IRS Form 5500 is a form that must be filed annually by companies that sponsor an employee retirement plan. Its main purpose is to provide information about the plan, such as its financial condition and allocation of investments. The form typically needs to be filed on the last day of the seventh month after the plan year ends, and failure to file can result in penalties that involve hefty fines.

The form is a commonly overlooked requirement for business owners who have completed a Rollover for Business Startups (ROBS). As part of the ROBS process that allows a business owner to get tax- and penalty-free access to retirement funds, the company must maintain a retirement plan. This plan is then subject to multiple regulatory requirements to remain compliant, one of which is the filing of Form 5500.

If you’re unsure how to fill out IRS Form 5500, you can consider working with a retirement plan company that provides assistance with the completion of the form. ShareBuilder 401k, for example, is a provider that can help ensure your plan remains compliant with this and other retirement plan regulations.

Where to Get IRS Form 5500

To get a copy, you can visit the IRS’s Form 5500 page or download it using our widget below.

To complete IRS Form 5500, you’ll need to provide basic information about your company and the plan. You can see the IRS’s Form 5500 instructions if you decide to do it without the help of a third party or read our instructions for form 5500 below.

How to Fill Out Form 5500

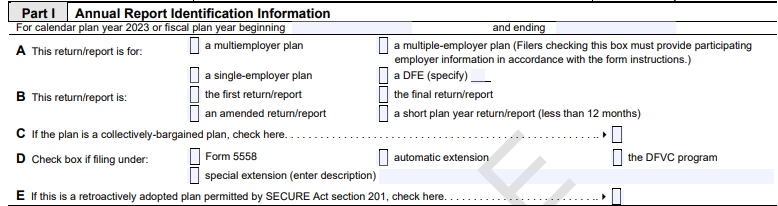

Complete Part I: Annual Report Identification Information

When filling out IRS Form 5500, the first step requires the completion of sections A through E of part I, in which you must check the applicable boxes for your plan.

Part 1 of IRS Form 5500, sections A through E

Section A

In this section, you’ll need to choose the required box that indicates what type of plan your company is running. You can choose from one of four options:

- Multiemployer plan: This plan typically requires more than one employer to contribute to your company’s retirement plan. It can also be classified as a multiemployer plan if it is subject to an agreement with more than one company.

- Single-employer plan: You should check this box if your plan is only maintained by one employer or is a single employee organization.

- Multiple-employer plan: This type of plan is defined as one that is maintained by more than one employer and does not meet the definition of the two plans above. A multiple-employer plan can sometimes be referred to as a pooled employer plan.

- Direct Filing Entity (DFE): DFEs can be classified as either a Master Trust Investment Account, Common/Collective Trust, Pooled Separate Entity, Investment Entity, or Group Insurance Arrangement. If you are a DFE, check the box and fill in the letter for your corresponding entity type.

Section B

Section B represents the filing status of IRS Form 5500 and requires you to check one of four boxes that applies to your filing situation. The options include the following:

- The first return/report

- An amended return/report (if you previously filed but now need to add or correct items)

- A final return/report (if this will be the last filing due to a termination of the plan or business)

- A short plan year return/report (if the information covers a time period of less than 12 months)

Section C

If you have a collectively-bargained plan, you will need to check the box in this section. These plans have contributions subject to the collective bargaining process and may be classified as such even if only certain employees are subject to that agreement.

Section D

If you are filing IRS Form 5500 as part of an extension or DVFC program, you’ll need to indicate this by checking one of the following four boxes in Section D.

- IRS Form 5558: Mark this box if you used the form to get an extension of time to file certain employee plan records.

- Automatic extension: An automatic extension of time to file IRS Form 5500 can be granted up until the due date of the federal income tax return of the employer.

- Special extension: Special extensions are typically announced separately by either the Internal Revenue Service, Department of Labor, or the Pension Benefit Guaranty Corporation. If you meet the requirements of this type of extension, you must also provide a brief description of the time extension needed.

- DFVC program: The DVFC program, short for Delinquent Filer Voluntary Compliance, is offered by the DOL.

Section E

Section E is a single box that only needs to be checked if your plan was retroactively adopted. For example, this may apply if the plan was adopted during the 2023 year but you want to treat the plan as if it had been adopted before that year. In some cases, this is beneficial as it can avoid the need to file a 2022 IRS Form 5500.

Fill Out Part II: Basic Plan Information

The next step in completing IRS Form 5500 consists of providing general information about the retirement plan. Necessary fields include the plan’s name and address, plan number, and type of participants. Part II consists of 10 main areas, each with various subsections.

