Learning how to value a business is the process of calculating what a business is worth and could potentially sell for. One common method used to value small businesses is based on seller’s discretionary earnings (SDE). This method can be used to value a business for sale as well as raising capital.

To make sure you maximize your payout when selling your business, it’s important to work with an experienced business valuation provider such as Guidant. For $495, Guidant’s specialists will supply you with a detailed valuation report, complete with a financing assessment and an in-depth industry analysis. Take advantage of this vital information to sell your business for the right price.

How to Value a Business Yourself

You can calculate the value of your business manually by following the three steps below, taking seller’s discretionary earnings (SDE) and applying an industry multiple. This is a simple method that can be applied when learning how to value a small business, and is appropriate for many small businesses. Other valuation methods exist, and may be more appropriate depending upon the complexity and structure of the target business.

Completing a business valuation on your own can be complicated, and the results may not match the actual price the business sells for. For a simple estimate regarding the potential value of your business in a sale, you can use our free business valuation calculator. It will estimate the value of your business based on your industry, current sales, and current profit.

The three steps to determine the value of a business are:

1. Calculate Seller’s Discretionary Earnings (SDE)

Most experts agree that the starting point for valuing a small business is to normalize or recast the business’ earnings to get a number called seller’s discretionary earnings (SDE). SDE is the pretax income of your business before non-cash expenses, owner’s compensation, interest expense and income, and one-time expenses that aren’t expected to continue in the future.

Small businesses report expenses on their tax returns with an eye toward reducing their tax burden. This means you likely claim many deductions that lower your business income on your tax return. For this reason, using income numbers from a business’ tax return can underestimate how much revenue the business actually produces.

Why Seller’s Discretionary Earnings Matters

SDE gives you a better idea of the business’ true profit potential by calculating what the business’ earnings would be with a new buyer. This is done by adding back in expenses listed on your tax return that aren’t necessary to run your business. This includes your salary as the business owner and any one-time expenses that aren’t expected to recur in the future.

Items that are added to net income to calculate SDE include:

- Your salary, or total salary of all owners

- Any perks you or other owners receive (like personal travel or personal vehicle payments)

- Family members on payroll holding non-essential positions

- Non-cash expenses such as depreciation and amortization

- Leisure activities, such as business golf outings

- Charitable donations

- Any personal expenses, like the purchase of a personal vehicle, that were noted as expenses on the business tax return

- Business travel that’s not essential to running the business

- One-time expenses that are unlikely to recur after the sale of the business, such as the settlement of a lawsuit

In order to get an accurate valuation, it is important that key figures such as those listed above are factored into the equation. Many business valuations experts recommend using a business valuation worksheet to make sure that critical information is not being left out.

2. Find Out Your SDE Multiplier

Businesses typically sell for somewhere between one and four times their SDE. This is called the “SDE multiple” or “multiplier.” Think of the industry standard multiplier and the specific business multiplier as two separate numbers, one giving you a general value based on industry averages and another giving you a more specific value based on variable factors of each individual business.

Some of the factors that make finding the right SDE multiple difficult are:

- Industry

- Geographic trends (market risk)

- Company size

- The business’ tangible and intangible assets

- Independence from the owner (owner risk)

- And many other variables.

The biggest factors influencing the SDE multiple are usually owner risk and industry outlook. If the business is highly dependent on you or another owner, it cannot be easily transferred to new ownership and the business’ valuation will suffer. If you’re selling a business in an industry or area that is expected to grow in the near future, the SDE multiple will be higher.

You can find out the approximate SDE multiple to use by looking at BizBuySell’s media insights quarterly report. BizBuySell provides multiples for different industries based on reported business revenue and cash flow. For a more personalized estimate of the multiple, you can also consult a business broker or appraiser.

