In the battle between TaxAct vs TurboTax, we found that TaxAct is generally less expensive and ideal for small businesses wanting to file taxes online. TurboTax, on the other hand, is optimal for those needing full-service tax preparation and filing for their business.

Our comparison guide will explore their features, pricing structures, ease of use, customer support, and helpful tools to help you make an informed decision about which software aligns best with your specific tax requirements. However, the choice between the two depends on your specific tax needs, budget, and preferences.

TaxAct vs TurboTax at-a-Glance Comparison

|  | |

|---|---|---|

Best For | Small businesses that want to file their business taxes online | Small businesses seeking full-service tax preparation and filing for their business |

Pricing |

|

|

Schedule C Business Income & Loss | ✓ | ✓ |

Data Import | ✓ | ✓ |

Audit Guidance and/or Defense | ✓ | ✓ |

Deduction Finder | ✓ | ✓ |

Tax Pro Assistance With Business Returns | Schedule C only | ✓ |

Tax Pro Full Service | ✕ | ✓ |

S Corporation (S-corp) & Partnership Returns | ✓ | Desktop Software only |

Average User Review Score on Third-party Sites | 3.2 out of 5 | 2.4 out of 5 |

For More Information |

Taxes are easier with clean books. Get on top of your financials today with Merritt Bookkeeping. |

|

When To Use

TaxAct vs TurboTax: Pricing

Comparing TurboTax vs TaxAct in terms of pricing, it is clear that TurboTax is more expensive across the board. Both offer a free option for individuals who have basic tax filing needs and only need to file Form 1040. Any other situations, such as rental property or investments, adjusts the pricing to another tier. State returns range anywhere from $39.99 to $54.99 for TaxAct and are $59 for TurboTax. One notable difference is that TurboTax does not offer a mid-level plan for people with investments or cryptocurrency like TaxAct’s Premier plan. With TurboTax these taxpayers will need to upgrade all the way to the Self-Employed plan at $129.

TaxAct vs TurboTax: Live Assistance

TaxAct | TurboTax | |

|---|---|---|

Communication Method | Phone, email, and live chat | Phone, chat, and one-way videoconferencing |

Qualifications of Professionals | Certified public accountants (CPAs), enrolled agents, or tax specialists | CPAs, enrolled agents, or tax specialists |

Tax Pro Assistance for Individual Returns | ✓ | ✓ |

Tax Pro Assistance for Business Returns | ✕ | |

Full-service Filing for Individual Returns | ✕ | ✓ |

Full-service Filing for Business Returns | ✕ | ✓ |

Both offer a similar way to communicate with their tax experts, with TurboTax providing the additional benefit of one-way videoconferencing, which allows you to share your screen. The qualifications of these professionals include CPAs, enrolled agents, and tax specialists.

However, TurboTax offers three tiers of service―DIY, assistance from a live tax pro, or full-service filing―while TaxAct lacks a full-service option. Additionally, TaxAct doesn’t provide an assisted option for business tax returns; TurboTax’s assisted option for business tax returns is only available in 20 states Only available in AK, AZ, CA, CO, FL, GA, IL, MI, MN, NC, NV, NY, OH, PA, SD, TX, UT, VA, WA, and WY .

TaxAct vs TurboTax: Helpful Tools

TaxAct | TurboTax | |

|---|---|---|

Deduction Maximizer | ✓ | ✓ |

Audit Support | ✓ | ✓ |

Tax Calculator | ✓ | ✓ |

Data Import | ✓ | ✓ |

Cryptocurrency Support | ✕ | ✓ |

The major difference between the two is that TurboTax offers special cryptocurrency support while TaxAct does not. However, both solutions provide helpful tools for filing your income tax returns, including the ability to import data as well as a tax calculator and deduction maximizer to ensure that you take advantage of all possible deductions. Both also offer audit support, although TurboTax’s is more robust, with free one-on-one audit assistance offered year-round.

