Our guide walks you through how to complete Form 4835, from getting the form, providing identifying business information, and completing the parts, to filing the form. The form is generally used by farm owners who receive a portion of farming profits in place of rental payments but don’t conduct the farming operations themselves. The rental income from farming profits and associated expenses are reported on this form. We’ve provided an example to further supplement the IRS Form 4835 instructions.

Key Takeaways:

- Form 4835 is for farm owners renting their land in exchange for an allocation of farming profits. Farmers who operate their own farms should use Schedule F.

- Form 4835 income is subject to ordinary income tax rates.

- Income from Form 4835 is carried forward to Form 1040, Schedule E, Line 40.

- Complete Schedule E instead of Form 4835 for fixed rental payments for farmland, but use Form 4835 if an allocation of operating profits is received by the landowner, which will transfer to Schedule E.

Step 1: Obtain the Form

You can pull Form 4835 instructions from the IRS website. However, generally, you would prepare the form using tax software.

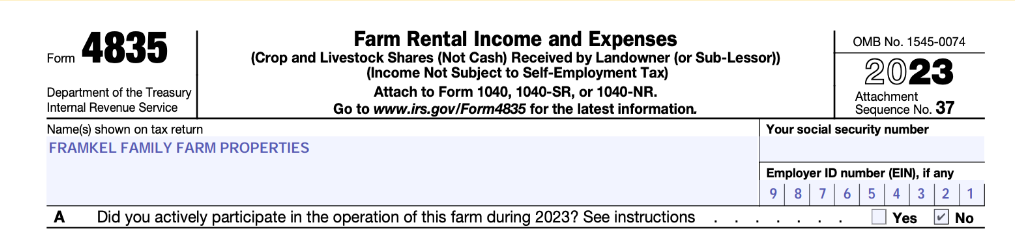

Step 2: Provide Identifying Information for the Business

Input your business name and employer identification number (EIN). In section A, mark if you have active participation Active participation means that you share in or are responsible for the management decisions of the business. in the business.

Sample Identifying Information for Form 4835

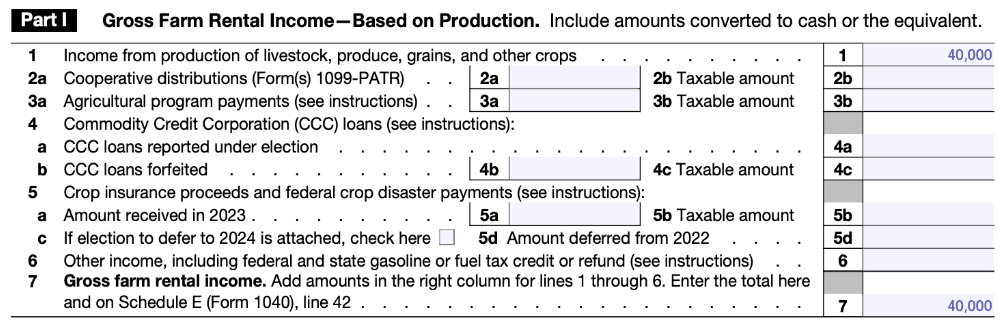

Step 3: Complete Part I – Gross Farm Rental Income

- Line 1: This is where income you receive from your share of profit from farm activity performed by a tenant on your farmland is input. Farm activity includes the proceeds from livestock, produce, grains, and other crops.

- Line 2: Income from farm co-ops (groups of farmers who share resources) is reported here.

- Line 3: Income from government payments (such as payments for livestock indemnity or following certain sanctioned conservation practices) goes here. Total assistance is reported on line 3a and the taxable amount is reported on line 3b. Government agricultural payments are reported to the taxpayer on Form 1099-G, box 7. Generally, payments reported in this section are taxable.

- Line 4: Forfeited loans from the Commodity Credit Corporation (CCC) are reported here. CCC loans generally aren’t reported as income, but when production is pledged as collateral, you can elect to recognize income in the year received. This income is reported on line 4a. reported on a CCC 1099-G. The full forfeited amount should be reported on line 4b, even if the proceeds were reported as income. You may also receive a Form 1099-A showing what was forfeited. If you previously reported the forfeited proceeds as income, you won’t have a line 4c entry. If you didn’t report the proceeds as income, please follow the Schedule F, lines 5a-5c instructions, as they also apply to this section of Form 4835.

- Line 5: Federal crop disaster payments are reported here. Special rules apply for cash basis taxpayers; see the IRS Form 4835 instructions for specific details. Note that if any crop insurance proceeds are deferred (including disaster payments), then all crop insurance proceeds must be deferred. Prior year deferral info is included on line 5d.

- Line 6: Report any other farm-related rental activity here.

- Line 7: The sum of the amounts reported on lines 1-6 should be reported here.

For instance, Frankel Family Farm Properties received crops in exchange for farmland rented to Green Thumb Gardens. The Frankels then reported that rental income on Form 4835. Frankel Family Farm Properties did not receive any federal assistance or co-op income, and the only income received was $40,000 from the sale of their share of the crops.