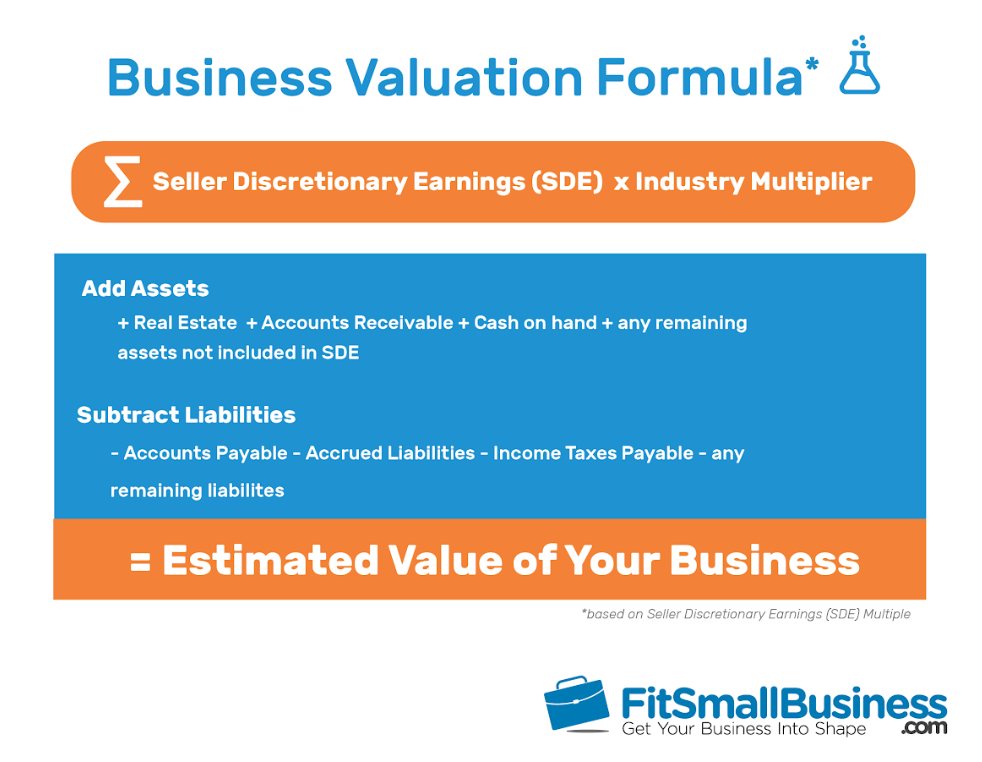

3. Add Business Assets & Subtract Business Liabilities

The final step of how to value a business is to account for business assets and liabilities that aren’t already included in the SDE. Most small business sales take the legal structure of an asset sale, which means the purchaser is buying the tangible and intangible things that make the business what it is. Typically the seller retains liabilities, but deal terms will vary from sale to sale.

Tangible Assets

Tangible assets are physical goods owned by the business that you can put a value on. Some examples include real estate (if the business owns any property), accounts receivable, and cash on hand. These are generally not included in the SDE multiple. All tangible assets should be added into the valuation separately (as shown in the examples below) if you are purchasing them.

Intangible Assets

Intangible assets are non-physical goods that have a value for a specific business purpose, like reputation, trademarks, patents, and goodwill. These assets are included in the SDE multiple because they are typically only sold if your business’ assets are sold.

Liabilities

A business’ current liabilities are debt or other obligations the business must pay in the future. When determining the value of a business, it’s important to factor whether the business’ liabilities will transfer with the sale or be settled by the selling owner.

An asset sale is typically structured so that the seller pays off the business liabilities with proceeds from the sale. However, it gets more complicated when discussing things like an open line of credit facility that the business needs in order to continue operations.

One way to determine what the potential liabilities are for a business is to run a business information report through Dun & Bradstreet. This can be purchased on virtually any company by any party for $121.99.

The information on a business information report includes:

- Current debt

- How often the business currently pays its suppliers on time

- Any debt the business is past due on

It’s an inexpensive way to get information about the business or to confirm that you’re not missing any important liabilities. It’s important to note that this may not include all liabilities, but it should give you a good estimate.