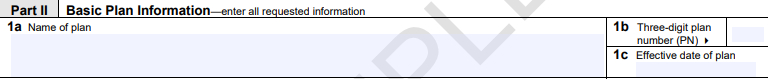

Section 1

This first section needs the name of your plan, the plan number (PN). For your plan’s name, it’s recommended that you use the same name from previous filings. Abbreviations are also acceptable if you run out of space. You’ll also need to include the effective date of your plan.

First section of IRS Form 5500 Part 2

With regard to your plan’s number, which may also be referred to as an entity number, it should be no more than three digits. This, in combination with other fields, is used to identify your specific plan.

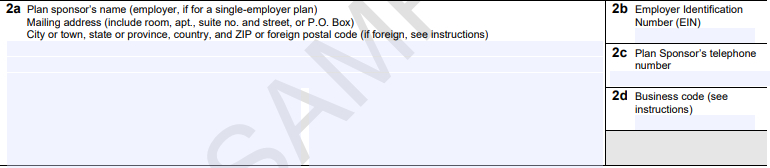

Section 2

The second section of Part II requires contact information of your plan sponsor. This includes its name and full mailing address, as well as the employer identification number (EIN), telephone number, and business code.

Part 2, section 2 of IRS Form 5500

Here are the details regarding each field requirement:

- Plan sponsor’s name and mailing address: Single-employer names should put the name of the employer in this field, making sure that the mailing address also includes any applicable information for apartment complexes, room numbers, or suites.

- EIN: This is the employer identification number for the plan’s sponsor that will allow the IRS to identify it.

- Plan sponsor’s phone number: Telephone numbers should include the area code and use only numbers without any dashes or special characters.

- Business code: The business code allows the IRS to categorize your business type. To find the code that applies to you, view the IRS’s Form 550 instructions starting on page 94.

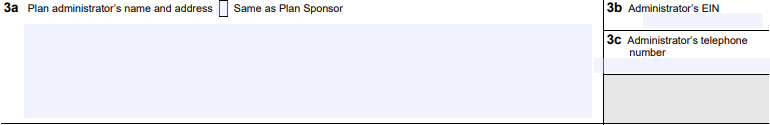

Section 3

Similar to the section above, this asks for your plan administrator’s contact information. This includes its full name, address, EIN, and telephone number. If the plan administrator is the same as the plan sponsor, you can simply check the box indicating they are the same.

Part 2, section 3 of IRS Form 5500

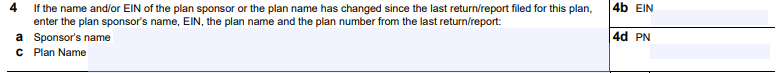

Section 4

Completing section 4 is only necessary if the plan sponsor’s name, its EIN, or the plan’s name has changed since the last time you filed IRS Form 5500. If this is the case, you must provide the name and EIN’s as they appeared on the last IRS Form 5500 filing.

Part 2, section 4 of IRS Form 5500

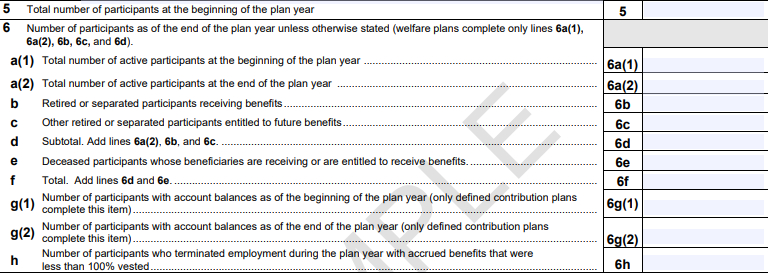

Sections 5 & 6

The following sections of IRS Form 5500 are to provide details regarding your plan’s participants. Some examples of this include participants with a plan balance, active participants at the beginning and end of the year, and deceased participants.

Part 2, sections 5 and 6 of IRS Form 5500

Here are the applicable options:

- Plan participants at the beginning of the plan year: Enter the number of individuals who were participants in the plan at the start of the year.

- Active plan participants at the beginning of the plan year: Enter the number of active participants at the start of the year. Active participants are individuals who are currently employed by a company covered under the plan or are earning or retaining credited service.

- Active plan participants at the end of the plan year: Enter the number of active plan participants at the end of the plan year.

- Retired participants receiving benefits: List the number of individuals whose employment has been terminated but are receiving benefits under the plan.

- Separated participants entitled to future benefits: List the number of individuals who are entitled to receiving future benefits but are no longer employed by the company covered by the plan.

- Deceased participants who have beneficiaries receiving or entitled to benefits: Provide the number of deceased participants who have beneficiaries currently receiving or are entitled to future benefits.

- Participants with account balances at the beginning and end of the plan year: Enter the number of participants with account balances at the start and end of the plan year—if you have a defined contribution plan.

