I’ll walk you through how to separate business and personal finances, from registering your business with the IRS and tracking expenses to engaging a tax professional and drawing clear dividing lines. Maintaining a division between your personal and business finances is crucial and should be one of the first things you do when starting a business. The earlier you establish clear boundaries, the easier it will be to keep up with markers like profitability and growth. Separating funds also aids in protecting your assets and filing both business and personal taxes.

Step 1: Put Your Business on the Map

Putting your business on the map involves registering your business, and this is a two-step process. You will want to register your business as a legal entity with the IRS by getting an Employer Identification Number (EIN). Then, you will need to register with your local state. Depending on which state you live in, this organization is called the Secretary of State or the Secretary of Commonwealth. These registrations will be needed for many of the following steps, so it’s important to do them first.

Step 2: File Registration Documents to Establish Your Business

When a business is formed, certain documents that legally separate the business from you as a person need to be filed. This is important since it directly affects the owner’s personal liability.

You will need to establish a business structure. The most common are LLCs, partnerships, C-corps, and S-corps. The business structure you choose will dictate the type of documents you will need. For a corporation, this document is referred to as the Articles of Incorporation. For an LLC the document is known as the Articles of Organization.

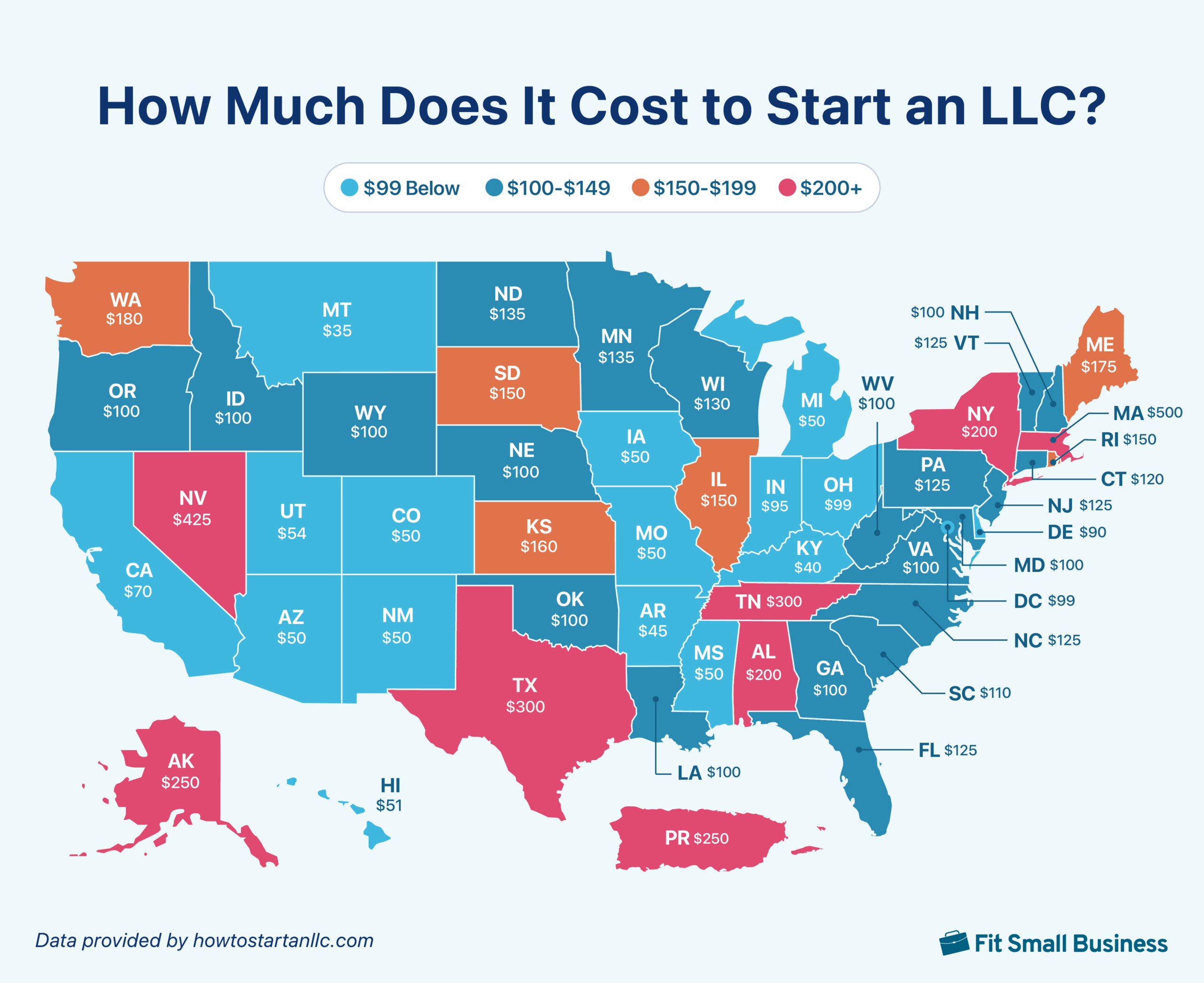

You can register a business for as little as $50 in some states. The image below shows the cost per state to register an LLC.

Step 3: Open a Business Checking Account With a Business Debit Card

This step may be one of the most crucial. Opening a business checking account makes it possible for you to house the funds your business is earning. Without this account, it would be tempting to deposit funds into your personal account. Establishing this account early allows you to disconnect personal and business funds from each other.

Another important step is to order a debit card when you open your business account. If you’re buying supplies or making an online purchase you will need an online payment method to complete the transaction. If you fail to order a debit card, you may be tempted to use your personal card for purchases instead. Having the debit card readily available will prevent any kind of crossover and will make account balancing easier at the end of each month.

Our related resources:

Step 4: Keep Receipts Separate and Track Shared Expenses

Keeping accurate financial records, good tracking, and bookkeeping is essential for a business. This includes physical and electronic receipts. Keeping personal and business receipts mixed together can become quite messy when trying to sort them out at tax time. After some time passes, it’s hard to remember what the purchase was for.

