TurboTax Online is perfect for business owners who need full-service tax preparation and filing, while TurboTax Desktop is the go-to option for small businesses that prefer handling their own partnership and S-corp (S Corporation) tax returns.

We’ll compare these two versions head-to-head — exploring their customer service, helpful tools, ease of use, and unique features — to help you make an informed decision. Ultimately, the choice between TurboTax Desktop vs TurboTax Online depends on personal preferences, such as whether you want access to tax experts and the desired level of convenience and control.

- TurboTax Online is best for business owners who prefer a full-service tax preparation experience with professional assistance.

- TurboTax Desktop is ideal for small businesses that want to handle their own partnership and S-corp tax filings independently.

TurboTax Desktop vs TurboTax Online quick comparison

Taxes are easier with clean books. Get on top of your financials today with Merritt Bookkeeping. |

|

Use cases and pros & cons

Pricing: TurboTax Online wins

TurboTax Online offers services that aren’t offered with TurboTax desktop, which makes it the winner in certain categories by default since there is no competition. This also makes TurboTax Online more attractive for those seeking free simple filing or expert assistance. However, TurboTax Desktop is more cost-effective for state filings, particularly for complex returns.

Live assistance: TurboTax Online wins

TurboTax Online | TurboTax Desktop | |

|---|---|---|

Communication method | Phone, live chat, or one-way videoconferencing | Free product support by phone |

Qualifications of professionals | Certified public accountants (CPAs), enrolled agents (EAs), and tax specialists | N/A |

Tax Pro Assistance for individual returns | ✓ | ✕ |

Tax Pro Assistance for business returns | Limited states | ✕ |

Full-service filing for individual returns | ✓ | ✕ |

Full-service filing for business returns | ✓ | ✕ |

When it comes to live assistance, TurboTax Online excels in all areas. Compared to TurboTax Desktop, which limits communication to product support by phone, TurboTax Online allows you to communicate via phone, live chat, or one-way videoconferencing. Tax pro assistance is available for individual returns and in limited states for business returns, and it also offers full-service filing for both business and individual returns.

Helpful tools: TurboTax Online wins

TurboTax Online | TurboTax Desktop | |

|---|---|---|

Import from QuickBooks | ✕ | ✓ |

Deduction maximizer | ✓ | ✓ |

Audit support | ✓ | ✓ |

Cryptocurrency support | ✓ | ✓ |

Tax calculator | ✓ | ✓ |

Import W-2s & 1099s | ✓ | ✓ |

Amended returns | ✓ | ✓ |

Automatic updates | ✓ | ✓ |

Real-time collaboration | ✓ | ✕ |

Prior year return filing | ✓ | ✕ |

TurboTax Online offers superior live assistance compared to TurboTax Desktop, which only provides phone support. With TurboTax Online, you can get help via phone, live chat, or one-way video conferencing.

Tax professionals are available for individual returns and, in some states, for business returns. It also offers full-service filing for both individuals and businesses. TurboTax online edges out the competition by offering real-time collaboration and prior year return filing.

Mobile app: TurboTax Online wins

TurboTax Online App | TurboTax Desktop App | |

|---|---|---|

Availability | iOS and Android | N/A |

Products supported | Free | N/A |

Talk live with tax specialist | ✓ | N/A |

E-file return | ✓ | N/A |

Scan and upload W-2 | ✓ | N/A |

IRS refund tracking | ✓ | N/A |

View/Print/Save return as PDF | ✕ | N/A |

The TurboTax mobile app is only compatible with TurboTax Online, and can be used for the free version. This version is for simple returns and excludes rental property owners and Schedule C businesses. However, it allows you to prepare and e-file your return, track your IRS refund, and scan and upload your W-2. You can even communicate live with a tax specialist, who will assist you with any questions you may have. Since these options are not available using TurboTax desktop, TurboTax Online wins this category.

