A petty cash fund is a small amount of cash on hand, usually less than $500, used to cover incidentals or petty expenses. Accounting for petty cash can be done either manually, since it only deals with small expenses, or made easier with bookkeeping software and employee expense cards.

As such, we’ll show you how to do petty cash accounting manually and how QuickBooks Online, our top pick in our best small business accounting software guide, can simplify and speed up petty cash accounting.

If you’re familiar with petty cash and need some help understanding how to record the journal entries, here are the most common petty cash journal entries in the bookkeeping process.

Journal Entry to Establish the Petty Cash Fund

Debit | Credit | |

|---|---|---|

Petty Cash | $XXX | |

Checking Account | $XXX | |

To establish the initial petty cash fund by transferring cash from the checking account. | ||

Journal Entry to Record the Monthly Expenses Paid From Petty Cash

Debit | Credit | |

|---|---|---|

Expense(s) | $XXX | |

Petty Cash | $XXX | |

To record expenses paid for out of petty cash. | ||

Journal Entry to Replenish the Petty Cash Fund

Debit | Credit | |

|---|---|---|

Petty Cash | $XXX | |

Checking Account | $XXX | |

To transfer cash from the checking account to the petty cash fund to replenish the fund to original balance | ||

Alternative Journal Entry

Many bookkeepers prefer to combine the second and third journal entries above if the cash is replenished at the same time as expenses are recorded, which is generally the best practice. By combining the journal entries, Petty Cash isn’t adjusted and the expenses are recorded coming directly from the checking account.

Debit | Credit | |

|---|---|---|

Expense(s) | $XXX | |

Checking Account | $XXX | |

To record expenses paid for out of petty cash and to record the transfer of cash from the checking account to the petty cash fund. | ||

Having a petty cash fund speeds up reimbursements and is an important best practice in cash management. It enables your employees to perform quick errands without using personal money. You have to craft a clear petty cash policy as it sets out the purpose and use of the petty cash fund.

List Allowable Expenses

With a petty cash fund in place, you can pay for small expenses like postage stamps, office supplies, office food and drinks, fuel expenses, parking tickets, and other unpredictable expenses. Any expense that’s too small to write a check for can be paid with cash from the petty cash fund. Note that it’s a good idea to set a maximum dollar amount for allowable expenses.

Delegate a Petty Cash Custodian

The petty cash custodian is the person accountable for the petty cash fund. They’ll be in charge of handling and disbursing petty cash and ensuring that the petty cash fund is used for its intended purpose. They’re also responsible for the safekeeping of the physical cash and possess the key to the lockbox where the cash and receipts are kept.

The petty cash custodian also must ensure that there is a petty cash voucher for every expense paid from the petty cash fund. Visit What is a Petty Cash Voucher for more information and an example of a completed voucher.

In your petty cash policy document, include the name and signature of the custodian so that there’s an official transfer of accountability for the petty cash.

Set the Maximum Fund & Reimbursement Threshold

Most companies maintain a petty cash fund balance of anywhere from $100 to $500, but the amount will depend on your petty cash needs. To illustrate further, assume that we have a fund balance of $500. Our policy states that petty cash reimbursements shouldn’t exceed 10% of the fund balance. This means that expenses above $50 cannot be charged to petty cash. However, we can also specify that certain expenses are always chargeable to petty cash, even if they’re above $50.

The petty cash custodian will keep all petty cash items inside a lockbox. Only the custodian can access the lockbox—and it mustn’t be left opened and unattended. Inside the box, you’ll find currencies and receipts.

Let’s look at a sample: To set up the petty cash fund for $300 in the books initially, you or the bookkeeper need to make the following journal entry:

DEBIT | CREDIT | |

|---|---|---|

Petty Cash Fund Checking Account | 300 | 300 |

A petty cash fund is a current asset account that should appear on your balance alongside other cash accounts, such as checking and savings accounts. After recording the journal entry, the custodian should receive $300 cash or check from the owner or cashier.

To reimburse expenses, require a receipt from the employee and then provide them with the exact amount of cash and coins from the lockbox. Then, place the receipt in the lockbox and record the expense in the petty cash log by entering the date, payee, description, reference number, and amount.

