SBA Form 912, the Statement of Personal History, is a document designed to determine eligibility for SBA funding based on things like a borrower’s character and reputation It is designed to collect basic identifying information and any history of criminal offenses. and must generally be completed by business owners and certain individuals who manage major daily operations of the company, regardless of the type of SBA loan you’re getting. It is a two-page document, only one of which requires you to provide information about you and your business and answer certain “Yes/No” questions. We’ll separate our guide on how to complete the Statement of Personal Information into two sections: the top half of page 1 and the bottom half of page 1.

- SBA Form 912 needs to be completed by all business owners and certain other individuals, which the SBA typically defines as individuals meeting the criteria below:

- Business owners: Any individual who has 20% or more ownership interest will likely need to complete it. This is true regardless of the legal business structure and applies to sole proprietors, partnerships, corporations, and LLCs.

- Officers and directors: This includes managing members who may oversee the daily operations of the company.

- Loan guarantors: This includes co-signers and other individuals taking on the role of guarantor for the SBA loan.

- Filling it out properly is critical as it can help streamline the processing of your loan application.

- The SBA states that Form 912 is used as just one component in its assessment of your program eligibility.

- While the expiration date on the form is July 31, 2022, this is still the most recent form currently being used by the SBA.

To obtain a copy of the most recent form, you can visit the SBA’s Form 912 page. You can also use our download widget below.

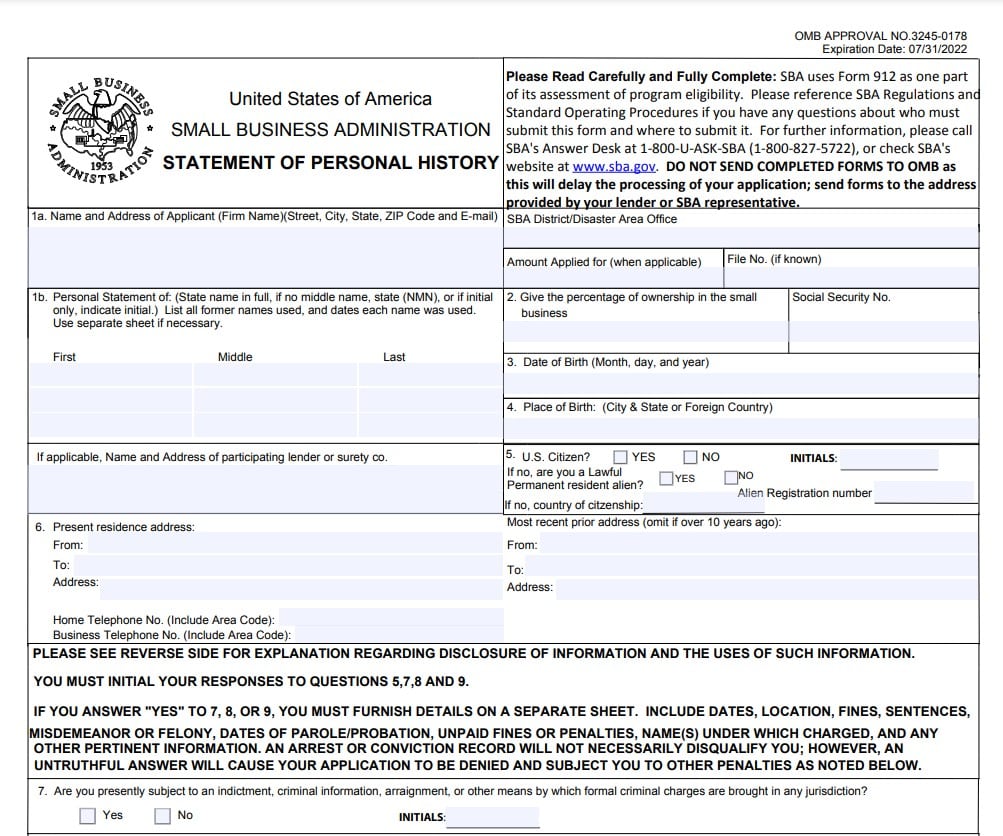

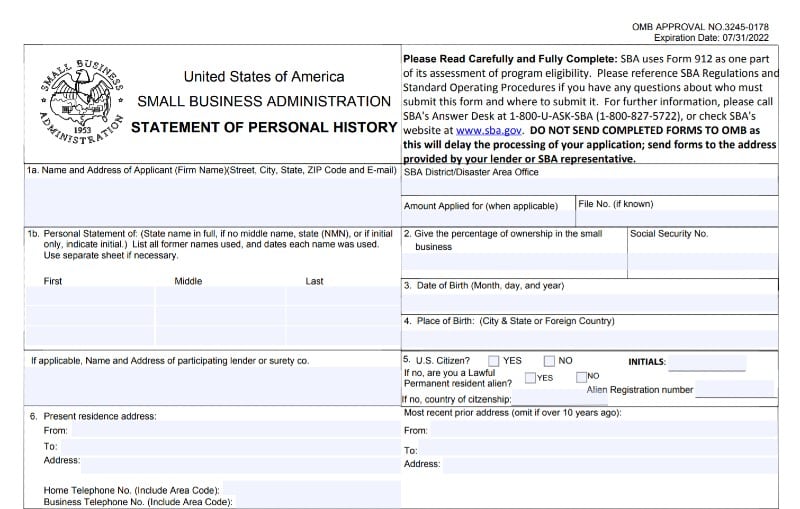

Step 1: Complete the Top Half of Page 1 With Basic Information About Yourself

The first section requires you to provide information about yourself and the lender you’re working with.

