IRS Form 6198 helps you determine how much of your losses are deductible when you’re not at risk of losing a portion of your investment in a business. The most common example of an investment which you are not at risk of losing is a nonrecourse loan to your business that you are not personally responsible for repaying. It is rare for a sole-proprietor to have an at-risk limitation, but S-corps that borrow money to purchase buildings or equipment frequently run into at-risk issues when they incur losses.

You must file a separate Form 6198 for each business activity unless the activities are within an S corporation (S-corp). In this case, the IRS lets you put all your activities on a single form. You should calculate your business’s income or loss on your appropriate tax form before starting Form 6198. This could be Form 1120-S K-1, Form 1065 K-1, Schedule C, Schedule E, or Schedule F.

- Form 6198 is filed with the individual return of business owners. The tax filing deadline, which is typically April 15 of each year, is when individuals should send the form along with Form 1040 or Form 1040-SR.

- Form 6198 is required if your business has a loss and you have an investment in that business for which you are not at risk of losing.

- Most taxpayers use the simplified computation in Part II of Form 6198 to calculate the amount at risk.

Step 1: Use Part I to Determine Your Loss for the Year

- Line 1: Enter the amount of ordinary income or loss here. This figure should be your overall business income minus your total business losses. For example, if your business lost $40,000, enter that here. Depending on what form you file, you can find the value for this line on any of the following lines:

- Sole proprietors filing Schedule C can find this information on Line 31.

- Rental property owners filing Schedule E can find this information on Line 26.

- S-corp owners/shareholders can find this information in box 1 of Form 1120-S, Schedule K-1.

- Partners can find information on this information in box 1 of Form 1065, Schedule K-1.

- Line 2: Enter all your long- and short-term capital gains and losses, along with ordinary gains and losses from selling assets used in the activity or your ownership in it. Enter gains and losses without considering any limitations for capital losses, passive activity losses, or at-risk amounts.

- Line 3: If you are a partner in a partnership or a shareholder in an S-corp, use this line to enter any Schedule K-1 income or gains you did not include on lines 1 through 2c.

- Line 4: If you’re a shareholder or partner in a partnership, include Schedule K-1 deductions and losses not included on lines 1 through 2c here.

- Line 5: Combine lines 1 through 4 to determine your current year’s profit or loss. If it shows a profit, you don’t need to complete Form 6198. If it shows a loss for the current year, you need to continue completing the form to determine if your loss is restricted by your amount at risk.

Step 2: Use the Simplified Method in Part II to Calculate Your Business’ At-Risk Amount

You can only use this section if you know your adjusted basis in the activity or if you own an interest in the partnership or S-corp. If you used Part III in the prior year, we recommend using it again in the current year since you can skip lines 11 through 14.

- Line 6: Enter your adjusted basis in the activity on January 1st if your business is an S-corp or a partnership. Sole proprietors (Schedule C) and Farmers (Schedule F) enter your adjusted basis in the assets of your business without any reduction for liabilities. Your adjusted basis generally equals the cash and other assets you’ve contributed to the business, plus prior year income for which you’ve paid tax, less prior year losses that have been deducted.

- Line 7: Put the amounts that have increased your basis in business activity over the course of the year. This could be the adjusted basis of any property you invested in the activity, the value of any personal loans you took out to pay for your business activity or the value of any cash you gave to the activity. Do not include any current year income or gains reported in step 1.

- Line 8: Add up lines 6 and 7 and write the total here.

- Line 9: Put any amount that has lowered your amount at risk over the course of the year. Amounts that may reduce your amount at risk include new nonrecourse loans that are not qualified nonrecourse financing, cash, property, borrowed amounts that are covered against loss by a guarantee, amounts borrowed from a person who has an interest in the activity other than as a creditor, and so on.

- Line 10: Subtract line 9 from line 8 to determine your amount at risk here. If line 10 is more than the loss reported on line 5, you can deduct the entire loss, and you don’t need to fill out the remainder of the form. If the amount on line 10 is less than the loss on line 5, your deductible loss is limited to the amount on line 10, or you can fill out Part III to see if it gives you a higher amount at risk.

Step 3 (Optional): Complete the Detailed Computation in Part III

This step is optional, but if your loss is limited because of an insufficient at-risk amount calculated in Step 2, then we recommend completing this step to see if it results in a larger at-risk amount and thus a larger deductible loss.

