Business owners who are applying for a Small Business Administration (SBA) 7(a) loan must fill out SBA Form 1919. This form gathers borrower information for the application process. It includes personal and business-identifying information and responses to questions ranging from citizenship status to the number of potential jobs created or retained through the loan. Filling this form out properly will minimize potential delays in loan approval.

Explore your SBA lending solutions now with Grasshopper Bank |

|

Who Completes SBA 1919?

When applying for an SBA loan, certain individuals with the company must fill out SBA 1919. Based on business structure, the individuals who need to fill out SBA Form 1919 are:

- Sole proprietorships: The sole proprietor of the business needs to complete the form.

- General partnerships: All general partners and all limited partners with 20% or more equity in the business must complete the SBA borrower information form.

- Corporations: All individuals owning 20% or more in the corporation, as well as each officer and director, must fill out the form.

- Limited liability companies (LLCs): All members owning 20% or more of the company, as well as each officer, director, and managing member, are required to complete SBA Form 1919.

In addition, any key employee hired by the business to manage day-to-day operations, as well as any other person the SBA requires to provide a personal guarantee on the loan, must submit the borrower information form.

You can download SBA Form 1919 from our download widget below, or you can download it from SBA’s website.

Note: While the form linked above shows an expiration date of Sept. 30, 2023, it is still being used by the SBA. If it updates the form, we will include that here.

How To Complete SBA Form 1919

Filling out SBA Form 1919 can be a bit difficult. However, submitting an accurate form will help prevent delays in getting your SBA loan approved.

Section I: Applicant Business Information

The first section of SBA Form 1919 is to be completed for the applicant business by a designated representative of your company. Once the information is provided, that designee will sign the form to attest to the accuracy of the borrower information being reported.

Applicant Business Identifying Information

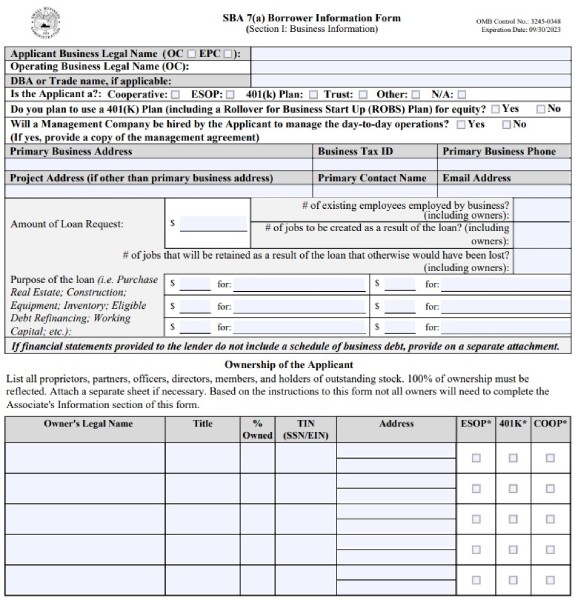

Top portion of Section I of SBA Form 1919

In this section, the following basic identifying borrower information is required:

- Applicant Business Legal Name & Operating Business Legal Name: Include your company’s legal name as reported on your organizational documentation and most recent federal tax returns. Also, indicate if your business is an operating company (OC) or eligible passive company (EPC).

- DBA or Trade Name: If you are “doing business as” (DBA) another name or using a trade name that’s different from the legal name of your business, list it in this section.

- Is the Applicant a?: Check the box if your business is a cooperative, ESOP (employee stock option plan), 401(k) plan, trust, or some other type of business. Check n/a if none of those apply.

- Use of 401(k)/ROBS plan for Equity: Check yes if you plan to use a 401(k) or ROBS plan for equity. Otherwise, check no.

- Management Company: If you plan to hire a management company to manage day-to-day operations, check yes and include a copy of the management agreement.

- Applicant Business Primary Business Address: Provide the current address of your business.

