Employers and some nonprofits that hire veterans can get tax credits through the Work Opportunity Tax Credit (WOTC). It cuts your tax bill by up to 40% of the wages paid, which can save you a lot of money. If you hire a vet and are an eligible employer, you may be able to use up to $24,000 in qualified wages to qualify for a WOTC of $9,600. You can claim it for wages paid until Dec. 31, 2025. After that, it will be gone forever.

- Has been unemployed for a total of at least four weeks, whether they were all in a row, but for less than six months in the year leading up to the date of hire

- Has been unemployed for a total of at least six months, whether they were all in a row, in the year before the hiring date

- Has been unemployed no more than one year after being discharged or let go from active duty in the United States Armed Forces and eligible for compensation for a service-related disability

- Has received money for a service-related disability and been unemployed for a total of at least six months, whether they were all at the same time, in the year leading up to the hiring date

- Has a family member who receives food stamps (Supplemental Nutrition Assistance Program, or SNAP) for at least three months in the 15 months before the hiring

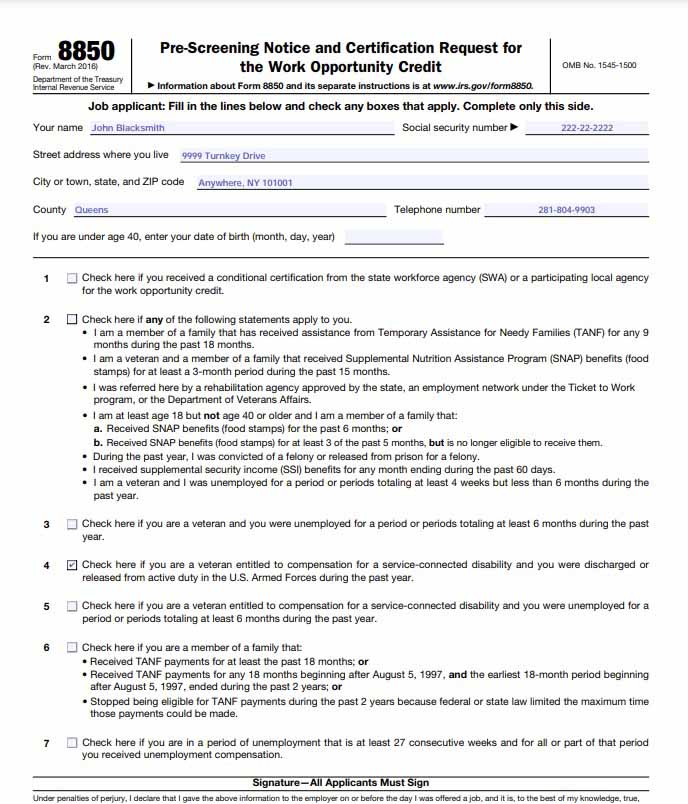

Step 1: Have Qualified Veterans Complete IRS Questionnaire Before Interview

To get started, you and the vet interested in a role with your company will need to fill out IRS Form 8850, Pre-Screening Notice and Certification Request for the Work Opportunity Credit, to get this credit. The vet will fill out Page 1 and check the box next to either Question 2, 3, 4, or 5.

You’ll make entries on Page 2 throughout the hiring process. Begin with filling out the informational section and indicating the date the vet gave you information about being a member of a targeted group.