If you run your business from your home, you will likely have some shared expenses, as your business probably uses electricity, water, internet, and your mobile phone during business hours. A qualified tax accountant can give you information on what percentage—if any—of these expenses is tax deductible. Keeping up with the monthly charges will help your tax advisor calculate these totals quickly in the event you can include any of them on your tax return.

Also, working from home has many perks. However, it’s easy to blur the lines of business and personal space regarding your working environment. Some have found it helpful to designate an entire room or area in your home for business-only activities or even rent a portion of your home to your business if needed.

Continue reading:

Step 5: Apply for a DUNS Number

A DUNS Data Universal Numbering System number is a great way to build business credit. This is a unique 9-digit identifier assigned to a business from Dun & Bradstreet (D&B) and is similar to a tax ID. Creditors can use the information to discern creditworthiness and financial stability.

If your business has a credit score, loans can be processed in the business name instead of your personal name, which helps keep business expenses separate. Obtaining a DUNS number is not only easy but is also completely free. I’ve gone through the process in the past, and it took less than 10 minutes since D&B’s site is user-friendly and intuitive.

Step 6: Engage a Tax Accountant or Bookkeeper

Keeping up with your finances may be challenging, especially if you’re trying to balance your personal and business finances. For complex tasks like this, it’s usually best to hire a licensed professional. When you engage a bookkeeper, especially an experienced one, you are likely to have fewer errors and more deductions. This is because they are aware of all the latest tax changes and requirements. Knowing everything is correct and in balance also gives you peace of mind as a business owner.

Our related articles:

Step 7: Give Yourself a Salary

When a new business becomes profitable, it’s advisable to add yourself to the payroll roster. Having a guaranteed paycheck will suppress the inclination to dip into the business profits for personal expenses. As a business owner, you work hard to keep your business going every day. You deserve to reap some of the benefits just like all your other employees. This will also ensure your personal expenses are taken care of which will reduce financial anxiety.

Keep reading:

Step 8: Apply for a Business Credit Card

There are many benefits to getting a business credit card. It ensures you keep business and personal expenses separate and enables you to purchase items online and get built-in fraud protection, which helps protect against unauthorized use. Another nice feature is the option for a physical and a virtual credit card—virtual cards have different card numbers than physical cards and keep the card details private.

Our related resources:

Step 9: Immediately Reimburse Personal Funds That Are Used for Business Purposes

Occasionally, you may find yourself in a situation where you don’t have access to your business card. A good example could be a fast trip to the local box store.

You run out the door with some cash expecting to pick up only a few items. While walking through the aisles, you notice an item you need for your business. The only way you can purchase it is to use personal funds since your payment options are limited.

