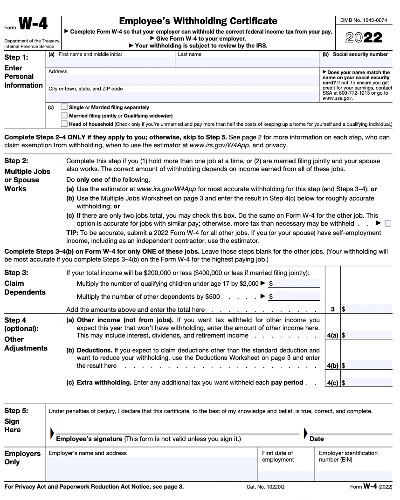

A W-4 Form, or Employee’s Withholding Certificate, gives you the information you need to determine how much money to withhold from your employees’ paychecks each pay period to pay their income taxes. Employees must fill it out properly and submit it to you before their first payday to avoid a big tax bill and penalties in April. There are five parts, and it shouldn’t take more than a few minutes to complete.

Employees, especially first-time workers, may have questions about completing their W-4. You can assist them and answer questions, but cannot tell them how to answer individual questions or sections on the W-4 or complete the form for them. For these specific cases, you’ll need to refer them to someone outside your company, like an accountant or tax advisor.

If you’d prefer to not have to collect and file W-4 forms for all of your employees manually, consider using a full-service payroll software like Gusto. Its self-service employee onboarding platform will prompt your employees to fill out a digital version of the W-4 form and will file it for you automatically. Try it today and get one month free when you run your first payroll. Offer will be applied to your Gusto invoice(s) while all applicable terms and conditions are met or fulfilled.

Did you know?

In 2020, the IRS modified the W-4 Form to simplify it and make it more accurate. Most employees now only need to fill out Steps 1 and 5. 2023 saw minor updates to the form:

- There’s no longer any reference to a tax withholding estimator

- Step 2(c) clarifies who should check the box for having two jobs

- The deductions worksheet has updated amounts

How Form W-4 Works

New hires should complete the W-4 form and submit it to you as soon as possible after they begin working, as you need time to process it before you start doing payroll. You’ll use the information they enter (i.e., marital status, dependents, etc.) to cross-reference the IRS withholding table so you know how much money to deduct from their paychecks. You’ll eventually report the tax withholding on their year-end W-2 form.

The Tax Cuts and Jobs Act drastically changed the W-4 form in 2020. You should no longer use any old forms, and it’s good practice to use the most up-to-date W-4 when having new workers complete the form. You don’t have to get existing employees to update their pre-2020 W-4 unless their situation has changed, like if they got married or had a child.

Note: You cannot accept a W-4 Form by email or fill it out for an employee. They must sign it in person. You can receive it in print or through electronic systems that comply with IRS regulations.

If you want to learn about more forms employers are responsible for filling out or collecting, check out our payroll forms article.

State W-4 Forms—Interactive Map

New Mexico, North Dakota, and Utah use the federal form. Other states have their own form instead of or in addition to the federal one. Click on the map below to see your state’s requirements, as well as how to run payroll compliantly.

State Payroll Directory

Tips to Help Your Employees Complete the W-4 Form

It’s not only in your best interest to get the W-4 Forms filled out correctly and on time, but it also helps your employees too. Here are some tips for getting the forms done right.

- Set a deadline: New employees who do not provide you with a Form W-4 must be treated as a single filer with no adjustments, meaning you’ll withhold the highest amount allowed. However, they must eventually submit the form. Give them a deadline—preferably before their first paycheck.

- Make filing it out part of orientation: Including the W-4 Form with the onboarding paperwork you give out when hiring a new employee ensures it will get done in a timely manner. Learn other best onboarding practices to ensure that your employee enters your company on the right foot.

- Remind new hires to use the name on their legal documents: To avoid confusion with identification, remind your employees to use their legal names—those on their Social Security cards—rather than nicknames or pen names.

- Keep it simple: The new form is designed to be simple, so if you know the employee does not have any of the deductions noted on the form, encourage them to fill out Parts 1 and 5 and turn it in.

- Walk through the process of how to fill out a W-4 Form with your employees: Even the simplest form can confuse a first-timer. Explain how to fill it out, but do not provide any advice or tell them how to answer sections.

- Offer video assistance: Create a how-to video for orientation, or find one on YouTube. (Money and Life TV has a very detailed video, with markers for specific sections and a spreadsheet with examples.)

Note: Employees can be hard hit if they underpay taxes, which can affect employee morale or cause them to need a pay advance. Ensuring that they fill their W-4 out correctly is vital to help reduce the amount of issues that you’ll face as a result of this.

Expand the headers below for more details on each section of the 2023 Form W-4:

The only parts that an employee is required to fill out are 1 and 5. Part 1 provides contact information and filing status, and Part 5 is the signature block. Be sure the employee signs the form with their legal name. If employees only complete these two sections, the IRS will direct you to withhold money based on their filing’s standard deduction without any other adjustments.

As an Employer, you need to fill out the Employers Only section in Part 5.

Part 2 is for employees with multiple jobs or those with a spouse who also works and will be filing taxes jointly with them. Some employees may not want to fill this out; it is not mandatory. If they choose to fill this out, they have two options for estimating withholdings.