Step 2: Interview & Make Your Hiring Decision

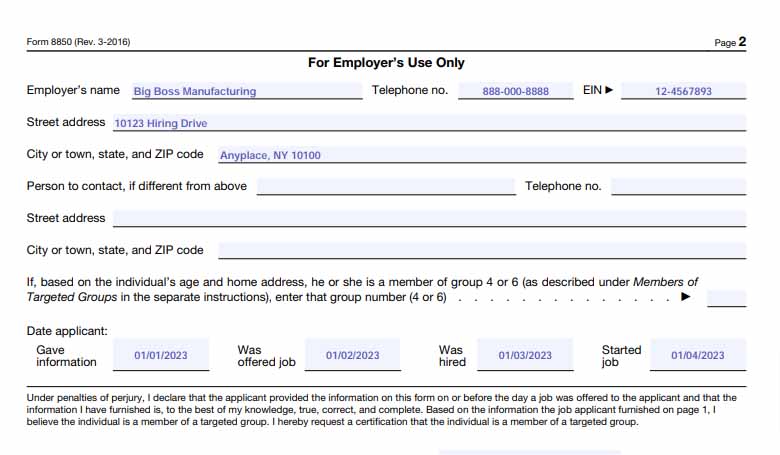

If you decide to move forward with the applicant, the next step is to interview the veteran and make a hiring decision. If the vet seems like a good fit for the job and you decide to move ahead with the hiring process, you’ll need to finish Form 8850. On Page 2, write down the date you interviewed the vet, the date you hired them, and their start date.

After completing the section, you’ll sign under penalty of perjury that the applicant gave you the information on this form on or before the day the job was offered and that the information you gave is true, correct, and complete, to the best of your knowledge. Based on what the job applicant said on Page 1, you hereby request certification that the individual is a member of a targeted group.

If you need assistance with this step, you may refer to our guide on how to hire veterans. We walk you through the process and discuss some benefits of hiring vets.

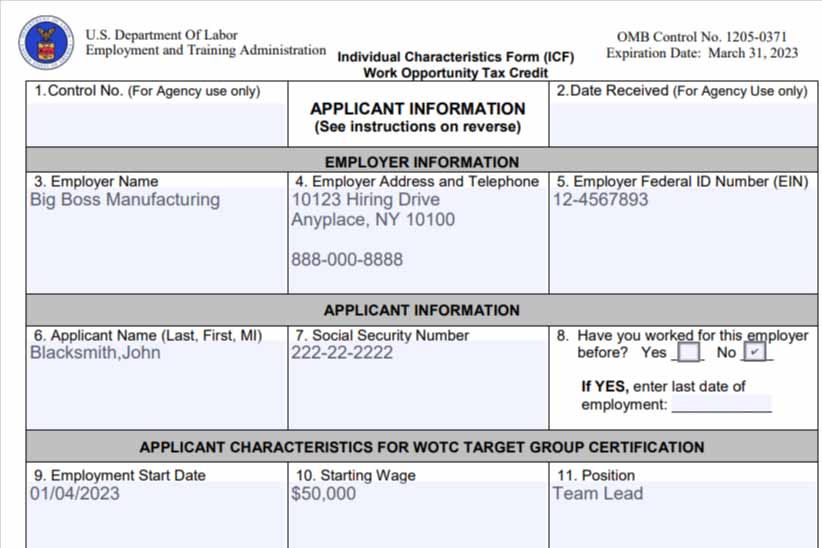

Step 3: Apply for Certification From Your State Workforce Agency

Once your new hire is onboarded, you’ll need to apply for certification for the WOTC. To get certified, you need to fill out a few forms:

- Department of Labor (DoL) Form 9061, Individual Characteristics Form (ICF) Work Opportunity Tax Credit

- Supporting documentation from your new hire such as Form DD-214

After the form is completed, you can mail them to your state’s workforce agency within 28 days of hiring your new employee. If you don’t know the address for your state workforce agency, you can check out the DoL’s list of WOTC State Coordinators to find an office in your local area.