- Project Address: If you are looking to finance property or business operations located at a different location than your primary business address, include that address in this section.

- Applicant Business Tax ID: Provide the tax identification number (TIN) for your business.

- Applicant Business Phone: Include the phone number for the primary business contact in this section.

- Primary Contact: List the name of the primary contact person here. This should most likely be the same as the person who is preparing Form 1919.

- Email Address: Provide the email address for the primary contact person.

- Amount of Loan Request: Include the dollar amount of the loan you are requesting in this section.

- Purpose of the Loan: List the purpose of the loan in this section. Example loan purposes include purchasing real estate, refinancing existing debt, or purchasing fixed assets. Our article on SBA loans provides information on eligible uses of loan proceeds by SBA loan type.

- Number of Existing Employees Employed by the Business: Include the number of employees your business currently employs, including owners.

- Number of Jobs To Be Created as a Result of the Loan: Estimate the number of jobs that your business will create as a result of this loan. There is no defined methodology for calculating this number but try to provide a reasonable estimate.

- Number of Jobs To Be Retained as a Result of the Loan: Estimate the number of jobs that your business will preserve as a result of this loan. As with the number of jobs created, there is no defined methodology.

- Small Business Applicant Ownership: Provide the name, title, ownership percentage, and address for each business owner. Make sure you reflect 100% of the ownership in this section. If you don’t have enough room to list all the owners, you can attach another sheet to provide the details. Include the name of the applicant business on the attachment, note it is a supplement to SBA Form 1919 Section I, include all the required fields, and sign the bottom of the attachment.

The next 11 questions mainly require either a yes or no response. Some questions will require additional information as well, depending on how you answer the question.

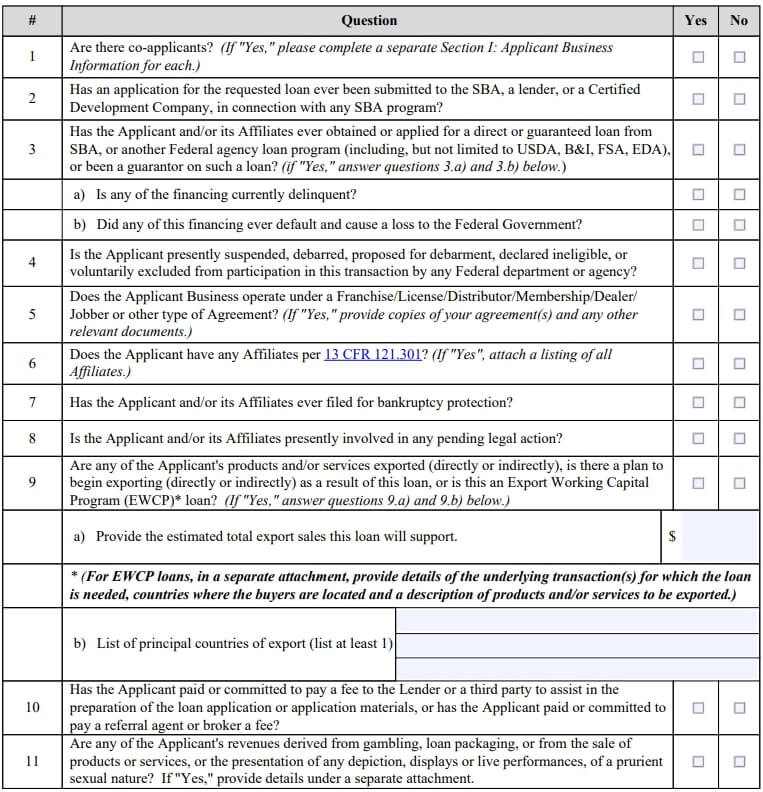

Questions 1-11 of SBA Form 1919

Question 1: Co-applicants

This question asks if there will be any co-applicants on the loan. If the answer is “yes,” the Section I: Applicant Business Application section of the SBA 1919 form needs to be completed and signed by an authorized representative for each applicant.