- Lines 11 through 14: Most taxpayers don’t need to complete lines 11 through 14. You don’t need to complete lines 11 through 14 if:

- You completed Part III in the prior year; or

- Your business began after 1986

- Lines 15 through 19a

- Line 15:

- If your business started after 1986 and you didn’t complete Part III in the immediately preceding year, enter zero and check box “a.”

- If you did complete Part II in the preceding year, enter the amount from line 19b of the prior year form and check box “b.”

- If your business started before 1986, see the instructions for lines 11 through 14.

- Line 15:

- Line 16: Check box (a) or (b) and then indicate the increases in amounts at risk since that date. You should check the same box as you did on Line 15. The increases to report are described in items (1) through (9) on page 7 of the instructions to Form 6198 for line 16.

- Line 17: Add lines 15 and 16 and enter the sum on line 17.

- Line 18: Check box (a) or (b) to agree with the boxes checked on both lines 15 and 16. Enter on this line any decreases described in items (1) through (8) on page 8 of the IRS’s instructions to Form 6198.

- Line 19a: Subtract line 18 from line 17 and enter the difference on line 19a.

- Line 19b If line 19(a) is more than zero, put that amount on line 19(b) and move to line 20. If not, enter -0 and look at Publication 925 for information on the recovery rules.

Step 4: Calculate Your Deductible Loss in Part IB

- Line 20: Enter either the greater of line 10b or line 19b on line 20 as your amount at risk.

- Line 21: Figure out how much your deductible loss is:

- If the loss on line 5 is equal to or less than the amount on line 20, you don’t have any at-risk limitation. You should report all values reported in Part I of Form 6198 on your tax return, subject to any other limits, such as the passive activity and capital loss limitations.

- If the loss on line 5 is more than the amount on line 20, you must limit your deductible loss to the amount on line 20. The amount of your deductible loss might still be subject to other limitations for passive activities or capital losses.

Example of a Completed Form 6198

Amara is a 50% shareholder in an S-corp, Quality Investment Properties, Corp. She materially participates in the business activities of the corporation. In 2023, the following applied to Amara:

- Basis in Quality Investment Properties, Corp. on January 1: $40,000

- Cash contribution to the corporation: $10,000

- New qualified nonrecourse loan amount: $25,000

- Loss incurred from renovations to properties: $150,000

- Distributions taken: None

- Charitable contribution: $3,000

- Interest Income: $2,000

Amara filed an extension on April 15, 2024. She has until the October 16 deadline, to fill out Form 6198, which will be filed with her personal return, Form 1040. Amara’s share of losses was $75,000, which is 50% of the total loss.

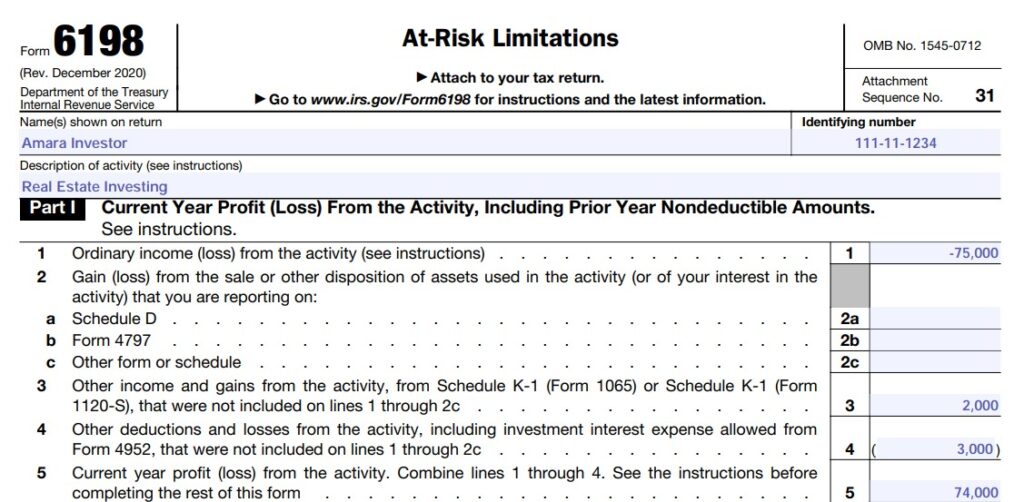

Step 1: Use Part I of Form 6198 to determine the loss for the current year.