Here’s an example of a petty cash log, followed by the fields you need to complete:

PAUL’S PLUMBING PETTY CASH LOG Custodian: Heather Smith | ||||

|---|---|---|---|---|

Date | Payee | Description/Purpose | Ref. No. | Amount |

xxx | xxx | xxx | xxx | xxx |

Beginning Balance | $:______________ | |||

Total Petty Cash Expenses | $:______________ | |||

Ending Balance | $:______________ | |||

Total Replenishment Requested | $:______________ | |||

Custodian’s Signature:_____________________ | ||||

- Date: Indicate the date when reimbursement was made

- Payee: Write the name of the employee who asked for reimbursement

- Description/Purpose: Explain the expense briefly; for example, you can write, “Fuel expense for delivery trucks” or “Postage stamp cost”

- Reference Number: Enter the official receipt number. If there’s none, you may leave it blank

- Amount: Indicate the amount reimbursed

The bottom portion of the petty cash log won’t be completed until the cash in the lockbox needs to be replenished. There’s no need to make journal entries when expenses are reimbursed from cash in the lockbox. Learn more about the petty cash log.

Petty cash must be reconciled when the cash is replenished. However, the petty cash custodian may perform weekly or daily reconciliation to keep track of the fund balance. Using a cash count sheet can be used to document the cash count, but it’s optional.

The reconciliation is straightforward—every time you take cash out of the box, you replace the cash with a receipt for the same amount. Therefore, all receipts plus remaining cash must be equal to the original amount placed in petty cash. To learn more, read our step-by-step instructions for reconciling petty cash.

Every month, or as cash is needed, the custodian should summarize the petty cash log by expense account and record a journal entry debiting each expense and crediting petty cash.

PAUL’S PLUMBING PETTY CASH LOG Custodian: Heather Smith | ||||

|---|---|---|---|---|

Date | Payee | Description/Purpose | Ref. No. | Amount |

Beginning Balance | $:______________ | |||

Total Petty Cash Expenses | $:______________ | |||

Ending Balance | $:______________ | |||

Total Replenishment Requested | $:______________ | |||

Custodian’s Signature:_____________________ | ||||

Enter the petty cash fund balance as the beginning balance. Then, get the total of the Amount column to determine total petty cash expenses. That’s also the amount you’ll ask for as reimbursement. The ending balance is the difference between the beginning balance and the total petty cash expenses. The currencies inside the lockbox should be equal to the ending balance.

After the owner or bookkeeper records all expenses in the books, cash must be taken from the checking account to replenish the petty cash box. Record the transfer of cash by debiting Petty Cash and crediting Checking Account.

Let’s assume the following information from the petty cash transactions of Paul’s Plumbing:

- January 1: The petty cash fund is set to $500 with Heather Smith as the custodian.

- January 3: The custodian reimbursed Deborah Wood $41 for fuel expenses. The receipt number is 22312.

- January 9: Richard Roe paid $49 for the fuel of the delivery truck. Heather Smith refunded the amount to him in exchange for the receipt with number 23330.

- January 14: Rafal Bolinski purchased postage stamps for $38.

- January 16: Heather Smith purchased office supplies from Office Depot. She took $187 out of the lockbox. The receipt number is 3397452.

In the petty cash policy document, we should state that the petty cash fund is $500 with Heather Smith as the custodian. She should also sign the document to transfer the petty cash fund accountability to her.

After Heather Smith signs the document, the cashier will release $500 to her. The bookkeeper should also make an entry to transfer cash to the Petty Cash account:

DEBIT | CREDIT | |

|---|---|---|

Petty Cash Fund Checking Account | 500 | 500 |

Heather Smith should always ask for receipts before reimbursing any amount to employees. After refunding the money to them, she should update the petty cash log, as presented below:

