Employers claiming a $2,400 Work Opportunity Tax Credit (WOTC) for hiring felons must follow a strict set of procedures to qualify for the credit. The first step is to have the potential employee complete IRS Form 8850 before offering them employment. You’ll then need to have the qualifying candidate certified by the state and file Form 5884 to calculate the credit. Read on for the important details regarding claiming the felon tax credit.

Step 1: Have Qualified Felons Complete the IRS Questionnaire

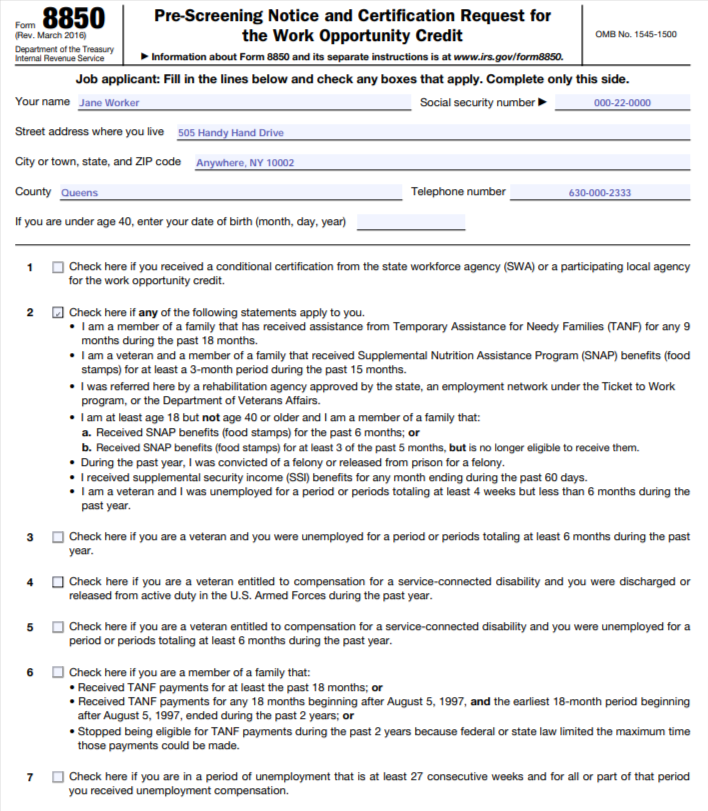

To apply for this credit, your candidate must first fill out Page 1 of IRS Form 8850, the Pre-Screening Notice and Certification Request for the Work Opportunity Tax Credit. They should complete the information section, and check Box 2, which indicates that they have been convicted of, or released from prison for, a felony in the past year. The candidate should also sign and date Page 1.

Once your candidate has completed Page 1, you’ll need to also complete the information section on the back of the form. You’ll also need to provide the date that your candidate completed Page 1. You’ll provide this information in the section denoted “Date Applicant Gave Information.” A good practice is to complete this section on the same day your candidate fills out Page 1.

Step 2: Interview the Qualified Felon & Make Your Hiring Decision

Once you have vetted your candidate through your prescreening process, your next step is to interview the candidate for the role and make a hiring decision that’s best for your company. You can learn more about the factors you should consider before hiring a felon in our guide on How to Hire Felons.