Step 4: Calculate the Credit for Hiring Veterans

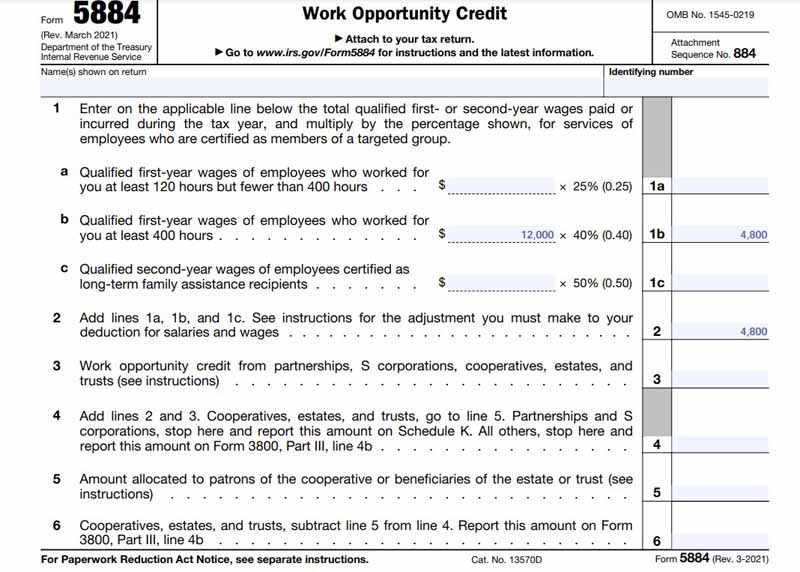

After your state workforce agency certifies that your new employee is a qualified veteran, you will need to calculate the credit to claim it on your tax return. The amount of qualified wages for veterans ranges from $6,000 to $24,000. That means your WOTC could be worth up to $9,600. You’ll use IRS Form 5884, or IRS Form 5884-C for tax-exempt employers, to figure out your allowable credit.

For each form, the amount of qualifying wages you’ll use to determine the credit depends on the category the vet checked on Form 9061 and Form 8850.

If you file Form 5884, you’ll use lines 1 (a) and 1 (b) to determine how much of their income qualifies for the credit.

- If your new hire worked less than 400 hours but more than 120, you’ll figure the credit using line 1 (a).

- If your new hire worked at least 400 hours, you’ll figure the credit using line 1(b).

The maximum wages that can be placed on line 1 (a) or 1 (b) depend upon the exact category of the qualified veteran.

Maximum Wages for Line 1(a) or Line 1(b) | $6,000 | $12,000 | $14,000 | $24,000 |

|---|---|---|---|---|

A qualified veteran who is | A member of a family receiving food stamps for at least three of the prior 15 months | Entitled to service-related disability compensation and discharged within the prior 12 months | Unemployed for more than six months in the prior 12 months | Entitled to service-related disability and unemployed for at least six of the prior 12 months |

Unemployed for at least four weeks, but less than 6 months in the prior 12 months |

Line 2 is used to calculate the allowable amount of your credit. Meanwhile, lines 3, 5, and 6 will typically be blank.

If you file Form 5884-C, you’ll use lines 4 (a) and 4 (b) or 5 (a) and 5 (b) to figure your credit.

- If your vet worked less than 400 hours but more than 120, you’ll figure the credit using line 4(a) and 4(b).

- If your vet worked at least 400 hours, you’ll figure the credit using line 5 (a) and 5(b).

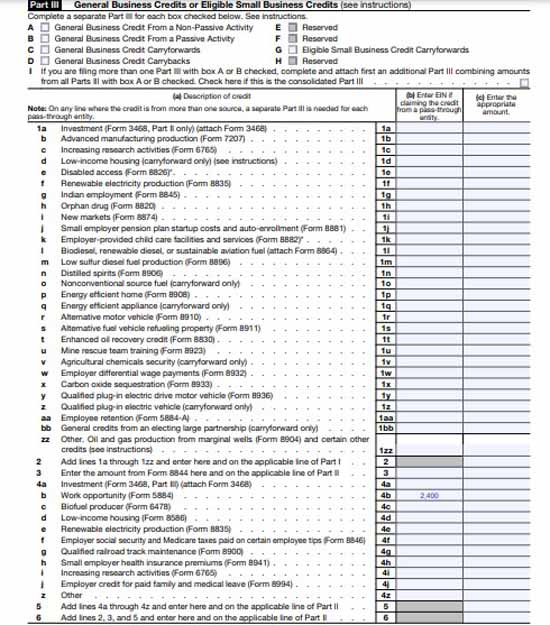

Step 5: Report the Credit on Your Tax Return

This credit will then go to IRS Form 3800 for sole proprietors and C-corporations, where it will be part of the General Business Credit. S-corporations and partnerships will report the credit on Schedules K and K-1. On their own tax returns, the owners or partners will then claim the credit. Your WOTC will be reported on one of the following forms if you’re a taxable entity:

Entity Type | Where to Report |

|---|---|

Sole Proprietor | IRS Form 1040 or 1040 SR, Schedule 3 |

C Corporation (C-corp) | IRS Form 1120, Schedule J, Part I, line 5 c |

S Corporation (S-corp) | IRS Form 1120-S, Schedule K, line 13 g |

Partnerships | IRS Form 1065, Schedule K, line 15 f |

If your entity isn’t taxable, you can claim the credit against your share of Social Security tax by filing Form 5884-C separately after filing the related employment tax return for the period for which the credit is claimed.