- Number of participants who terminated employment before becoming fully vested: Provide the number of individuals who had accrued benefits as part of their employment but separated from the company covered by the plan before becoming fully vested.

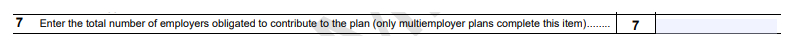

Section 7

Section 7 only needs to be completed if you have a multiemployer plan. If this is applicable to you, you’ll enter the total number of employers that are required to contribute to the plan. These are employers that are a party to a collective bargaining agreement. Entities that share the same EIN but have separate collective bargaining agreements are only counted as a single employer for purposes of this section.

Part 2, Section 7 of IRS Form 5500

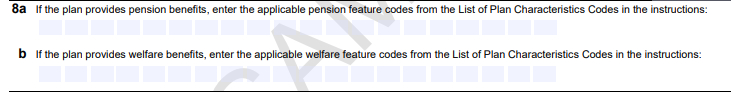

Section 8

Information for this section only needs to be filled in by plans that provide pension or welfare benefits. If this applies to your plan, you’ll need to provide the applicable IRS code that can be found on pages 22 and 23 of the IRS Form 5500 instructions.

Part 2, section 8 of IRS Form 5500

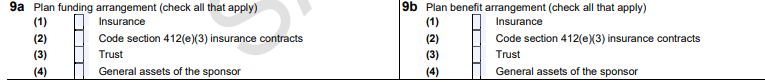

Section 9

Sections 9a and 9b of IRS Form 5500 require you to check all boxes that apply to both your plan’s funding arrangement and its benefit arrangement. You can check multiple boxes for both columns if they apply to your plan.

Part 2, section 9 of IRS Form 5500

Your available options include the following:

- Insurance: This box should be checked if the plan had a policy with an insurance company during the plan year. This includes certain annuity account arrangements. However, if the insurance company’s only function was for administrative purposes, you should not check this box.

- Code section 412(e)(3) insurance contracts: These contracts are made in reference to those that pay out retirement benefits that are guaranteed by an insurance provider.

- Trust: A Trust, for the purposes of this section, is an account that manages plan assets other than that of an insurance company. This account can receive, hold, or otherwise invest plan assets.

- General assets of the sponsors: This box should be checked if the plan had no assets. This also applies if the plan’s assets were commingled with general assets of the plan’s sponsor before any benefits were provided.

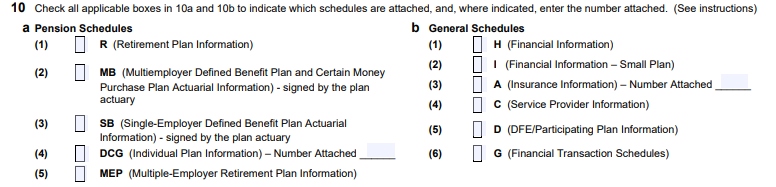

Section 10

This final section for the second part of IRS Form 5500 requires you to check all boxes that apply to your plan and attach the corresponding Schedules as part of your filing, as listed below. Additionally, the IRS provides guidance on how to complete each of these forms; see page 24 of IRS’s Form 5500 instructions for more information.

Part 2, section 10 of IRS Form 5500

- Schedule R: This Schedule is needed for reporting information on retirement plan distributions, funding, and coverages. This form must be filed for both tax-qualified and nonqualified pension benefit plans.

- Schedule MB (multiemployer defined benefit plans): This form must be completed by the plan administrator of a multiemployer defined benefit plan and must also be signed by the plan’s actuary.

- Schedule SB (single-employer defined benefit plans): This Schedule must be filed if you have a single-employer defined benefit plan or a multiple-employer defined benefit plan. To be considered completed, it must also be signed by your plan’s enrolled actuary.

- Schedule DCG (individual plans): This Schedule needs to be completed if you checked the box for DFE in Part 1, Section A of IRS Form 5500 and also indicated that it is for a DCG reporting arrangement. A separate Schedule must be completed for each participating plan.

- Schedule MEP (multiple-employer plans): This form must be completed for multiple-employer plans and is designed to provide various information about each participating employer. Multiple-employer welfare plans, however, are exempt from this filing requirement.

- Schedule H (financial information): This Schedule must be completed if you have a pension benefit plan or welfare benefit plan that covered 100 or more participants at the beginning of the plan year.

- Schedule I (financial information for small plans): Similar to Schedule H, this Schedule must be completed if your plan covered fewer than 100 participants at the beginning of the plan year.

- Schedule A (insurance information): This must be attached to IRS Form 5500 for every defined benefit pension plan, defined contribution plan, and welfare plan if benefits are provided under an insurance company.

- Schedule C (service provider information): The purpose of this form is to report certain information concerning service providers and must be completed by large pensions, welfare benefit plans, and certain other entities.

