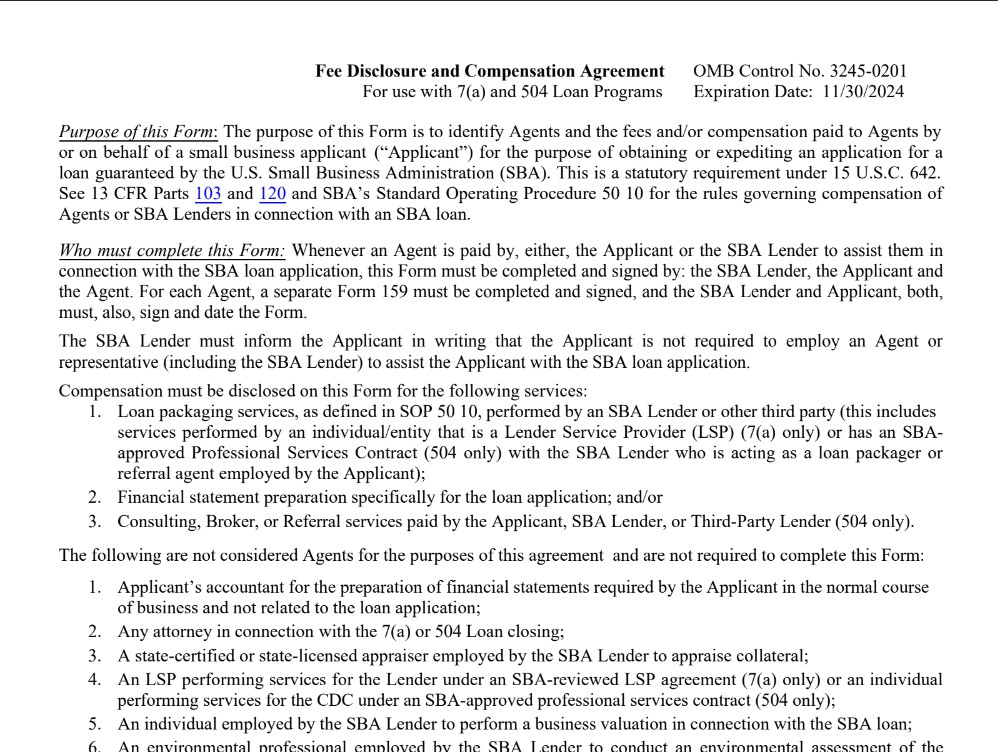

The purpose of SBA Form 159 is to identify the fees that were paid to an individual or company that meets the SBA’s definition of an Agent. The form also informs applicants that hiring an Agent to assist with an SBA loan is not required. However, if you hire someone to help with your SBA loan application, you may be required to complete SBA Form 159.

Two versions of SBA Form 159 exist: Form 159 and Form 159D. The standard Form 159 is used for the SBA’s 7(a) and 504 loan programs, while Form 159D is used in connection with an SBA disaster loan. Each can be obtained through the download links provided below.

Purpose of SBA Form 159 & When It’s Required

SBA Form 159 is designed to provide full disclosure to all parties involved of any fees that were paid in connection with assisting an applicant with an SBA loan. In part, it’s also meant to protect consumers by informing them that they have the option of completing an SBA loan without needing to pay certain fees.

The SBA loan application process can be complex, so it’s not uncommon for applicants to hire someone for help. If you’re thinking of saving some money, however, and want to try doing this on your own, we recommend reading our guide on how to apply for an SBA loan for insight into what you can expect for each stage of the SBA approval process.

Ultimately, the need to complete SBA Form 159 will be dependent on who assisted the loan applicant. The specific services performed will also dictate what fees must be disclosed.

Individuals/Companies Exempt From Filing SBA Form 159

SBA Form 159 is required if you paid an Agent fees for assistance with your SBA loan application. The following list of individuals, however, are exempt from this requirement:

- Loan applicant’s accountant: Accountants who prepared financial statements for the loan applicant in the normal course of business, unrelated to the SBA loan application;

- Attorney: Attorneys used or hired in connection with an SBA 7(a) or SBA 504 loan closing;

- Appraiser: Licensed and certified appraisers employed by the SBA lender to determine the value of collateral;

- Lender Service Provider (LSP): LSPs that performed services under an SBA-approved agreement for a 7(a) loan, or anyone performing services for the CDC for a 504 loan;

- Employee of the SBA lender: Anyone employed by the SBA lender who conducted a business valuation as part of the SBA loan review process;

- Environmental professional employed by the SBA lender: An individual employed by the SBA lender to conduct an environmental assessment of collateral in connection with the SBA loan;

- Real estate agent: A licensed real estate agent receiving commission for the sale of real estate;

Services That Would Require SBA Form 159

If you are required to complete SBA Form 159, the following types of fees must be disclosed:

- Loan packaging services: This can include assistance provided to the loan applicant for things like preparing a business plan, cash flow projections, or other documents related to the SBA loan. Services may have been conducted by the SBA lender or other third party.