Customer service and ease of use: TurboTax Online wins

TurboTax Online | TurboTax Desktop | |

|---|---|---|

User interface | Easy-to-use | Straightforward |

Support channels | Phone, chat, and one-way video conferencing | N/A |

Expert help offered | ✓ | N/A |

TurboTax Online is user-friendly, cloud-based, and requires no downloads or manual updates. Users can access their tax returns from any device and switch seamlessly between them. It offers various support options, including live chat, phone assistance, videoconferencing, and a knowledge base.

Users can also choose full-service filing, where a tax professional helps prepare and file their returns. TurboTax Desktop, however, lacks tax filing assistance, offering only free product support by phone. Users can access help and support resources directly within the software and also opt for full-service filing, in which you’re paired with a tax professional who will work with you to prepare and file your return.

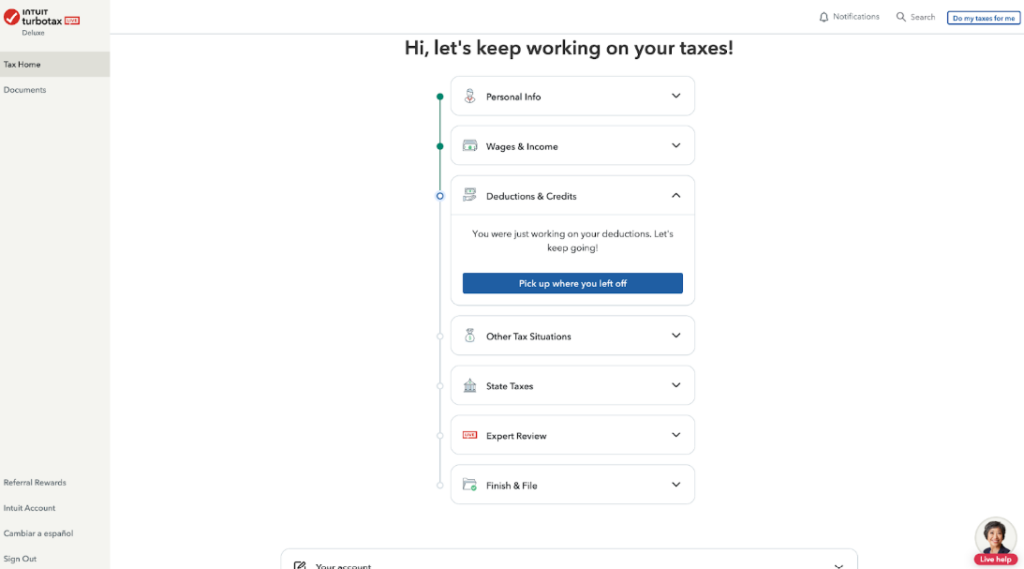

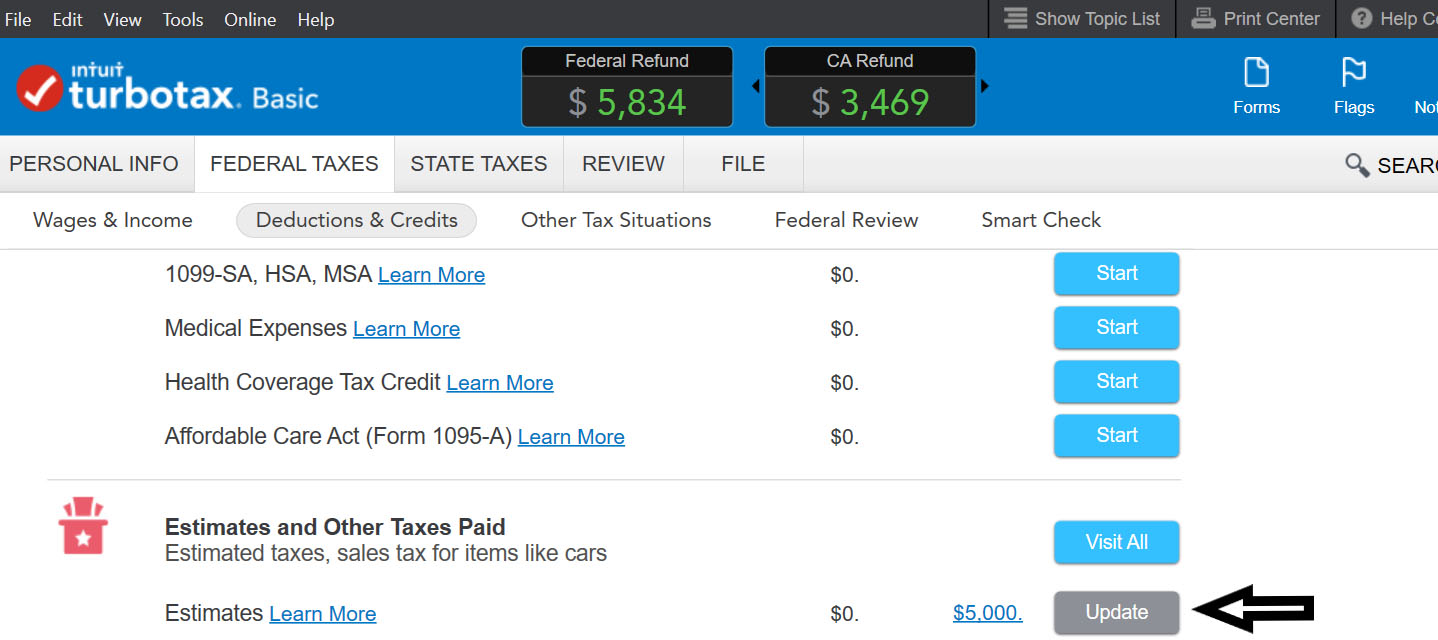

TurboTax Online input screen

TurboTax Desktop has a steeper learning curve than TurboTax Online and requires installation on a single device, limiting accessibility unless transferred. While the interface is intuitive, some users may find it less convenient than the online version. It only offers free product support by phone, so those needing tax filing assistance may prefer TurboTax Online.

TurboTax Desktop input screen

TurboTax Desktop vs Online: User Reviews

Third-party review sites rarely separate TurboTax Online from TurboTax Desktop, so we relied on reviews from Intuit’s website, which distinguishes between them. TurboTax Desktop has a 4.1 out of 5 rating from 15,426 reviews. Positive reviews highlight its ease of use, while negative ones mention installation issues and program crashes. The lack of installation makes TurboTax Online a clear advantage in this regard. Some users also found the Desktop version time-consuming due to irrelevant questions.