Questions 2 to 4: Past SBA Loan Applications & Other Restrictions

Question two addresses whether you have previously applied to the SBA, a lender, or a certified development company (CDC) for this project. If the answer to question 2 is “yes,” then you must provide a separate attachment explaining the circumstances surrounding your prior loan application.

Question three of the SBA Form 1919 requires you to answer if you have previously taken any other government loans. This includes other SBA loans, Federal Housing Administration (FHA) home loans, veterans loans, student loans, and disaster loans. Subquestions (a) and (b) also require you to indicate whether any of these loans were ever delinquent or in default.

The fourth question asks if you have been suspended, debarred (actual or proposed), or otherwise deemed ineligible or excluded from participation in the SBA loan program by any Federal department or agency. If the answer to this question is “yes,” you won’t be approved for an SBA loan. You can work with your loan provider to understand more about what this means to you, or you can consider alternative financing sources if an SBA loan is not an option.

Question 5: Franchise Businesses

This question determines whether your business operates under a franchise agreement. The SBA has a list of franchises approved for SBA loans, which may help your chances of approval if you are a franchise business. Refer to the SBA Franchise Directory to identify if your franchise is included.

Question 6: Business Affiliates

This question determines whether your business has any official affiliates. According to the SBA, an “affiliate” includes:

- A parent company

- Subsidiaries and other companies that are owned or controlled by the applicant

- Companies in which an officer, director, general partner, managing member, or party owning 20% or more of the business is also an officer, director, general partner, managing member, or 20% or greater owner

- Companies or individuals with unexercised options owning 50% or more of the business’s stock

- Companies that have entered into agreements to merge with the business

If you have any affiliates, provide the legal names of those entities as included on your most recent federal income tax forms. Refer to SBA’s affiliation guide for more information about affiliates. Many of the subsequent questions refer to your business and your affiliates, so make sure you are considering both the applicant business and any affiliates when answering.

Question 7: Bankruptcy Protection

Question seven on Form 1919 deals with whether your business or any of its affiliates have ever filed for bankruptcy protection. Individual owner bankruptcy is addressed in Question 24. If there was a prior loss to the government resulting from a bankruptcy filing protection on the part of your business or any guarantors, then your loan cannot be approved.

The extent to which a prior bankruptcy that did not result in a government loss will be factored into the decision to approve your loan is at the discretion of both the SBA and your lender. Be prepared to provide your lender with as much information as possible about the factors surrounding any prior bankruptcy filings.

Question 8: Pending Legal Actions

If your business or any affiliates are currently involved in a pending legal action, respond “yes” to this question. While having a pending legal action does not necessarily mean your application will be denied, you need to be prepared to give your loan provider information about the situation. Honesty and transparency will go a long way toward building your case and establishing credibility with your loan provider.

Question 9: Export Activities

This question evaluates your export activities. If you’re using this loan to expand your exports or begin exporting for the first time, try to estimate the total export sales that you will have if you’re approved for this loan. There is no defined methodology for this calculation but do your best to provide a reasonable dollar amount.

Question 10: Help With Your Application

This question determines whether you have received any outside help with your SBA loan application. If you hired a packager, provider, broker, accountant, lawyer, or others who have specifically helped you with the loan application, answer “yes.” If “yes,” the person you hired is required to fill out SBA Form 159.

Question 11: Business Revenue From Gambling

This question determines whether any of your revenues are derived from activities related to gambling, loan packaging, or displays that are overtly sexual. The SBA will not approve your loan if your business falls into these ineligible categories.