If this happens, a good practice is to reimburse personal funds as soon as possible. Expenses paid out-of-pocket should be thoroughly documented with receipts to support the charge.

Continue reading:

Why Separating Business and Personal Finances Is Important

- Allows you to track business performance and profit margins easily: Having a dedicated checking account for your business helps you to analyze its financial health quickly. You can also connect software that allows the categorization of expenses for easier reporting and income tracking.

- Simplifies tax season: When expenses are separated, it becomes much easier to prepare for tax season. All of your business expenses will be properly allocated to the correct business accounts. This will allow your tax advisor or bookkeeper to quickly prepare reports and documents needed to file your tax returns.

- Allows your business to establish credit: Filing legal business documents and opening dedicated accounts for your business will completely separate it from you as a person. Once this is done, your business becomes its own entity. This will allow creditors to easily analyze business stability and creditworthiness if a loan is ever needed.

- Establishes credibility with your customers and vendors: When making payments or sending out documentation, your business will be perceived as reliable and trustworthy if the business name is shown. Checks drawn on a personal account could cause accounting issues when vendors match up payments with invoices. A business account that clearly shows the payor will help to alleviate confusion while building confidence.

- Makes personal budgeting easier: It’s nice to look at your personal account and see the exact total of funds available for personal use. If you have personal and business finances combined, it will require quite a bit of calculation to determine which funds can be used for household expenses.

What Business Benefits From Learning How to Separate Business and Personal Finances?

Every business can benefit from this type of separation. When business and personal funds get tangled up, it can cause issues in many areas. If you’re an LLC, S-corp, partnership, or C-corp, you’re required to have a separate tax ID number. A business with a tax ID number thus becomes a different entity from the person who created it.

If you’re a sole proprietor, you may feel it’s easier to keep these funds together since you’re filing your taxes under your Social Security number. In the long run, even a sole proprietor benefits from keeping business funds separated from personal income. Banks have made it easier for sole proprietors to do so, as they offer accounts called DBA (Doing Business As) accounts. This allows you to give your business a trade name and manage everything under your Social Security number.

Best Business Bank Accounts for Separating Business and Personal Finances

One of your first steps to separate business and personal finances is opening a business checking account. Many banks offer interest bearing accounts and charge little to no fees. Usually, they have multiple levels of checking options depending on your monthly transaction totals. Once you choose the bank for your small business, you can inquire about the different account types and open the one that’s the best fit for you.

The table below shows three different options. Bluevine is a financial technology (fintech) company, which partners with Coastal Community Bank to offer options for higher balances over the $250,000 FDIC limit. Meanwhile, Chase and U.S. Bank are traditional banks with many account options depending on your needs.

The options below are considered level one options for all three banks for easy comparison.

Provider and Account Name | Monthly Fee | Free Monthly Transactions | Cash Deposit Limit | |

|---|---|---|---|---|

Standard Checking | None | No limit | 1.5% on balances over $250,000 |

|

Business Essentials Checking | None | Unlimited digital transactions and 25 free teller transactions | N/A | 25 free cash deposits |

Business Complete Banking | Unlimited debit card and ATM transactions and up to 20 teller and paper transactions | N/A | $5,000 of free cash deposits per cycle | |

Frequently Asked Questions (FAQs)

Keeping business and personal finances separate is important since the business is a separate entity. When funds are combined, it will likely create confusion for accountants and tax preparers trying to balance your business expenses for the year. Having funds combined also makes it hard to track profit margins and review financial progress. It will be hard to see which income belongs to the business and which is personal when they are commingled.

There are a few key steps to separate business and personal finances. The first step is to apply for an EIN with the IRS. You will also want to register your business with your local state authority and have documents prepared to establish your business legally. A separate bank account would need to be opened to ensure all business funds can be housed in a separate account for easier bookkeeping and tax preparation.

This will cause a great amount of confusion for you, your employees, and any other party you engage to help with bookkeeping. Also when paying for monthly expenses, it will be difficult to discern which funds are personal and which are business, which could lead to bookkeeping mistakes and incorrect tax calculations. If your business is an LLC or an S-corp, you could even lose personal asset protection if it appears your business and personal funds are combined.

Bottom Line

Now that you know how to separate business and personal finances, you can ensure proper allocation of income for record keeping. You will be able to calculate profit margins quickly and share your totals with an accountant or tax preparer during tax season. Having the funds completely separated also ensures you are protected under the provisions of your business structure. It will help you establish business credit and credibility with your customers and vendors.