rental properties. If you follow the steps above and do financial research before purchasing a rental property, it is highly likely that you’ll generate a profit from just one rental property.

However, if you want to generate enough rental income to replace or supplement a corporate career, you’ll need to analyze your financial goals, investment strategy, and market conditions to determine an optimal portfolio size.

Bottom Line

Whether you’re an experienced investor or simply renting out a room in your house, you need to answer the question, “How much should I rent my house for?” If you price your rental too high, you won’t attract renters and won’t generate any income.

In contrast, charging too little won’t allow you to afford your carrying costs and can get you stuck in a lease with massive financial problems. Consider all of the elements in this article to create a rent estimate, and use the rental rate calculator to help you determine the right price to minimize vacancies and maximize your profits.