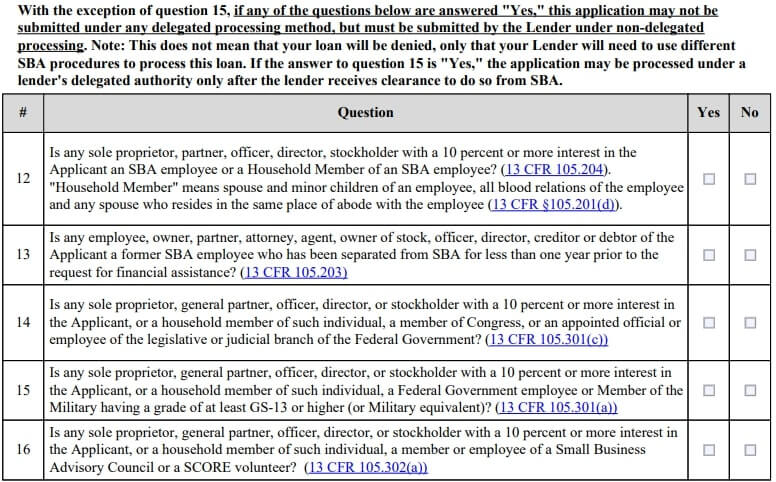

Questions 12 to 16: Conflicts of Interest

Questions 12 to 16 of SBA Form 1919

This section of Form 1919 includes true or false questions that determine whether there is a conflict of interest between any member of your company and the SBA or any other government agency. If you answer “false” to any questions, this does not mean that your loan will be denied, only that you must use different SBA procedures.

Some potential conflicts of interest that the SBA will ask about include:

- Whether you, your spouse, or another member of your household works for the SBA

- If any employee, owner, partner, attorney, agent, owner of stock, officer, director, creditor, or debtor of the applicant has worked for the SBA within the past year

- If a member of Congress, an appointed official of the judicial or legislative branch, or family member of such an individual is a sole proprietor, general partner, officer, director, or stockholder with a 10% or more interest in the business

- If any government employee with a grade GS-13 or household member of such an individual is a sole proprietor, general partner, officer, director, or stockholder with a 10% or more interest

- If any member or employee of the Small Business Advisory Council, a SCORE volunteer, or household member of such an individual is a sole proprietor, general partner, officer, director, or stockholder with a 10% or more interest

Once you have completed Section I of the borrower information form and truthfully answered all the questions, an authorized representative of the applicant business must sign, date, and print their name and title.

Section II: Principal Information

Section II of the SBA Form 1919 is to be completed by key employees and by every individual with 20% or greater ownership of the business. Each of these individuals will need to prepare their version of this form. Once the information is provided, the individual or authorized business representative must sign the form to attest to the accuracy of the information reported.

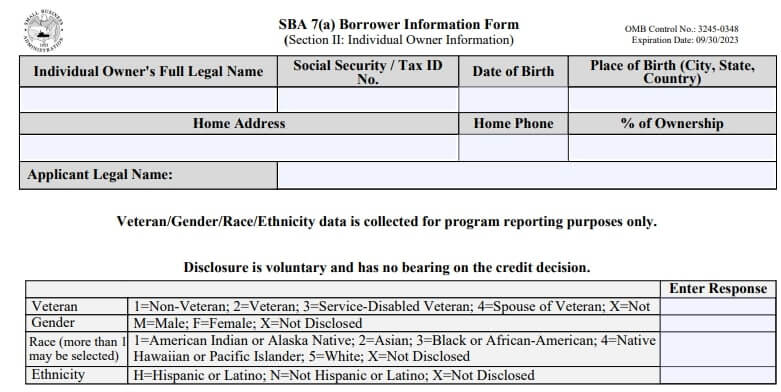

Principal Identifying Information

Top portion of Section II of Form 1919

In this section of the form, as a principal of the business, you’ll begin by providing the following basic identifying information:

- Individual Owner’s Full Legal Name: Include your full legal name.

- Social Security Number or Tax ID: Provide your Social Security number or TIN.

- Date of Birth: List your birth date in this section.