PAUL’S PLUMBING PETTY CASH LOG Custodian: Heather Smith | ||||

|---|---|---|---|---|

Date | Payee | Description/Purpose | Ref. No. | Amount |

1/3/22 | D. Wood (Owner) | Fuel expense - meeting with client | 22312 | $41 |

1/9/22 | R. Roe (Driver) | Fuel expense - delivery truck | 23330 | $49 |

1/14/22 | R. Bolinski (Employee) | Postage stamps | $38 | |

1/16/22 | H. Smith | Office supplies - Office Depot | 3397452 | $187 |

Beginning Balance | $:_________ | |||

Total Petty Cash Expenses | $:_________ | |||

Ending Balance | $:_________ | |||

Total Replenishment Requested | $:_________ | |||

Custodian’s Signature: _________ | ||||

Heather Smith should reconcile the petty cash account before asking for replenishment. First, she should update the petty cash log and count the remaining cash inside the lockbox. She should then fill out a cash count sheet to document the cash count. Assuming that we only have $185 on hand, the cash count sheet should look like this:

PAUL’S PLUMBING CASH COUNT SHEET | ||

|---|---|---|

Denomination | Qty | Total |

$1 | 15 | $15 |

$5 | 8 | $40 |

$10 | 4 | $40 |

$20 | 2 | $40 |

$50 | 1 | $50 |

$100 | - | - |

Total | - | $185 |

The remaining $185 on hand is what’s left of the $500 petty cash fund after reimbursements.

Since Heather is running out of cash, she may ask for replenishment. Before going to the cashier, she should first complete the bottom of the petty cash log.

PAUL’S PLUMBING PETTY CASH LOG Custodian: Heather Smith | ||||

|---|---|---|---|---|

Date | Payee | Description/Purpose | Ref. No. | Amount |

1/3/22 | D. Wood (Owner) | Fuel expense - meeting with client | 22312 | $41 |

1/9/22 | R. Roe (Driver) | Fuel expense - delivery truck | 23330 | $49 |

1/14/22 | R. Bolinski (Employee) | Postage stamps | $38 | |

1/16/22 | H. Smith | Office supplies - Office Depot | 3397452 | $187 |

Beginning Balance | $ 500 | |||

Total Petty Cash Expenses | $ 315 | |||

Ending Balance | $ 185 | |||

Total Replenishment Requested | $ 315 | |||

Custodian’s Signature: Heather Smith | ||||

In our example above, we asked for $315 as replenishment because it’s the amount of total receipts. Hence, the sum of all receipts plus the ending balance should be equal to the petty cash of $500.

At the time the entry is made, the custodian will receive a $315 check that’s cashed and the money placed in the lockbox. Overall, there’s a total of $500 in the lockbox after replenishment.

The bookkeeper should make the following entries:

DEBIT | CREDIT | |

|---|---|---|

Office supplies Postage stamps expense Transportation expense Petty cash (To record reimbursement of petty cash expenses) | 187 38 90 | 315 |

Petty cash Checking account (To record replenishment of petty cash fund) | 315 | 315 |

QuickBooks Online uses a petty cash register format that’s easy to use and maintain. If you plan to have the custodian use QuickBooks Online, there are four easy steps to follow:

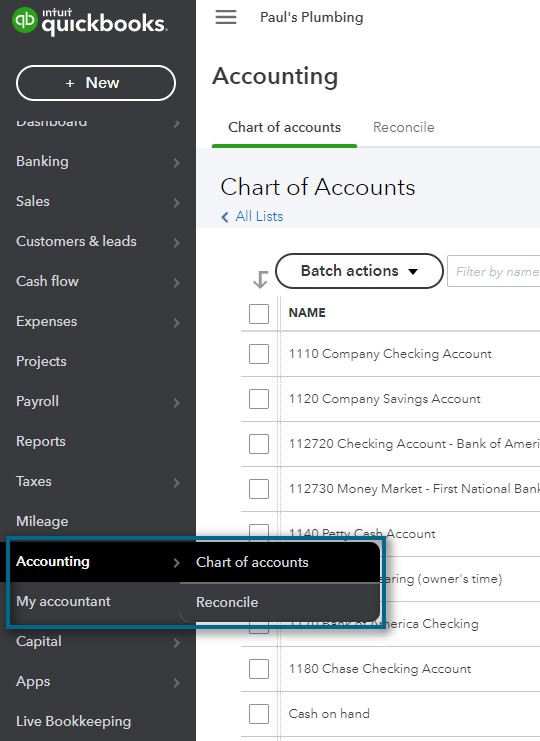

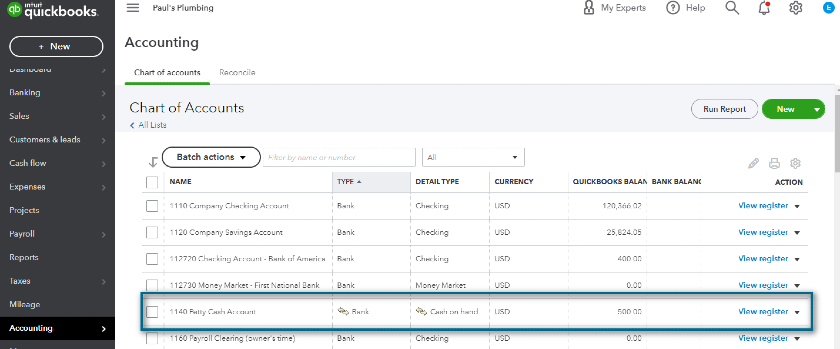

Click Accounting on the left-hand side menu and then choose Chart of Accounts.

Accessing Chart of Accounts on QBO

Accessing Chart of Accounts on QuickBooks Online

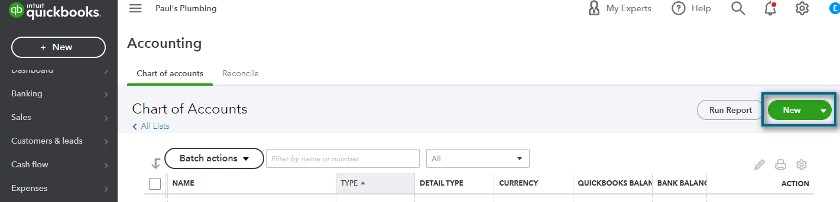

In the upper right portion of the window, click the green New button to create a petty cash account.

Creating a New Account

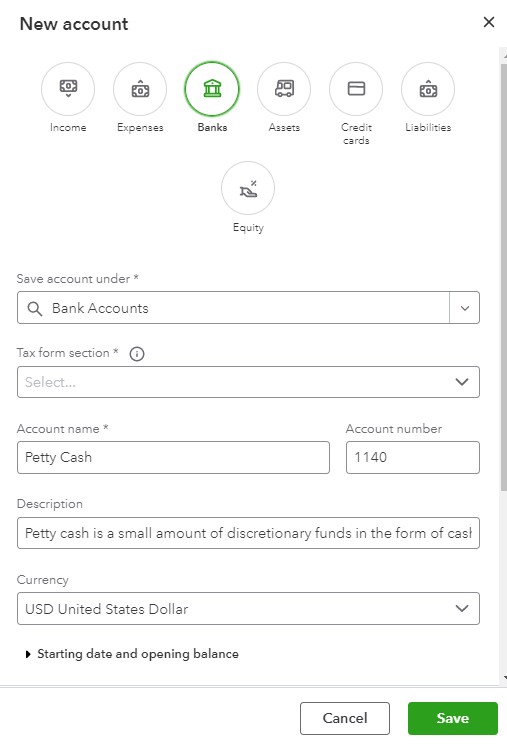

A sidebar window where you can create a new account will appear. Fill out the form and don’t enter a beginning balance. Click the green Save button once you’re done.

Creating a Petty Cash Account

Go back to the Chart of Accounts screen and look for Petty Cash Account. On the far right of the column, click View Register to arrive at the petty cash register.

Accessing the Petty Cash Register

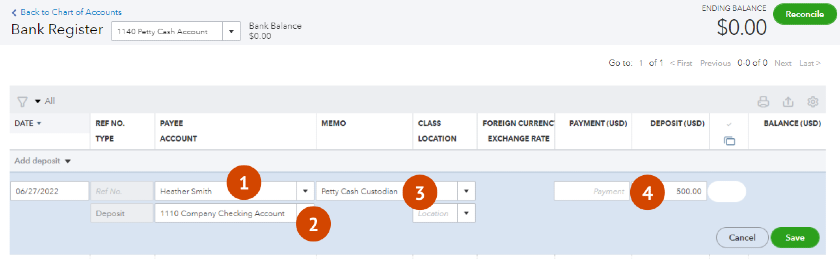

Once the register appears, click the drop-down arrow and choose Deposit.

