IRS Code 806 represents the tax withheld during the year on your behalf, generally on Form W-2 or 1099. Tax withholding is typically done by an employer or brokerage account administrator and acts as a prepayment of the tax that the IRS may assess when your tax return is filed. The Code 806 amount on your transcript does not represent an amount you will receive as a refund or an amount owed. Instead, that code 806 amount is factored into the final result.

Key Takeaways:

- Code 806 does not require immediate action on the part of the taxpayer.

- Amounts withheld are shown as negative dollar amounts with code 806 and are a credit to your account.

- The total amount of withholding for the year can be found on Form 1040, page 2, line 25d.

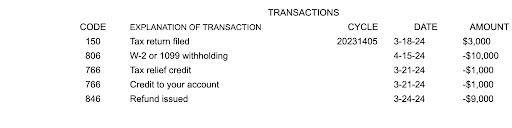

Example of Code 806 on an IRS Transcript

In the example below, the IRS acknowledged the receipt of the tax return (code 150) and determined that the tax allocable to the taxpayer’s income is $3,000.

$10,000 was withheld on the taxpayer’s W-2 (code 806). Then, the taxpayer received two different credits of $1,000 each (code 766). On March 24, the IRS issued a refund to the taxpayer in the amount of $9,000 (code 846).

Example of IRS Transcript with Tax Code 806

What Does the Number Next to Tax Code 806 Mean?

The number next to tax code 806 reflects the total amount withheld and submitted to the IRS and is shown as a negative number.

- A dollar amount that is greater than the IRS’s assessment of your tax will result in a refund.

- A dollar amount that is less than the IRS’s assessment of your tax will result in an amount owed.

What to Do if Your Code 806 Information Is Wrong

Identify which component of the total 806 withholding is incorrect. For example, if you had two W-2 forms and realized that your total code 806 amount for both is wrong, your first step would be to determine which W-2 is incorrect. Then, you should contact the issuer and request a corrected W-2.

If you are unable to get the issue resolved with your employer, contact the IRS at 1-800-829-1040 from 7 a.m. to 7 p.m., Monday through Friday, local time. You may also make an appointment to speak to someone in person through your local IRS Taxpayer Assistance Center. The IRS will contact the issuer and request that the revised information be provided within 10 days.

What You Can Do to Correct Future Withholding

When code 806 withholding is insufficient to cover your current year’s tax liability and you expect your income to be similar for the following year, you may need to modify your withholding. To ensure that the appropriate amount is withheld for future withholding periods, you’ll first need to review your W-4. Then, you’ll need to revise the form as needed.

Frequently Asked Questions (FAQs)

No. It represents your tax withholding for the year, which will be factored into whether or not you receive a refund.

A negative balance shown for IRS code 806 means that a credit has been posted to your account for the taxes withheld during the year.

A future date on IRS transcript code 806 often denotes the due date of the tax return with extensions.

Bottom Line

IRS code 806 represents the tax withheld for the tax year filed. For a complete picture of how IRS code 806 will impact your refund, you should review this code together with the other information presented on the transcript. For more detail on how to interpret the information presented, check out our guide on How to Read an IRS Transcript (+ Example).