- Place of Birth: If you were born in the United States, list the city and state where you were born. If born outside the US, list the name of the foreign country.

- Home Address: Provide your current address.

- Home Phone: In this section, provide the number where you can most easily be reached. This can be your cell phone.

- % of Ownership in the Small Business Applicant: Indicate your percentage of ownership in the company in this section.

- Applicant Legal Name: The applicant’s full legal name for this loan.

- Veteran, Gender, Race, & Ethnicity Data: You can voluntarily disclose this information, collected only for program reporting purposes. The information provided in this section does not affect the credit decision made by the SBA or the lender.

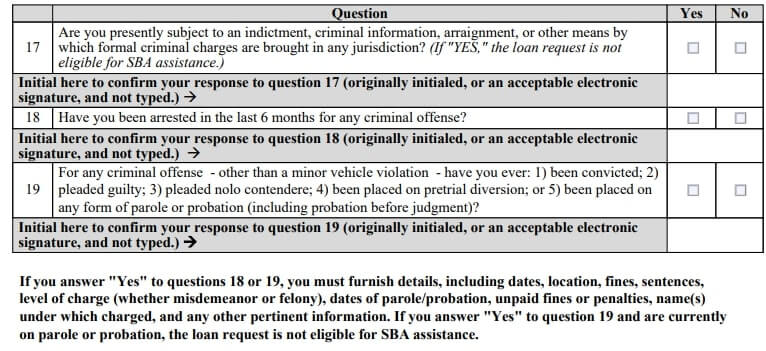

Questions 17 to 19 of SBA Form 1919

Question 17: Current Legal Proceedings

The SBA does not support loans to people currently under indictment, on parole, or on probation. All criminal investigations must be resolved, and all parole and probations lifted before you can be considered for eligibility under an SBA loan program. If you have to answer “yes” to this question, you and the applicant business are ineligible for an SBA loan at this time.

Questions 18 and 19: Past Criminal Activity

These questions on the borrower information form deal with past legal offenses. If you answer “yes” to these questions, you may still be eligible for an SBA loan but you will need to complete SBA Form 912 in addition to SBA Form 1919. That will give the lender additional information to conduct a background check and character determination to see if you and your company are still eligible for an SBA loan.

You must report all of your criminal offenses, excluding minor vehicle violations. This includes convictions, guilty pleas, no contest pleas, pretrial diversions, paroles, and probations, regardless of how long ago they took place. Do not lie or leave off information in this section, even if it was a felony from 20 years ago. If you leave off this information, you will not get a loan, and you’ll be committing a crime by knowingly signing the form while stating that all information is correct.

Questions 17 to 19 of SBA Form 1919

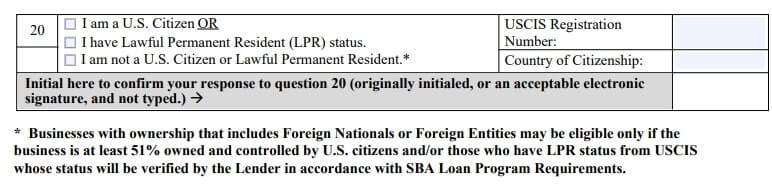

Question 20: US Citizenship

This section of Form 1919 determines whether you are a US citizen or have received lawful permanent resident status. If you’re not a US citizen, provide your Alien Registration Number. Lawful permanent residents are eligible for SBA loans. Some non-US citizens are also eligible for SBA loans but need to meet additional requirements to qualify. Having real estate collateral and operations located in the US, a management team made up of US citizens or lawful permanent residents, or an established business with more than one year of operational history can all help a non-US citizen qualify.