TurboTax Online has a higher rating of 4.6 out of 5 from 264,171 reviews. Like Desktop, it is praised for being user-friendly. However, many users find it expensive and report unexpected fees. Some complaints stem from automatic plan upgrades when additional tax forms are needed. This can be frustrating since TurboTax does not allow users to downgrade, even if the upgrade was due to a mistake.

How I evaluated TurboTax Online vs TurboTax Desktop

I compared TurboTax online and TurboTax desktop based on these criteria:

- Features: I considered product characteristics such as ease of data import, navigation, refund tracking tools, and in-product support.

- Pricing: I verified the availability of free trials and confirmed pricing for varying tax prep packages.

- Technical support: Being able to access help when needed is a primary concern for users, so I assessed the ease of access to product experts via phone, email, or chat options.

- Ease of use: Particularly with DIY software, it’s important that software be easy to navigate. I reviewed how easy it is to move around the product from inception to completion of the tax return.

Frequently Asked Questions (FAQs)

Yes, TurboTax Online is cloud-based, allowing you to access your tax returns from any device with an internet connection. It also offers a free mobile iOS and Android app that gives you access to your tax return.

TurboTax Online automatically updates to the latest version, so you don’t need to manually download updates. In contrast, TurboTax Desktop gives you control over updating the software and allows you to choose whether to install updates or not.

No, you can’t switch between TurboTax Online and Desktop once you have started your tax return. It’s important to choose the version that suits your needs before you begin the process.

Yes, TurboTax Audit Defense is available as an optional service for both TurboTax Online and Desktop. It provides professional representation in case of an audit.

Bottom Line

Both TurboTax Online and Desktop offer powerful tax preparation solutions, catering to different user preferences and needs. However, TurboTax online emerges as the winner, given that it is simply a more robust product.