- Schedule D (DFE information): This Schedule must be filed by employee benefit plans that participated in a common collective trust, master trust investment account, pooled separate account, or a 103-12 investment entity.

- Schedule G (financial transactions): Schedule G must be filed for a large plan, master trust investment account, 103-12 investment entity, DCG, or group insurance arrangement. The purpose of this form is to report loans and financial obligations in default or those that are deemed uncollectible.

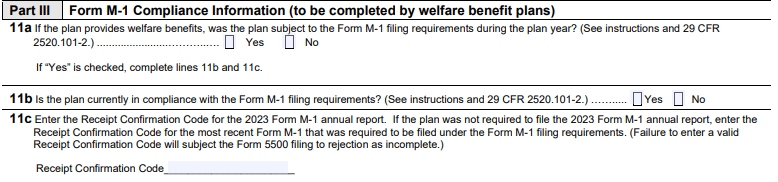

Complete Part III: Form M-1 Compliance Information

The final part of IRS Form 5500 is only applicable to welfare benefit plans. If your plan is eligible, you’ll need to indicate whether the plan was subject to Form M-1 filing requirements during the year and if it is currently in compliance. You’ll also need to provide the receipt confirmation code for the most recent filing.

Part 3 of IRS Form 5500

M-1 filings are typically required for registration, origination, or other special events. It is an annual report that must be filed by Multiple Employer Welfare Arrangements. These are arrangements that usually provide some form of health or other benefits to at least two different employers.

For more details on the M-1 filing requirements, head over to the DoL’s M-1 page.

How and When to Submit IRS Form 5500

You can submit IRS Form 5500 online through the DoL’s EFAST2 website. The deadline to do so is the last day of the seventh month after your plan year ends.

As an example of how to determine the deadline, a plan operating on a typical calendar year from January 1 through December 31 would have a deadline of July 31.

Common IRS Form 5500 Errors to Avoid

There are a few common errors to avoid when filling out Form 5500, and you should practice due diligence to ensure you’ve included all necessary information to avoid penalties and fines. Below are some common mistakes to keep an eye out for:

- Missing signatures: Double check that you’ve signed every required field and include dates where applicable. Otherwise, you’ll get an error message for lack of signature and will need to resubmit.

- Not updating prior year information: Ensure you’ve included current year information and updated any information regarding your plan from the prior year.

- Choosing the wrong check box: While this is applicable to all sections of the form, ensure you’re choosing the right boxes that are specific to your plan. The most common error here is incorrectly checking the multiemployer box or the single-employer box.

Late Filing Penalties

In addition to common errors, it’s important to file the form on time. Otherwise, both the Department of Labor and the Internal Revenue Service can impose significant penalties for businesses that fail to file Form 5500 in a timely manner. The DOL charges up to $2,568 per day that the filing is late, while the IRS charges $250 per day up to a maximum of $150,000.

The IRS offers a 401(k) guide for those that do not file on time. This includes information that can help reduce fines by taking advantage of certain programs. Some examples include the DOL’s Delinquent Filer Voluntary Correction Program and the IRS’s penalty relief program.

Similar IRS Forms

Depending on the details of your plan, you may be eligible to use alternative forms to satisfy the IRS Form 5500 filing requirement. The two forms listed below are shorter in length and require less time and paperwork to complete.

- IRS Form 5500-SF: This is a shortened form typically designed for plans that covered fewer than 100 participants during the plan year, did not hold any employer securities during the year, and were fully invested in assets with easily known values.

- IRS Form 5500-EZ: This shortened form is for a one-participant retirement plan or foreign plan with more than $250,000 in assets.

Frequently Asked Questions (FAQs)

IRS Form 5500 must be filed for any retirement plan subject to the Employee Retirement Income Security Act (ERISA). A common example is a 401(k) plan, including those that were completed as part of a rollover for business startups (ROBS).

You’ll be charged a penalty fee for failure to file. The IRS charges $250 per day up to a maximum of $150,000. The DOL also charges up to $2,568 per day. Both the IRS and DOL, however, have programs that allow for reduced penalties. That said, it’s important to stay up-to-date on deadlines to avoid such penalties.

IRS Form 5500 can be filed online through the Department of Labor’s EFAST2 website. The website also allows for other similar forms, such as Form 5500-SF and 5500-EZ, to be filed.

Bottom Line

IRS Form 5500 is an annual filing requirement for companies that sponsor an employee retirement plan and can be filed electronically through the US DOL website. Keep in mind, failure to do so can result in heavy fines and penalties assessed by the DOL and the IRS. While the IRS provides detailed filing instructions, you can also find a third-party company that specializes in retirement plan compliance should you need further assistance.