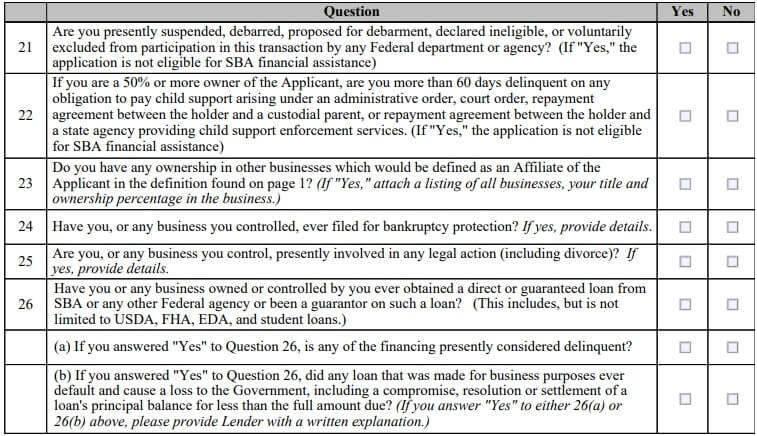

Questions 21 to 26 of SBA Form 1919

Question 21: Application Prohibitions

This question addresses whether you are currently prohibited from applying for this type of loan. If you have been suspended, debarred (actual or proposed), or otherwise deemed ineligible or excluded from participation in the SBA loan program by any Federal department or agency, then you won’t be approved for an SBA loan.

Question 22: Child Support Payments

This question applies to individuals who own 50% or more of the business applicant and asks if you are more than 60 days delinquent on any legally required child support payments. If the answer to this question is “yes,” then the SBA cannot approve your loan request.

Question 23: Affiliated Business Interests

This borrower information form question pertains to whether you have any ownership in businesses considered affiliates of the applicant. You can identify whether other businesses you own are considered affiliates by referring to Question 6 in Section I of SBA Form 1919.

Question 24: Bankruptcy Protection

This question addresses whether you have ever personally filed for bankruptcy protection. If there was a prior loss to the government resulting from your bankruptcy filing protection and you are required by the SBA to provide a guarantee on the loan, then the loan to your business cannot be approved.

The extent to which a prior bankruptcy that did not result in a government loss will be factored into the credit decision is partially at the discretion of the SBA and your lender. That said, you should provide your lender with as much information as possible about the factors surrounding any prior bankruptcy filings.

Question 25: Pending Legal Actions

If you, or any business you control, are currently involved in a pending legal action, you need to respond “yes” to this question. This includes divorce proceedings. While having a pending legal action does not necessarily mean the SBA loan application will be denied, you need to be prepared to provide your loan provider with information about the situation. Honesty and transparency will go a long way toward building your case and establishing credibility with your loan provider.

Question 26: Past Government Loans

This section of the borrower information form requires you to disclose whether you have previously taken any other government loans. This includes other SBA loans, FHA home loans, veterans loans, student loans, and disaster loans. Sub-questions (a) and (b) also require indicating whether any of these loans were ever delinquent or in default.

Don’t forget to sign the form: Once you have completed SBA Form 1919 and truthfully answered all the questions, you must sign, date, and print your name. For more about the application process, read our guide on how to apply for an SBA loan. For general guidelines on how to get any business loan, see our article on how to get a small business loan.

Frequently Asked Questions

As of August 1, 2023, SBA Form 1920, the lender’s loan application for guaranty, is no longer required. This information will be sent electronically through ETRAN, according to the SBA.

Any business applying for an SBA 7(a) loan must fill out SBA 1919. If you use a lender specializing in SBA loans, it can assist you in filling out the form.

The SBA helps well-qualified businesses obtain loans with lower interest rates and longer repayment terms. Because the government backs the loans, you also get more support and education on the loans from the government than you might get from a traditional loan.

Bottom Line

While the amount of paperwork required to get an SBA loan can seem overwhelming, taking the time to complete SBA Form 1919 truthfully will help you in the process of getting your SBA loan approved. Providing false information or failing to disclose required borrower information may cause your application to be denied or significantly delayed.

Do you need other SBA loan forms? We’ve got you covered.