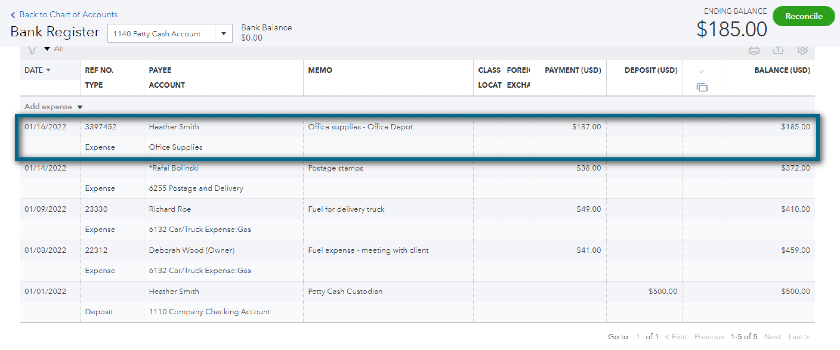

Petty Cash Register

- Payee: The payee is the petty cash custodian. In our sample above, the petty cash custodian is Heather Smith.

- Account: Select the Checking Account as the source of petty cash.

- Memo: If you want to add explanations to the entry, you may insert them in the Memo field. In our sample, we placed “Petty Cash Custodian” to make it clear that we’re depositing cash to the custodian.

- Amount Deposited: Enter the petty cash fund balance based on the policy.

When it’s time to record expenses, such as the end of the month, go back to the Petty Cash Register and click Add Expense. You need to create an expense entry for each receipt that you’re recording from the lockbox.

Let’s record the transactions one-by-one on QuickBooks Online.

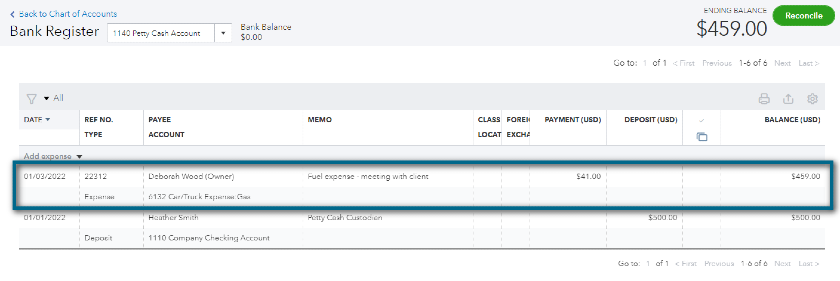

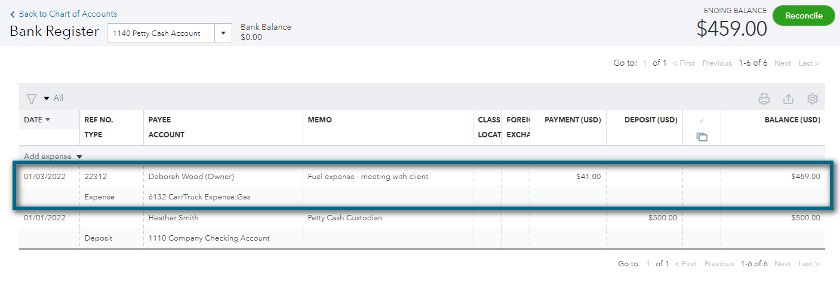

- January 3: The custodian reimbursed Deborah Wood $41 for fuel expenses. The receipt number is 22312.

Based on the information above, fill out the fields to record the expense. Repeat this process for all succeeding transactions.

After we click the green Save button, the first entry should appear like in the image below. Notice that the ending balance of Petty Cash became $459.