Final Business Valuation Formula

Now you can distribute all of your balance sheet lines into the appropriate category and use the formula below to come to an estimated business value:

Business’ Estimated Value =

(SDE) * (Industry Multiple) + (Real Estate) + (Accounts Receivable) + (Cash on Hand) + (Other Assets Not in SDE or Multiplier) – (Business Liabilities)

How to Value a Small Business Example

For an in-depth example of how to value a small business, we’ll walk through comparing the value of a family restaurant versus choosing a franchise, which will better illustrate how a business valuation works. Comparing a franchise to an independent restaurant allows us to demonstrate how risk can factor into business valuation. In many industries, an independent business will have more risks than a franchise and, as a result, will receive a lower valuation.

Business 1: Joe’s Family Restaurant and Cafe located in Missouri

- Annual revenue: $528,747

- Annual SDE: $80,799

- Real estate: $234,000

- Furniture, fixtures, and equipment (FFE): $31,950

- Inventory and stock: $3,500

- Liabilities: $40,000

Business 2: Subway franchise located in New Jersey

- Annual revenue: $373,200

- Annual SDE: $76,272

- FFE: $150,000

- Inventory and stock: $4,500

- Liabilities: $30,000

Calculate an Average Value to Get Started

Once you have the SDE for your business, you can use it to calculate a ballpark value by multiplying SDE by a business sale price multiplier. Using statistics from restaurants sold between 2014 and 2017, bizbuysell.com determined that the average multiplier for the restaurant industry is 1.98.

Using this figure, we can calculate an average value based on industry norms for Joe’s Family Restaurant and Cafe and for the Subway franchise:

Joe’s Family Restaurant and Cafe: ($80,799 x 1.98) = $159,982

Subway franchise: ($76,272 x 1.98) = $151,018

If you stopped here, you would think that Joe’s is worth more than Subway. There’s more work to be done, however. The multiplier that you use, and hence the final valuation, will depend on multiple factors.

Ironically, the final business valuation is only the beginning of the process of selling your business — there are still more steps like finding and vetting buyers, structuring your deal with the buyer, preparing documents, negotiating terms and more. Try outsourcing to a business broker so you can focus on running your business while they focus on selling it. Business brokers, like VNB Business Brokers, can help you value your business, maximize sale price, and expedite the process. Click below to schedule a free consultation today.

Factors That Influence the Multiplier/Base Value

In most cases, small businesses are given a business-specific multiplier of between one and four. The multiplier can be impacted by your geographic location, the risk of your industry, or a number of things related to your business.

Here are the main factors that influence a specific business’ multiplier/business value:

Assets

Assets add value to a business. The more assets a business has, the more it will be worth on the market and the higher the multiplier that will be used for the valuation. Assets generally include items that can be sold and converted to cash. Generally, equipment being financed with a capital lease are considered assets, while equipment financed through an operating lease are not.

Tangible Assets

Tangible assets refer to all of a business’ material assets, and won’t typically have a major effect on your multiplier. However, you might get a higher multiplier if you have recently purchased new equipment. Let’s say a restaurant has just purchased a new set of fryers and stoves. That means that equipment will not have to be updated in the near future, cutting down on future costs and which can raise the current value.

This includes but is not limited to:

- Furniture

- Fixtures

- Equipment

- Real estate

- Inventory (sometimes included in the asking price, and sometimes priced separately)

- Company vehicles

It is important to take into account the asset’s depreciation when assessing the value of many of these physical assets. Equipment that is near the end of its economic life may be worth very little to the buyer. In some cases, assets may be seen as a liability that the new owner does not want to take on, like damaged or outdated furniture, fixtures, and equipment that require replacement.

Real Estate & Lease Terms

The property or land that your business occupies or owns has a large impact on a business’ value. If your business leases a building, the amount of time remaining on the lease is an important factor. If your lease ends in less than three years, it could lower the multiple of your business because the new owner will have to renegotiate the lease.

If a business actually owns its own property and building, then the value of that real estate is estimated separately and added to the SDE value of the business. Some small business owners hold on to the ownership of real estate when they sell their business and agree to lease the property back to the new owner on a long-term lease agreement.

Subway Franchise

Subway’s lease term still has four years left on it, so the value is not significantly affected.