- Box 1a (Business Name and Address of Applicant): Provide your company’s name and its contact information such as its full mailing address including the street number, street name, city, state, ZIP code, and e-mail address.

- Box 1b (Name of Business Owner): Here, you’ll need to provide your full personal name. If you have no middle name, you must specifically write “NMN.” You must also provide all names you’ve previously gone by, such as maiden names, as well as the dates they were used.

- Box 2 (Ownership Percentage): Enter the ownership percentage you have in the company. In the box to the right, you may also provide your social security number.

- Box 3 (Date of Birth): Provide your date of birth, including the month, day, and year.

- Box 4 (Place of Birth): If you were born in the US, enter the city and state where you were born. If you were born outside the US, provide the name of the country.

- Box 5 (Citizenship Status): Check the appropriate “Yes/No” boxes to indicate if you are a US citizen or a lawful permanent resident alien.

- If you are a US citizen, check the box and write your initials to confirm.

- If you are a lawful permanent resident alien, provide your alien registration number.

- If you are neither, provide your country of citizenship.

Top section of page 1 of SBA Form 912

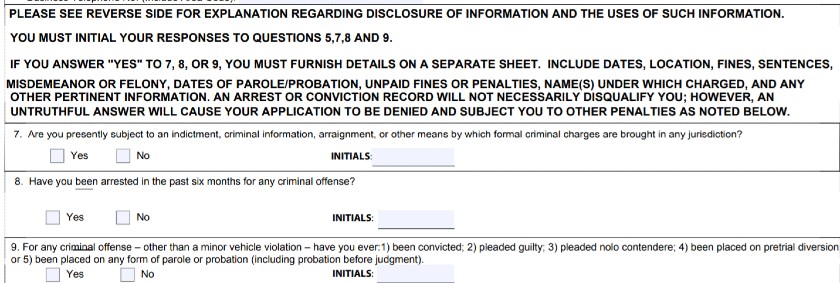

Step 2: Complete the List of ‘Yes/No’ Questions at the Bottom of Page 1

One of the last sections of SBA Form 912 requires you to complete a series of “Yes/No” questions. Some items may require additional documentation if you answer “Yes”.

- Box 7 (Criminal Charges): Mark the box to indicate if you’re currently the subject of any criminal charges. This includes being indicted or arraigned. Regardless of your answer, you must also initial to confirm your selection.

- Box 8 (Arrest History): Indicate if you’ve been arrested in the past six months for any type of criminal offense. Regardless of your answer, you must also initial to confirm your selection.

- Box 9 (Criminal Offenses): Excluding minor vehicle violations, you’ll need to indicate if you’ve ever been the subject of a criminal offense. This includes convictions, entering a plea of guilty or no contest, being placed on pretrial diversion, or any type of parole or probation. Provide your initials, regardless of whether you mark the box for Yes or No.

Yes/No questions from page 1 of SBA Form 912

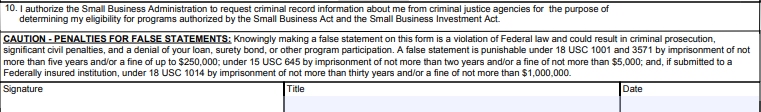

Step 3: Sign and Date the Form

The last step involved with completing SBA Form 912 is to sign, date, and enter your title to indicate the capacity in which you are completing the form. Although a simple step, it is critical, as forgetting to sign the form can cause delays in processing your SBA loan application.

Signature section of SBA Form 912

How the SBA Handles Past Convictions

Here are three scenarios involving prior criminal history and how the SBA may look at them:

- One misdemeanor that was not prosecuted: In this case, it is possible for your lender to clear the misdemeanor without consulting the SBA. Your lender may not require fingerprints or a background check. Also, you only have to report the misdemeanor if any portion of the proceedings occurred within the last six months.

- Multiple misdemeanors that occurred several years before your loan application: As these occurred over six months before, you are not required to disclose information to the SBA. However, your lender may have different requirements. Make sure you understand what their rules are before you submit documentation to them.

- Any felony: You will be required to pass a background check and provide fingerprints. Your application must be cleared by either the Office of the Inspector General or the Office of Security Operations.

Frequently Asked Questions (FAQs)

Typically, individuals with a 20% or more ownership interest in the company must complete SBA Form 912. Guarantors, officers, directors, and managing members of the company are also generally included in this requirement.

The SBA states that it should take no more than approximately 15 minutes to complete SBA Form 912. This can vary depending on your circumstances. For example, some “Yes/No” questions may require additional paperwork and explanations if marked as “Yes.”

Yes. Having a criminal record will not necessarily disqualify you from getting SBA financing. However, it will depend on the nature of the offense, such as whether it was financially related and the parties that were involved.

Bottom Line

SBA Form 912 may be required if you’re applying for an SBA loan and must be completed by individuals with 20% or more ownership interest, guarantors, and managing members, officers, or directors. The form should take no more than around 15 minutes to complete as most of the form consists of “Yes/No” questions. Completing the form correctly is critical as the information provided is used to determine your eligibility for SBA financing.

For information on getting small business financing, our guide on how to get a small business loan contains information on the different types of programs available and how you can get the best loan for your needs. Lendio is a business loan broker that can help with a wide range of loan types, as it has a network of over 75 lending partners to choose from.