- Step 1.1: On line 1, she entered her share of Quality Investment Properties, Corp.’s losses, which is $75,000.

- Step 1.2: Amara’s share of interest income received by the S-corp is $2,000, so she entered this amount on line 3.

- Step 1.3: Amara’s share of charitable contributions made by the S-corp is $3,000, so she entered this amount on line 4.

- Step 1.4: Her total loss on Line 5 is $74,000.

Part I of Amara’s Form 6198

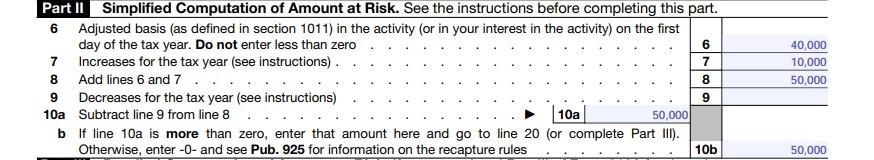

Step 2: Calculate the amount at risk using Part II.

- Step 2.1: Entered her basis of $40,000 on line 6.

- Step 2.2: On line 7, she entered the $10,000 cash contribution she made during the year.

- Step 2.3: On line 8, she added lines 6 and 7, to arrive at $50,000.

- Step 2.4: Amara did not have any decreases for the year since she didn’t take any distributions.

- Step 2.5: The accountant subtracted line 9 from 8 and entered $50,000 on line 10a. This value was then carried to line 10 b since it is greater than zero.

Part II of Amara’s Form 6198

Step 3: Leave Part III blank.

Since Amara’s activity began after the effective date (the effective date is the first day of the first tax year beginning after 1975), she does not need to complete Part III of this form. So, her accountant left it blank.

Part III of Amara’s form 6198

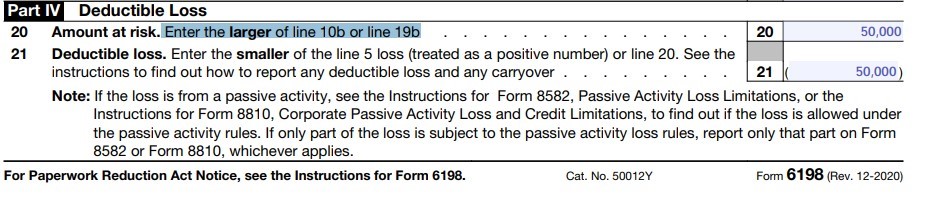

Step 4: Part IV Deductible Loss.

Amara then calculated her deductible loss in Part IV of her Form 6198 by:

- Step 4.1: On line 20, Amara enters the greater of line 10b or line 19b, which is $50,000 for Amara. This is the amount Amara has at risk and is the maximum amount she’ll be able to deduct.

- Step 4.2: They entered the smaller of the line 5 loss or line 20, which is also $50,000, on line 20. This is the maximum amount of loss Amara can deduct in the 2023 tax year.

Part IV of Amara’s Form 6198

Since Amara materially participates in the activity, she will carry this value over to IRS Schedule E page 2 Part II, line 28A, column i. Then, they will enter the total allowable loss on line 41, which is $50,000.

Who Must File Form 6198

You are required to file Form 6198 with your tax return if you incur a loss from an activity subject to the at-risk rules (meaning your entire investment is not at-risk). The at-risk limits apply to most business operations, including:

- Filers of Schedule C

- Filers of Schedule E, including partnerships and S-corps

- Filers of Schedule F

- Estates,

- Trusts

- Certain closely held C corporations (C-corps) are described in Section 465(a)(1)(B), as modified by Section 465(a)(3).

Frequently Asked Questions (FAQs)

Yes, since the at-risk rules apply to activities related to rental property ownership.

Yes, if you have losses that are disallowed in any year, you may carry the losses forward to future years.

You will not need to file Form 6198 if your business doesn’t generate a loss or if your entire investment is at risk.

Bottom Line

Now that you know how to fill out Form 6198, you can use the form to figure out how much you can deduct for losses from at-risk activities. You must file the form with your tax return for the year in which you had an at-risk activity and lost money in that activity. The form should be sent in by the filing deadline.