Sample Input for Form 4835, Part I

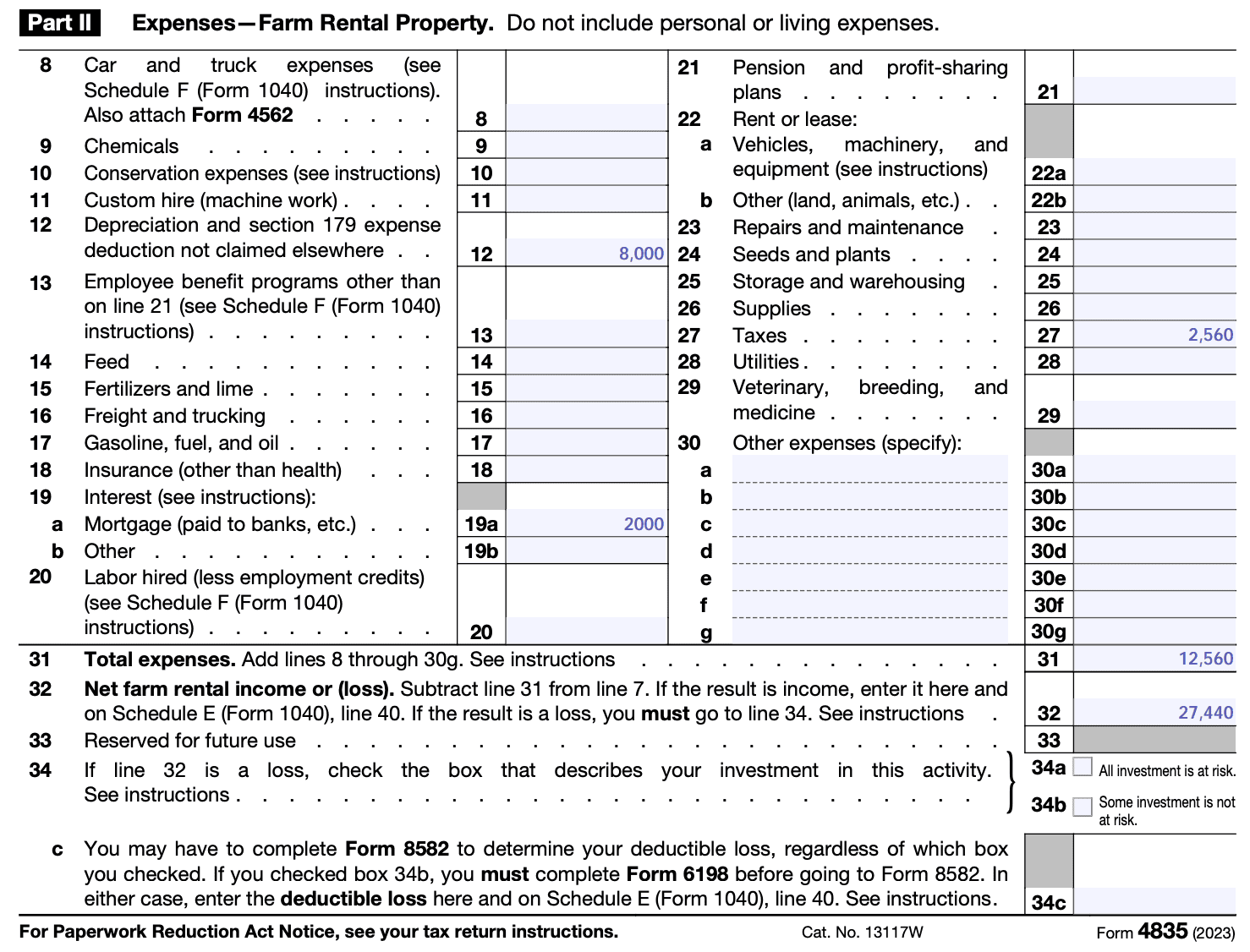

Step 4: Complete Part II – Expenses – Farm Rental Property

Frankel Family Farm Properties had the following expenses for the year:

- Property depreciation: $8,000

- Property taxes: $2,560

- Mortgage interest: $2,000

- Lines 8-30: These lines include general expenses that can be deducted against the income reported in Part I.

- Line 31: The sum of the expenses on lines 8-30 should be reported here.

- Line 32: Subtract the line 31 expenses from the income in Part I to arrive at the total farm rental income or loss.

- Line 34: This line is only relevant if there is a loss because additional steps are required to determine if the full loss can be taken. Lines 34a through 34c break down the amount of personal investment involved in the business venture—which impacts the amount of loss that can be taken.

Loss limitations apply to Schedule E and C filers and should also be considered for Form 4835 filers. For more information, read our article on at-risk rules for rental properties & Schedule C businesses.

Since Frankel Family Farm Properties did not have a loss for the year, line 34 does not apply.

Sample Input for Form 4835, Part II

Step 5: File the Form

Form 4835 is submitted with the taxpayer’s personal tax return and is subject to ordinary income tax rates. Income from Form 4835 is carried forward to Schedule 1 of Form 1040. Form 4835 has the same due date as the taxpayer’s individual income tax return including extensions. For individual taxpayers, this due date will either be April 15 if filed with no extension or October 15 if filed with an extension.

Frequently Asked Questions (FAQs)

Qualified business income may be offset by a 20% deduction if certain criteria apply. Income from rental real estate, (including farming activity reported on Form 4835) may qualify as trade or business activity that is eligible for the deduction.

Farm income is reported on either Schedule E, Schedule F, or Form 4835, depending on the type of farming activity being conducted.

Schedule E is used to report fixed payments from rented farmland, while Form 4835 is used when proceeds from third-party farm operations are used for rent.

Bottom Line

Form 4835 is used to report income allocation from farm operations conducted on farmland by someone other than the landowner in exchange for rent. This two-part form separately categorizes income and expenses to arrive at net income or net loss. If there is a net loss, additional analysis is required to determine the allowable amount of loss.