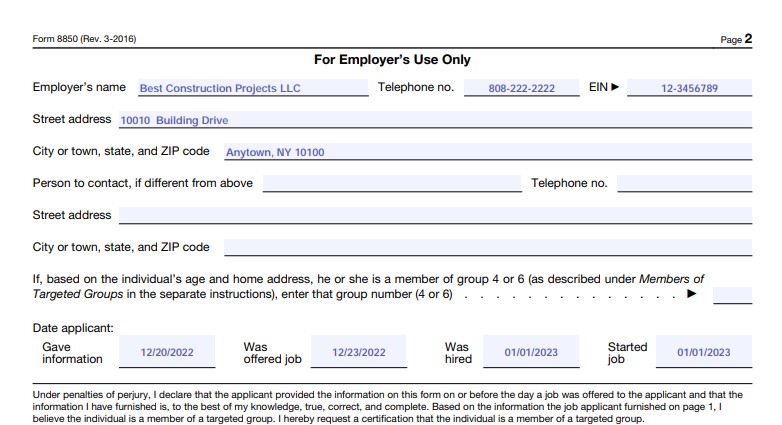

If you determine that the candidate is the right fit and are ready to hire them, additional information needs to be added to Form 8850. On Page 2, you’ll need to provide dates for when the job was offered, when the candidate was hired, as well as the date for the candidate’s first day of employment.

Next, you’ll need to provide a signature to confirm the following information under penalty of perjury:

- The applicant gave you the information on this form on or before the day the job was offered.

- To the best of your knowledge, the information provided is correct and complete.

- Based on the information provided by the job applicant on Page 1, the person is part of a target group and relevant certification is being requested.

Step 3: Apply for Certification From Your State Workforce Agency

Now that Form 8550 is completed and signed, you’re ready to apply for certification. To complete your application, you will need the following items, in addition to Form 8850:

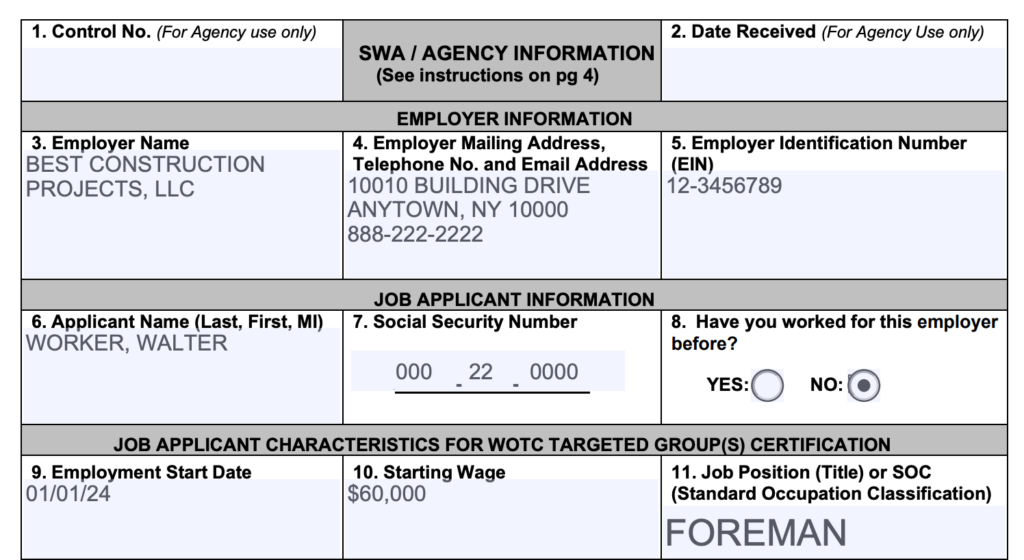

- United States Department of Labor (DoL) Form 9061, Individual Characteristics Form (ICF)

- Form 9061 attachments showing proof of felony using supporting info such as parole officer’s name, correctional institution records, or extracts from court records

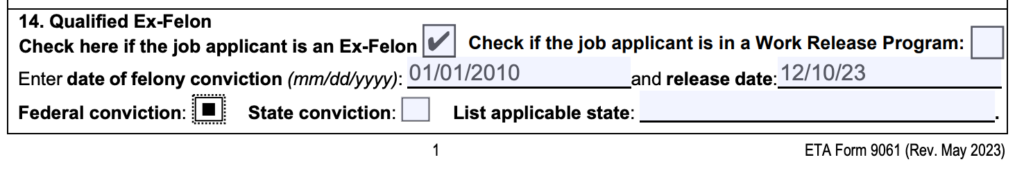

Ex-felons can complete Form 9061 by checking the applicable box next to Question 14. They must also indicate the date of conviction, the date of release, and whether it was a federal or state conviction.

