The short answer to this question is no. Due to regulatory changes, this process has been refined over the years and generally requires a business relationship with a bank.

Walking into a bank, endorsing the back of a business check, and requesting cash is not handled like it once was. Under certain circumstances, this may be possible for specific types of businesses based on the business structure. Generally, this occurs when your business is new and you’ve received your first check. Possibly, a business account has not been set up, but you still need access to the funds.

In this article, we will consider the changes to regulations. As a banker, I’ve had a lot of experience helping business owners navigate this situation, so I will provide alternative solutions to give you access to your hard-earned dollars.

Which Business Model May Be Able to Cash a Check

- Sole proprietors may be able to cash a check made out to them for services, especially if the business name is the same as their personal name. Many sole proprietors work under their Social Security number (SSN) and do not have a tax ID number (TIN).

- Those who do a job occasionally and do not own an official business even though they track their income for tax purposes. In circumstances like this, it could be unclear if a check is payable to a person or a business named after them. In this case, a financial institution may decide to cash the check.

Laws & Banking Regulations

Multiple laws and banking regulations come into play when a person desires to cash a check made out to a business. Due to financial transparency, the final destination of the funds needs to be documented.

Financial Crimes Enforcement Network (FinCEN) is the government agency that oversees the following laws and regulations:

- The Bank Secrecy Act (BSA)

- Anti-Money Laundering (AML)

Most banks and credit unions set their check cashing guidelines based on these in an effort to follow federal regulations regarding record keeping and tracing the movement of money. These help to prevent money laundering and create a strong force to slow down or completely stop financial crimes.

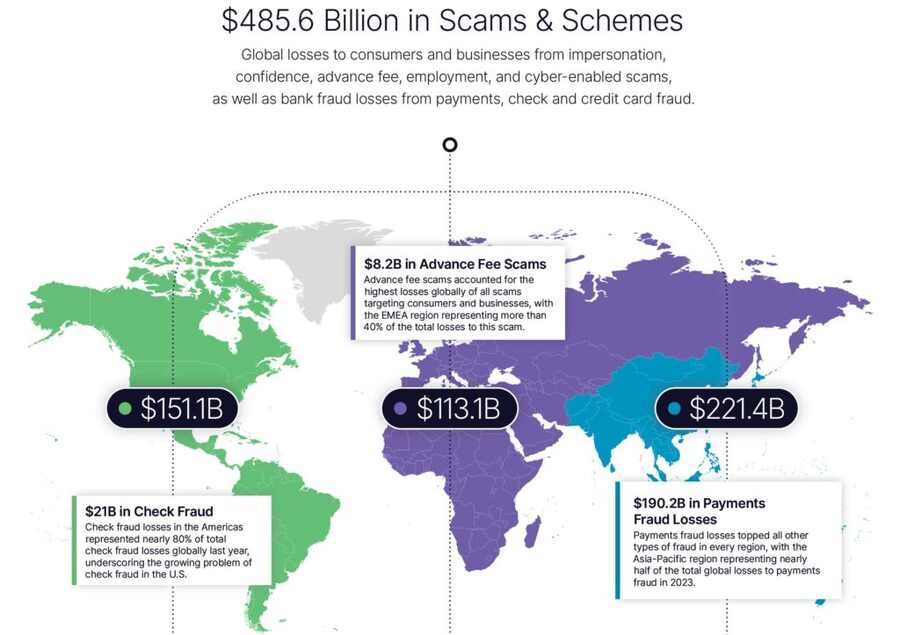

The large impact of financial crime globally (Source: AML Intelligence)

According to the AML Intelligence website, illegal money schemes account for $485.6 billion in losses worldwide as of January 2024. These crimes are massive, so the compliance of banks, credit unions, financial institutions, check cashing centers, and Money Services Businesses (MSBs) is imperative to getting a handle on this global issue.