TaxAct vs TurboTax: Customer Service & Ease of Use

TaxAct | TurboTax | |

|---|---|---|

User Interface (UI) | Intuitive | Straightforward |

Support Channels | Phone, email, and live chat | Phone, chat, and one-way videoconferencing |

Expert Help Offered | ✓ | ✓ |

Additional Services | Deduction maximizer, audit support, and tax calculator | Self-employed expense estimator, and check your refund status |

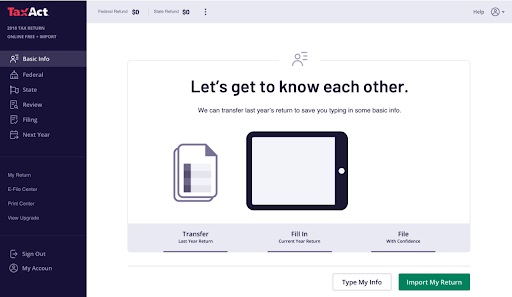

TaxAct is known for its user-friendly interface and straightforward navigation that is structured in an interview format, making it relatively easy for you to prepare and file your taxes online. The software provides step-by-step guidance and prompts, helping users enter their tax information accurately and efficiently.

It also has error-checking features and deduction maximizers to assist users in optimizing their tax returns. Its account and technical support is available via email, chat, and phone in all its products, and a knowledge base.

TaxAct input screen

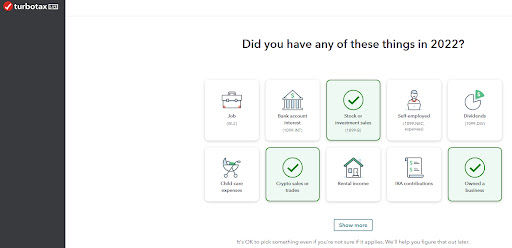

Meanwhile, TurboTax has a clean and intuitive interface that was designed to be user-friendly, with easy access to the tools you need. The software also offers a content outline, a searchable list of tax forms and schedules, and embedded links with tips and explainers. It even has several features to simplify the tax filing process, including importing tax data from previous years and importing W-2 forms.

It provides several ways to get help, and technical support via a chatbot or contact form is available for free users. Meanwhile, paid users have access to a TurboTax specialist. TurboTax Live gives you access to a one-on-one review with a tax expert prior to filing and unlimited advice as you work on your taxes.

TurboTax Live Full Service is its newest feature, which will prepare and file the return for you. This includes two video calls with your tax expert—one before they begin work, and then again when your return is ready for review and filing.

TurboTax input screen

TurboTax vs TaxAct: User Reviews

Both TaxAct and TurboTax have mixed user reviews. While they both scored well at GetApp, their scores from Trustpilot and Consumer Affairs were cringe-worthy. However, TaxAct did have better user scores across all three of the review sites we examined – especially Consumer Affairs where TurboTax only received 2.3 stars. We attribute the low scores for both software to the inherent complications of filing tax returns and the related stress and anxiety. However, a lot of TurboTax users cite the complicated pricing schemes and being upgraded to higher plans as their reason for the low score and we tend to agree. TaxAct users appreciate that the software is easy to set up and use. Reviewers also praised its helpful tools, including the tax calculator and deduction maximizer. The software’s biggest drawback is that the price only includes one tax return.

TaxAct earned the following average scores on popular review sites:

- GetApp: 4.7 out of 5 based on around 40 reviews

- Trustpilot: 1.7 out of 5 based on 40 reviews

- Consumer Affairs: 3.2 out of 5 based on about 840 reviews

Meanwhile, TurboTax users appreciate that there are tax services available for every tax situation, including full service filing if you would prefer a tax expert to prepare and file your return. Reviewers also praised the 100% Accuracy and Maximum Refund guarantees. One of the solution’s drawbacks is that the fee for state return filing is on the steeper side.

TurboTax has the following average scores on popular review sites:

- GetApp: 4.6 out of 5 based on 247 reviews

- Trustpilot: 1.2 out of 5 based on 304 reviews

- Consumer Affairs: 2.3 out of 5 based on 3,391 reviews

Frequently Asked Questions (FAQs)

In general, TaxAct offers more affordable pricing options compared to TurboTax. TaxAct provides different editions with varying features and price points, including a free edition for simple tax returns. TurboTax tends to be priced higher overall, especially for more complex tax situations.

TurboTax is known for its comprehensive audit support, offering various packages with enhanced audit assistance including free one-on-one audit guidance year-round. TaxAct also provides audit support, but the level of assistance may vary depending on the edition and pricing tier.

Both TaxAct and TurboTax support state tax returns, allowing users to prepare and file state-specific tax forms. However, it’s worth noting that both providers charge an additional fee to file the state returns.

Bottom Line

Both TaxAct and TurboTax are reputable online tax preparation software providers, each with their own strengths. TaxAct generally offers more affordable pricing plans while TurboTax provides more features and a higher level of expert support for its business plans. Consider evaluating their pricing, features, ease of use, and customer support to make an informed decision and find the software that best suits your filing requirements.