Once Form 9061 has been completed and the required information attached, you’ll need to mail it to your state workforce agency. These agencies may have different names, but they all usually offer training, job, career, and business services, as well as programs for unemployment insurance, programs for veteran reemployment, and information about the job market.

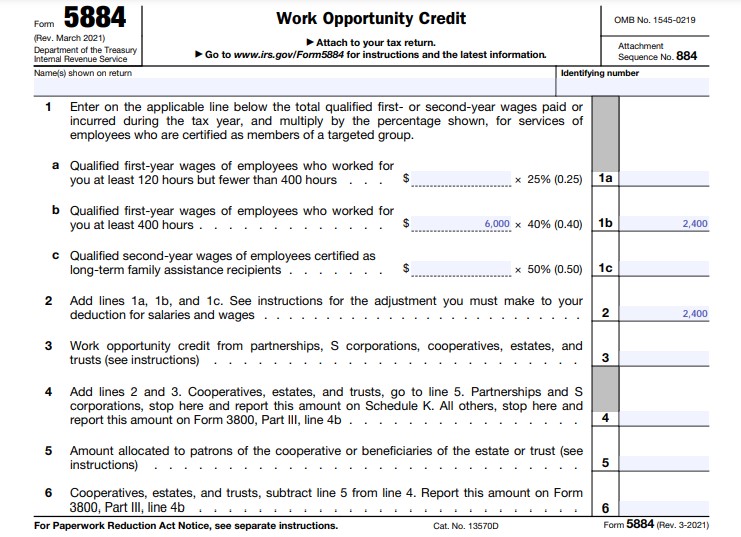

Step 4: Calculate the Credit for Hiring Felons

Once you receive the state certification that your employee qualifies as a felon, you must calculate and report the credit on your return. The credit is usually worth $2,400 per employee if they worked at least 400 hours. You’ll calculate your credit using IRS Form 5884.

Step 5: Report the Felon Tax Credit on Your Tax Return

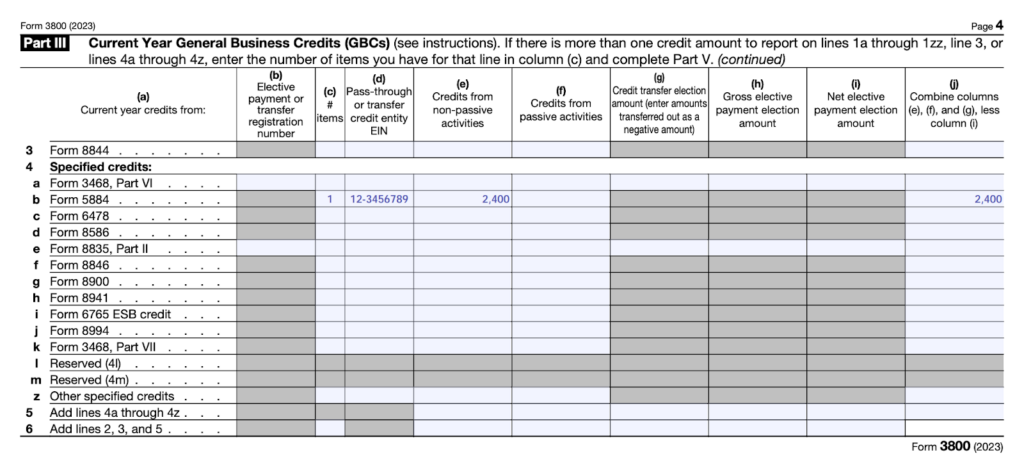

For sole proprietors and C corporations (C-corps), this credit will then flow to IRS Form 3800, and you’ll claim it as part of the General Business Credit. S corporations (S-corps) and partnerships will report the credit on Schedules K and K-1. The owners or partners will then claim the credit on their individual returns.