- Preparation of financial statements: Fees paid for financial statements that you needed to have prepared specifically for your SBA loan application will require SBA Form 159 to be completed.

- Consulting, broker, or referral services: This can include fees paid by the loan applicant, SBA lender, or third-party lender.

Who Completes SBA Form 159?

SBA Form 159 must be completed and signed by the loan applicant, the SBA lender, and the Agent who received compensation in exchange for assistance with the loan application. A single form can be used if one Agent provided multiple services.

However, if multiple Agents were used, then each Agent must complete a separate Form 159. Similarly, if a single Agent provides paid services to the same borrower for different SBA loan applications, a separate Form 159 must be completed for each application.

How to Fill Out SBA Form 159

SBA Form 159 can be obtained from the SBA website and consists of 4 pages. The first and last pages, however, consist of only instructions and disclosures. Because of this, we’ll focus on the second and third pages.

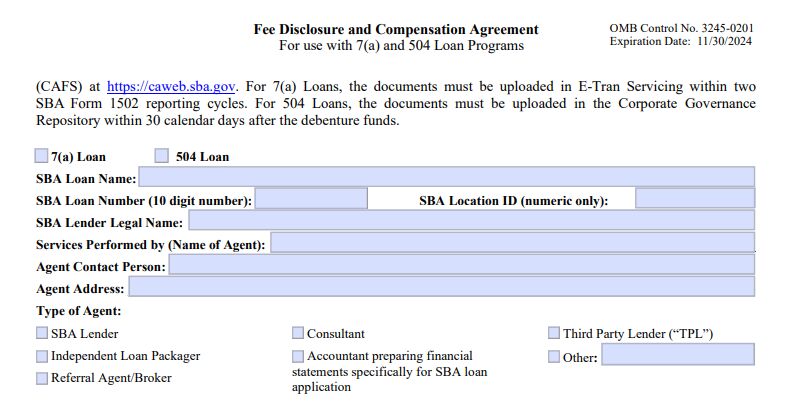

Step 1: Fill In Basic Information About the SBA Loan

The top half of page 2 requires you to fill in basic information about your SBA loan:

- Loan type: Check a box to indicate if you’re getting an SBA 7(a) loan or an SBA 504 loan

- SBA loan name: Enter the name you are using on your SBA loan application. This may be your personal legal name or the name of your business.

- SBA loan number: Your SBA lender will generate a loan number for you when you submit your application.

- SBA location ID: You can request your location ID from your SBA lender once your application has been submitted.

- SBA lender legal name: This is the lender’s legal business name.

- Services performed by: Enter the name of the Agent who agreed to provide assistance with the SBA loan in exchange for compensation

- Agent contact person: If the Agent is a lender or other business entity, enter its representative’s contact information here.

- Agent address: Enter the address of the Agent.

- Type of Agent: Check one of the boxes to indicate the type of Agent.

Top half of SBA Form 159

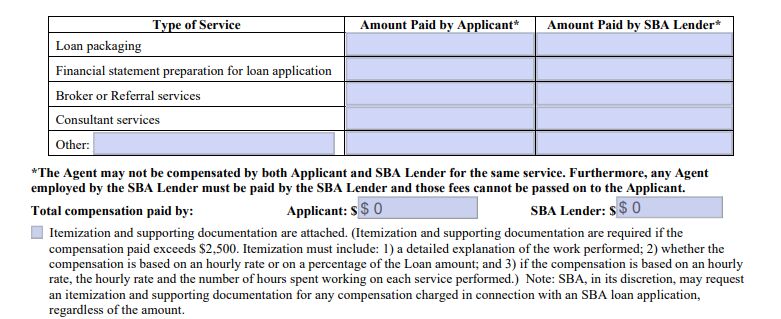

Step 2: Enter Details About the Services Provided and Fees Paid

The next section of SBA Form 159 consists of details on the services provided:

- Loan packaging: Enter the amount paid by either the loan applicant or the SBA lender. Examples of packaging services can include help with preparing a business plan, cash flow projections, or other SBA documents.

- Financial statement preparation: Here, you’ll enter the amount paid by either the applicant or SBA lender when it came to preparing financial statements specifically for the SBA loan application.