How Financial Crimes Affect a Business Owner Cashing a Check

You may wonder about this; after all, you are not committing a financial crime and just need access to your business funds—and I totally understand. I’ve been on the teller side, informing customers they can’t cash their checks when I’m fully aware of how badly they need the funds.

Here’s the bottom line, cashing a business check leaves a huge gap in the money trail that tracks funds to the final destination. When an individual cashes a check, they are considered the real person who takes possession of the funds. This is different for a business.

If banks cashed checks for a business, it would be impossible to determine the paper trail and the final destination—no one would know who the real person who took possession of the funds is. Therefore, cashing checks made out to a business is prohibited by most financial institutions and check cashing centers.

A Clear Money Trail

A clear money trail involves funds being placed somewhere and moved following all laws and regulations.

What About Check Cashing Centers or MSBs?

While a check cashing center and an MSB are not officially banks, credit unions, or financial institutions, the laws and regulations still apply to their check cashing facilities. Every check cashing center and MSB must partner with a bank to facilitate the processing of checks cashed.

If a bank does not allow a transaction, chances are it will not be accepted when the check center makes the deposit either. These are blanket laws and regulations that apply to the entire US and thus apply to all money handlers.

If You Can’t Cash Your Check, Do This Instead

There are two main solutions for business owners who are unable to cash a business check.

- Have the payor of the check reissue it in your personal name if you do not own a business; or

- Open a business bank account using your business name and have payors make checks payable to that entity.

Benefits of Opening a Business Account

Small business owners and sole proprietors just starting out often don’t think to separate personal and business finances. It seems easy to use a personal checking account for business, but it’s not the recommended method. Without a business bank account, it can be challenging to gain access to your funds.

Business bank accounts allow you to

How to Get Cash From a Business Check

Opening a business checking account still does not give you permission to walk into a bank and cash a check made out to your business.

The proper process to get cash is as follows:

- Step 1: Deposit the check into your business account.

- Step 2: Write a check for the amount of cash you need made out to yourself.

- Step 3: Endorse the back of the check.

- Step 4: Present the check to a teller requesting cash with your ID.

In this case, the paper trail is complete since a deposit was made to the business account, the business made a payment to you personally, and you took possession of the cash.

Frequently Asked Questions (FAQs)

Banks generally honor business checks within six months (180 days) from the date of issue. Once a check passes 180 days, it’s considered stale and it’s up to the discretion of the bank or financial institution to honor it or not. However, different types of checks may vary in expiration dates, such as cashiers’ checks and government-issued checks.

No, not all banks offer check cashing services to non-customers. In general, banks that offer these services charge additional fees. The best place to cash a check made out to you personally is to visit a bank you have a relationship with.

No. A check made out to a business must be deposited into a matching account. If the business needs cash, a check will need to be written to a specific person with an endorsement on the back. This check will be presented to a teller for cash.

No. Business checks need to be deposited to a business account with a matching title. The only exception may be a sole proprietor working under their SSN without a registered business who receives funds made payable to them personally.

If you have a check made out to a business name, Walmart will not be able to cash it. To confirm, I contacted my local Walmart with this scenario and the rep informed me that they would be unable to cash a business check. However, if you have received a check from a business made out to you personally, you can cash it.

A sole proprietor is the only business entity that may encounter this situation. If you are working under your personal name, you may be able to deposit a check into your personal account. This practice is not recommended; however, it is possible. Business checks made out to a business name will need to be deposited into a matching titled business account, so a personal account would not qualify.

Bottom Line

Many business owners have wondered how to cash a business check without a bank account. Banks, credit unions, financial institutions, check cashing centers, and MSBs can’t directly cash checks made out to a business.

If you need cash from a check made out to your business, you must follow the steps to comply with the banking regulations and laws put in place by FinCEN. Opening an account and depositing the check is a simple solution to gaining access to your business funds while abiding by regulations and thus doing your part to fight financial crime.