- Multiple Jobs Worksheet: The worksheet provided on page 3 of the full Form W-4 is simple to follow. Advise employees not to use this unless your company is their highest-paying employer. If your company isn’t their highest-paying employer, recommend they redo the W-4 for the employer that pays them the most. If they are married filing jointly, this means the highest-paying employer between them and their spouse.

- Check the box in Option C: Advise employees to do this if they only have two jobs and both are similar in pay.

Part 3 is for employees with children or those with a qualifying relative living with them and depending on their income may qualify for tax credits. Tell your employee that they need to earn less than $200,000 in total income (from all income sources) if single, or less than $400,000 if married filing jointly to qualify for dependent-related credits.

Not claiming dependents is an easy way to make sure more money is withheld upfront. Therefore, many people will elect not to claim dependents to have more withheld now and receive a refund at the end of the year. It can also help if your employee has had problems with paying a tax bill and needs to repay the IRS for a past debt.

Another way your employee can avoid a big tax bill is by requesting that you withhold an additional amount in Part 4. Advise them to consider this option if:

- They have had tax bills in the past

- They want a refund

- They file 1099s for self-employment, contract work, interest, or dividends

- They receive pensions or Social Security retirement benefits

Other Adjustments & Deductions

Another way your employee can avoid a big tax bill is by requesting that you withhold an additional amount in Part 4. Advise them to consider this option if:

- They have had tax bills in the past

- They want a refund

- They file 1099s for self-employment, contract work, interest, or dividends

- They receive pensions or Social Security retirement benefits

Processing Changes to Employee Form W-4s

Employees who filled out the old Form W-4 do not need to fill out a new form. However, they may want to fill out a new form if they have a lifestyle change that affects their taxes. You should suggest filling out a new form if you know they have experienced any of these events:

- Marriage

- Divorce

- New baby or dependent

- Working more than one job

- Gain a new income source, such as a pension

- Significant pay changes, such as a bonus or large commission

- Complained of a large tax bill last year

- Want to change their withholdings for any reason

Changing to the new form is as easy as submitting it for the first time. If an employee does not change to the new form, then you will continue withholding according to the information on the old form.

Digital Tools for W-4 Form Processing

There are software applications that automate the collection, storage, and management of W-4 forms. These often feature intuitive interfaces that guide employees through the form-filling process, ensuring all necessary fields are filled completely. These also automatically update tax withholdings in your payroll system based on the information provided in the W-4 forms.

There are several key advantages of using digital tools for W-4 processing:

- Accuracy: Digital tools reduce the risk of human error in data entry and calculations, ensuring accurate tax withholdings.

- Efficiency: Automating the process saves time for both employers and employees, eliminating the need for manual data entry and paper form management.

- Record-keeping: These tools often include robust record-keeping features, making it easy to store and retrieve W-4 forms as needed for compliance.

When choosing software for your W-4 processing, consider the following:

- Cost: Ensure the tool fits within your budget. Don’t forget to account for any setup or recurring costs.

- Ease of use: The software should be straightforward and easy for both you and your employees to use and access.

- Integration: Ideally, your chosen software should integrate seamlessly with your existing payroll and accounting systems.

- Support: Look for tools that offer robust customer support, including resources for troubleshooting and learning how to use the software.

We recommend several all-in-one systems to streamline your processes:

- Gusto: Known for its user-friendly interface, Gusto offers comprehensive payroll services, including automated W-4 processing. Learn more about how it works in our Gusto review.

- QuickBooks Payroll: This service from Intuit allows for easy integration with their accounting software and offers automated tax form processing. Find out if it’s right for you by checking out our QuickBooks Payroll review.

Can’t decide which one is best for you? Check out our Gusto vs QuickBooks Payroll article to find out how these two compare.

Form W-4 Frequently Asked Questions (FAQs)

If an employee makes a mistake on their W-4, they should submit a new, corrected form as soon as possible. Once you receive the corrected form, adjust the withholding on the next payroll.

Employees should update their W-4 form whenever they experience a significant life event that affects their tax situation, like getting married or having children. It’s also a good idea for employees to review their W-4 annually.

The information provided on the W-4 form determines how much federal income tax is withheld from an employee’s paycheck. If too little is withheld, the employee may owe tax when they file their return.

Yes, an employee can submit a new W-4 form at any time during the year to adjust their withholdings. However, it’s important to note that changes won’t be retroactive so they’ll only apply to future paychecks.

The IRS recommends keeping W-4 forms on file for all active employees and for four years after an employee leaves your company.

Bottom Line

As an employer, your only responsibilities are ensuring an employee turns in a Form W-4 correctly and withholding taxes according to the information they supply. Although you won’t be penalized, if employees do not properly fill out the form, they can be hit with a big tax bill in April and even penalties. Taking time to instruct them on how to fill out a W-4 Form properly can save them money and help employee morale.

Collecting and filing W-4 forms for all of your employees manually can be stressful and time-consuming. If you’d prefer to have it done for you, consider using a full-service payroll software like Gusto. Its self-service employee onboarding platform will prompt your employees to fill out a digital version of the W-4 form and will file it for you automatically. Try it today and get one month free when you run your first payroll. Offer will be applied to your Gusto invoice(s) while all applicable terms and conditions are met or fulfilled.