- Broker or referral services: Enter any applicable fees paid for broker or referral services.

- Consultant services: Fees paid by the loan applicant or SBA lender for consulting services should be inputted here.

- Other: If other fees were paid, you can enter them here.

- Total compensation paid: Complete these fields to indicate the total amount paid by the applicant and the SBA lender.

- Itemized expenses: If the total amount charged by an Agent exceeds $2,500, this box must be checked, and an itemized list detailing each expense must be provided.

Bottom half of SBA Form 159

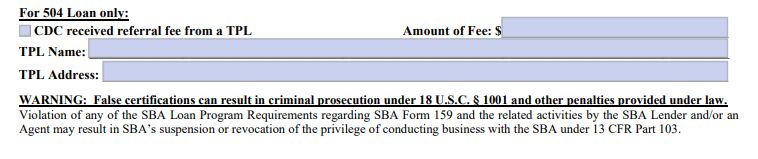

Step 3: Complete Additional Information for SBA 504 Loans Only

This section is required for SBA 504 loans only. If a referral fee was received from a third-party lender (TPL), the box must be checked, the fee amount entered, and the contact information of the TPL must be provided.

Special section of SBA Form 159 for SBA 504 loans

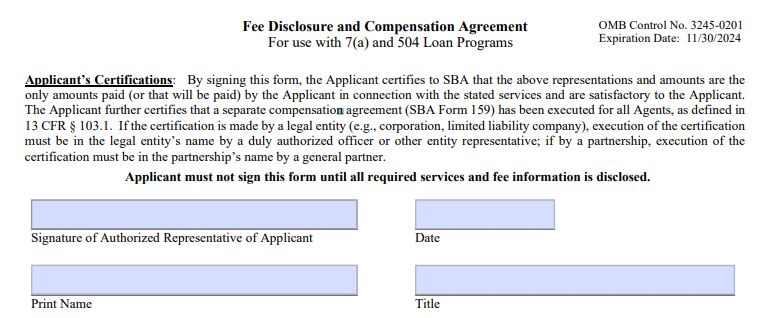

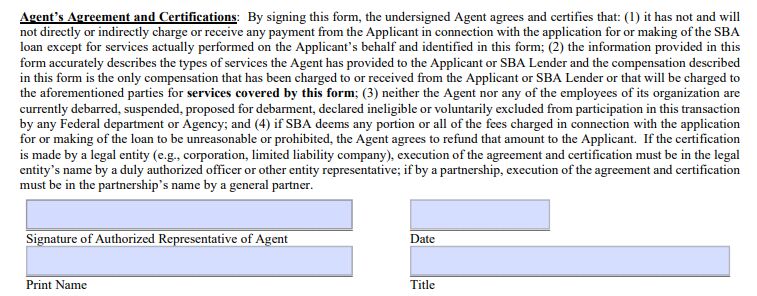

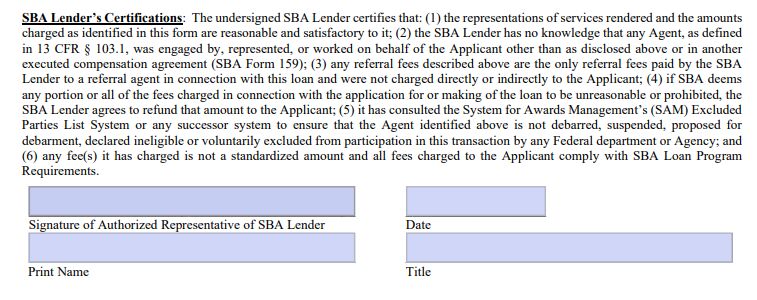

Step 4: Have All Parties Sign and Date the Form

The final step to complete SBA Form 159 is to have the loan applicant, Agent, and SBA lender sign and date the form. For each party, make sure a printed name is provided, in addition to the applicable title of the authorized signer.

How to Fill Out SBA Form 159D for Disaster Loans

SBA Form 159D consists of three pages, with only the last two pages containing items needing to be filled in.

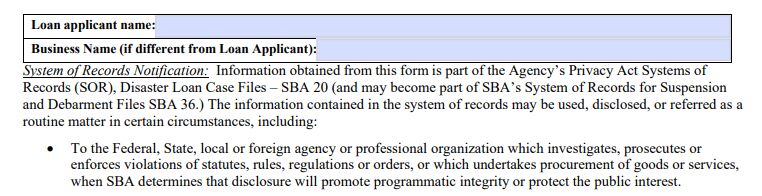

Step 1: Provide Basic Information

The top of page two requires you to enter your name (as shown on the SBA loan application) and your company’s name.