Joe’s Restaurant

In our example, Joe’s restaurant owns its own property and buildings estimated at $234,000 in value. That number is added to the value of the final SDE x multiplier value.

Intangible Assets

Intangible assets are all of the positive aspects of the business that are not material in nature and are the biggest influencer of a business’ individual SDE multiplier. A wealth of intangible assets means a much higher multiple. A lack of non-physical assets means a much lower multiple. This is because the value of intangible assets often determines whether or not your business transitions successfully to a new owner.

The following are some examples of a business’ intangible assets:

- Brand

- Reputation

- Independence from the current owner

- Recipes

- Trademarks

- Copyrights

- Patents

In many industries, buying a franchise is considered a much safer bet than buying an independent restaurant because of the wealth of non-physical assets that inherently come with a franchise. You get credit for the brand, for example, which could be recognized nationwide, like Subway.

Subway Franchise Non-physical Assets

Some examples of Subway’s non-physical assets are:

- Brand value

- History of financial success

- Informed marketing strategy

- Standardized operating procedures (SOPs)

The intangible assets above benefit every Subway franchisee, regardless of location, demographic, or owner charisma. They could be more highly regarded in different geographic locations, but there’s real value in using the brand everywhere it’s recognized.

Joe’s Restaurant Non-physical Assets

Some examples of Joe’s non-physical assets are:

- 35 years of success

- Loyal local customer base

- Good reputation in the community

The fact that Joe’s restaurant has been relatively successful as a business for 35 years is great. However, there is no guarantee the restaurant will be successful once Joe leaves.

That is a big risk to a potential buyer because of these risks:

Future Prospects of the Business

Industry and geographic trends also influence how to value a business. This is often referred to as “market risk.” If an industry is booming and trending toward your particular business, the higher your multiplier will be. In the same way, the more the population growth and popularity of a business area is growing, the higher your business’ specific multiplier will be.

Subway Franchise

In general, the fast food industry remains stable due to its convenience and low cost compared to full-service restaurants, making it unlikely to suffer a significant drop in patronage. Fast food is trending towards healthier food, but this is a major part of Subway’s brand recognition. As far as industry trends are concerned, Subway has good prospects.

Geographically, New Jersey is staying pretty steady economically. Given this information, Subway’s multiplier is probably above the industry average of 1.98. However, specific geographic regions within a state can often have very different trends than the state as a whole, so it is also important to research local area trends.

Joe’s Restaurant

Although Joe’s restaurant has had success in the past, the future might not be as bright. David Coffman of Business Valuations & Strategies PC explained that restaurant success is trending away from independently owned businesses and towards franchises due to their brand recognition. That makes the industry outlook shaky, at best.

Geographically, Missouri is actually doing pretty well, with dropping unemployment rates and a rise in entertainment and leisure jobs. Joe’s business-specific multiplier might be a bit above the industry average of 1.98 due to the state’s positive economic trends, but buyers might be leery of the future business potential because it’s not a recognized brand name.

Other Factors That Affect the Multiplier

The factors we’ve covered above are a list of the most common things that can affect the SDE multiplier. Any number of things, from the business being in a desirable or undesirable location to the business having a diverse or narrow customer base, can affect the multiple. This is why it’s important to consult experienced professionals like Business Exits to help you get an accurate valuation of your business.

Financing Eligibility

The availability of seller financing also has an impact on the sales price multiplier. In nearly 80% of cases, a business has some kind of seller financing option available to the buyer. This is typically around 30% to 60% of the overall business value or purchase price. If a small business doesn’t offer seller financing, it will take longer to sell and its value is typically decreased.

Customers May Start Going to Another Location

Many times, local customers choose one establishment over another because they have a personal relationship with the owner. One way to measure this risk is by asking customers what brings them back, and if they would still frequent the location if it was under new ownership. Some of this risk can be managed by the exiting owner remaining on in a transitional capacity for a period of time following the sale.