Example of How To Claim the Tax Credit for Hiring Veterans

Step 1: John Completes IRS Questionnaire Before Interview With Bob

On Jan. 1, 2023, Bob Boss, the owner of a manufacturing company in Anytown, New York, placed a “Help Wanted” sign on his door. On the same day, John Blacksmith, a veteran with a service-related disability, asked about the job. John was interested in the possibility of an opportunity after being discharged from the service 10 months ago and is entitled to compensation.

Bob handed John an application along with Form 8850. John filled out both forms, and Bob also completed Page 2 of Form 8850 and filled in the date that John gave him information about being a member of a target group.

Filled-out sample of IRS Form 8850 Page 1

Step 2: Bob Interviews John & Makes a Hiring Decision

After reviewing John’s employment application and Form 8850, Bob decided to call John to interview for the position on Jan. 2, 2023. The interview was a success, so Bob decided to hire John, who was offered a position as a team leader, earning $50,000 per year, on Jan. 3, 2023. John accepted the position and started the next day. Bob completed Page 2 of Form 8850.

Completed sample of IRS Form 8850 Page 2

Step 3: Bob Applies for Certification From His State Workforce Agency

Once John started his new position, Bob wanted to get all of the paperwork out of the way and complete the certification process, so he completed Form 9061 and also received Form DD-214 from John.

Example of a filled-out Form 9061

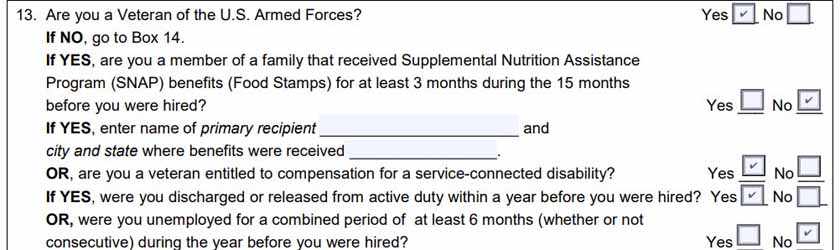

On Form 9061, question 13 is answered yes, because John has a service-related disability and was discharged from the service less than a year before being hired. John also signed the bottom of the form under penalty of perjury.

A sample of Form 9061’s Question 13 filled in

Once the forms were completed, Bob immediately mailed them off to his state workforce agency.

Step 4: Calculate the Credit for Hiring Veterans

The state of New York certified John as a qualified veteran, so for 2023, Bob will be eligible to claim the credit on his business tax return. Since John is a full-time employee, Bob anticipates that he will work more than 400 hours this year.

We will use Form 5884 to calculate the projected credit.

Calculating the WOTC for 2023 on IRS Form 5884

Since John has a service-related disability and is entitled to compensation, the WOTC will be figured using a maximum of $12,000 of qualified wages as per the instructions for Form 5884.

Step 5: Report the Credit on Your Tax Return

Since Bob Boss operates an LLC, he’ll report the credit on IRS Form 3800, line 4b. He will claim this credit on IRS Form 1040, Schedule 3.

Bob’s IRS Form 8300, filled in

Frequently Asked Questions (FAQs)

No, the WOTC is available to the employer of veterans, not to the veterans individually.

If you are looking to hire veterans who could potentially qualify your business for this credit, you can search Hire Heroes USA and the US Department of Labor’s website, CareerOneStop. You may also want to see our recommendations for the best free job posting sites for veterans.

The general business credit is the sum of many different types of credits a business may claim on its tax return. The general business credit may include investment credit, employer credit for paid family and medical leave, disabled credit, and WOTC.

Bottom Line

Having a veteran as a member of your team could be a great asset to your company. Not only will you earn a tax credit for doing so, but you’ll also help a veteran transition back into the workforce.