Top half of SBA Form 159D for SBA disaster loans

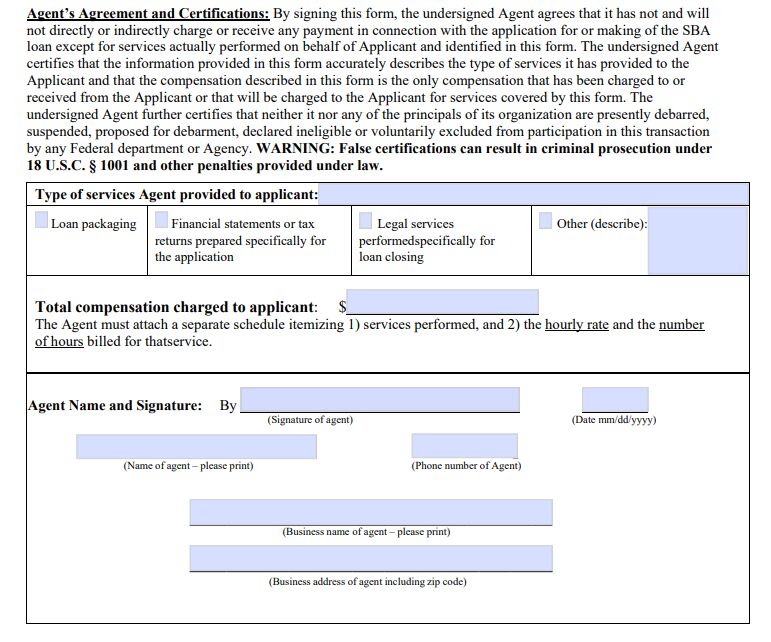

Step 2: Enter Details About Services Provided

The next section of SBA Form 159D is where details of the services rendered can be entered:

- Type of services provided to applicant: Here, you can check off all of the applicable boxes that describe the services the Agent provided the loan applicant.

- Total compensation charged to applicant: Enter the total amount the loan applicant was charged in this field. An itemization of fees must also be provided if this figure exceeds $500 for SBA disaster home loans or $2,500 for disaster business loans.

- Agent name and signature: Here, the Agent should sign and date the form. The contact information should also be provided, including the Agent’s phone number, business name, and business address.

Bottom half of SBA Form 159D for SBA disaster loans

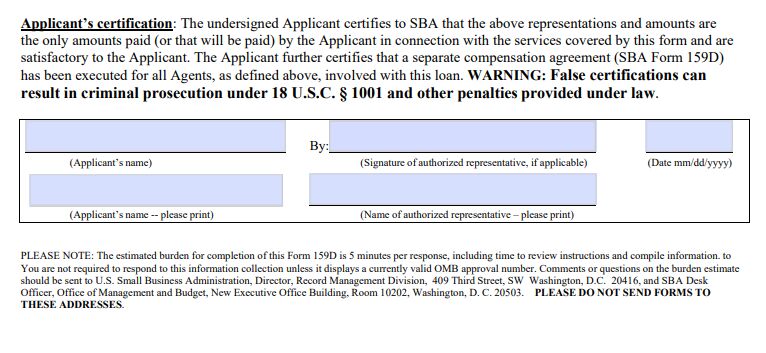

Step 3: Sign and Date the Form

The final step involved with completing SBA Form 159D is for the loan applicant to sign and date the form. If someone else is signing on behalf of the loan applicant, the authorized representative’s name and signature should also be provided.

Applicant signature section of SBA Form 159D

Frequently Asked Questions (FAQs)

SBA Form 159 is required when you pay an individual or company to help complete your SBA loan application. Not all services require disclosure, however, and the SBA also has a list of individuals and entities that are exempt from the filing requirement.

The SBA has multiple loan programs, each of which has varying permissible and prohibited uses. Its 7(a) program is its most popular and allows funds to be used for working capital, acquiring equipment, financing real estate, and more.

It can take anywhere from 30 to 90 days or more to get an SBA loan. Much of this depends on the lender you choose, the type of financing you’re seeking, and the complexity of your company’s credit and finances.

Bottom Line

If you paid an individual or a company for assistance with completing an SBA loan application, you may be required to file SBA Form 159. The SBA provides detailed instructions outlining the circumstances under which the form would need to be filed, such as specific services that were performed, as well as which individuals or lenders provided assistance as part of the loan process.

Regardless of the type of loan you’re applying for, our guide on how to get a small business loan can help you get approved quickly and at a competitive rate. It contains information on how lenders evaluate your application and insights on commonly required documentation you can prepare ahead of time to expedite approval and funding times.