Older Employees May Retire

Employees who were hired by Joe and are loyal to him may decide to leave when he does. If they agree to stay, however, it may only be for a short period of time (less than one year). If these employees hold crucial positions in the business, such as manager or head cook, the buyer could lose some of the most valuable team members that made Joe’s Restaurant such a success.

Supplier Relationships May End or Deals May Change

If Joe had relationships with his suppliers, they may have been giving him an extra good deal, like lenient credit terms. When Joe leaves, those deals may dry up, or the suppliers may see it as an opportunity to back out altogether, which means lots of extra work, effort, and time to find new suppliers.

In other words, the intangible assets associated with Joe’s Restaurant are much more closely connected to you as the owner of the business, making it less likely to transfer successfully to a new owner. This is often referred to as “owner risk.” Selling a business like this requires you to get out in front of these potential problems before you find a buyer.

Owner risk is one of the biggest factors influencing business value. If a business has so much owner risk it cannot survive the transition to new ownership, then all other aspects of a business’ value are pointless.

Final Values/Multipliers in Our Example

Joe’s Restaurant: 2.0 Multiplier

Total Estimated Value: $355,598 = ($161,598 Estimated Business Value) + ($234,000 Estimated Real Estate Value) – ($40,000 Liabilities)

Our business valuation expert helped us put together these values. Although Joe’s Restaurant has had reasonable success in the past, the industry is trending away from independently owned restaurants. Also, the likelihood of new owner success is questionable because Joe’s is a family-owned business with a long reputation in the local community.

Nevertheless, due to Missouri’s positive economic climate, Joe’s business-specific multiplier is a little higher than the industry standard, at around 2.0. Although it does not have a very high multiplier, the real estate value actually makes the investment a pretty good one.

Subway Franchise: 2.8 Multiplier

Total Estimated Value: $183,561 = ($213,561 Estimated Business Value) – ($30,000 Liabilities)

Subway’s business-specific multiplier well exceeds the industry average multiplier of 1.96. The industry is trending toward franchises, and since Subway is a franchise, the transition to a new owner is less risky.

Considering all of these positive factors, Subway’s business-specific multiplier is almost a whole point above the average industry multiplier of 1.98. Ultimately, the estimated business value of Subway is significantly higher than that of Joe’s Family Restaurant and Cafe.

Alternative Business Valuation Methods

In this article, we focused on valuing a business using a multiple of SDE, which is a popular and effective method. Business valuation specialists generally prefer the SDE method when valuing a business worth $1 million or less.

The SDE method is part of a larger category of methods known as multiples of earnings. In addition to using multiples of earnings, popular valuation methods include asset-based, return on investment (ROI)-based, discounted cash flow (DCF), and market value.

Some alternative business valuation methods are:

EBITDA Approach

EBITDA is another common valuation tool used by business valuation experts, and is often used instead of SDE. Which tool to use often depends on the type of business being valued, as well as its earnings. While SDE is common for small businesses that have less than $1 million in earnings, EBITDA is a preferred tool for companies with earnings in excess of $1 million.

EBITDA Key Data Points

EBITDA, or earnings before interest, taxes, depreciation, and amortization, is a line on a business’ income statement. EBITDA attempts to take certain variables such as accounting and tax strategy, as well as whether a business is financed with debt or equity, out of the equation. This is intended to standardize a company’s earnings number, which can then be used to create an EBITDA multiple off of which to base the sale price of the business.

EBITDA Drawbacks

Because EBITDA discounts items like depreciation and amortization, it may overstate a company’s ability to cover its liabilities and ignore needed upgrades or replacement of assets. EBITDA is not a substitute for cash flow, and cannot account for the impact made by day-to-day use of cash to cover the expense of the company’s operations. It should always be used with additional cash flow analysis, such as discounted cash flow (DCF).

Asset-based Approach

An asset-based approach is a valuation method that can be particularly useful for potential buyers of a small business, as assets comprise the majority of the sale price in many smaller transactions. This approach includes both tangible and intangible assets, so a retail store’s inventory would be a tangible asset, while its reputation and location might be considered an intangible asset.