Your allowable portion of the general business credit will be reported on one of the following forms:

Entity Type | Where to Report |

|---|---|

Sole Proprietor | IRS Form 1040 or 1040 SR, Schedule 3, line 6a |

C Corporation (C-corp) | IRS Form 1120, Schedule J, Part I, line 5c |

S Corporation (S-corp) | IRS Form 1120-S, Schedule K, line 13g |

Partnership | IRS Form 1065, Schedule K, line 15f |

Example of How to Claim the Tax Credit for Hiring Felons

Step 1: Request for Applicant to Complete IRS Questionnaire

On December 20, 2023, ex-felon Walter Worker contacted Jim at Best Construction Projects LLC, wishing to apply for a foreman position. Jim and Walter arranged for a same-day meeting. When Walter arrived, Jim gave Walter a job application and Form 8850, and requested that page one of the latter document be completed.

Walter’s completed form is shown below:

Filled-out sample of IRS Form 8850 Page 1

Walter checked box 2 because bullet point 5 applied to his recent felony conviction. Once he completed page one, Jim completed the information section on Page 2 of Form 8850, including the current date (12/20/23) as the date that Walter (the applicant) gave the information.

Step 2: Conduct Interview and Finalize Hiring Details

On Dec. 22, 2023, Jim arranged for a formal interview with Walter. The next day, Jim invited Walter to start as a foreman with the company on January 1, 2024, with annual compensation of $60,000 per year.

Completed sample of IRS Form 8850 Page 2

Step 3: Apply for Certification from the State Workforce Agency

Walter started his new role on January 1, 2024. Jim immediately picked up the tax credit application process by completing Form 9061, Individual Characteristics Form (ICF) Work Opportunity Tax Credit and requesting Walter’s incarceration records. The form was completed as shown below:

Example of a filled-out IRS Form 9061

On Form 9061, question 14 was the only one completed for Walter as it is the only one that applies to felons. Since Walter completed the form, he also signed it, under penalty of perjury—as the form indicates.

A sample of Form 9061’s Question 17 filled in

Jim mailed Form 9061 and the supporting documentation to New York’s state workforce agency on January 2, 2024.

Step 4: Calculate the Credit for Hiring Felons

Since the state of New York certified Walter as a qualified felon for 2024, Jim will be eligible to claim the credit on his return. Since Walter is a full-time employee, Jim estimates that he will work well over 400 hours during the tax year.

The Form 5884 shown below calculates Jim’s projected amount of WOTC.

IRS Form 5884 2024 WOTC for Best Construction Projects LLC

Step 5: Report the Tax Credit on Your Tax Return

The amount figured on IRS Form 5884 is then carried over to Part III of IRS Form 3800, line 4b. Since Jim is a sole proprietor, he’ll claim this credit on IRS Form 1040, Schedule 3.

Jim’s completed IRS Form 8300

Frequently Asked Questions (FAQs)

No, they do not. What’s commonly referred to as the “felon tax credit” is a tax credit for employers of people previously convicted of felonies, not the employee reentering the workforce.

Yes, any unused WOTC can be carried back one year and then forward for 20 years on IRS Form 3800.

No, you can’t. Family members, former employees, and undocumented immigrants are not qualified employees for purposes of the WOTC.

Bottom Line

The tax credit for hiring felons can be claimed in 5 steps. Once your prospective employee completes the IRS questionnaire, you’ll need to finalize your new hire, apply for a certification from your state workforce agency, calculate, and then report the credit. If you’re an employer offering a job to an ex-felon, you don’t want to miss this tax credit. While you are not obligated to claim the credit, it is a useful income offset for tax purposes. You get the dual benefit of claiming a credit of up to 40% of eligible wages while simultaneously helping your community.