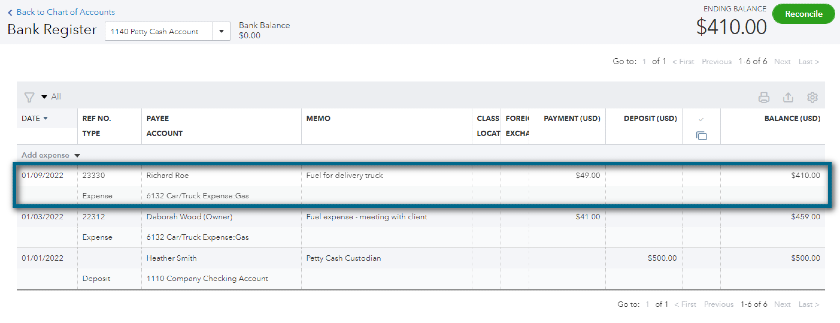

- January 9: Richard Roe paid $49 for the fuel of the delivery truck. Heather Smith refunded the amount to him in exchange for the receipt with receipt number 23330.

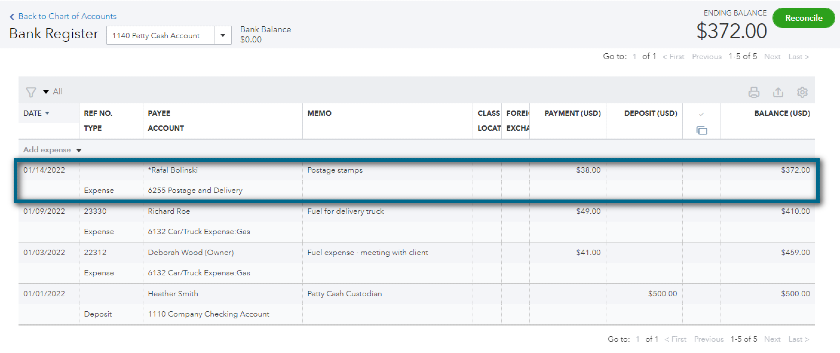

- January 14: Rafal Bolinski purchased postage stamps for $38.

- January 16: Heather Smith purchased office supplies from Office Depot. She took $187 out of the lockbox. The receipt number is 3397452.

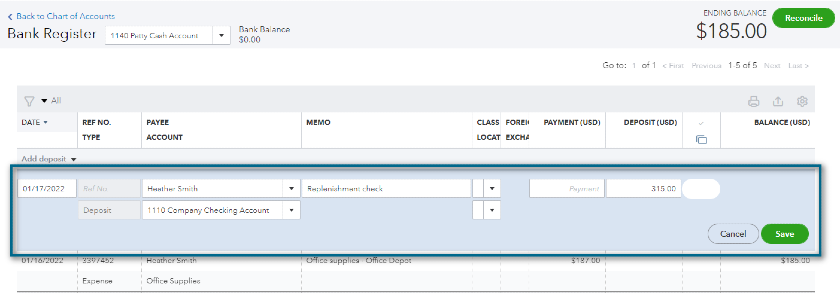

After entering all expenses, it’s time to record the replenishment. First, click Add Deposit then fill out all the required information. Currently, we have $185 in our petty cash account. Heather needs a $315 reimbursement to bring the petty cash balance back to $500.

Recording Petty Cash Replenishment

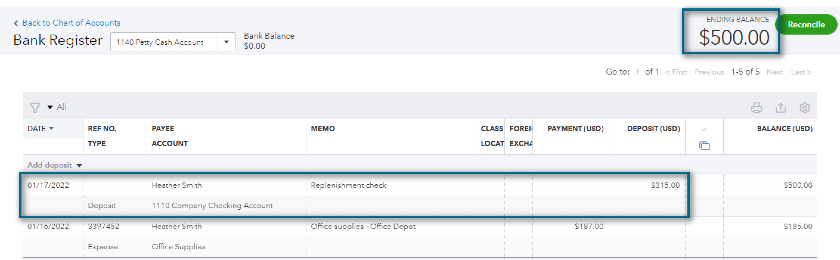

Once you hit the green Save button, the petty cash account’s balance should be $500 again.

Petty Cash Balance after Replenishment

Bottom Line

If you plan to use petty cash for small business purchases like postage and office supplies, it may be handy to use the petty cash log to keep track of your transactions. Keeping careful records of cash expenditures will be a huge help when it comes time to reconcile your petty cash account. However, using accounting software, like QuickBooks Online, can make managing petty cash expenses easier and faster because it simplifies the recording of expenses.