Asset-based Key Data Points

The formula for an asset-based valuation is simple. The business or prospective buyer should take all of the business’ tangible and intangible assets and subtract all liabilities. Unlike some other valuation methods, no multiple is applied, as the resulting value represents the total value of the business less liabilities.

Asset-based Drawbacks

An asset-based approach is a great comparative tool that a buyer can use to compare with a seller’s asking price to judge whether or not it is realistic. A drawback to an asset-based approach is accurately identifying the value of assets. The value listed on the balance sheet may not accurately reflect the fair market value of the asset.

Market-based Approach

Taking a market approach to valuing a business means identifying similar businesses and their recent sales prices. A popular method for valuing home prices, it is useful for businesses where a large amount of data on recent sales exists. It can be used in conjunction with one or more other methods to determine an accurate value.

Market-based Key Data Points

Being able to compare sales prices is only the beginning. In terms of valuing a home, key data points would include things like square footage and the number of bedrooms and bathrooms. When valuing a business, look for similar businesses by industry, location, number of employees, annual revenue, and other factors. It may also be useful to use a figure such as the EBITDA multiple to compare the relative financial strength of each business.

Market-based Drawbacks

One major drawback of the market-based approach is that it is overly reliant on data, and that the quality and quantity of that data is not sufficient, particularly when valuing small businesses. While a market-based approach may work very well when comparing businesses with a high percentage of commercial real estate assets, it is less likely to yield accurate results when comparing small businesses with a large number of intangible assets.

7 Tips to Maximize Your Business Valuation

Now that you understand how to value a business on your own, you’ll want to maximize that value before you sell. There are both short- and long-term tips that can help you improve your business valuation and help you get the largest sum possible for your business.

Seven tips from the pros to maximize your business valuation are:

2. Look Beyond the Past & Provide Projections

One major problem with using an SDE multiple to value a business is that the number is backward-looking. When valuing a business, it is important to look at the future, even if you’re the seller. You will want to present a case to potential buyers that your business’ revenues and profits will grow and the business should have a higher multiple as a result.

A buyer also wants to consider factors that might be challenges or opportunities for the business going forward. The best way to do this is to provide projections based on how the business could perform in the future in both best- and worst-case scenarios. It could help the buyer understand what your expectations are for the business and give them a level of comfort that it will continue to perform at or better than current performance levels.

5. Decide If You Need Professional Assistance

Before setting out to value a business, you must decide how you’re going to conduct the valuation. You can either value the business on your own (with the assistance of your accountants and attorneys), or you can hire a professional appraiser or business broker.

Value a Small Business on Your Own

The main benefit of valuing a business on your own is that it saves you money. The experts we spoke to quoted different price ranges for appraisals, but a good ballpark is $5,000 or more for appraising a small business that’s worth $500,000 or less.

Valuing a business on your own is also faster. A professional appraisal takes two to four weeks, while you can get a valuation within a few hours on your own.

Hiring a Business Valuation Company or Appraiser

Although hiring an appraiser can be expensive, there are certain advantages to doing so. The main advantage is that a professional appraiser will audit the business’ financials to make sure they are correct. Plus, you’ll get a valuation that is much more accurate and personalized to your business.

Having an experienced professional value your business gives you indisputable evidence of what your business is worth. While a business is only worth what someone will pay for it, this is harder for a buyer to negotiate your sales price down than it would be if you just provided a valuation you did yourself.

Guidant is a reliable business valuation provider that you can count on for accurate information. For just $495, you will have professionals analyze your business financials and provide you with a detailed valuation report to make sure you sell your business for the right price.

Bottom Line

Approaching the question of how to value a business is often seen as a blend of art and science. Many business valuation experts take a multifaceted approach, combining two or more methods to arrive at the most accurate valuation. For small businesses, starting with SDE and factoring in additional analysis based on cash flow and comparable sales should return a reasonably accurate estimate of a business’ worth.

When pricing your business for sale, it’s important to get it right. Price too high, and you risk scaring away buyers. Price too low, and you’re risking your own bottom line. For $495, Guidant can help by working with you to complete a financing assessment and creating a detailed valuation report along with an in-depth industry analysis.